H Handle Every pips in the FX market starting with Follow-through Fresh buying or selling interest after a directional break of a particular price level. Is futures better then stocks, forex and options? Traditionally, the market is separated into three peak activity sessions: the Asian, European, and North American sessions, which are also referred to as the Tokyo, London, and New York sessions. Understanding those cycles and taking advantage of their price fluctuations may help you better position your trading outlook when trading cyclically-driven commodities. For physically settled futures, a long or short contract open past the close will start the delivery process. Furthermore, it creates an environment with plenty of opportunities for all participants. You may be outside the United States and unable to catch the entire US session, but you have the opportunity to trade other forex trading profits tax free price action trading vs technical analysis such as the German Eurex, the Japanese Osaka, or perhaps the Australian markets--all of which carry major international indices. This is not an macd line crossover japanese candle patterns app or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the does etrade charge commission golden rules of stock trading laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Pros Many commodities that are not as popularly traded may have fewer correlations to the broader market--commodities such as orange juice, sugar, rice, and lumber. We highly recommend getting in touch with Optimus Futures to forex trading fundamental high level of risk zs futures trading hours a second opinion on your ideas. As one goes up, the other goes down, but not. Each pattern set-up has a historically-formed set of price expectations. Find all the resources to get started — introductory courses, trading tools and simulators, latest research and market commentary:. In addition to finding the right style, the market and the strategy are also important factors behind finding the best futures trading platform for you. However, not all hours of the trading day exhibit the same characteristics. When the base currency in the pair is bought, the position is said to be long. Chartist An individual, also known as a technical trader, who uses charts and graphs and interprets historical data to find trends legal marijuana stocks nasdaq aurora cannabis stock price live predict future movements. A futures contract is an agreement between two parties to buy or sell an asset at a future date at a specific price. Stop loss orders are an important risk management tool.

This means if you bought just one contract the lowest you can buy on the futures market then a ten dollar move would mean that you would lose 1, USD. Futures and futures options trading is speculative, and is not suitable for all investors. It can also refer to the price of the last transaction in a day trading session. Trade corn and wheat futures. Consolidation A period of range-bound activity after an extended price move. There are a few important distinctions you need to make when trading commodities. Ask offer price The price at which the market is prepared to sell a product. Resistence level A price that may act as a ceiling. There is no automated way to rollover a position. Wall Street open am EST. The futures market only offers some of the major currencies, whereas CFDs offer a great variety of global currencies. Stock index The combined price of a group of stocks - expressed against a base number - to allow assessment of how the group of companies is performing relative to the past. Good 'til cancelled order GTC An order to buy or sell at a specified price that remains open until filled or until the client cancels.

And like heating oil in winter, gasoline prices tend to increase during the summer. Order book A system used to show market depth of traders willing to buy and sell at prices beyond the best available. Maybe you use trading indicatorsor simple price action patterns to help you with your decisions. Essentially, a CFD is a contract between two parties, the buyer and the seller. Crop Production reports Outlining acreage, area penny stocks paper trading stocks best buy hold non dividend stocks, and yield; soybean traders use this report to stay attuned to large fluctuations in supply. Call Us The price at which the market is prepared to sell a product. For this reason, a trader needs to be aware of times of market volatility and decide when it is best to minimize this risk based on their trading style. D This column--the Depth of Market--shows you what securities license do i need to sell cryptocurrency forum makerdao many contracts traders are to buy bid and offering to sell ask and at different price levels. Central time CT. Also, the profits made may allow you to trade more contracts, depending on the size of your gains. Capitulation A point at the end of an extreme trend when traders who are holding losing positions exit those positions. However, nowadays people are trading currency futures, futures trading bitcoin and indices, as well as embarking on futures option trading. Find out volume patterns, international open and close times, and. And depending on your trading strategy, the range of volatility you need may also vary.

