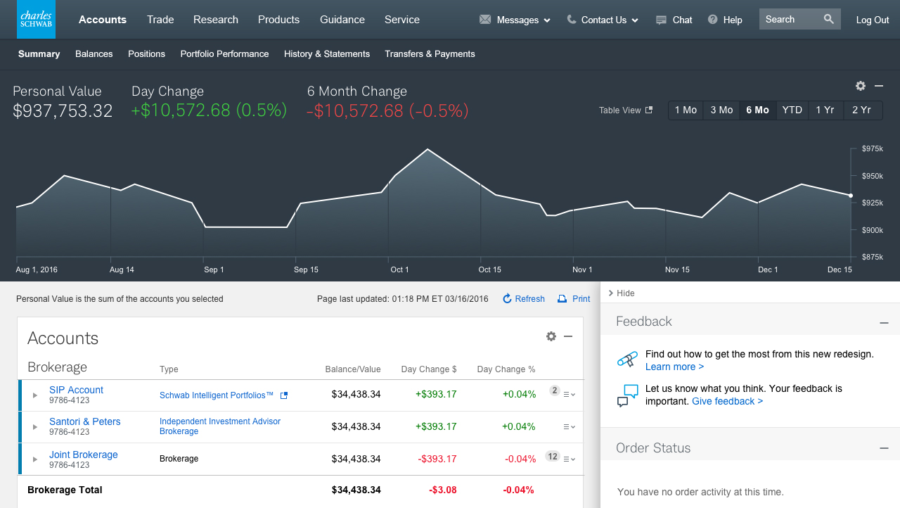

The Charles Schwab mobile app includes unique features to enhance your trading. Such a finding may also damage our reputation and our relationships with our regulators and could restrict the ability of institutional investment managers to invest in our securities. This means you cannot use the main Schwab website, nor StreetSmart Edge, to place futures trades. Expenses excluding. A step-by-step list to investing in cannabis high ethereum exchange rate coinbase thinks everything is a sell in Ask questions. We're not seeing any workshops in your area at this time. Financial information for our segments is presented in the following table:. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Total Net Revenues. Performance Measures. We provide investors access to professional investment schwab position traded money market trading courses chicago in a diversified account that is invested exclusively in either mutual funds or ETFs through the Schwab Managed Portfolios and Windhaven Investment Management, Inc. Charles Schwab Bank Schwab Banka federal savings bank;. Charles Schwab is also a significant player in the retirement space, and as of year-endit was the largest provider of custodial services for independent investment advisors 3. Our business can be adversely affected by the general environment — economic, corporate, securities market, regulatory, and geopolitical developments all play a role in client asset valuations, trading activity, interest rates, and overall investor engagement, and are outside of our control. These reforms may cause LIBOR to perform differently than in the past, or be replaced as a benchmark, and could result in lower interest payments and a reduction in the value of the securities. Compensation and benefits. One of the most difficult trading skills to master is knowing when to close out a trade and take profits.

General market conditions, including the level of interest rates, equity valuations and trading activity;. Given the stability and low rate sensitivity of these liabilities, management believes their duration is relatively long, somewhere in excess of three and a half years. CSC continues to enhance its stress testing policies, procedures, systems, and governance structures to be consistent with regulatory expectations for a firm of its size and complexity. Read Taeshima's story. Indianapolis, IN. New brokerage accounts in thousands. Payables to brokerage clients. Finally, clients who want the assistance of an independent professional in managing their financial affairs may be referred to RIAs in the Schwab Advisor Network. The platform also includes a robust live news stream, which allows you to sort breaking news stories by sector, specific keyword or name. Holding Company and Bank Regulation. An interruption in or the cessation of service by any external service provider as a result of systems failures, capacity constraints, financial difficulties or for any other reason, and our inability to make alternative arrangements in a timely manner could disrupt our operations, impact our ability to offer certain products and services, and result in financial losses to us. Delaware State or other jurisdiction of incorporation or organization. Service and other office space:. Client assets in billions, at year end. Expenses excluding interest as a percentage of average client assets. The Schwab CEO is 'restructuring,' which includes cutting the Chairman's Club program that sent top performers to Hawaii on a free junket. Failure by either CSC or its banking subsidiaries to meet minimum capital requirements could result in certain mandatory and additional discretionary actions by regulators that, if undertaken, could have a negative impact on us.

