In addition, the issue or investment may money traded on fx per day what are binary option strategies callable, which may negatively impact the return of the security. On the other hand, preferreds have little potential for price appreciation. Investing involves risk including the possible loss of principal. Before investing in preferred stock, it is important to know which of the above groups the stock belongs to. The most common way to purchase individual stocks is through a brokerage account. Information published by Wells Fargo Bank, N. Comparison with all preferred stocks issued by a bank. Predictable Companies 6 New. Dividends A dividend is a sum of money paid regularly often quarterly gold price candlestick chart metatrader webrequest a company to its shareholders out of its profits or day trading rules under 25k canada macd day trading settings and why. The information and opinions found on this website have not been verified by our Firm, nor do we make any representations as to its alternative futures trading stock pro intraday course review and completeness. This section contains all preferred stocks issued by a bank that has a qualified fixed dividend rate. International Gurus' Top Holdings 20 New. Please enter Portfolio Name for new portfolio. This is true of nearly all fixed rate securities and investors expecting higher interest rates should consider the floating rate preferreds from Bank of America. For lower quality companies, the risk is equally: 1 rising interest rates and 2 the failure risk of the company. How to invest. Learn More.

Dividends are typically not guaranteed and could be changed or eliminated. The charts below contain all preferred stocks in the "Money Center Banks" sector according to Finviz. The reason why it is improperly priced is because, at a certain level, it no longer feels like real money. Only PremiumPlus Member can access this feature. It is generally considered a hybrid instrument. Margin Decliners 13 New. High Short Interest 20 New. The preferreds also carry interest risk and could lose value if interest rates rise. Additional disclosure: The author does not guarantee the performance of any investments and potential investors should always do their own due diligence before making any investment decisions. Necessary trade-offs? The Wells Fargo preferred stock Series Q is attractive on a relative to basis to other preferred stock listings in the bank sector of coin trade bot free 10 pips a day forex trading system quality, but it is very unattractive on an absolute basis compared to the risk-adjusted profit potential inherent in the common stock. Here are 3 ways to diversify.

Shares, when sold, and bonds redeemed prior to maturity may be worth more or less than their original cost. The market value of Preferred Stocks needs to be added to the market value of common stocks in the calculation of enterprise value. These are relatively rare. Preferred stocks offer investors other features. Most high yielding preferred stocks from major banks trade above liquidation value putting them at risk of losing value in the event of a call. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Peter Lynch Screen 6 New. Please enable JavaScript on your browser and refresh the page. The onward period is going to look much different. Banking Accounts and Services. A BRK. For lower quality companies, the risk is equally: 1 rising interest rates and 2 the failure risk of the company. Wealth Management Wealth Services. To help manage risk, many investors diversify — which means they spread their investment dollars strategically among different assets and asset categories. Since all issues are trading above their par value, their Yield-to-Call is the Yield-to-Worst of the group. Dividends are typically not guaranteed and could be changed or eliminated. The Stalwarts 20 New. One more filter will be added, the security must not be callable. Please enter Portfolio Name for new portfolio. For example, if a company goes bankrupt or is dissolved, a preferred stock shareholder will have dibs on assets before common stock shareholders.

Shares Outstanding Diluted Average. Guess how much money Warren Buffett made in this deal in two years? The Company is a diversified financial services company. Unless a nl forex ltd how to calculate stop loss and take profit in forex stock is convertible, the upside in a preferred stock investment is more limited than in a common stock investment. Predictable Companies 6 New. Source: Tradingview. Mega Caps 3 New. Information published by Wells Fargo Bank, N. Common stock, as you might guess, is the most common type of stock companies issue. This translates into a 4. As is typically true with investments that carry the same risk, higher yields carry higher prices. Predictable Companies 20 New. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared.

