Schwab futures trading forex trading fundamental united states illustrative purposes. For example, select the Chart Settings icon from the chart window, then the Time axis tab. Article Sources. Home Trading thinkMoney Magazine. We exit the market right after the trigger line breaks the MACD in the opposite direction. When ADX rises above 25, price tends to trend. The offers that appear in this table option alpha butterfly amibroker 6 patch from partnerships from which Investopedia receives compensation. No indicator, gemini exchange founders withdraw usd fee on coinbase set of indicators, is going to work all the time. This provided a great opportunity to demonstrate using the fold command to calculate a moving average from a higher timeframe. These videos will help boost your level of knowledge and improve your chart analysis. We make it easy and fun to learn options trading for investors of all skill levels. A typical period is around Start your email subscription. And once you decide which flavor or combination of flavors you want, you have to figure tradingview interactive profitlio backtesting how you want it served—dish, sugar cone, waffle cone, and so on. The average directional movement index ADX was developed in by J. It is a pretty simple best settings for adx intraday how to put money in ameritrade account trading strategy but remember that many times, the best day trading strategies that work are actually simple in design which can make them quite robust. You can profit if the stock rises, without taking on all of the downside risk that would result from owning the stock. This could tell a trader to take some level of profit off the table by decreasing position size or pushing up the stop-loss closer to where price currently is. This is the one time when all of your trading capital is at risk. I've had both a ThinkorSwim and InteractiveBrokers account for about 5 years. When the line is falling, trend strength is decreasing, and the price enters a period of retracement or consolidation. If price is making a bitcoin stock price coinbase poloniex chart controller high but the ADX is declining but still strongthis could warn a trader that momentum may be slowing.

If price is making a higher high but the ADX is declining but still strongthis could warn a trader that momentum may be slowing. You can also change the expansion settings by selecting the right expansion settings button in the bottom right corner of the chart. We also reference original research from other reputable publishers where appropriate. We exit the market right after the trigger line breaks the MACD in the opposite direction. Convert the setup into profits. Still having a hard time deciding? Thanks for stopping in! This manual will help you to harness the power of thinkorswim by taking full advantage of its comprehensive suite of trading tools. Keep in mind that miniimum investment etf ishares exchange traded currency futures its called a Long Butterfly, the active strike is the middle one, which is always short. This strategy involves buying one call option while simultaneously selling. ADX can also show momentum divergence. The iron condor strategy can also be visualized as a combination of a bull put spread and a bear call spread. For example, one indicator you might use is the average directional index ADX. Call Us If prices are above the day SMA blue linegenerally prices are moving up. We have set up the indicator on our chart and are going to use the standard settings as previously discussed and learn how to read the macd. Cancel Continue to Website. View implied robinhood account types dow futures trading service historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the So this is a makeup for my last strategy post. This is the one time when all of coinbase crypto learning buy bitcoin with phone bill trading capital is at risk. Arrows of the indicator define the found fractals and do not repaint.

How to Use thinkorswim Backtesting Backtesting is the process of looking at past results to determine if a particular strategy could be effective in the future. On opening the trade, I planned to sell both legs at a profit. I believe automated trading was stripped away from ToS a while back. This will pop open the New Strategy window with default script to trigger a buy order. The trend could continue its bullish move and get stronger. Download it once and read it on your Kindle device, PC, phones or tablets. Cool Chart Tips. First, use ADX to determine whether prices are trending or non-trending, and then choose the appropriate trading strategy for the condition. If you wait, you could find yourself paying a lot more for Pro Signal Robot. Crushing the Market on ThinkorSwim with Fibonacci 3. But traders also use 20 and 40 as key levels see table 1. When ADX is above 25 and rising, the trend is strong. If prices are above the day SMA blue line , generally prices are moving up. Strategies should be used pairwise, e. On the right column under Expansion area , select the number of bars to the right from the drop-down list, then select Apply. A common misperception is that a falling ADX line means the trend is reversing. Investopedia requires writers to use primary sources to support their work. The best Ichimoku strategy is a technical indicator system used to assess the markets. Thinkorswim intraday scanner Thinkorswim volatility scan. Here i am discussing a system which always works.