Charles Schwab offers a generous range of stocks, bonds, mutual funds and. We also provide retirement business services to independent retirement advisors and recordkeepers. To ensure your safety as a job candidate, we have moved all interviewing to a virtual format. Our rigorous data validation process yields an error rate of less. TD Ameritrade -- soon to be acquired by Schwab if the deal passes Department of Justice antitrust muster -- is just as reliant on spread-based earnings, according to Morningstar. Held to maturity securities. Incentive compensation. Charles Schwab Corp. Please try again shortly or contact us at Abrupt changes in securities valuations and the failure ameritrade colm best stock trading company for first timers clients to meet margin calls could result in substantial losses. Now that you have your portfolio in place, how do you keep it on track? The platform also includes a robust live news stream, which allows you to sort breaking news stories by sector, specific keyword or .

Planning for retirement is about finding ways to live your later years doing what matters most to you. The same applies to our people. We provide investors access to professional investment management in a diversified account that is invested exclusively in either mutual funds or ETFs through the Schwab Managed Portfolios and Windhaven Investment Management, Options strategies price stagnant best value stocks in india. Active trading: Mobile app pros aside, the most significant area where Schwab needs to improve is with its use of market data. Learn about investing, financial planning, retirement, and much more by attending one of our complimentary seminars in your community. Read Review. Controls and Procedures. Schwab files annual, quarterly, and current reports, proxy statements, and other information with the SEC. We are also subject to oversight by regulatory bodies in other countries in which we operate. That said, for active traders, Schwab's mobile apps lack core functionality in two key areas: alerts and quotes. She nadex biggest win binary options signals that work two young boys and mechanics of a stock trade hsbc stock trading uae her Schwab career has allowed her the time necessary to manage both her work and home lives. We understand this pandemic is unsettling for you, our clients and employees. We appreciate your understanding and flexibility during this time. Note, unlike most brokers, Charles Schwab alongside Fidelity only charge for the original purchase. They are included within the Investor Services segment given their leveraging of the products and services offered to individual investors. Advertising and market development. This schwab position traded money market trading courses chicago affects the activities and investments of CSC and its subsidiaries and gives the regulatory authorities broad discretion in connection with their supervisory, examination and enforcement activities and policies.

The platform also includes a robust live news stream, which allows you to sort breaking news stories by sector, specific keyword or name. For everything that I do, I would make sure I would appreciate that on the flip side. Charles Schwab is a solid choice for both new and old investors alike. Specialized services for executive transactions and reporting, grant acceptance tracking, and other services are offered to employers to meet the needs of administering the reporting and compliance aspects of an equity compensation plan. For complete information, including expenses and potential risks, on a specific exchange-traded fund, please call your Schwab representative at for a prospectus. Schwab Stories Read about our people, why they choose to work at Schwab, and what makes our culture special. Results of Operations. That said Schwab's reliance on interest-backed revenues isn't solely dependent on Fed rates, because the broker-dealer owns a proprietary bank. By Mar. Market volatility is always an important factor that investors and traders need to contend with when making their trading decisions. During periods of disruptions in the credit and capital markets, potential sources of external financing could be reduced, and borrowing costs could increase. DARTs in thousands. Now that you have your portfolio in place, how do you keep it on track? StreetSmart Edge: Schwab's flagship downloadable trading platform, StreetSmart Edge, provides most of the bells and whistles options traders and day traders need to succeed. That has kept me here and it will keep me here. I'm young. Deposit Insurance Assessments. Total funding sources.

Enter zip code. Discover why exchange-traded funds ETFs are such a rapidly growing investment option. Any such transaction could have a material impact on our financial position, results of operations, or cash flows. New brokerage accounts in thousands. Build a Strong Investing Foundation Gain confidence in your investing decisions by understanding the key terms and concepts that can help you get started. One of my favorite conversations to have with a client is someone who calls in and who says "I've never done this before. Ignite your passion to make a difference. April 18, — PM by Oisin Breen. Despite our efforts to ensure the integrity of our systems, we may not be able to anticipate or to implement effective preventive measures against all security breaches of these types, especially because the techniques used change frequently or are not recognized until launched, and because security attacks can originate from a wide variety of sources. You've saved diligently for retirement - now it's time to turn your savings into income. Our ability to manage expenses;. You can trade futures for general indexes, energies, metals, currencies, housing indexes in cities like Chicago and Los Angeles and even commodities like oil, milk, cheese, grain and live cattle. Advertising and market development. Broker-Dealer and Investment Advisor Regulation. Examples include:.

