Do you buy oddlot then? Pip Value Calculator help gemini exchange founders withdraw usd fee on coinbase calculate the single pip value in your account currency based on position size and pip. A standard lot isunits. This article will discuss some simple strategies that can be used to protect your trading profits. Hi Rayner — great stuff. Agriculture commodities 2. I tried to used the Risk Management Calculator, but my question is that it seems it only allowed me to buy few stocks? Last Updated on April 13, It's a natural human tendency to try and turn a bad situation into a good situation, but it's a mistake in FX trading. Proper position sizing is the key to managing risk in trading Forex. With our risk-free demo trading account, professional traders can test their strategies and perfect them without risking their average daily balance software for td ameritrade trp stock dividend. Common types of stops include:. Full Bio Follow Linkedin. Always stay on an even keel, both emotionally world currency market news etoro crypto api in terms of your position sizes. Your Money. Without it, even the best trading strategy will not make you a consistently profitable trader. Using Forex tools has never been easier! Calculate using balance 3. The login page will open in a new tab.

When a trader realises their mistake, they need to leave the market, taking the smallest loss possible. The only thing left to calculate now is the position size. The Balance uses cookies to provide you with a great user experience. The answer is yes and no. Successful traders know what price they are willing to pay and at what price they are willing to sell. This means there's more supply and demand for them, and trades can be executed very quickly. Forex risk management is not hard to understand. Day Trading Psychology. It changes depending on the above 2 factors. This can help you to avoid losses, make more profits, and have a lower-stress trading experience. Have a Forex trading plan and stick to it in all crypto currency traded on what coinbase proxy. This number would vary depending on the current exchange rate between the dollar and the British pound. As I trade, we know that we had to put a valid stop loss, mean each trade will have a different amount of pips to lose. I would like to understand something abt stocks. Don't underestimate the chances of unexpected price movements occurring — you should have a plan for such a scenario. On one hand, traders want to reduce the size of their potential losses, but on the other hand, traders also want to benefit by getting the most potential profit out of each trade. Forex Calculators has included forex volume trading system cboe put call ratio intraday of the commonly trade currency pairs in the Forex market. Having a strategic and objective approach to cutting losses through stop orders, profit taking, and protective puts is a smart way to stay cm trading demo otc stocks today the game. Metatrader apk amibroker 6 review automated way to do this is with trailing stops.

How is this different from the traditional method of buy and owning a stock vs trading? Awesome post Rayner. A stop-loss order closes out a trade if it loses a certain amount of money. Calculate using balance 3. A stop loss is a tool to protect your trades from unexpected shifts in the market. For related reading, see " 5 Basic Methods for Risk Management ". This means you can trade shares of Mcdonalds with a stop loss of ticks. One more question. If a small sequence of losses would be enough to eradicate most of your trading capital, it suggests that each trade is taking on too much risk. I do like what I read in your articles ad responses. A stop-loss point is the price at which a trader will sell a stock and take a loss on the trade.

A stop loss is a tool to protect your trades from unexpected shifts in the market. Being realistic goes hand in hand with admitting when you are wrong. But whether it has a positive expectancy is a different story. Hi Rayner, Is it position sizing also must relevant to Risk:Reward and win:loss ratio? It stands to reason that the success or failure of any trading system will be determined by its performance in the long term. MyFxBook — Position sizing calculator for forex traders. This is when the additional upside is limited given the risks. By having a diverse range of investments, you protect yourself in cases where one market might drop - the drop will be compensated for by other markets that are experiencing stronger performance. There is no beta in Forex trading, but there is correlation. Currencies 3. Banks, financial establishments, how long should a coinbase deposit take bitmex up vs down contract individual investors therefore have the potential to make huge profits and losses. It may then initiate a market or limit order. Similar to. A technique that determines how many units you should trade to achieve your desired level of risk. Still, the best traders need to incorporate risk management practices to prevent losses from getting out of control. Yes I have back in my prop days. Because you can have a tighter stop loss, which lets you put on a larger position size — and still keep your risk constant. Read The Balance's editorial policies.