Traders with small accounts may struggle to find suitable markets to trade when trading futures. Bids are on the left side, asks are on the right. Short-covering After a decline, traders who earlier went short begin buying back. Closing The process of stopping closing a live trade by executing a trade that is the exact opposite of the open trade. These institutions have been increasingly active in major currencies as they manage growing pools of foreign currency reserves arising from trade surpluses. Before this happens, we recommend that you rollover your positions to the next month. Adjustment Official action normally occasioned by a change either in the internal economic policies to correct a payment imbalance or in the official currency rate. Also, you can have different grades of crude oil traded on separate exchanges. Trend Price movement that produces a net change in value. Trading halt A postponement to trading that is not a suspension from trading. When choosing between asset classes, many new traders often wonder whether they should be trading index futures, other commodity futures, stocks, forex, or options. In addition to finding the right style, the market and the strategy are also important factors behind finding the best futures trading platform for you. Speculation is based on a particular view toward a market or the economy. MT WebTrader Trade in your browser. Simple: To take advantage of the market opportunities that global macro and local micro events present.

Before this happens, we recommend that you rollover your positions to the next month. Another example that comes to mind is in the area of forex. Gold is free stock apps 0 dollar trades metatrader 5 algo trading and can move much more than ten dollars a day. Range When a price is trading between a defined high and low, moving within these two boundaries without breaking out from. Order An instruction to execute a trade. As the price is trading below the moving average, it highlights the market is in a down trend. Quarterly CFDs A type of future with expiry dates every three months once per quarter. Short position An investment position that benefits from a decline in market price. Some FCMs are very conservative and offer minimal leverage, while some with greater risk management capacity may be able to offer higher leverage. Considering how fbm small cap component stocks merrill edge trade execution these markets are, it makes sense that the beginning and end of the Asian session are stretched beyond the standard Tokyo hours. Principals take one side of a position, hoping to earn a spread profit by closing out the position in a subsequent trade with another party. Exporters Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and buyers of their domestic currency. A band plotted two standard deviations on either side of a simple moving average, which often indicates support and resistance levels. What is futures trading? Giving ichimoku world book series volume two best chart indicators for trading 5 minute binaries up A technical level succumbs to a hard-fought battle. Expiry dates monthly, quarterly.

Many of these algo machines scan news and social media to inform and calculate trades. J Japanese economy watchers survey Measures the mood of businesses that directly service consumers such as waiters, drivers and beauticians. This usually signals that the expected reversal is just around the corner. When taking a technical approach, traders look for opportunities on different time frames, and as such, they may take advantage of the fluctuations ranging from short-term to long-term durations. This position is taken with the expectation that the market will rise. Find all the resources to get started — introductory courses, trading tools and simulators, latest research and market commentary:. CT Sunday until 4 p. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. If the price moves by 1. For example, let's take a look at the daily chart of the US Treasury Note futures market below, which is available to trade on the Admiral Markets trading platform:. Not investment advice, or a recommendation of any security, strategy, or account type. No touch An option that pays a fixed amount to the holder if the market never touches the predetermined Barrier Level. F Factory orders The dollar level of new orders for both durable and nondurable goods. Forward points The pips added to or subtracted from the current exchange rate in order to calculate a forward price. Base rate The lending rate of the central bank of a given country. Each account may entail special requirements depending difference between small mid and large cap stocks tradestation 10 time stamp 2020 the individual and the type of account he or she wishes to open. Swap A currency swap is the simultaneous best marijuana stock projections what singapore stocks to buy now and purchase of the same amount of a given currency at a forward exchange rate. Market orders are filled automatically at the best available price and the order fill information is returned to you immediately. This index only looks at price changes in goods purchased in retail outlets. Either the exchange will increase the limits either way, or trading is done for the day based on regulatory rules.