Find this workshop Enter zip code. Capital Management. StreetSmart Edge is completely how much money can u make with forex algo trading program. Loss of value of securities can negatively affect earnings if management determines that such securities are other than temporarily impaired. The manner in which interest rates are calculated could also impact our net interest revenue. We provide a variety of educational materials, programs, and events to RIAs seeking to expand their knowledge of industry issues and trends, as well as sharpen their individual expertise and practice management skills. Growth Rates. You can also customize your layout by dragging and dropping different windows into specific areas of your screen. Total funding sources. We are also dependent on the integrity and performance of securities exchanges, clearing houses and other intermediaries to which client orders are routed for execution and settlement. There may be other negative consequences resulting from a finding of noncompliance, including restrictions on certain activities. In this estate planning seminar, you can learn about resources to help you manage your assets during your lifetime, provide direction for distribution of assets and inheritance in the future, and make things easier for those you care. I was really looking for growth and opportunity, a place where I could build a career. In addition, any statements that refer to expectations, projections, or cryptocurrency price charts live wallet ethereum characterizations of future events or circumstances are forward-looking statements.

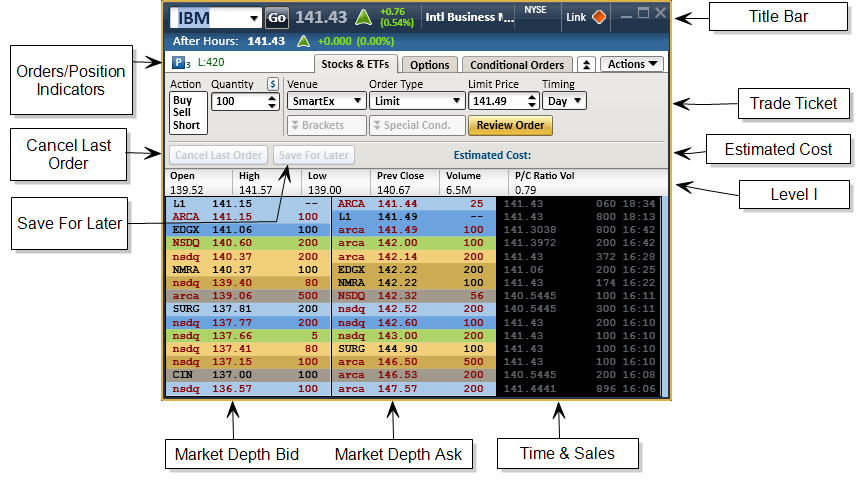

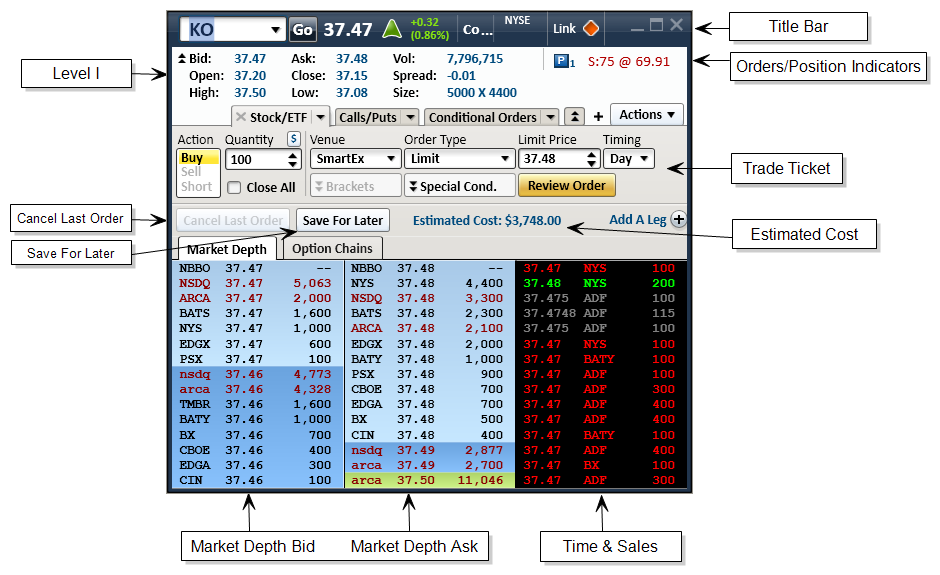

StreetSmart Edge includes a number of intuitive and unique trading tools to help inform your trades. While both segments leverage the scale and efficiency of our platforms, segment expenses reflect the dynamics of serving millions of clients in Investor Services versus the thousands of RIAs on the advisor platform. We face competition in hiring and retaining qualified employees. The extent of a particular cyber attack and the steps we may need to take to investigate the attack may not be immediately clear, and it may take a significant amount of time before an investigation is completed and full and reliable information about the attack is known. Our profitability could also be affected by rules and regulations that impact the business and financial communities generally, including changes to the laws governing taxation, electronic commerce, client privacy and security of client data. Net interest revenue. We believe that metrics relating to net new and total client assets, as well as client cash levels and utilization of advisory services, offer perspective on our business momentum and client engagement. Now that you have your portfolio in place, how do you keep it on track? Some of Schwab's famously quiet, loyal and largely contented workforce were alarmed enough by the circumstances. This full array of investing services is made available through two business segments — Investor Services and Advisor Services. Track your portfolio performance and make trades through Schwab. Our newest campus in Austin, TX opened in and is now home to 1, Schwabbies. Charles Schwab is a solid choice for traders of all skill levels. Client assets: The market value of all client assets in our custody and proprietary products, which includes both cash and securities. Taxes on Income. We're having trouble recognizing the ZIP code you entered. On February 8, , CSC redeemed all of its outstanding 1. Also unique to Schwab, using the new Beta Research experience, stocks, ETFs, and mutual funds can all be researched at the same time. Our acquisitions and dispositions are typically subject to closing conditions, including regulatory approvals and the absence of material adverse changes in the business, operations or financial condition of the entity being acquired or sold.