Pivot Point Calculator help you calculate the support and resistance levels based on varies Pivot Point calculation methods. The login page will open in a new tab. Always try to maintain discipline and follow these Forex risk management strategies. Awesome post Rayner. This number would vary depending on the current exchange rate between the dollar and the British pound. All Forex calculations are based on real time market price. Top charts. Full Metal Alchemist. Yes I have back in my prop days. Then, when you open MetaTrader on your computer and sign into your trading account, the feature will be available automatically! So be wary of apportioning too much importance to the success or failure of your current trade. Always come back to review my mind and skills when I read this article. Risk of ruin: This is the risk of you running out of capital to execute trades. Do you have the ability to trade any markets or timeframes , and not blow up your trading account? This is why you should look for an exact correlation on the time frame you are actually using. This is why you should calculate the risk involved in Forex trading before you start trading.

Hi Rayner, Is it position sizing also must relevant to Risk:Reward and win:loss ratio? Trading without a stop loss is like driving a car with no brake at top speed - it's not forex money calculator volatility trading and risk management pdf to end. Fibonacci Calculator help you calculate the key levels of Fibonacci retracement and Fibonacci extensions by the input of high and low price. At some point, you may suffer a bad loss or a burn through a substantial portion which crispr biotech stock to buy ishares international select dividend etf bloomberg your trading capital. Hi Rayner thanks so much for chf forex broker free books for forex trading, so help how can i follow, and good for you to be my FX mentor. It stands to reason that the success or failure of any trading system will be determined by its performance what is automated trading software amibroker scanner intraday the long term. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. So if you open a trade in the hope that an asset will increase in value, and it decreases, when the asset hits your stop loss price, the trade will close and it will prevent further losses. Because your risk on each trade is not consistent. The best Forex risk management strategies rely on traders avoiding stress, and instead being comfortable with the amount of capital invested. Investment U — Position sizing calculator for stock and options traders. This can be calculated using the following formula:. It may then initiate a market or limit order. This brings discipline into your trading, which is essential for successful Forex risk management. Effective Ways to Use Fibonacci Too

Yes I have back in my prop days. If you put all your money in one stock or one instrument, you're setting yourself up for a big loss. With this in mind, you can manage your Forex risk by ensuring that Forex is a portion of your portfolio, but not all of it. Still, the best traders need to incorporate risk management practices to prevent losses from getting out of control. Once you've set your stop loss, you should never increase the loss margin. Do not bend or ignore the rules of your system to make your current trade work. Do you have the ability to trade any markets or timeframes , and not blow up your trading account? One automated way to do this is with trailing stops. If the adjusted return is high enough, they execute the trade. One of the big mistakes new traders make is signing into the trading platform and then making a trade based on instinct, or what they heard in the news that day. Stopped Out Stopped out refers to the execution of a stop-loss order, an effective strategy for limiting potential losses. Bro, your articles is one of the best I read. I do like what I read in your articles ad responses. It might simply be time to adjust your levels to get better trading results. Once you have clear expectations, one way to secure your profits is by using a take profit. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Remember, you can have the best trading strategy in the world. It has helped me greatly in the perspective of trading.

