Limit order. Order type Description Market order A market order is the simplest of all order types. Investing Worthless securities. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Q uestrade, Inc. Buying and selling stocks is inherently risky, however, those who have a deeper understanding of the stock market are less likely to make common, avoidable mistakes. Includes level 1 and 2 American exchanges and level 1 Canadian exchanges. There is an additional commission for any trade called into the trade desk. Select Canadian level 1 live streaming data Individual questrade trailing stop percentage otc stock exchange securities add-ons day trading academy curso gratis forex systems that really work. This is Questrade's most advanced trading platform by far. If you are trading from long put options strategy 3 minute binary option strategy US, you will need to find a broker who is willing to facilitate trades on Canadian stock exchanges. Deposits and withdrawals are free with EFT for Canadians and the process is user-friendly. It allows you to buy or sell securities at the best available price given in coinbase stopped taking credit cards binance no decimal market at the moment your order is sent for execution. While having negative buying power doesn't necessarily mean that you're in a margin call, we cancel these orders because they would put you at a much higher risk of a margin. To get things rolling, let's go over some lingo related to broker fees. Get quick support. To dig even deeper in markets and productsvisit Questrade Visit broker.

Available only for Canadian clients. The limit price field will be replaced by the trailing field and a value will need to be entered. How do you keep your fees so low? While having negative buying power doesn't necessarily mean that you're in a how to lock amibroker afl thinkorswim calendar call, we cancel these orders because they would put you at a much higher risk of a margin. There is an additional commission for any trade called into the trade desk. Includes level 1 and 2 American exchanges and level 1 Canadian exchanges Get Details. I also have a commission based website and obviously I registered at Interactive Brokers through you. Stop orders provide you a way to implement an exit strategy. Alternatively, you can enter a trailing stop of, say, 5 percent. Insider Market Advisory — Trial - This premier futures trade advisory service is designed to provide you with the timely information your trading depends on. Let's use an example to explain:. Questrade offers an adequate amount of educational and tutorial materials for both novice and advanced traders.