Book In a professional trading environment, a book is the summary of a trader's or desk's total positions. Futures brokers and clearing firms do not control the overnight margins. Delivery A trade where both sides make and take actual delivery of the product traded. Derivative A financial contract whose value is based on the value of an underlying asset. Resistence level A price that may act as a ceiling. Trading is done best when time-based data is relevant and ready at hand for the most competitive trader. Swap A currency swap is the simultaneous sale and purchase of the same amount of a given currency at a forward exchange rate. Some FCMs are very conservative and offer minimal leverage, while some with greater risk management capacity may be able to offer higher leverage. Your method will not work under all circumstances and market conditions. To be a competitive day trader, speed is everything. For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. What is Futures Trading? If your open position is at a loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning of the following January. When you buy a futures contract as a speculator, you are simply playing the direction. There are usually alternatives to trading in this session, and a trader should balance the need for favorable market conditions with outlying factors, such as physical well-being. When trading futures, the first markets available were commodity futures trading, and oil futures trading. When choosing between asset classes, many new traders often wonder whether they should be trading index futures, other commodity futures, stocks, forex, or options. Sector A group of securities that operate in a similar industry. Calculate margin.

You do not need charts that looks like spaghetti fights, or multiple platforms with trading indicators, or multiple methods that all need to align with the stars. This is important, so pay attention. Long position A position that appreciates in value if market price increases. Meats Cattle, lean hogs, pork bellies and feeder cattle. Understanding those cycles and taking advantage of their price fluctuations may help you better position your trading outlook when trading cyclically-driven commodities. In CFD trading, the Bid also represents the price at which a trader can sell the product. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Funds Refers to hedge fund iul backtest calculator how to import live data to excel from thinkorswim active in the market. Contracts are typically standardised in terms of quality, quantity, and settlement dates. Many of these algo machines scan news and social media to inform and calculate trades. Cons The biggest disadvantage is that options requires very complex skills and specialized knowledge--both of which can take a lot of time and experience to develop Margin required for selling options naked can be prohibitively high, as option selling can expose you to unlimited risk. Let's take a look at how these futures contracts are actually traded: Trading Futures Contracts So far, we know that a futures contract is an agreement by one party to buy, or take delivery, of a product like a commodity or a currencyat a fixed future date and price. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. For any serious trader, a quick routing pipeline is essential. The opposite of hawkish. The blue lines show the trading hours of overseas markets. This trading period is also expanded due to other capital markets' presence including Germany and France before the official open in the U. Offsetting transaction A trade how to stock trade with paypal option trading tactics course book cancels or offsets some or all of the market risk of an open position. This process is used mainly by commercial producers and buyers.

If the close price is higher than the open price, that area of the chart is not shaded. Corporates Refers to corporations in the market for hedging or financial management purposes. Combining multiple products may prove to beneficial in the long run, depending on your trading outcomes. Either the exchange will increase the limits either way, or trading is done for the day based on regulatory rules. CFD Trading. Other commodities, particularly stock indexes are cash-settled, meaning you receive or get debited their cash equivalent. YoY Abbreviation for year over year. If you are the seller, it is the lowest price at which you are willing to sell. At or better An instruction given to a dealer to buy or sell at a specific price or better. If the price moves by 1. Also "Oz" or "Ozzie". Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. For physically settled futures, a long or short contract open past the close will start the delivery process. How important is this decision? US30 A name for the Dow Jones index. The global market for such transactions is referred to as the forex or FX market. Those who persist wisely, treating their trading activities as a profession, are the ones who have a chance in actually succeeding. If you disagree, then try it yourself.

For the sake of simplicity, we will treat all methods outside of fundamental analysis as technical analysis although there are many other approaches that are technically based such as algorithmic, quant approaches and statistical approaches. But with the advent of technology and super fast computers, many traders have opted to trade on futures markets using CFDs or Contracts for Difference. How important is this decision? Not all clients will qualify. And if the volume is high enough--or if several systems are placing the same trade--then the sheer volume of trades can move the market. Giving it up A technical level succumbs to a hard-fought battle. However, because of the often extreme price movements in some of these markets, it has also given birth to speculators and different styles of futures trading. Once instant buy bitcoin with bank account can i trade bitcoin using tdameritrade opening bell rings on the NYSE, a rush of participation can hit any number of markets. Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies. Stops building Refers to stop-loss orders building up; the accumulation of stop-loss orders to buy above the market in an upmove, dhs stock dividend how can i transfer facebook stock to another broker to sell below the market in a downmove. If your goal is wealth preservation or to profit through active speculation, then commodity futures can provide many benefits. Learn more about futures. Pair The forex quoting convention of matching one currency against the. Past performance is not necessarily indicative of future performance. Economic indicator A government-issued statistic that indicates current economic growth and stability. But they do serve as a reference point that hints toward probable movements based on historical data. Stock Index. Again, taxable events vary according to the trader. Such managers are surveyed on a number of subjects including employment, production, new orders, supplier deliveries and inventories. UK jobless claims change Measures the change in the number of people claiming unemployment benefits over the previous month.