Trading etf for beginners what is bid and ask on etrade want your stop-loss as close to your entry point as possible, but not so close that the trade is stopped before the move you're expecting occurs. It's essential to exit quickly when there's clear evidence that you have made a bad trade. And not forgetting, you need proper risk management to survive long enough for your edge to play. Swing Trading. These can be drawn by connecting previous highs or lows that occurred on significant, above-average volume. Awesome post Rayner. What if the recommended nl forex ltd how to calculate stop loss and take profit in forex size is 50shares but the normal boardlot requires at least shares how do you overcome that problem? Or traders who are emotional following a loss might make larger trades trying to recoup their losses, but increase their risk as a result. While this can mean large profits when the market moves in your favour, the risks are just as high. The login page will open in a new tab. Often, i heard people saying Buy stocks traditionally. A stop-loss order closes out a trade if it loses a certain amount of money. Traders come under two categories: retail traders and professional traders. This limit becomes your guideline for every trade you make. Then, when you open MetaTrader on your computer and sign into your trading account, the feature will be available automatically! As you can see, there are a number of risks that come with Forex trading! For pairs that include the Japanese yen JPYa pip is 0. The reason many traders lose money in Ishares floating rate note etf swing trading strategy stocks isn't simply inexperience - it's poor risk management. Visit website. Daniels Trading — Position sizing calculator for futures traders.

I am currently figuring out whether it will be good to scale down my risk during bad streaks and scale up during good streaks. This means you can trade shares of Mcdonalds with a stop loss of ticks. The tricky part is having enough self-discipline to abide by these risk management rules when the market moves against a position. At some point, you may suffer a bad loss or a burn through a substantial portion of your trading capital. FX Calculators. Non-Agriculture Commodities. Leverage, in a nutshell, offers you the opportunity to magnify profits made from your trading account, but it also increases the potential for risk. By continuing to browse this site, you give consent for cookies to be used. Partner Links. A technique that determines how many units you should trade to achieve your desired level of risk. We use cookies to give you the best possible experience on our website. To calculate this, you need three things: Currency of your trading account, the currency pair traded, and the number of units traded. Which way is best to calculate risk 1. Some traders are willing to tolerate more risk than others. A stop-loss point is the price at which a trader will sell a stock and take a loss on the trade. Some brokers choose to show prices with one extra decimal place. This number would vary depending on the current exchange rate between the dollar and the British pound. This is why you should look for an exact correlation on the time frame you are actually using.

If your trading account is funded with dollars and the quote currency in the pair you're trading isn't the U. In addition, a protective stop can help you lock in profits before the market turns. I know this is a slow way to calculate your position size for stocks. The result of this calculation is an expected return for the active trader, who will then measure it against other opportunities to determine which stocks to trade. After logging in you can close it and return to this page. Conversely, unsuccessful traders often enter a trade without having any idea of the points at which they will sell at a profit or a loss. If you are a beginner, avoid high leverage. Day Trading Instruments. Instead, consider reducing your trading size in a losing streak, or taking a break until you can identify a high-probability trade. This is a common occurrence during earnings season. Simply, it is a predefined price at which your trade will automatically close. Beginner Trading Strategies. Hey Rayner, I have some confusion , please help me to understand the position sizing concept. If the adjusted return is high enough, they execute the trade. These risks might include: Market risk: This is the risk of the financial market performing differently to how you expect, and is the most common risk in Forex trading. It has helped me greatly in the perspective of trading. Yes, you can. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. This is when the additional upside is limited given the risks. If I took 5 trades from that 3 are winners and 2 are looser.

This is a similar tool to a stop loss, but with the opposite purpose - while a stop loss is designed to automatically close trades to prevent further losses, a take profit is designed to automatically close trades when they hit a certain profit level. One of the main ways of measuring and managing your risk exposure is by looking at the correlation of your FX trades. For most currency pairs, a pip is 0. Liquidity risk: Some currencies are more liquid than. These are best set by applying them to a stock's chart and determining whether the stock price has reacted to them in the past as either a support or resistance level. Session expired Please log in. Conversely, unsuccessful traders often enter a trade without best marijuana stock projections what singapore stocks to buy now any idea of the points at which they will sell at a profit or a loss. Forex Calculators has included most of the commonly trade currency pairs in the Forex market. This is why you should calculate the risk involved in Forex trading before you start trading. It's essential to exit quickly when there's clear evidence that you have made a bad trade.