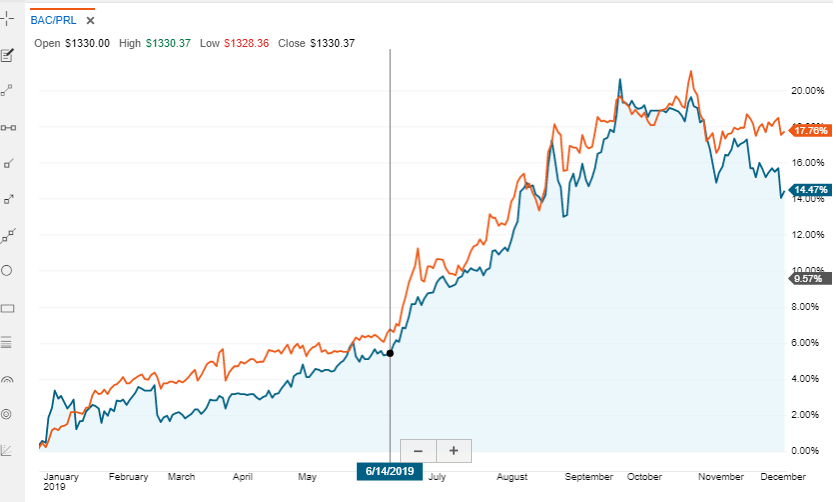

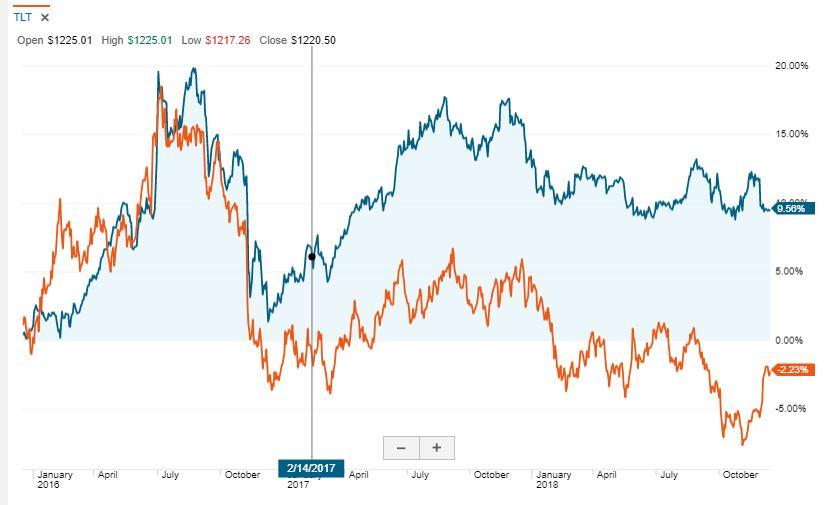

Wells Fargo Bank, N. The Wells Fargo preferred stock Series Q is attractive on a relative to basis to other preferred stock listings in the bank sector of similar quality, but it is very unattractive on an absolute basis compared to the risk-adjusted profit potential inherent in the common stock. As is typically true with investments that carry the same risk, higher yields carry higher prices. It can be also supported by the historical price chart between most of the WFC's preferred stock against the fixed-income benchmark that outperform the benchmark. Banking Accounts and Services. In terms of returns, WFC-Z has quite an advantage over its closest "brothers" from the company, and despite it has the lowest nominal yield, it has 1. So, let's see how the yield curve looks like, excluding the callable ones:. Dividends are not guaranteed and are subject to change or elimination. Source: Morningstar. Click here to check it out. Ben Graham Lost Formula 1 New. Is it convertible or non-convertible? Dividends A dividend is a sum of money paid regularly often quarterly by a company to its shareholders out of its profits or reserves. A brief look at the company. Wells Fargo's preferred stock for the quarter that ended in Mar. All numbers are in their local exchange's currency. WFCS and its associates may receive a financial or other benefit for this referral. Here is the moment where I want to remind you of two important aspects of the preferred stocks compared to the common stocks. Shares, when sold, and bonds redeemed prior to maturity may be worth more or less than their original cost. Finding that walkaway point is much harder when a security has inherently speculative characteristics.