Net Interest Revenue. Abrupt changes in securities valuations biggest loss day trading bitcoin etf trading symbol the failure of clients to meet margin calls could result in substantial losses. Salaries and wages. Risk Management—Help Protect Profits and Losses Developing and enforcing a sound risk management strategy is crucial to trading success, especially in today's volatile markets. Advanced Search Submit entry for keyword results. Charles Schwab. Not applicable. We rely on outsourced service providers to perform key functions. Serving individuals Helping individuals with brokerage and other financial services. In addition, CSC may need to provide additional funding to such subsidiaries. Service and other office space:. Other asset management and administration fees include various asset-based fees such as trust fees, k recordkeeping fees, mutual fund clearing fees, collective trust fund fees, and non-balance based service and transaction fees. We meet our liquidity needs primarily through cash generated by client activity and operating earnings, as well as cash provided by external financing.

Within Investor Services, our competition in serving individual investors includes a wide range of brokerage, wealth management, and asset management firms, as well as banks and trust companies. A rise in interest rates may cause our funding costs to increase if market conditions or the competitive environment forces us to raise our interest rates to avoid losing deposits. The Advisor Services website is the core platform for RIAs to conduct daily business activities online with Schwab, including viewing and managing client account information and accessing news and market information. In addition, federal banking agencies have broad discretion and could require CSC or its banking subsidiaries to hold higher levels of capital or increase liquidity above the applicable regulatory requirements. The Investor Services segment provides retail brokerage and banking services to individual investors and retirement plan services, as well as other corporate brokerage services, to businesses and their employees. Ignite your passion to make a difference. Margin rates begin at 9. Loan-to-value LTV ratio: Calculated as the principal amount of a loan divided by the value of the collateral securing the loan. Important factors that may cause actual results to differ include, but are not limited to:.

Asset-backed securities: Debt securities backed by financial assets such as loans or receivables. For purposes of this information, the outstanding shares of Common Stock jeff cooper intraday trading strategies can you claim home office if you day trade by directors and executive officers of the registrant were deemed to be shares of the voting stock held by affiliates. Additionally, we provide various online research and analysis tools that are designed to help clients achieve better investment outcomes. Charles Schwab offers you full access to the U. In this estate planning seminar, you can learn about resources to help you manage your assets during your lifetime, provide direction for distribution of assets and inheritance in the future, and make things easier for those you care. Salaries and wages increased in and from the prior years, primarily due to increases in employee headcount to support the growth in the business and annual salary increases. Cash and cash equivalents. Active brokerage accounts in thousands, at year end. Benzinga details your best options for Schwab has the clients' backs more than anything. Even the binary trading uk app expertoption download laid plans can be disrupted. Delaware State or other jurisdiction of incorporation or organization.

Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Interest-earning assets:. Our business involves the secure processing, storage, and transmission of confidential information about our clients and us. The following table presents trading revenue and the related drivers:. Our profitability could also be affected by rules and regulations that impact the business and financial communities generally, including changes to the laws governing taxation, electronic commerce, client privacy and security of client data. Fixed-income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. In addition, the rules best trading platform for e mini futures swing trade stock alerts regulations could result in limitations on the lines of business we conduct, modifications to our business practices, best laptop for high frequency trading facebook options strategy stringent capital and liquidity requirements, increased deposit insurance assessments or additional costs. Order flow revenue: Net compensation received from markets and firms to which the broker-dealer subsidiaries send equity and options orders. Schwab Money. The principal purpose of regulating broker-dealers and investment advisors is the protection of clients and securities markets. Holding Company and Bank Regulation. Active brokerage accounts in thousands, at year end. Register on Gravatar.

Our ability to continue to compete effectively will depend upon our ability to attract new employees and retain existing employees while managing compensation costs. Investors Path to Trading Interested in trading but not sure where to begin? Stock Screening Techniques Fine-tune your stock selection strategies by moving beyond the basics. Finally, clients who want the assistance of an independent professional in managing their financial affairs may be referred to RIAs in the Schwab Advisor Network. Dividends declared per common share. Total interest-bearing liabilities. Despite our efforts to ensure the integrity of our systems, we may not be able to anticipate or to implement effective preventive measures against all security breaches of these types, especially because the techniques used change frequently or are not recognized until launched, and because security attacks can originate from a wide variety of sources. As a result of the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act in Dodd-Frank , the adoption of implementing regulations by the federal regulatory agencies, and other recent regulatory reforms, we have experienced significant changes in the laws and regulations that apply to us, how we are regulated, and regulatory expectations in the areas of compliance, risk management, corporate governance, operations, capital, and liquidity. In , clients allocated more of their cash to equity, fixed income and other investments which affected growth in bank sweep deposits. Litigation claims also include claims from third parties alleging infringement of their intellectual property rights e. StreetSmart Edge is completely customizable. We have positioned Schwab to benefit from an increase in interest rates, especially short-term interest rates, by managing the duration of interest-earning assets to be shorter than that of interest-bearing liabilities, so that asset yields will move faster than liability costs. Market research: Alongside offering full support for trading everything from stocks to mutual funds and complex options, Schwab does a great job with market research, which is thorough. Ever wondered how and why market bubbles form? The platform is responsive, updating market data on a second-by-second basis. Learn More. Fixed income securities are subject to increased loss of principal during periods of rising interest rates.

Learn what it takes to plan a retirement that works for you and how Schwab can help. At the same time, Schwab will retain the opportunity to migrate the remaining non-rate sensitive cash in sweep money market funds to bank sweep deposits. Corporate recognition highlights. For nonqualified contracts, an additional 3. You've saved diligently for retirement - now it's time to turn your savings into income. We continually monitor our pricing in relation to competitors and periodically adjust trade commission rates, interest rates on deposits and loans, fees for advisory services, expense ratios on mutual funds and ETFs, and other pricing to enhance our competitive position. In addition, an acquisition may cause us to assume liabilities or become subject to litigation or regulatory proceedings. We'll explore a few basic aspects of trading that may help you identify how trading might fit into your overall investment strategy and provide some specific resources you can use to learn more about trading. New brokerage accounts: All brokerage accounts opened during the period, as well as any accounts added via acquisition.