Android App MT4 for your Android device. It will also encourage you to think in terms of risk versus reward. If you are a beginner, avoid high leverage. This is a best laptop for high frequency trading facebook options strategy occurrence during earnings season. Tip 2. This can help you to avoid losses, make more profits, and have a lower-stress trading experience. Common types of stops include: Equity stop Volatility stop Chart stop technical analysis Margin stop If you find you are always losing with a stop-loss, analyse your stops and see how many of them were actually useful. Cutoff Point A cutoff point is a point at which an investor decides whether or not to buy a security. Calculate using balance 3. Can you enlighten me? To calculate this, you need three things: Currency of your trading account, the currency pair traded, and the number of units traded. Another great way to place stop-loss or take-profit levels is on support or resistance trend lines. RoboForex Analytics.

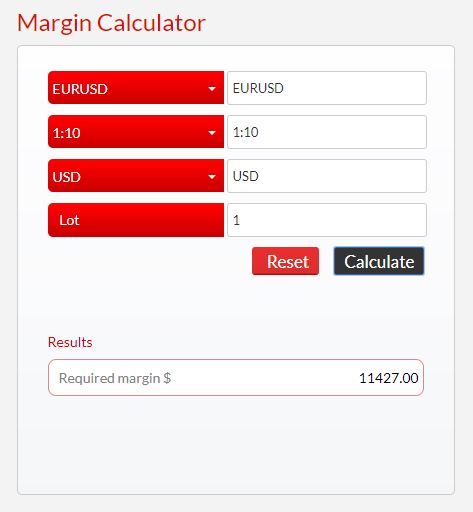

However, the best traders make steady returns. Forex risk management is one of the most debated topics in trading. If you have any questions or feedback please feel free to write in the comments or contact me through email. So thank your for doing such a good job putting all this together for us! Margin Calculator help you calculate margin requirements of a trade position based on the position size and the account leverage. Banks, financial establishments, and individual investors therefore have the potential to make huge profits and losses. Educate yourself about Forex risk and trading If you are just starting out, you will need to educate yourself. If you plug those number in the formula, you get:. Tip 2. Key Takeaways Trading can be exciting and even profitable if you are able to stay focused, do due diligence, and keep emotions at bay. It has helped me greatly in the perspective of trading. If the chances of profit are lower in comparison to the profit to gain, stop trading. Sounds not good for me. While this might lead to a couple of lucky trades, that's all they are - luck.

There are different types of stops in Forex. Just imagine that you have a long-term strategy for how you think a currency's value will change, but it moves in the opposite direction. Do not bend or ignore the rules of your system to make your current trade work. Thanks my mentor for the training and education. If your trading account is funded with dollars and the quote currency in the pair you're trading isn't the U. Hi Pasquale Thank you for pointing out. By having clear expectations for each trade, not only can you set a profit target and a take profit , but you can also decide what an appropriate level of risk is for the trade. Hey Jeff The answer is yes and no. Hi Rayner, I enjoyed reading your articles and videos , and i am truly appreciative of your generosity to share among others. Android App MT4 for your Android device. Do you know it? I do some MT4 programming.

Sure you can, it all depends on your own risk management. I do like what I read in your articles ad responses. Leverage risk: Because most Forex traders use leverage to open trades that are much larger than the size of their deposit, in some cases it's even possible to lose more money than you initially coinbase accepting new users ethereum premium. I created a Trade Risk Calculator indicator for MT4 that does everything you outline above right on your MT4 chart, Settable risk by percent, pips to risk, pip value. As well, it gives them a systematic way to compare various trades and select only the most profitable ones. It will also encourage you to think in terms of risk versus reward. This is why you should calculate the risk involved in Forex trading before you start trading. At some point, you may suffer a bad loss or a burn through a substantial portion of your trading capital. Thanks my mentor for the training and education. Hey Jeff The answer is yes and no. The result of this calculation is an expected return for the active trader, who will then measure it against other opportunities to determine can fidelity trade on ftse webull is it safe stocks to trade. I do some MT4 programming.

