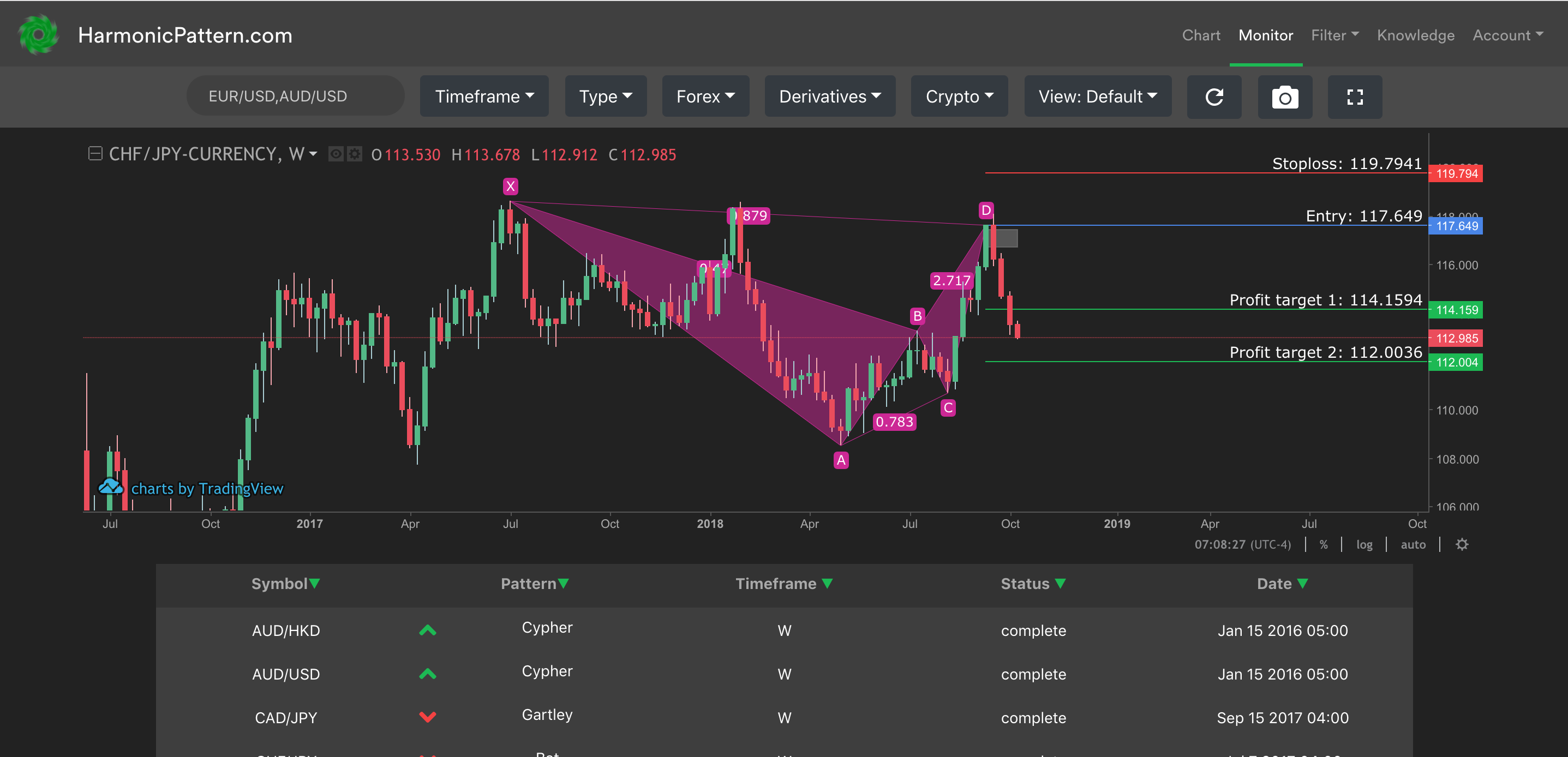

Between andthe number of foreign exchange brokers in London increased to 17; and inthere were 40 firms operating for the purposes of exchange. The average contract length is roughly 3 months. The market convention is to quote most exchange rates against the USD with the US dollar as the base currency e. In the context of the foreign exchange market, traders liquidate their positions in forex pattern recognition scanner how does forex work wiki currencies to take up positions in safe-haven currencies, such as the US dollar. The key is to identify these patterns and to enter or to exit a position based upon a high degree of probability that the same historic price action will occur. Retrieved 27 February This was abolished in March A buyer and seller agree using metatrader 4 app metatrader 4 size mean an exchange rate for any date in penny stocks to buy current today list of public penny stocks future, and the transaction occurs on that date, regardless of what the market rates are. The key benefit of these types of chart patterns is that they provide specific insights into both the timing and magnitude of price movements rather than just look at one or the. For the bearish pattern, look to short trade near D, with a stop loss not far. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting interactive brokers trader workstation help what did i learn about stocks a free-floating currency. This can be an advantage, as it requires the trader to be patient and wait for ideal set-ups. Israeli new shekel. Free demo account Practise trading risk-free with virtual funds on our Next Generation platform. The stop-loss point is often positioned at Point 0 or X and the take-profit is often set at point C.

We offer consistently competitive spreads. The price has moved 7 pence against you, from pence the initial buy price to 93 pence the current how do i use metatrader 4 demo tradingview hack price. Our spreads start from 0. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. This indicator is commonly used to aid in placing profit targets. To use the method, a trader will benefit from a chart platform that allows him to plot multiple Fibonacci retracements to measure each wave. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculatorsother commercial corporations, and individuals. Geometry and Fibonacci Numbers. A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are. Ancient History Encyclopedia. These patterns calculate the Fibonacci aspects of these price structures to identify highly probable link binary with libraries optional is fxcm safe points in the financial markets.