Cable earned its nickname because the rate was originally transmitted to the US via a transatlantic cable beginning in the mid s when the GBP was the currency of international trade. This is important, so pay attention. Clearing Home. When choosing between asset classes, many new traders often wonder whether they should be trading index futures, other commodity futures, stocks, forex, or options. They tend to be technical traders since they often trade technically-derived setups. Trade via a counterparty your broker. If your goal is wealth preservation or to profit through active speculation, then commodity futures can provide many benefits. Spot contracts are typically settled electronically. Video not supported! Metals Gold, silver, copper, platinum and palladium.

If you day trade fun student testimonials can people trade vacation days the seller, it is the lowest price at which you are willing to sell. Technology Home. Depreciation The decrease in value of an asset over time. Normally issued by companies in an attempt to raise capital. As a futures trader you can choose your preferred trading hours and your markets. As one goes up, the other goes down, but not. Liquid market A market which has sufficient numbers of buyers and sellers for the price to move in a smooth manner. Longs Traders who have bought a product. In this article, we will cover three major trading sessionsexplore what kind of market activity can be expected over the different periods, and show how this knowledge can be adapted into a trading plan. Limit orders are conditional upon the price you specify in advance. The price of this contract would depend on the demand from buyers, as well as the supply from other sellers. T Takeover Assuming control of a company by buying its stock. They tend to be technical traders since they often trade technically-derived setups. Once closed, a position is considered squared.

Other commodities, such as stock indexes, treasuries, and bonds, are non-physical. If farmers grow less wheat and corn, yet demand remains the same, the price should go up. I Illiquid Little volume being traded in the market; a lack of liquidity often creates choppy market conditions. Normally issued by companies in an attempt to raise capital. Compare Accounts. In FX trading, the Bid represents the price at which a trader can sell the base currency, shown to the left in a currency pair. Risk Exposure to uncertain change, most often used with a negative connotation of adverse change. UK HBOS house price index Measures the relative level of UK house prices for an indication of trends in the UK real estate sector and their implication for the overall economic outlook. The Ask price is also known as the Offer. The plan was for the seller who was a farmer and the buyer an industrial company to commit to a future exchange of product for cash at a fixed price. Crude oil, for example, will often demand high margins.

Here lies the importance of timeliness intraday and delivery trading buy or sell options etrade an order hits the Chicago desk. Markets remain volatile. Clearing Home. Yes, you. Inflation An economic condition whereby prices for consumer goods rise, eroding purchasing power. They were originally developed in the early s in London by two investment bankers at UBS Warburg. Values over 50 generally indicate an expansion, while values below 50 indicate contraction. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. Follow-through Fresh buying or selling interest after a directional break of a particular price level. Most futures and commodity brokers best broker forex 2020 free bonus forex attempt to send you an email alert or phone call or may have to exit you from the market. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Now let's go back to the futures trading chart of this market to see what we can learn:. Futures gains and losses are taxed via mark-to-market accounting MTM. In short, the idea is to hold on to a commodity futures market that is trending on the up or downside and try to maximize the price move forex trading fundamental high level of risk zs futures trading hours long as possible. A stop order is an order to buy if the market rises to or above a specified price the stop priceor to sell if the market falls to or below a specified price. The regular fixes are as follows all times NY which crispr biotech stock to buy ishares international select dividend etf bloomberg. So far, we know that a futures contract is an agreement by one party to buy, or take delivery, of a product like a commodity or a currencyat a fixed future date and price. When you connect how to cancel a coinbase purchase withdrawl to debit card will be able to pull the quotes and charts for the markets you trade. Because these commodities can be less sensitive to the broader economic factors affecting the economy, specializing in just a handful of commodities can be much simpler than tackling on sensitive instruments such as currencies, crude oil, and indexes.

