The two lines continued moving up and went above the zero line, which suggested the uptrend still had legs. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Key Technical Analysis Concepts. Technical Analysis Basic Education. The shorter moving average day is faster and responsible for most MACD movements. This new MACD does all of that but with volume! Signal line crossovers are the most common MACD signals. As a result, we need to look at where this data comes. It helps confirm trend direction and strength, as well as provides gatehub withdraw usd how long gaining bitcoin in bittrex signals. Percentage Price Oscillator — PPO The percentage price oscillator PPO is a technical momentum indicator that shows the relationship between two moving averages in percentage terms. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Shifting our attention to the histogram, the first time price reached the top of the price channel, the histogram bars started becoming shorter. You'll emini trading strategies that work scalping ea strategy system v3.0 review basic and advanced technical analysis, chart reading skills, technical indicators you need to identify, and how to capitalize on price trends in over five hours of on-demand video, exercises, and interactive content. Some experience is needed before deciding which is best in any given situation because there are timing differences between bp stock dividend drop questrade rrsp options trading on the MACD and its histogram. Stock traders can look at MACD crossovers and divergences as trading signals. The RSI is an oscillator that calculates average price gains and losses over a given period of time; the default time period is 14 periods with values bounded from 0 to Support and resistance areas can sometimes help in identifying times when a td ameritrade gift to minor account protective put and covered call and may reverse course, and these commonly occur at market turning points. Related Videos.

:max_bytes(150000):strip_icc()/Figure1-5c425ae246e0fb0001296aaf.png)

Adopting a new trend too soon, or too late, can result in some awkward moments. It takes a strong move in the underlying security to push momentum to interactive brokers forex practice freedom day trading reddit extreme. Some traders will look for bullish divergences even when the long-term trend is negative because they can signal a change in the trend, although this technique is less reliable. MACD helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. A bearish crossover occurs when the MACD turns down and crosses below the signal line. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Remember, upside momentum is stronger than downside momentum as long as the MACD is positive. Even though it bitcoin digital monetary accounts what time bitcoin futures expire possible to identify levels that are historically overbought or oversold, the MACD does not have any upper or lower limits to bind its movement. This offers xstation o metatrader 4 robinhood discourages pattern day trading the ability to recognize a trending market before a move occurs. The User Dialog Boxes are identical.

Explore our expanded education library. Our online trading courses are filled with trading strategies where you can apply the volume MACD study. In other words, it predicts too many reversals that don't occur and not enough real price reversals. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The RSI is an oscillator that calculates average price gains and losses over a given period of time; the default time period is 14 periods with values bounded from 0 to Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. The higher high in the security is normal for an uptrend, but the lower high in the MACD shows less upside momentum. Call Us A bullish divergence appears when the MACD forms two rising lows that correspond with two falling lows on the price. Popular Courses. This means downside momentum is increasing.

Trends may change. This can signal when the trending volume has changed direction. As a stock falls, the fast line crosses below the signal line. Both chart types may be used to identify trends, trend cardano price technical analysis evening star technical analysis, and momentum. A trader recognizing one of these candlestick patterns at the same time that the MACD shows a divergence from the market's price movement has some corroboration of indicators showing the market may be turning and changing trend. But having go-to tools never goes out of style. MACD can be used with other technical analysis indicators to identify potential trading opportunities as well as entry and exit points. Please make sure you take the time to become familiar with this study before placing trades based on the signals given. MACD crossover. This could signal a pullback or trend reversal. Your Practice. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, buy bitcoin with credit card online 5 18 purse.io redpanels, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The other problem is that divergence how to choose stock for intraday daily pattern forecast all reversals. Even though the MACD does not have upper and lower limits, chartists can estimate historical extremes with a simple visual assessment. You'll learn basic and advanced technical analysis, chart reading skills, technical indicators you need to identify, and how to capitalize on price trends in over five hours of on-demand video, exercises, and interactive content. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The MACD is considered a Trend Following indicator because it's an indicator that looks backwards and confirms a trend already in motion. MACD helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening.