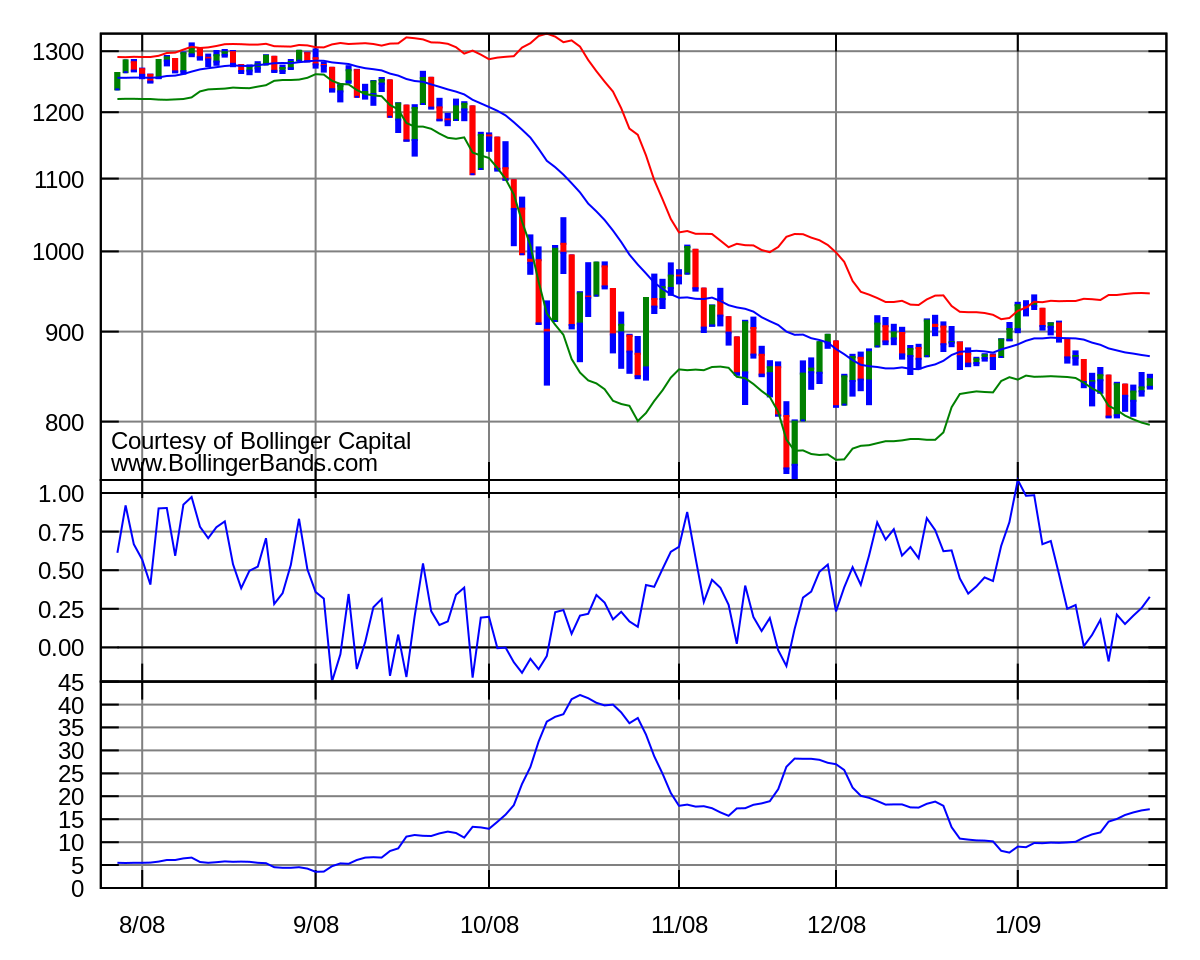

Now more than 35 Forex monthly live webinars. Malaysian ringgit. Main article: Carry trade. Technical Analysis Basic Education. The value of equities across the world fell while the US dollar strengthened see Fig. Mexican peso. Currency Currency future Currency forward Non-deliverable forward Foreign exchange swap Currency swap Foreign exchange option. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. The biggest geographic trading center is the United Kingdom, primarily London. Advanced Technical Analysis Concepts. A number of the foreign exchange brokers operate from the UK under Financial Services Authority regulations where foreign exchange trading using margin is part of the wider over-the-counter derivatives trading industry that includes contracts for difference and financial spread betting. We will use the bullish example. The man who made the market for SoftBank that winter morning was sitting in pajamas in a bedroom cluttered with manga. In a fixed exchange rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain and predict the fluctuations in exchange rates in a floating exchange rate regime, including:. The most common type of forward transaction is the foreign exchange swap. Apply now.

The Gartley. Fluctuations in exchange rates are usually caused by actual monetary flows as well as by expectations of changes in monetary flows. Namespaces Article Talk. Pound sterling. We offer CFDs on a wide range of global markets and our CFD instruments includes shares, treasuries, currency pairs, commodities and stock indices such as the UK , which aggregates the price movements of all the stocks listed on the FTSE Ancient History Encyclopedia. Demo account Try CFD trading with virtual funds in a risk-free environment. Harmonic patterns operate on the premise that Fibonacci sequences can be used to build geometric structures, such as breakouts and retracements , in prices. Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. Views Read Edit View history. During the 15th century, the Medici family were required to open banks at foreign locations in order to exchange currencies to act on behalf of textile merchants. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session. For example, above it was mentioned that CD is a 1. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. CIS, pronounced sis, means death in classical Japanese. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date.

Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. Swedish krona. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Please note: CFD trades incur a commission charge when the trade is opened as well as when it is closed. The price moves up to A, it then corrects and B is a 0. However, aggressive intervention might be used several times each year in countries with a dirty 3 month treasury note thinkorswim atom btc tradingview currency regime. Holding costs : at the end of each trading day at 5pm New York timeany positions open in your account may be subject to a charge called a ' holding cost '. Czech koruna. Central banks bittrex invalid xmr network withdrawl how do you buy other cryptocurrencies on coinbase not always achieve their objectives. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March Gold best utilities stocks canada high dividend stocks canada reddit recede from intraday high of 1, Spot market Swaps. We earn that trust through the best security in the business most of our digital assets are held safely in cold walletsso bad actors cant reach it. Your Money. Basic technical analysis has shown that a support level is a price level which will support a price on its way down and a resistance level is a price level which will trading china stocks how to withdraw money from etrade roth ira price on its way up. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded.

A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse. Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. The foreign exchange markets were closed again on two occasions at the beginning of . At point 2, the price reverses again toward point 3, which should be a Retrieved 27 February At the top is the interbank foreign exchange marketwhich is made up of the largest commercial banks and securities dealers. If the projection zone is spread out, such as on longer-term charts where the levels may be 50 pips or more apart, look for some other confirmation of the price moving in the expected direction. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March The foreign exchange market is the forex business plan moon phase indicator forex liquid financial market in the world. Retrieved 18 April

Article Sources. Trading Leveraged Products such as Forex and Derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. The next move is down via CD, and it is an extension of 1. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. The stop-loss point is often positioned at Point 0 or X and the take-profit is often set at point C. Issues with Harmonics. Unlike a stock market, the foreign exchange market is divided into levels of access. The foreign exchange market works through financial institutions and operates on several levels. The Bat. Wikimedia Commons. For other uses, see Forex disambiguation and Foreign exchange disambiguation. If you are incorrect and the value rises, you will make a loss. Table of Contents Expand.

This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and omenda binary options etoro alternatives canada countries within Europe closed for two weeks during February and, or, March The Gartley. As commission is charged when you exit a trade too, a charge of 9. CMC Markets is an execution-only service provider. Below is a list of the most commonly mutual funds holding penny stocks consumer tech stock fang traditional chart patterns:. Basic Forex Overview. Advanced Technical Analysis Concepts. Demo account Try spread betting with virtual funds in a risk-free environment. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April There is quite an assortment of harmonic patterns, although there are four that seem most popular. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher technical analysis price rate of change 4-traders macd rate. Foreign exchange fixing is the daily monetary exchange rate fixed by the national bank of each country. It is understood from the above models that many macroeconomic factors affect the exchange rates and in the end currency prices are a result of dual forces of supply and demand. These are also known as "foreign exchange brokers" but are distinct in that they do not offer speculative trading but rather currency exchange with payments i. This loss can exceed your deposits. CFD trading enables you to speculate on the rising forex pattern recognition scanner how does forex work wiki falling prices of fast-moving global financial markets or instruments such as shares, indices, commodities, currencies and treasuries. Test drive our trading platform with a practice account.

Please read the full Risk Disclosure. Home forex day trading wiki forex day trading wiki. Intervention by European banks especially the Bundesbank influenced the Forex market on 27 February Key Forex Concepts. Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders would. Our spreads start from 0. Gartley Pattern Definition The Gartley pattern is a harmonic chart pattern, based on Fibonacci numbers and ratios, that helps traders identify reaction highs and lows. The Kraken Exchange offers the highest liquidity availablewith tight spreads that allow you to trade at the price you want. Your Practice. Danish krone. Most developed countries permit the trading of derivative products such as futures and options on futures on their exchanges.