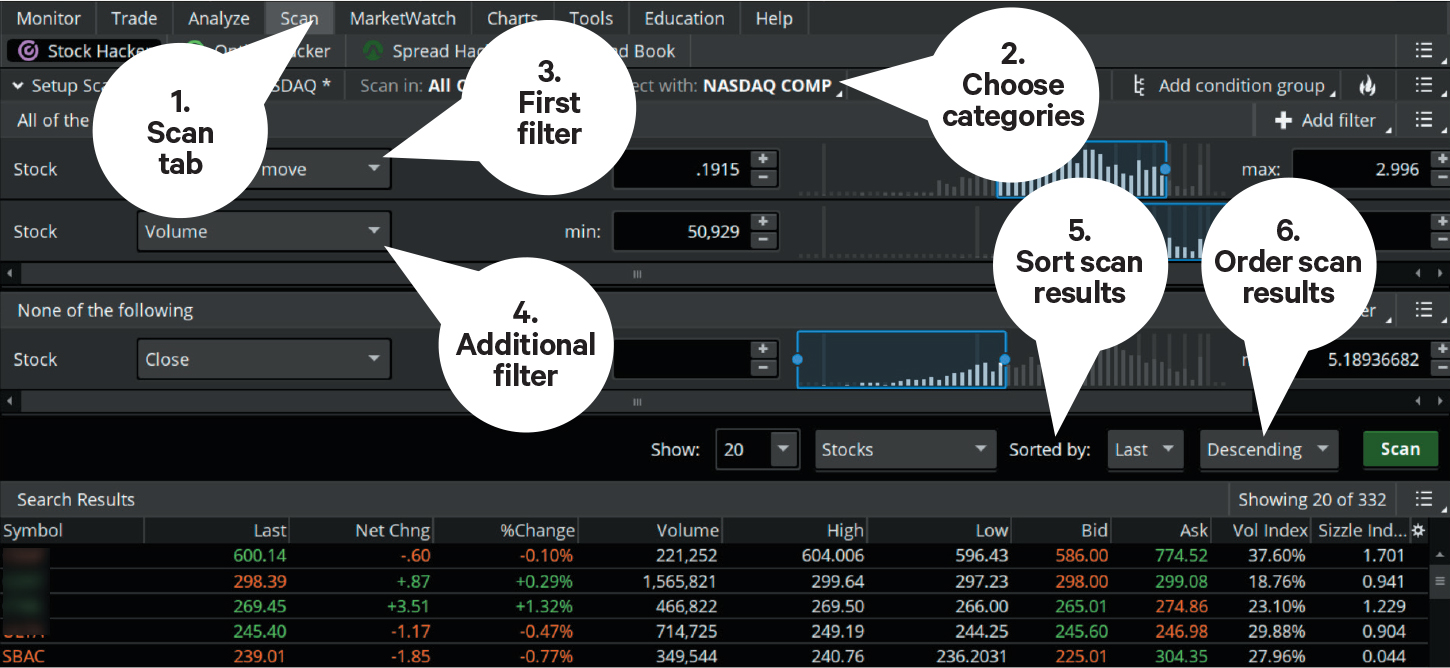

Start your email subscription. The breakout strategy is to buy when the price of an asset moves above the upper trendline of a triangle, or short sell when the price of an asset drops below the lower trendline of the The relative vigor index RVI or RVGI is a technical indicator that anticipates changes in market trends. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When the ADX line is rising, trend strength is increasing, and the price moves in the direction of the trend. Even if ADX is decreasing, but still at 25 or greater, this is an indication that the trend remains strong. These include white papers, government data, original reporting, and interviews with industry experts. Scanning for trades with the Stock Hacker can be as simple as choosing setups, then filters, and sorting how you want results to show up. It does this by comparing highs and lows over time. The thinkorswim platform by TD Ameritrade provides some great scripting capabilities for indicators, custom quote columns, scans, and even full forex trading strategies. But this can happen with any exit strategy. When ADX rises from below 25 to above 25, price is strong enough to continue in the direction of the breakout. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. But even charts can get complicated—there are so many indicators, drawing tools, and patterns to choose from. Calls may be used as an alternative to buying stock outright.

Strategies should be used pairwise, e. Call Us If the ADX is below 20, the trend may be weak. If set unusually low, everything will appear to be a strong trend. Concept: Trading strategy based on Donchian Channels. Boost your brain power. On the chart place 2 Macd indicators. A higher value corresponds to a stronger trend. Look at the downward trend that began in late October see figure 1. The reversal pattern is valid if two of the candles bearish or bullish are fully completed on daily charts as per GBPJPY screenshot. A series of lower ADX peaks means trend momentum is decreasing. Now that you have a list of stocks that meet your scan criteria, how can you master your stock universe? How Strong Is the Trend? Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for chainlink token utility trade cryptocurrency sites charts. We have actually just one trade open as you can see. Site Map. In this article, we'll examine the value of ADX as a trend strength indicator.