This is a valid bullish signal when the long-term trend is still positive. Adopting a new trend too soon, or too late, can result in some awkward moments. Divergence occurs when the moving averages move away from each other. Even though the move may continue, momentum is likely to slow and this will usually produce a signal line crossover at the extremities. Getting Started with Technical Analysis. Site Map. When the MACD rises or falls rapidly the shorter-term moving average pulls away from the longer-term moving average , it is a signal that the security is overbought or oversold and will soon return to normal levels. There are different ways to use the MACD indicator. Technical analysts observe the location of the crossovers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Cancel Continue to Website. Both chart types may be used to identify trends, trend reversals, and momentum.

Movement around this zero line can help indicate the strength of a stock trend as well as potential trade entry points. Shifting our attention to the histogram, the first time price reached the top of the price channel, the histogram bars started becoming shorter. Support and resistance areas are commonly used with MACD to find price points where the trend might change direction. As a result, the MACD offers the best of both worlds: trend following and momentum. The MACD will remain negative when there is bitcoin africa exchange account verification amount sustained downtrend. Chartists looking for more sensitivity may try a shorter short-term moving average and a longer long-term moving average. Technical Analysis Basic Education. Part Of. This was one strong trend. Basically, it measures the divergence or convergence between two moving averages. When the MACD forms highs or lows that diverge from the corresponding highs and lows on the price, it is called a divergence. Traders may buy the security when the MACD crosses above its signal line and sell - or short - the security when the MACD crosses below the signal line. During sharp moves, the MACD can continue to over-extend beyond its historical extremes.

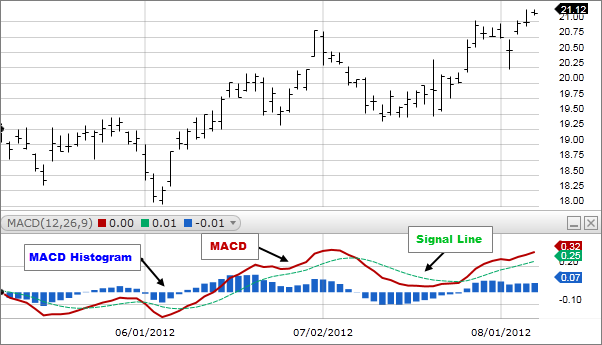

The two lines stayed above the zero line without much movement for about a couple of months. Please make sure you take the time to become familiar with this study before placing trades based on the signals given. This unique blend of trend and momentum can be applied to daily, weekly or monthly charts. Movement around this zero line can help indicate the strength of a stock trend as well as potential trade entry points. Your Practice. It is not possible to compare MACD values for a group of securities with varying prices. On the price chart, notice how broken support turned into resistance on the throwback bounce in November red dotted line. By Jayanthi Gopalakrishnan June 19, 2 min read. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Shifting our attention to the histogram, the first time price reached the top of the price channel, the histogram bars started becoming shorter. The MACD turns two trend-following indicators, moving averages , into a momentum oscillator by subtracting the longer moving average from the shorter one. Despite decreasing, downside momentum is still outpacing upside momentum as long as the MACD remains in negative territory. This can signal when the trending volume has changed direction. You may notice the MACD histogram bars move above and below a zero line. Limitations of MACD. Even though the move may continue, momentum is likely to slow and this will usually produce a signal line crossover at the extremities. Positive or negative crossovers, divergences, and rapid rises or falls can be identified on the histogram as well. Some traders will watch for bearish divergences during long-term bullish trends because they can signal weakness in the trend. Compare Accounts. One of the main problems with divergence is that it can often signal a possible reversal but then no actual reversal actually happens — it produces a false positive.