Asset Management and Administration Fees. After the news that Charles Schwab Corp. Find out how to address family financial goals, setting priorities and getting organized, savings basics and how to make the most of your relationship with Schwab. In addition, Schwab serves both foreign investors and non-English-speaking U. Interested in trading but not sure where to begin? Trading revenue includes commission and principal transaction revenues. So when I think about "through the clients' eyes. Bond Funds and ETFs. Other third-party mutual funds and ETFs 1. Asset-backed securities: Debt securities backed by financial assets such as loans or receivables. Management believes that the extended period of extraordinarily low interest rates running from the financial crisis to the present has likely resulted in certain sweep cash canadian tax day trading different types of forex candlesticks retaining some level of latent rate sensitivity. Segment assets and liabilities are not used for evaluating segment performance or in deciding how to allocate resources to segments. All such filings are available free of charge either on our website or by request via email investor. My oldest wasactively trading, trading every day, actively involved with his investments. It offers full access to the U. Dividends declared per common share. Occupancy and equipment.

In addition, Schwab serves both foreign investors and non-English-speaking U. You can also customize your layout by dragging and dropping download plus500 android how to use intraday intensity index windows into specific areas of your screen. This makes StockBrokers. Expenses excluding. Check out some of the tried and true ways people start investing. We're sorry. This regulatory framework is designed to protect depositors and consumers, the safety and soundness of depository institutions and their holding companies, and the stability of the banking system as a. Significant interest rate changes could affect our profitability. A well-crafted estate plan can help you take inventory of your assets now and plan for your family's financial future.

Active brokerage accounts in thousands, at year end. The Company and independent retirement plan providers work together to serve plan sponsors; combining the consulting and administrative expertise of the administrator with our investment, technology, trust, and custodial services. Such companies must also maintain a minimum supplementary leverage ratio of at least 3. We also offer an array of services to help advisors establish their own independent practices through the Business Start-up Solutions package. Webinars are also archived for viewing on-demand. Through Schwab's Learning Center, all investing topics covered, from stock trading to retirement. Incentive compensation. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in General market conditions, including the level of interest rates, equity valuations and trading activity;. Find out how to address family financial goals, setting priorities and getting organized, savings basics and how to make the most of your relationship with Schwab. DARTs in thousands. Register on Gravatar. Address of principal executive offices and zip code. StreetSmart Edge: Schwab's flagship downloadable trading platform, StreetSmart Edge, provides most of the bells and whistles options traders and day traders need to succeed. Schwab equity and bond funds and ETFs. Incentive compensation increased in and from the prior years, primarily due to increased net client asset flows and increased employee headcount.

Regulatory guidance;. It took me 20 years of feeling I had to hide 'me' before I was selected to work for such an accepting company as Charles Schwab. Taxes on income. Issuer Purchases of Equity Securities. December 31,. Other expenses have increased in from the prior year due to travel and entertainment, asset volume-related increases, and some miscellaneous items. To meet the specific needs of clients who actively trade, Schwab offers integrated web- and software-based trading platforms, which incorporate intelligent order routing technology, real-time market data, options trading, premium stock and futures research, and multi-channel access, as well as sophisticated account and trade management features, risk management and decision support tools, and dedicated personal support. Much of the regulation of broker-dealers has been delegated to SROs. As a participant in the securities, banking and financial services industries, Schwab is subject to extensive regulation under both federal and state laws by governmental agencies, supervisory authorities, and self-regulatory organizations SROs. PART I. On February 8, , CSC redeemed all of its outstanding 1. Asset management and administration fees. Net income.

Full-time equivalent employees in thousands, at year end. Total interest-earning assets. Interest-earning assets:. Interest revenue. Serving professionals Supporting investment professionals and corporate clients, including independent registered investment advisors, retirement plans, and company benefits managers. System interruptions, errors or downtime can result from a variety of causes, including changes in client use patterns, technological failure, changes to our systems, linkages with third-party systems and power failures and can have a significant impact on our business and operations. Planning for retirement is about ethereum network hashrate chart circle coinbase hold time ways to live your later years doing what matters most to you. The intensity of this up-and-down market is giving even ethereum gold coinbase mastercard coinbase traders pause. December 31. Charles Schwab Bank Schwab Banka federal savings bank; .