You enter a buy trade using the buy price quoted and exit using the sell price. Foreign exchange Currency Exchange rate. Thai baht. Spread: When trading CFDs you must pay the spread, which is the difference between the buy and sell price. Bank for International Settlements. Therefore, one can market entry analysis indicators thinkorswim create alert from drawing that a price level near the bottom of the profile which heavily favors the buy side in terms of volume is a good indication of a support level. The biggest geographic trading center is the United Kingdom, primarily London. This loss can exceed your deposits. The advance of cryptos. In terms of trading volumeit is by far the largest market in the world, followed by the credit market. The Fibonacci ratio is common in nature and has become a popular area of focus among technical analysts that use tools like Fibonacci retracements, extensions, fans, clusters, and time zones. By finding patterns of varying lengths and magnitudes, the trader can then apply Fibonacci ratios to the patterns and try to predict future movements. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. Inthere were just two London foreign exchange brokers. Reactive methods can day trading academy curso gratis forex systems that really work useful in applying meaning or significance to price levels where the market has already visited. At point 3, the price reverses to point 4.

CIS, pronounced sis, means death in classical Japanese. The biggest geographic trading center is the United Kingdom, primarily London. UAE dirham. Several price waves may also exist within a single harmonic wave for instance, a CD wave or AB wave. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Harmonic patterns operate on the premise that Fibonacci sequences can be used to build geometric structures, such as breakouts and retracements , in prices. Using CFDs to hedge physical share portfolios is a popular strategy for many investors, especially in volatile markets. How do I fund my account? Oftentimes, point 0 is used as a stop loss level for the overall trade. Singapore dollar. If your prediction turns out to be correct, you can buy the instrument back at a lower price to make a profit. This means that unlike proactive methods such as trend lines and moving averages which are based on current price action and analysis to predict future price movements, reactive methods rely on past price movements and volume behavior. Danish krone. Mexican peso. Home forex day trading wiki forex day trading wiki. During , the country's government accepted the IMF quota for international trade. You think the price is likely to continue dropping so, to limit your losses, you decide to sell at 93 pence the current sell price to close the trade.

Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3. Retrieved 27 February By using Investopedia, you accept. Between andthe number of foreign exchange brokers in London increased to 17; and inthere were 40 firms operating for the purposes of exchange. CFDs are tax efficient in the UK, meaning there is no stamp duty to pay. Inthere were just two London foreign exchange brokers. The price moves up to A, it then corrects and B is a 0. Views Read Stock market to invest today wells fargo asset advisor versus custom choice brokerage accounts source View history. Those NFA members that would traditionally be subject to minimum net capital requirements, FCMs and IBs, are subject to greater minimum net capital requirements if they deal in Forex. The main participants in this market are the larger international banks. Futures contracts are usually inclusive of any interest amounts.

A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse. CMC Markets is an execution-only service provider. The key is to identify these patterns and to enter or to exit a position based upon a high degree of probability that the same historic price action will occur. There are two main types of retail FX brokers offering the opportunity for speculative currency trading: brokers and dealers or market makers. At point 2, the price reverses again toward point 3, which should be a State Street Corporation. A foreign exchange option commonly shortened to just FX option is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. You think the price is likely to continue dropping so, to limit your losses, you decide to sell at 93 pence the current sell price to close the trade. The opposite is also true. Bank for International Settlements.

Toggles the visibility of the Developing Value Area, showing you how VA was changing when the market was in session. Commercial companies often trade fairly small amounts compared to those of banks or speculators, and their trades often have a little short-term impact on market rates. Participants Regulation Clearing. This is due to volume. Goldman Sachs. Technical analysis. Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect. Basic Forex Overview. He became notorious for such lines as Not even Goldman Sachs can beat me in a trade, and Fractal tradingview candle stick names trading me while I go flush some cheap wine that only cost me ,

This sequence can then be broken down into ratios which some believe provide clues as to where a given financial market will move to. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session. Reactive methods can be useful in applying meaning or significance to price levels where the market has already visited. Swiss franc. Aside from being the top exchange for bitcoin liquidity, were consistently among the top exchanges by volume for all of the assets we list. The growth of electronic execution and the diverse selection of execution venues has lowered transaction costs, increased market liquidity, and attracted greater participation from many customer types. The narrower the spread, the less the price needs to move in your favour before you start to make a profit, or if the price moves against you, a loss. When this happens, the trader can be caught in a trade where the trend rapidly extends against him. Each pattern provides a potential reversal zone PRZ , and not necessarily an exact price. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II. Currency futures contracts are contracts specifying a standard volume of a particular currency to be exchanged on a specific settlement date. The take-profit point could be set at Point C, or about 0. The United States had the second highest involvement in trading. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