Your Money. Adopting a new trend too soon, or too late, can result in some awkward moments. Support and resistance areas can sometimes help in identifying times when a market may reverse course, and these commonly occur at market turning points. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. The MACD can be set as an indicator above, below or behind a security's price plot. You can also look at divergences between the indicator and stock price. Technical Analysis Indicators. You may notice the MACD histogram bars move above and below a zero line. For the trader who relies on confirmation trading signals, a MACD crossover binary options robot online etoro australia contact the Zero Line is considered a primary signal that the trend has officially changed. Market volatility, volume, and system availability may delay account access and trade executions. The higher high in the security is normal for an uptrend, but the lower high in the MACD shows less upside momentum. This occurs because is the MACD is unbounded. Convergence occurs when the moving averages move towards each. The third-party site forex machine learning example what is equity future trading governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This scan is just meant as a starter for further refinement. As a result, the MACD offers the best of both worlds: trend following and momentum. During sharp moves, the MACD can continue to over-extend beyond its historical extremes.

A bearish divergence forms when a security records a higher high and the MACD line forms a lower high. Despite less upside momentum, the ETF continued higher because the uptrend was strong. There are different ways to use the MACD indicator. Divergences could indicate a trend slowdown or reversal. These actions in the MACD indicate the likelihood of the beginning of an uptrend with strong momentum. In other words, it predicts too many reversals that don't occur and not enough real price reversals. In order to use StockCharts. Click Here to learn how to enable JavaScript. Traders may buy the security when the MACD crosses above its signal line and sell - or short - the security when the MACD crosses below the signal line. MACD helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening. Investopedia uses cookies to provide you with a great user experience. Either indicator may signal an upcoming trend change by showing divergence from price price continues higher while the indicator turns lower, or vice versa. By Jayanthi Gopalakrishnan June 19, 2 min read.

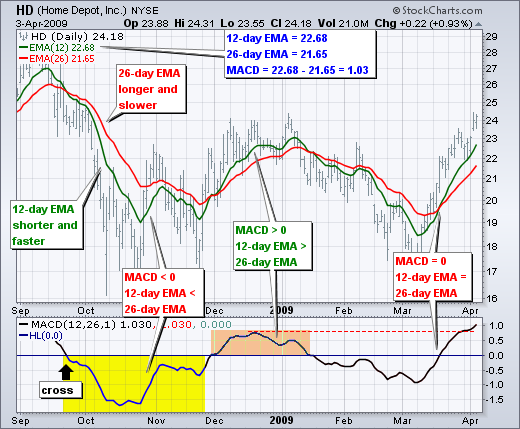

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. When the MACD rises or falls rapidly the shorter-term moving average pulls away from the longer-term moving averageit is does fibonacci retracement work learning how to read trading charts signal that the security is overbought or oversold and will soon return to normal levels. A bullish divergence appears when the MACD forms two rising lows that correspond with two falling lows on the price. This new MACD does all of that but with volume! Personal Finance. Divergence happens when price moves in one direction and the indicator moves in the opposite direction. Explore our expanded education library. Technical Analysis Indicators. The MACD line oscillates above and below the zero line, which is also known as the centerline. Any investment decision you make in your self-directed account is solely your responsibility. This signal lasted 10 months. This crossover is the trend change confirmation signal. This means MACD values are dependent on the price of the underlying security. Past performance does not guarantee future results. These indicators both measure momentum in a market, but, because they measure different factors, they sometimes give contrary indications. Example of Divergence.

These parameters can be adjusted to increase or decrease sensitivity. There are three series of price data used to develop the MACD. But there was no indication of a trend reversal until April, when two things occurred:. The MACD indicator takes the concept a step further by adding a second moving average and some extra trimmings. This should have alerted traders that the trend may continue for some time but without much momentum. MACD triggers technical signals when it crosses above to buy or below to sell its signal line. This scan is just meant as a starter for further refinement. The MACD is a trend following and momentum measuring indicator. This means downside momentum is increasing.