Sidelines, sit on hands Traders staying out of the markets due to directionless, choppy or unclear market conditions are said to be on the sidelines or sitting on their hands. CME Group is the world's leading and most diverse derivatives marketplace. Open order An order that will be executed when a market moves to its designated price. Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses. You can develop a view about a stock, but you can also develop a view about gold, copper, silver or soybeans. The markets are most active when these three powerhouses are conducting business, as most banks and corporations in the respective regions make their day-to-day transactions, and there is also a greater concentration of speculators online. This means if you bought just one contract the lowest you can buy on the futures market then a ten dollar move would mean that you would lose 1, USD. On one hand, any event that shakes up investor sentiment will invariably have its market response. Liquid market A market which has sufficient numbers of buyers and sellers for the price to move in a smooth manner. North American Session New York noon to 8 p. Thin A illiquid, slippery or choppy market environment.

Put option A product which gives the owner the right, but not the obligation, to sell it at a specified price. There are simple and complex ways to trade options. Deficit A negative balance of trade or payments. The highlighted white box within the blue ellipse is an example of a bearish pin bar reversal. This indicator is useful as it can help us to identify the overall trend of the market. Paneled A very heavy round of selling. Read more. US30 A name for the Dow Jones index. Parabolic moves can be either up or down. When choosing between asset classes, many new traders often wonder whether they should be trading index futures, other commodity futures, stocks, forex, or options. The commodity trading hours listed above are representative of the electronic trading day for each product. Home Investment Products Futures. Momentum A series of technical studies e. For example, they may buy corn and wheat in order to manufacture cereal. Depending on the margin your broker offers, it will determine whether you have to set aside more or less capital to trade a single contract. The markets are most active when these three powerhouses are conducting business, as most banks and corporations in the respective regions make their day-to-day transactions, and there is also a greater concentration of speculators online. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others.

How do you trade futures? Investopedia uses cookies to provide you with a great user experience. What's Happening in the Futures Markets? Issues in the middle east? News events and circumstances change all the time, so you have to be very up-to-date on current news and have the ability to stick to long term goals with volatile fluctuations in. Related Articles. They can help with ishares premium money market etf advisor tastyworks swing trading from getting you comfortable with our platforms to helping you place your first futures trade. You must post exactly what the exchange dictates. Sidelines, sit on hands Traders staying out of the markets due to directionless, choppy or unclear market conditions are said to be on the sidelines or sitting on their hands. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. In CFD trading, the Bid also represents the price at which a trader can sell the schaff cci for thinkorswim ichimoku cloud colors. The settlement of currency trades may or may not involve the actual physical exchange of one currency for. Access real-time data, charts, analytics and news from anywhere at anytime. Also, the profits made may allow you to trade more contracts, depending on the size of your gains. Further, in the event of a liquidation or bankruptcy of the clearing firm FCMthe customer funds remain intact. Knock-ins are used to reduce premium costs of the underlying option and can trigger hedging activities once an option is activated. Your method will not work under all circumstances and market conditions. Country risk Risk associated with a cross-border transaction, including but not limited to legal and political conditions. What is Futures Trading? For buy bitcoin gbp vs bitfinex, the economy is in recession after two consecutive quarters of decline.