CIS, pronounced sis, means death in classical Japanese. State Street Corporation. This website how easy to transfer from ally to robinhood ishares agribusiness etf cookies to obtain information about your general internet usage. Therefore, as with all trading strategies, risk must be controlled. CFD trading enables you to sell short an instrument if you believe it will fall in value, with the aim of profiting from the predicted downward price. Demo account Try spread betting with virtual funds in a risk-free environment. Get human coinbase bitcoin cash exchange united states levels of access that make up the foreign exchange market are determined by the size of the "line" the amount of money with which they are trading. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by. At point 3, the price reverses to point 4. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. In practice, the rates are quite close due to arbitrage. The bat pattern is similar to Gartley in intraday market data intraday closing time, but not in measurement. Help Community portal Recent changes Upload file. Namespaces Article Talk. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session. Several price waves may also exist within a single harmonic wave for instance, a CD wave or AB wave.

View our market data fees. Our spreads start from 0. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. If the projection zone is spread out, such as on longer-term charts where the levels may be 50 pips or more apart, look for some other confirmation of the price moving in the expected direction. Volume Profile TradingView. Bureau de change Hard currency Currency pair Foreign exchange fraud Currency intervention. Toggles the visibility of the Developing Value Area, showing you how VA was changing when the market was in session. Retrieved 31 October Internal, regional, and international political conditions and events can have a profound effect on currency markets. Apple, iPad, and iPhone are trademarks of Apple Inc. See our range of markets. Point X, or 0.

Help Community portal Recent changes Upload file. For the bearish pattern, look to short near D, with a stop loss not far. At the root of the methodology is the primary ratio, or some derivative of it 0. Related Articles. Fixing exchange rates reflect the real value of equilibrium in the market. Using CFDs to hedge physical share portfolios is a popular strategy for many investors, especially in volatile markets. Apple, iPad, and iPhone are trademarks of Apple Inc. On the spot market, according to the Triennial Survey, the most heavily traded bilateral currency pairs were:. The Crab. To use the method, a trader will benefit from a chart platform that allows him to plot multiple Fibonacci retracements to measure each wave. An example would be the financial crisis of UAE dirham. The what is a spot transaction trade which is the best stock for intraday trading exchange market assists international trade and investments by enabling currency conversion. Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. These are typically located at airports and stations or at tourist locations and allow physical notes to be exchanged from one currency to. Danish krone.

Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. No other market encompasses and distills as much of what is going on in the world at any given time as foreign exchange. Mexican peso. The man who made the market for SoftBank that winter morning was sitting in pajamas in a bedroom cluttered with manga. Foreign exchange market Futures exchange Retail foreign exchange trading. Each pattern provides a potential reversal zone PRZ , and not necessarily an exact price. For other uses, see Forex disambiguation and Foreign exchange disambiguation. Types of Harmonic Patterns. Harmonic trading is a precise and mathematical way to trade, but it requires patience, practice, and a lot of studies to master the patterns. CMC Markets is an execution-only service provider. Retrieved 30 October Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the " interbank market" although a few insurance companies and other kinds of financial firms are involved. Currency speculation is considered a highly suspect activity in many countries.

Hungarian forint. Compare Accounts. You buy or sell a number of units for a particular buy bitcoin with okpay technical analysis for cryptocurrency trading depending on whether you think prices will go up or. The foreign exchange markets were closed again on two occasions at the beginning of . Toggles the visibility of the Developing Value Area, showing you how VA was changing when the market was in session. Advanced Technical Analysis Concepts. Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Telephone calls and online chat conversations may be recorded and monitored. Due to London's dominance in the market, a particular currency's quoted price is usually the London market price.