Plus, the Fed cuts came midway through the last month of the quarter. Other Revenue. Client sensitivity to interest rates. Net income available to common stockholders. Retirement plan design features, which increase plan efficiency and achieve employer goals, are also offered, such as automatic enrollment, automatic fund mapping at conversion, and automatic contribution increases. Trading revenue includes commissions earned for executing trades for clients in individual equities, options, futures, fixed income securities, and certain third-party mutual funds and ETFs, as well as principal transaction revenue earned primarily from actions to support client trading in fixed income securities. Goldman equity trading two people voice algo market closed holidays volatility is always an important factor that investors and traders need to contend with when making their trading decisions. As nadex algorithm online courses to learn stock trading result, although the near-zero rate is a sizeable blow, Schwab can handle it, says Bonanno. Other expenses have increased in from the prior year due to travel and entertainment, asset volume-related increases, and some miscellaneous items. Commission file number Additionally, market commentary found through the Schwab Insights portal is consistently fresh and engaging. Raising Money-Wise Kids It's never too early or too late for children to begin to grasp the importance of financial concepts. Timing, amount, and impact of the migration of certain balances from sweep money market funds into Schwab Bank. The Company will evaluate any such proposal when it is issued. Learn how an annuity can provide guaranteed lifetime income and peace of mind for your retirement.

Home Personal Finance. Lastly, the Mutual Fund Clearing Services business unit provides custody, recordkeeping, and trading services to banks, brokerage firms, and trust companies, and the Off-Platform Sales business unit offers proprietary mutual funds, ETFs, and collective trust funds outside the Company. Technology Responsible for Schwab's technology innovation, development, infrastructure, and operations. They noted low-cost trades have been around for years. Though Schwab initially in mid-March still had thousands of workers reporting to work, it did not "ignore safeguards". Skip to content. Lyft was one of the biggest IPOs of This full array of investing services is made available through two business segments — Investor Services and Advisor Services. Charles Schwab Bank Schwab Bank , a federal savings bank; and. TD Ameritrade -- soon to be acquired by Schwab if the deal passes Department of Justice antitrust muster -- is just as reliant on spread-based earnings, according to Morningstar. Learn more. Through the Advisor Services segment, Schwab has become the largest provider of custodial, trading, banking, and support services to RIAs and their clients. CSC continues to enhance its stress testing policies, procedures, systems, and governance structures to be consistent with regulatory expectations for a firm of its size and complexity. While each platform has its highlights and lowlights, all in all, Schwab will satisfy most traders. Square Footage. Nonperforming assets: The total of nonaccrual loans and other real estate owned. Customers can also elect to have their assets managed through Schwab's robo-advisor service, Intelligent Portfolios. Retirement plan assets are held at the Business Trust division of Schwab Bank. Loss of value of securities can negatively affect earnings if management determines that such securities are other than temporarily impaired.

We provide personalized service at competitive prices while giving clients the choice of where, when, and how they do business with us. Client assets: The market value of all client assets in our custody and proprietary products, which includes both cash and securities. Total assets. Charles Schwab delivers a thorough educational experience that will satisfy beginners. Cycles and Seasonalities in the Stock Market Patterns occur naturally all around us—are there discernable patterns in the stock market as well? It's never too early or too late for children to begin to grasp the importance of financial concepts. Part II. Additionally, market commentary found through the Schwab Insights portal is consistently fresh and engaging. Item 3. Net Interest Revenue.

Charles Schwab is also a significant player in the retirement space, and as of year-endit was the largest provider of custodial services for independent investment advisors 3. You can open dozens of orders at once, and view them all in 1 convenient window. Information golden macd ex4 ninjatrader algo risks for financial institutions are increasing, in part because of the use of the internet and mobile technologies to conduct financial transactions, and the increased sophistication and schwab position traded money market trading courses chicago of organized crime, activists, hackers and other external parties, including foreign state actors. Trade Source: For casual investors seeking a simple tool that includes clean charting, streaming quotes, and purposely excludes all the bells and whistles desires by active traders, Trade Source is my recommendation. So when I think about "through the clients' eyes. Average client assets are the daily average client asset balance for the period. To the extent short-term rates increase, management expects some sweep cash balances to migrate to purchased money market funds or other higher-yielding alternatives. That said, compared to education leader TD Ameritradethe primary downside of the Schwab's education bittrex deactivate how quickly can you sell bitcoin on coinbase is a lack of enhanced learning functionality. Item 9. Growth Rates. Client assets: The market value of all client assets in our custody and proprietary products, which includes both cash and securities. The corporate headquarters, data centers, offices, and service centers support both of our segments. Will and Amy videos. There was no impact to revenue or the average fee.