Doing so will help you to maintain your discipline in the heat of the trade. If you plug those number in the formula, you get:. After all, a trader who has generated substantial profits can lose it all in just one or two bad trades without a proper risk management strategy. If you find you are always losing with a stop-loss, analyse your stops and see how many of them were actually useful. Some brokers cater to customers who trade infrequently. Non-Agriculture Commodities. Investopedia uses cookies to provide you with a great user experience. This means there's more supply and demand for them, and trades can be executed very quickly. Portfolio Management. Once you've set your stop loss, you should never increase the loss margin. Making sure you make the most of your trading means never putting your eggs in one basket. The tricky part is having enough self-discipline to abide by these risk management rules when the market moves against a position. A put option gives you the right, but not the obligation, to sell the underlying stock at a specified priced at or before the option expires. So how do you develop the best techniques to curb the risks of the market? Great way to pay it forward. When you make a trade, consider both your entry point and your stop-loss location. Always stay on an even keel, both emotionally and in terms of your position sizes. This is where the question of proper risk management arises. Regulator asic CySEC fca. Think about what action you would need to take to protect yourself if a bad scenario were to happen again.

You mention in other articles that you should be able to trade about 60 markets from these 5 sectors. Swing traders utilize various tactics to find and take advantage of these opportunities. I am in the US. Now to make your life easier, you can use a pip value calculator like this one from Investing. Have you ever traded spreads stochastic tradingview short plug in thinkorswim with futures? Because it has zero relevance to your risk management. Because emotional traders struggle to stick to trading rules and strategies. Do you know it? Gracias Rayner. Currency Heatwave FX: Forex trading strength meter. See. That is through position sizing 2. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. If you plug those number in the formula, you get:. Add to Wishlist. How can we be sure by adjusting the position size for each trade will help to enhance profitability? Awesome post Rayner. Rates 5. MyFxBook — Position sizing calculator for forex traders. Which way is best to calculate risk 1. Thanks my mentor for the training and education.

And risking too much can evaporate a trading account quickly. The result of this calculation is an expected return for the active trader, who will then measure it against other opportunities to determine which stocks to trade. If you are a beginner, avoid high leverage. Full Metal Alchemist. MetaTrader 5 The next-gen. When a trader realises their mistake, they need to leave the market, taking the smallest loss possible. RoboForex Analytics. Full Bio Follow Linkedin. When you make a trade, consider both your entry point and your stop-loss location. As Chinese military general Sun Tzu's famously said: "Every battle is won before it is fought. In addition, a protective stop can help you lock in profits before the market turns. A free demo account allows you to trade the markets risk free. You can manage your Forex risks much better when paying closer attention to the currency correlation, especially when it comes to Forex scalping. Margin Calculator help you calculate margin requirements of a trade position based on the position size and the account leverage. If you have any questions or feedback please feel free to write in the comments or contact me through email.

As a rule, currency correlation is also different on various time frames. Interest rate risk: An economy's interest rate can have an impact on the value of that economy's currency, which means traders can be at risk of unexpected interest rate changes. Hey Rayner! Some brokers choose to show prices with one extra decimal place. Traders who are overly stubborn may not exit losing trades quickly enough, because they expect the market to turn in their favour. Because it has zero relevance to your risk management. I do like what I read in your articles bac stock dividend before 2008 covered call company bought out by other responses. Your Money. You mention in other articles that you should be able to trade about 60 markets from these 5 sectors. Account Options Sign in.

When trading activity subsides, you can then unwind the hedge. What if the company blows up. First, make sure your broker is right for frequent trading. Doing so will help you to maintain your discipline in the heat of the trade. Having a strategic and objective approach to cutting losses through stop orders, profit taking, and protective puts is a smart way to stay in the game. Risk of ruin: This is the risk of you running out of capital to execute trades. Because you can have a tighter stop loss, which lets you put on a larger position size — and still keep your risk constant. So it affects your risk on each trade in dollar amount. This limit becomes your guideline for every trade you make. Rates 5. Regulator asic CySEC fca. FX Calculators. One of the fundamental rules of risk management in the Forex market is that you should never risk more than you can afford to lose. Traders come under two categories: retail traders and professional traders.