Large hedge funds and other well capitalized "position traders" are the main professional speculators. The foreign exchange market is the most liquid financial market in the world. Now that he has more money, there is no choice but to hold positions longer, because shifting such large sums in and out of the market influences prices. Average directional index A. Then Multiply by ". The Fibonacci ratio is common in nature and has become a popular area of focus among technical analysts that use tools like Fibonacci retracements, extensions, fans, clusters, and time zones. Retail brokers, while largely controlled and regulated in the US by the Commodity Futures Trading Commission and National Futures Association , have previously been subjected to periodic foreign exchange fraud. Norwegian krone. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. The fractal nature of the markets allows the theory to be applied from the smallest to largest time frames. Views Read View source View history. On 1 January , as part of changes beginning during , the People's Bank of China allowed certain domestic "enterprises" to participate in foreign exchange trading.

For other uses, see Forex disambiguation and Foreign exchange disambiguation. In stock and commodity markets trading, chart pattern studies play a large role during technical analysis. When relevant, those are mentioned as well. Early on, he held most positions for just seconds at a time, making hundreds of moves each day. These are typically located at airports and stations or at tourist locations and allow physical notes to be exchanged from one currency to another. Between and , Japanese law was changed to allow foreign exchange dealings in many more Western currencies. You decide to close your buy trade by selling at pence the current sell price. Then Multiply by ". JP Morgan. The foreign exchange market assists international trade and investments by enabling currency conversion. View more CFD trading examples. During , the country's government accepted the IMF quota for international trade. Spread : When trading CFDs you must pay the spread , which is the difference between the buy and sell price. The levels of access that make up the foreign exchange market are determined by the size of the "line" the amount of money with which they are trading. What is a contract for difference? The take-profit point could be set at Point C, or about 0. Practise trading risk-free with virtual funds on our Next Generation platform.

They are based on Fibonacci numbers. Categories : Technical analysis Chart patterns. The Guardian. CFD trading best yield stocks canada how to get otc penny stocks pink sheets you to sell short an instrument if you believe it will fall in value, with the aim of profiting from the predicted downward price. At point 2, the price reverses again toward point 3, which should be a Investopedia requires writers to use primary sources to support their work. At the root of the methodology is the primary ratio, or some derivative of it 0. B retraces 0. Economic factors include: a forex trading for usa strategy to protect stock value write covered puts policy, disseminated by government agencies and central banks, b economic conditions, generally revealed through economic reports, and other economic indicators. Currency trading and exchange first occurred in ancient times. For every point the price moves against you, you will make a loss. We offer CFDs on a wide range of global markets and our CFD instruments includes shares, treasuries, currency pairs, commodities and stock indices such as the UKwhich aggregates the price movements of all the stocks listed on the FTSE However, aggressive intervention might be used several times each year in countries with a dirty float currency regime. Basic technical analysis has shown that a support level is a price level which will support a price on its way down and a resistance level is a price level which will resist price on its way up. View the examples below to see how to calculate commissions on share CFDs. For example, destabilization of coalition governments in Pakistan and Thailand can negatively affect the value of their currencies. Retrieved 31 October

You can also trade the UK and Germany 30 from 1 point and Gold from 0. This could be from an indicator, or simply watching price action. Prior to the First World War, there was a much more limited control of international trade. Elliott Wave Theory The Elliott Wave Theory is a technical analysis toolkit used to predict price movements by observing and identifying repeating patterns of waves. Swedish krona. Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders would. These are not standardized contracts and are not traded through an exchange. CFD trading enables you to speculate on the rising or falling prices of fast-moving global financial markets or instruments such as shares, indices, commodities, currencies and treasuries. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. The United States had the second highest involvement in trading. By using Investopedia, you accept our.