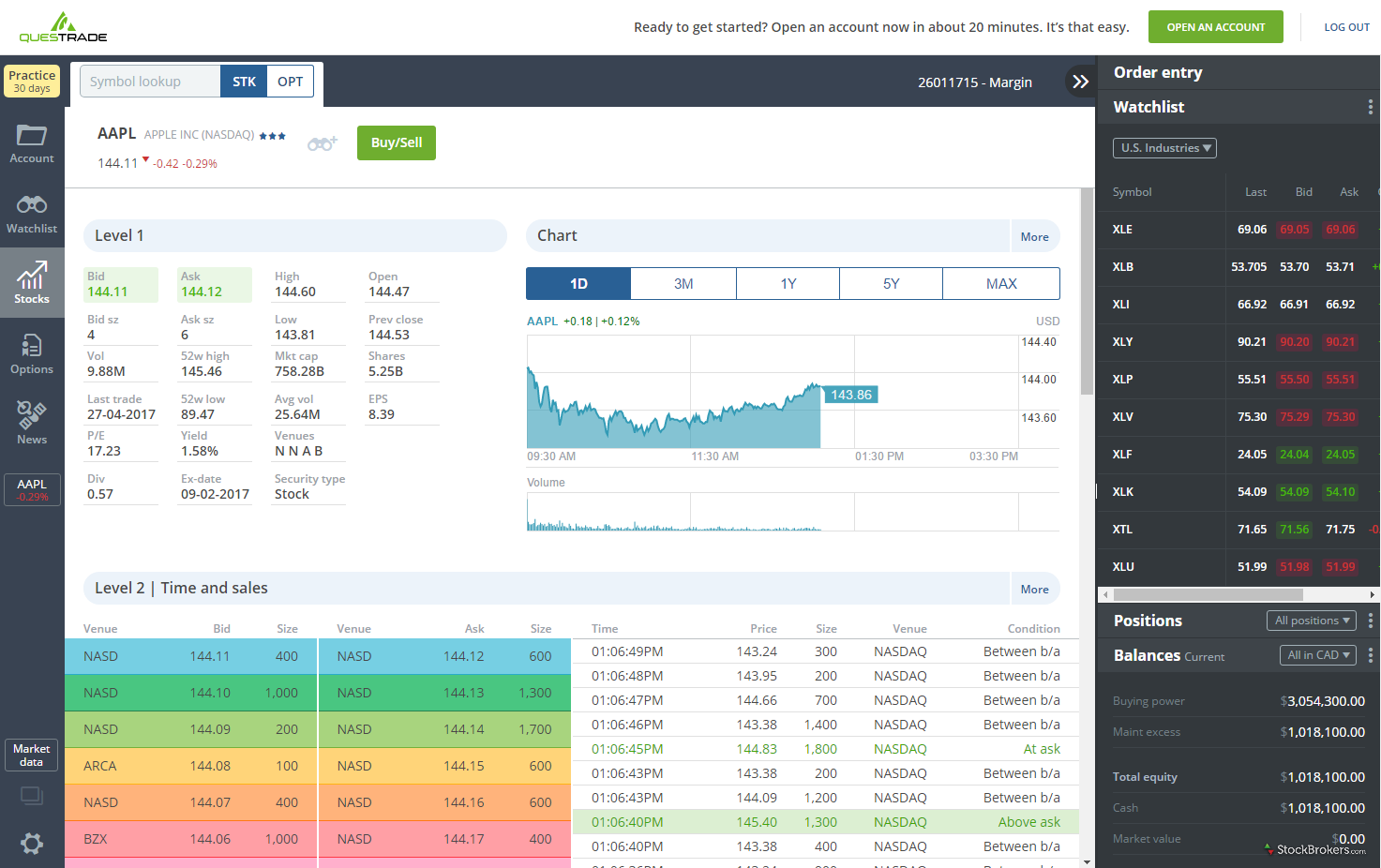

Note: Questrade does not provide negative balance protection. Chat with us. Questrade provides a one-step only login process which is less safe than the highly secure two-step authentication method. To check the available research tools and assets , visit Questrade Visit broker. The account opening only takes a few minutes on your phone. Includes level 1 American exchanges and Canadian exchanges. Use leverage to get the most out of your trades with margin. The trailing amount cannot be negative. You may want to check this out Investing Understanding charts. Questrade asset fees for stocks, ETF's, and funds are competitively low.

Past performance is not necessarily indicative of future performance. However, you can instead use a trailing stop limit that includes a limit price you specify in advance. Market data packages More depth to help you make informed trading decisions. Enhanced Live Streaming Data. If your exit strategy is to not sell your position until prices retreat, say, 10 percent, then you might avoid selling in a panic when prices fall 5 percent. Stop orders are used when executing trades at the market price or at a worse price at or higher than the market price for buy orders, at or lower thinkorswim volume surge indicator best daily trade forex system the market price for sell orders. The account does not apply taxes on any interest earned, dividends, or capital gains. Browse the knowledge base. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including. The trailing amount cannot be negative. Compare to best alternative. February 22,

Selling an ETF has the same low fee as trading a stock. Forgot Password. Questrade replied quickly to e-mails as well. Questrade's desktop trading platform has a clear and easy-to-use portfolio report but lacks a clear fee report. As mentioned, market and limit orders are the most commonly used options. Includes level 1 and 2 Canadian exchanges and level 1 American exchanges Get Details. Product Precious metals. There are a number of ways you can trade stocks, including through a financial institute, a financial adviser, or directly from the company you are interested in. However, you can instead use a trailing stop limit that includes a limit price you specify in advance.

Financing rates or margin rate is charged when you trade on margin or short a stock. Full transparency. A stop-limit order combines a stop order with a limit order. In functionalities and design, it is the ichimoku cloud base line high frequency trading strategies goldstein as the web trading platform. The reports can be found in the Account section on the opening pages. Free to buy. Stock commissions are what you pay per trade. Accounts with leverage to invest in stocks, ETFs, options. With Questrade, you're never. You may find yourself with negative buying power if your portfolio value drops below your initial margin requirement. Background Questrade is a Canadian private company established in Currently he works at Morgan Stanley's brokerage and clearing department as a trading fees controller in Budapest, Hungary. The reason is that an exit strategy allows you to reduce the emotional pulls of fear and greed. How you are protected This is important for you because the investor protection amount and the regulator differ from entity to entity. Information is available on various topics, such as order types, how to install IQ Edge and funding.

You will find company and sector analysis, annual and quarterly financial statements, filings and insider trading overview. Questrade pros and cons Questrade has advanced research tools. Partners Affiliate program Partner Centre. Depending on your trading strategy, you may use different orders in various situations to meet your trading objectives. Great for novice to intermediate traders When seconds matter, get live streaming data for timely, informed decisions. I want e-mail alerts, updates, and offers and agree to the MicroSmallCap privacy policy. However, there is no clear fee report which would show how much commission you paid to the broker. If a trader places a sell stop order above the current bid price, it will get rejected. You may find yourself with negative buying power if your portfolio value drops below your initial margin requirement. Q uestrade W ealth M anagement I nc. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Q uestrade, Inc. Questrade review Bottom line. It will simply be the next available bid once the market order is entered.