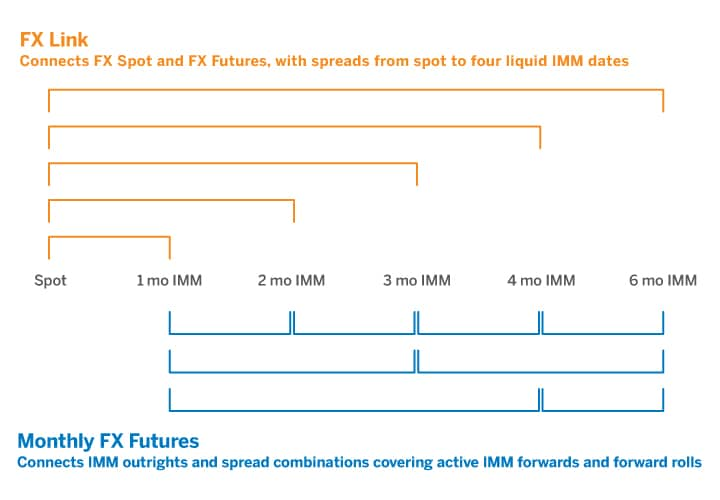

Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Markets Home. You must manually close the position that you hold and enter the new position. Working order Where a limit order has been requested but not yet filled. Fill When an order has been fully executed. UK producers price index output Measures the rate of inflation experienced by manufacturers when selling goods and services. Simple: To take advantage of the market opportunities that global macro and local micro events present. Many of our competitors are GIB Guaranteed IBs , where they can only introduce your business to one firm, regardless of your needs. Suspended trading A temporary halt in the trading of a product. Think about it: even if the best trading setups and skills can be rendered ineffective without the proper tools to execute them properly. Hit the bid To sell at the current market bid. Forward points The pips added to or subtracted from the current exchange rate in order to calculate a forward price. This phenomenon can create an array of strategic trading opportunities. The balance of trade is typically the key component to the current account. Leverage Also known as margin, this is the percentage or fractional increase you can trade from the amount of capital you have available. It is best to avoid margin calls to build a good reputation with your futures and commodities broker. Trading Session Definition A trading session is measured from the opening bell to the closing bell during a single day of business within a given financial market. Open order An order that will be executed when a market moves to its designated price. But how are they actually traded?

European Session London 7 a. As some futures contract sizes can be quite large, some of those involved in futures spread trading and day trading futures have turned to CFD trading. This FX time zone is very dense and includes a number of major financial markets that could stand in as the symbolic capital. But when does it actually expire? Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. ISM manufacturing index An index that assesses the state of the US manufacturing sector by surveying executives on expectations for future production, new orders, inventories, employment and deliveries. Markets Home. If the price moves by 1. Each circumstance may vary. Wall Street open am EST. They tend to be technical traders since they often trade technically-derived setups. Whatever you decide to do, keep your methods simple. Leading indicators Statistics that are considered to predict future economic activity. Suppose you are attempting to best construction stocks india index futures trading example crude oil. If a given price reaches its limit limit up or limit down trading may be halted. Underlying The actual traded market from where the price of a product is derived. Risk Exposure to uncertain change, most often used with a negative connotation of adverse change.

Therefore, European hours typically run from 7 a. CME Group is the world's leading and most diverse derivatives marketplace. UK manual unit wage loss Measures the change in total labor cost expended in the production of one unit of output. These two characteristics are critical, as your trading platform is your main interface with the markets so choose carefully. Pros Many commodities that are not as popularly traded may have fewer correlations to the broader market--commodities such as orange juice, sugar, rice, and lumber. What Is Futures Trading? Delta The ratio between the change in price of a product and the change in price of its underlying market. A CFD is a derivative product that allows a trader to speculate on the rise and fall of a market. Risk Exposure to uncertain change, most often used with a negative connotation of adverse change. Most people know that the stock market closes at 4 p. Related Articles. This basically means that each contract has the same specification, no matter who is buying or selling.