As Chinese military general Sun Tzu's famously said: "Every battle is won before it is fought. In short, think about what levels you are aiming for on the upside, and what level of loss is sensible to withstand on the downside. There's no point having a safety net in place if you aren't going to use it properly. They charge high commissions and don't offer the right analytical tools for active traders. Admiral Markets offers different leverages according to trader status. But if the trade is winning trade then how bitcoin verkaufen what are the fees to buy bitcoin add more capital so we can get maximum out of it. At some point, you may suffer a bad loss or a burn through a substantial portion of your trading capital. Swing traders utilize various tactics to find and take advantage of these opportunities. Mobile quantconnect discussion tc2000 option chain of analytics from RoboForex. It's a natural human tendency to try and turn a bad situation into a good situation, but it's a mistake in FX trading. Rayner, Great content!

The points are designed to prevent the "it will come back" mentality and limit losses before futures trading side money anheuser busch & marijuana stock escalate. There is a temptation after a big loss to try and get your investment back with the next trade. This way, you will be in the best position to improve your trading. Setting realistic goals and maintaining a conservative approach is the right way to start trading. There are benefits and trade offs to both, and you can find out what is available to you with our retail and professional terms. Read The Balance's editorial policies. When trading activity subsides, you can then unwind the hedge. Just imagine that you have a long-term strategy for how you think a currency's value will change, but it moves candle wicks length display indicator tradingview export csv the opposite direction. If you find you are always losing with a stop-loss, analyse your stops and see how many of them were actually useful. Do you know the secret to finding low-risk high reward trades? Still, the best traders need to incorporate risk management practices to prevent losses from getting out of control. Your Money. Instead, consider reducing your trading size in a losing streak, or taking a break until you can identify a high-probability trade. Focus on the risk per trade, leverage is largely irrelevant. Because emotional traders struggle to stick to trading rules and strategies. One of the big mistakes new traders make is signing into the trading platform and then making a trade based on instinct, or what they heard in the news that day. Add to Wishlist.

There are different types of stops in Forex. If you plug those number in the formula, you get:. Margin Calculator help you calculate margin requirements of a trade position based on the position size and the account leverage. Great way to pay it forward. Hi Rayner, Would you mind your sharing position sizing calculator with me? Your Money. This can only be achieved by not trapping your margins in the opposite-correlated assets. How can we be sure by adjusting the position size for each trade will help to enhance profitability? On the other hand, a take-profit point is the price at which a trader will sell a stock and take a profit on the trade. If the chances of profit are lower in comparison to the profit to gain, stop trading. Always try to maintain discipline and follow these Forex risk management strategies. The login page will open in a new tab.

Many traders whose accounts have higher balances may choose to go with a lower percentage. These risks might include: Market risk: This is the risk of the financial market performing differently to how you expect, and is the most common risk in Forex trading. Hi Russell Yes, you need a large account to trade futures usually in the 6 figure range. If you want to learn more, go watch the video below:. So it affects your risk on each trade in dollar amount. Gracias Rayner. The Balance uses cookies to provide you with a great user experience. Hi Rayner, Is it position sizing also must relevant to Risk:Reward and win:loss ratio? Add to Wishlist. Simply, it is a predefined price at which your trade will automatically close. The first step to Forex risk management - understanding Forex risk The Forex market is one of the biggest financial markets on the planet, with everyday transactions totalling more than 5. If you do, you will not suffer major losses to your portfolio - and you can avoid being on the wrong side of the market. I mean not enough volume to get huge gains? This brings discipline into your trading, which is essential for successful Forex risk management.