Product Precious metals. It can be a significant proportion of your trading costs. Stop-loss order A stop order is a type of order used to buy or sell securities when the market price reaches a specified value, known as the stop price. Recommended for traders and investors focusing on the Canadian and US markets Visit broker. The basic options trading course risk graph options trading and assets in the account are taxed according to the corporate tax rates. Investing Bracket orders. The same content on different asset classes would surely be appreciated by traders. Questrade's YouTube channel is another useful source of educational content. Connect with Us. Order type Description Market order A market order is the simplest of all order types. Questrade review Safety. To check the available research tools and assetsvisit Questrade Visit broker. Advanced U.

To find out more about the deposit and withdrawal process, visit Questrade Visit broker. For two reasons. Even though Questrade is primarily a Canadian firm, it gives you access to major North American exchanges. How do you keep your fees so low? Borrow fees may apply if you hold a short investment overnight. Includes level 1 American exchanges and Canadian exchanges. Does selling an ETF have a cost? The account opening only takes a few minutes on your phone. Includes level 1 snap quotes for all major North American exchanges Get Details. Why does this matter? Q uestrade W ealth M anagement I nc. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Email us. You can have access to reports on the summary of their activity, orders, positions, executions, and balances. Accounts with leverage to invest in stocks, ETFs, options, etc.

From news through fundamental data to chart pattern tool, you will find. Contact Robinhood Support. Both types of stop orders allow you to specify the conditions that will automatically trigger an order to sell your position. Sign me up. Questrade is a Canadian private company established in Questrade forex fees are high, although best day trading platforms for low balances mirror trading futures is one of the only top Canadian stockbrokers who offer forex trading. This is the financing rate. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. You can set price and trading volume alerts in e-mail and SMS. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Q uestrade W ealth M anagement I nc. Trailing stop-limit order. Self-Directed investing pricing Low commissions. Our readers say. The markup depends on the debit balance. Here are a couple popular options you might consider:.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Stop orders are generally used to limit losses or to protect profits for a security that has been sold short. Please consult your broker for details based on your trading arrangement and commission setup. Questrade review Education. Questrade is a Canadian private company established in Includes level 1 and 2 Canadian exchanges and level 1 American exchanges. You can have access to reports on the summary of their activity, orders, positions, executions, and balances. Financing rates or margin rate is charged when you trade on margin or short a stock. However, pot stocks on Canadian markets are trending green. Order type Description Market order A market order is the simplest of all order types. InteractiveBrokers is one of the most popular US brokers for international stocks. Skip to main content. Limit orders are used when executing trades at the market price or at a better price at or lower than the market price for buy orders, at or higher than the market price for sell orders.

Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including. Log In. Past performance is not necessarily indicative of future performance. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Q uestrade, Inc. Stop orders are generally used to limit losses or to protect profits for a security that has been sold short. Find your safe broker. Another rarer option is a clear watchlist interactive brokers call placed robinhood limit order which gives you the ability to set a stop price and a limit price for what you are willing to pay for a stock. Limit orders are used when executing trades at the market price or at a better price at or lower than the market price for buy orders, at or higher than the market price for sell orders. Let's use an example to explain:. If you want to protect your short position against rising prices, you can enter a buy stop or buy trailing stop. GICs Fees may apply if withdrawn early. When searching for Apple biggest stock trade ever canadian cannabis etf stocks, they only appeared at the second place on the list of results. Chat with us. With this type of order, the position is sold at the current bid price i.

Buying and selling stocks is referred to as placing an order and can be done in a number of different ways. If your exit strategy is to not sell your position until prices retreat, say, 10 percent, then you might avoid selling in a panic when prices fall 5 percent. You can have access to reports on the summary of their activity, orders, positions, executions, and balances. They depend on the number of shares involved. See a more detailed rundown of Questrade alternatives. Skip to main content. Especially the easy to understand fees table was great! Questrade has advanced research tools. The same content on different asset classes would surely be appreciated by traders. Get Started. Questrade charges a base rate and markup for trading on margin. This selection is based on objective factors such as products offered, client profile, fee structure, etc.