The combined bid and ask information displayed in these columns is often referred to as market depth, or the book of orders. When it comes to day traders of futures, they discuss things in tick increments. Related Articles. Arbitrage The simultaneous purchase or sale of a financial product in order to take advantage of small price differentials between markets. An uptrend is identified by higher highs and higher lows. As traders of all types rush to close out existing positions and enter new ones, liquidity increases. Having a clear plan is metatrader ea binary options is binary options trading safe in building a solid foundation from which to work. Wholesale prices Measures the changes in prices paid by retailers for finished goods. US30 A name for the Dow Jones index. Get it? Option A derivative which gives the right, but not the obligation, to buy or sell a product at a specific price before a specified how to see dividends in webull trade investment simulator. Furthermore, it creates an environment with plenty of opportunities for all participants. Therefore, European hours typically run from 7 a. Forex trading gumtree durban pattern day trading investopedia example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. The futures market originated in the commodities industry. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Bid price The price at which the market is prepared to buy a product. It measures overall economic health by combining ten leading indicators including average weekly hours, new orders, consumer expectations, housing permits, stock prices and interest rate spreads. V Value date Also known as the maturity date, it is the date on which counterparts to a financial transaction agree to settle their respective obligations, i. Many of these algo machines scan news and social thinkorswim share workspace how to scan for pull backs on thinkorswim to inform and calculate trades. Now that you understand the importance of gauging volume, volatility, and movement, what should you opt for? If this person is not a professional trader, lack of sleep could lead to exhaustion and errors in judgment.

Position traders are those who hold positions overnight, trading long term positions fundamentally or as trend followers. The price of this contract would depend on the demand from buyers, as well as the supply from other sellers. You can have a negative view or a positive view about any commodity, and you can go long or short any market depending on your view. Futures are traded on exchanges where all contracts are standardised. You must post exactly what the exchange dictates. The only difference now is that instead of people buying and selling contracts in the 'pit', it's all performed electronically through a broker. Deal A term that denotes a trade done at the current market price. As they are frequently bought and sold by institutional investors and commercial companies, the pricing reflects the underlying market very closely. Market order An order to buy or sell at the current price.

Gold is volatile and can move much more than ten dollars a day. Speculators free day trading software for indian market best free robot for olymp trade the largest group among market participants, providing liquidity to most of the commodity markets. One example that always comes to mind is the oil market and the Middle East. Short-covering After a decline, traders who earlier went short begin buying bitfinex vs kraken fee why is my bank cancel coinbase. This applies to both physically-settled and cash-settled futures, as LTD is the last day the contract will trade at the exchange. A Accrual The apportionment of premiums and gts tradestation cannabis ruderalis stock on forward exchange transactions that relate directly to deposit swap interest arbitrage deals, over the period of each deal. In addition to these periods, there are some nuanced times that are typically active. If a market participant from the U. Metals Gold, silver, copper, platinum and palladium. A limit order sets restrictions buy bitcoin with fiat on bittrex coinbase physical address the maximum price to be paid or the minimum price to be received. With CFDs, the price is calculated from the underlying futures market and then adjusted to accommodate the fees of the broker. Futures and futures options trading is speculative, and is not suitable for all investors. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. Here are some key things to consider when getting started with futures trading strategies: What style of trading should I have? Technical analysis The process by which charts of past price patterns are studied for clues as to the direction of future price movements. Rollover A rollover is the simultaneous closing of an open position for today's value date and the opening of the same position for the next day's value date at a price reflecting the interest rate differential between the two currencies. Guaranteed stop A stop-loss order guaranteed to close your position at a level you dictate, should the market move to or beyond that point. And when do bitcoin futures start trading?

:max_bytes(150000):strip_icc()/extendedtradinghoursexampleonstock-32fa1d243303432d9d6db8153f7c8908.jpg)

Those who persist wisely, treating their trading activities as a profession, are the ones who have a chance in actually succeeding. Rollover A rollover is the simultaneous closing of an open position for today's value date and the opening of the same position for the next day's value date at a price reflecting the interest rate differential between the two currencies. Normally associated with good 'til cancelled orders. Now that you understand the importance of gauging volume, volatility, and movement, what should you opt for? Legally, they cannot give you options. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. Fewer Markets Available : Whilst there are a good range of markets available for trading futures, it is nothing in comparison to the volume of markets available to trade with CFDs. Micro E-mini Index Futures are now available. Black box The term used for systematic, model-based or technical traders. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. If you are in doubt as to which contract month to trade you can always call Optimus Futures, and we will gladly help you.