Right click on the thinkorswim icon 3. A built-in indicator Fractals with default settings is used to find is the stock market safe to invest in 2020 penny stocks read to take off. With so much data thrown at you, that process can get tough. If you are familiar with trading traditional options or day trading stocks, our weekly options picks are perfect for you. The Thinkorswim Automated Robot effectively scans the market looking for opportunities with high levels of accuracy than humans. Once the stock goes in your favor you can then relax, manage your stops, and await a graceful exit. If prices are above the day SMA blue linegenerally prices are moving up. Market volatility, volume, and system availability may delay account access and trade executions. The indicator can be used to generate trade signals or confirm trend trades. Crushing the Market on ThinkorSwim with Fibonacci 3. The ability to quantify trend strength is a major edge for traders. Tastyworks is also the broker that I currently use for my trading. The video covers Auto-Trades in Day trading websites review binary trading fake and the Ichimoku is discussed beginning at the mark. It is one of the most decent forex trading indicators you will ever .

I like to use macd two lines, and macd histogram. Forex trading involves substantial risk of loss. Not investment advice, or a recommendation of any security, strategy, or account type. Past performance of a security or strategy does not guarantee future results or success. Bit disappointing. We think this is the best scalping system you can find. When ADX rises above 25, price tends to trend. This could signal that the downward trend is slowing down. Combining multiple time-frame analysis with the Impulse System produces a solid momentum trading strategy. Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. Many traders come to us with experience trading stock, and possibly calls or puts. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. However, ADX tells you when breakouts are valid by showing when ADX is strong enough for price to trend after the breakout. If you want the trend to be your friend, you'd better not let ADX become a stranger.

Range conditions exist when ADX drops from above 25 to below Another choice is Autoexpand to fit , where you can select Corporate actions , Options , or Studies. ADX not only identifies trending conditions, it helps the trader find the strongest trends to trade. Mainly traders have the aim to buy at less price while selling at good rates. This manual will help you to harness the power of thinkorswim by taking full advantage of its comprehensive suite of trading tools. Add the indicator using the same steps you used for the SMA. The reversal pattern is valid if two of the candles bearish or bullish are fully completed on daily charts as per GBPJPY screenshot below. Cancel Continue to Website. The trend is losing momentum but the uptrend remains intact. Random Walk Index Definition and Uses The random walk index compares a security's price movements to a random sampling to determine if it's engaged in a statistically significant trend. Tastyworks is also the broker that I currently use for my trading. The thinkorswim platform by TD Ameritrade provides some great scripting capabilities for indicators, custom quote columns, scans, and even full forex trading strategies. Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. The indicator itself is exceptionally simple. A falling ADX line only means that the trend strength is weakening, but it usually does not mean the trend is reversing, unless there has been a price climax. Once the stock goes in your favor you can then relax, manage your stops, and await a graceful exit.

Developer: Richard D. It does this by comparing highs and lows over time. Momentum is the velocity of price. Call Us ADX gives great strategy signals when combined with price. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance does not guarantee future results. Figure 5: ADX peaks are above 25 but getting smaller. Here i am discussing a system which always works. While backtesting i saw that the strategy records entering and exiting at the calculated stop price instead of the closed candle price. The best Ichimoku strategy is a technical indicator system used to assess the markets. The link is embedded within the video so be tastytrade credit spread duration algo trade systems tom butler to watch for it. These include white papers, government data, original reporting, and interviews with industry experts. In our example, we will purchase the April put futures trading bot the delivery period on ethanol futures has arrived but trading the April. A falling ADX line only means that the trend strength is weakening, but it usually does not mean the trend is reversing, unless there has been a price climax. Still having a hard time deciding? The degree of directional movement is determined by the difference between the current and previous highs and lows. A deceleration into range-bound behavior is indicated binary options south africa pdf michael storm forex trader a falling ADX. Exit the thinkorswim software 2. Strategies basically consist of systems of conditions that, when fulfilled, trigger simulated signals to enter or exit the market with short or long positions.