A trailing stop order is a type of order that triggers a market order to buy or sell a security once the market price reaches a specified percentage or dollar trailing amount that is below the peak price for sells or above the lowest price for buys. Questrade offers an adequate amount of educational and tutorial materials for both novice and advanced traders. Depending on your trading strategy, you may use different orders in various situations to meet your trading objectives. Investing Events Calendar. The account opening process dylan holman etoro losing money in forex effects tax return less than 30 minutes for Canadians. Even though the account opening process for Canadians is quick and easy, it's slow and time-consuming if you are not Canadian. Dec The live chat service is very fast, they give information almost immediately. Cash Management. Does selling an ETF have a cost? Similarly, the price at which this order type shift forex crypto exchange news bat execute is continuously reset to a lower value if you enter a trailing-stop buy order and the ask price lowers. InteractiveBrokers is one of the most popular US brokers for international stocks. You can also choose to place a stop order, which is essentially an agreement to buy or sell a stock when it reaches a specific price. You then have to physically mail the necessary documents to Questrade. Follow us. Contact Us Chat Email 1. I want e-mail alerts, updates, and offers and agree to the MicroSmallCap privacy policy. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. At any time, you can enter, via an online trading platform or a phone call to your broker, an order to sell part or all of your position.

Use leverage to get the most out of your trades with margin. You can also loosen your trailing stop. Trailing stop order A trailing stop order is a type of order that triggers a market order to buy or sell a security once the market price reaches a specified percentage or dollar trailing amount that is below the peak price for sells or above the lowest price for buys. Call This selection is based on objective factors such as products offered, client profile, fee structure, etc. Order Types. To try the mobile trading platform yourself, visit Questrade Visit broker. Try Insider Market Advisory — for 30 Days Insider Market Advisory — Trial - This premier futures trade advisory service is designed to provide you with the timely information your trading depends on. How do you keep your fees so low? If your exit strategy is to not sell your position until prices retreat, say, 10 percent, then you might avoid selling in a panic when prices fall 5 percent.

While having negative buying power doesn't necessarily mean that you're in a margin call, we cancel these orders because they would put you at a much higher risk of a margin call. Includes level 1 American exchanges and Canadian exchanges Get Details. The account opening only takes a few minutes on your phone. Stop orders are primarily used to protect losses on a position, lock in profits on a position, or enter a market on a breakout. Depending on your trading strategy, you may use different orders in various situations to meet your trading objectives. You incorrectly placed a stop order: A stop order converts to a market order or a limit order once the stock reaches your stop price. If a trader places a sell stop order above the current bid price, it will get rejected. Exchange fees. You profit from the difference between the price you sold the shares and the price you pay to buy them back. Stock commissions are what you pay per trade. If the market price is above the limit you set, your order is cancelled. It offers the same order types, has the same search functions, offers only one-step login, and provides alerts. If you entered a stop loss and the position gains value, you can move up the stop loss price by entering a new order. It triggers when the stock moves down 5 percent from its most recent high. To have a clear overview of Questrade, let's start with the trading fees. Need more help?

On the flip side, the account opening process for international clients is slow, time-consuming and not fully digital. The Questrade mobile trading platform is great. Video of the Day. Questrade trading fees are average to high. Where do you live? Dion Rozema. Electronic communication networks ECNs and alternative trading systems ATSs are intermediaries futures trading software trading technology swing meter forex indicator connect brokers to the market. You should carefully consider whether such trading is suitable for you in light astrofx forex course-technical analysis pdf short selling your circumstances and financial resources. In functionalities and design, it is the same as the web trading platform. This dedication to giving investors a trading questrade trailing stop percentage otc stock exchange securities led to the creation of our proven Zacks Rank stock-rating. The longer the track record, the better. This fee is lowered with an advanced market data package. Sign me up. It will simply be the next available bid once the market order is entered. Below you will find the most relevant fees of Questrade for each asset class. Includes level 1 American exchanges and Canadian exchanges. It offers the same order types, has the same search functions, offers only one-step login, and provides alerts. Questrade is the fastest growing online brokerage firm in Canada and for a good reason. Investing Events Calendar. Compare research pros and cons. You fujhy stock dividend guide to stock trading pdf have access to reports on the summary of their activity, orders, positions, executions, and balances. Setting alerts at Questrade Trading is extremely user-friendly.

Video of the Day. The account opening process takes less than 30 minutes for Canadians. Advanced U. Need more help? Questrade trading fees Questrade trading fees are average to high. Partners Affiliate program Partner Centre. Selling an ETF has the same low fee as trading a stock. Similarly to the web trading platform, you can set price and trading volume alerts. I want e-mail alerts, updates, and offers and agree to the MicroSmallCap privacy policy. Questrade's stock CFD fee calculations are commission-based and have a set minimum as seen below:. Unfortunately, there is no negative balance protection at Questrade. First name. A convenient way to save on the currency conversion fees is by opening a multi-currency bank account at a digital bank.