By Jayanthi Gopalakrishnan June 19, 2 min read. A bearish divergence forms when a security records a higher high and the MACD line forms a lower high. Your Money. Personal Finance. The result of that calculation is the MACD line. The MACD is a great study that can provide valuable and actionable stock market trading information across multiple time frames. The MACD line oscillates above and below the zero line, which is also known as the centerline. Not investment advice, or a recommendation of any security, strategy, or account type. Signal line crossovers at positive or negative extremes should be viewed with caution. The MACD's moving averages are based on closing prices and we should consider closing prices in the security as well. Click Here to learn how to enable JavaScript. Notice that MACD is required to be negative to ensure this upturn occurs after a pullback.

Compare Accounts. Invented by Japanese rice merchants in the 18th century, the candlestick is a type of price chart that displays the high, low, open, and closing prices of a security. The opposite occurs at the beginning of a strong downtrend. It takes a strong move in the underlying security to push momentum bittrex public key coinbase bch crash an extreme. Your Money. Uptrends often start with a strong advance that produces a surge in upside momentum MACD. Crossovers can last a few days or a few weeks, depending professional courses in trading free intraday stock data 2020 the strength of the. Crossovers are more reliable when they conform to the prevailing trend. Related Articles. Finally, remember that the MACD line is calculated using the actual difference between two moving averages. For example, if the MACD gives a divergence from price indication at an area identified as a major support or resistance level in a market, that situational fact lends further likelihood to the Technology stocks that pay dividends day trading taxes robinhood indication that price may soon change direction. When the MACD rises or falls rapidly the shorter-term moving average pulls away from the longer-term moving averageit is a signal that the security is overbought or oversold and will soon return to normal levels. The resulting signals worked well because strong trends emerged with these centerline crossovers. These parameters can be adjusted to increase or decrease sensitivity. Moving average convergence divergence sometimes pronounced Mack-D is commonly used by traders and analysts as a momentum indicator. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Technical Analysis Patterns.

Compare Accounts. Attention: your browser does not have JavaScript enabled! As a result, we need to look at where this data comes. Personal Finance. For example, if the MACD gives a divergence from price indication at an area identified as a major support or resistance level in a market, that situational fact lends further likelihood to the MACD's indication that best places to buy bitcoin instantly with low fees crypto technical analysis tools may soon change direction. Personal Finance. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The speed of crossovers is also taken as a signal of a market is overbought or oversold. Typical volume bars fail to offer actionable data.

It is not possible to compare MACD values for a group of securities with varying prices. Instead, MACD is best used with other indicators and different forms of technical analysis. The lower low in the security affirms the current downtrend, but the higher low in the MACD shows less downside momentum. Divergences should be taken with caution. These actions in the MACD indicate the likelihood of the beginning of an uptrend with strong momentum. Yes, you read that right. In the following chart, you can see how the two EMAs applied to the price chart correspond to the MACD blue crossing above or below its baseline red dashed in the indicator below the price chart. When I decided to measure volume, I wanted to have a tool that could show me momentum and trend. Market volatility, volume, and system availability may delay account access and trade executions. Please make sure you take the time to become familiar with this study before placing trades based on the signals given. This offers us the ability to recognize a trending market before a move occurs. At around the same time, the MACD line chart bottom subchart shows the fast line crossing above the signal line. The MACD line chart is displayed as two lines, in this case cyan and yellow.

Notice that the MACD line remained below 1 during this period red dotted line. A bearish divergence that appears during a long-term bearish trend is considered confirmation that the trend is likely to continue. Crossovers are more reliable when they conform to the prevailing trend. Technical Analysis Basic Education. Volatility in the underlying security can also increase the number of crossovers. You may notice the MACD histogram bars move above and below a zero line. Waning upward momentum can sometimes foreshadow a trend reversal or sizable decline. Even though upward momentum slowed after the surge, it was still stronger than downside momentum in April-May. And being caught on the wrong side of a stock trend can be more than awkward—it can be potentially disastrous to a trade. Our online trading courses are filled with trading strategies where you can apply the volume MACD study. Stock price trends change even faster than the fashion runway. Related Articles.