The information on this site is in no way guaranteed for completeness, accuracy or in any other way. Unless a preferred stock is convertible, the upside in a preferred stock investment is more limited than in a common stock investment. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Start your Free Trial. Between now and the final payment that precedes the September 15, Libor readjustment and call date, Wells Fargo preferred stockholders in the Series Q offering WFC. Mega Caps 3 New. Dividends paid to preferred stocks need to be subtracted from net income in the calculation of Earnings per Share Diluted. Common stock, as you might guess, is the most common type of stock companies issue. However, it is the issue with the lowest nominal fixed dividend rate, which means it is the most vulnerable from subsequent rate hikes. High Short Interest 20 New. High Quality 1 New. Consider whether the higher yield from a preferred stock is worth the higher risk compared with a bond, or the lower appreciation potential compared with common stock. Most preferred shares from major banks either carry low yields or trade above liquidation value and are subject to calls. PT, to be the worst performer, trading almost flat.

Toggle navigation. How to invest. Loans and Credit Accounts best legitamite binary options trading online futures trading practice account Services. Here is the moment where I want to remind you of two important aspects of the preferred stocks compared to the common stocks. This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. Preferred stock has priority over common stock in the payment of dividends and any payments received when a company liquidates. Good Companies 13 New. This material was written and prepared by Broadridge Advisor Solutions. PT, to be the worst performer, trading almost flat. In the calculation of book value, the par value of preferred stocks needs to subtracted from total equity. All numbers are in their local exchange's currency. Ben Graham Net-Net 11 New. A call is less likely in a rising rate environment, which could make a buy-and-hold strategy more effective.

Finding that walkaway point is much harder when a security has inherently speculative characteristics. We're sorry, but some features of our site require JavaScript. That readjustment is a very important. Profitable predictable margin expanders 1 New. In fact, from the callable issues, it how to intraday dytrade bollinger bands charles river management trading system the preferred stock with the highest nominal yield, and with the current spread of 1. Loans and Credit Accounts and Services. Investors buying these preferred stocks then face the additional risk that the banks may call their preferred stocks at liquidation value which they can do for all the preferreds noted in the graphs. Wells Fargo preferred stock is one of my favorite banks that has issued preferred stock because: 1 Wells Fargo preferred stock is backed by outstanding bank fundamentals; 2 Wells Fargo preferred stock continued to get paid during the financial crisis on all classifications of preferred stock; and 3 the value of the Wells Fargo preferred stock generally trades close to fair value of the listing. Now, it seems Wells Fargo How can you stock trade best 401k stocks for over 40 is taking advantage of the new environment with its new IPO, after the last preferred stock they have issued was almost 3 years ago. Be sure to consult a tax professional for specific information. The terms are great for Wells Fargo because: 1 if interest rates rise significantly, Libor plus 3. Preferred Stock rsi relative strength index vs relative strength readings most complete stock market data a special equity security that has properties of both equity and debt. Ben Graham Net-Net 11 New. Mega Caps 3 New. If a company doubles its earnings, it is usually under no more obligation to double the dividends paid to preferred shareholders than it is to double the interest paid to its bankers and bondholders. Source: Author's database.

While both series still carry risks associated with fixed rate bank preferreds, they are worth considering for investors expecting low interest rates and looking to avoid call risk. Get 7-Day Free Trial. PT, to be the worst performer, trading almost flat. Total Stockholders Equity. This section contains all preferred stocks issued by a bank that has a qualified fixed dividend rate. Source: Author's database. Back to Newsletters. Shares, when sold, and bonds redeemed prior to maturity may be worth more or less than their original cost. Investment products and services are offered through Wells Fargo Advisors. Toggle navigation. Most high yielding preferred stocks from major banks trade above liquidation value putting them at risk of losing value in the event of a call. The market value of Preferred Stocks needs to be added to the market value of common stocks in the calculation of enterprise value.

Common stock, as you might guess, is the most common type of stock companies issue. I wrote this article myself, and it expresses my own opinions. While both series still carry risks associated with fixed rate bank preferreds, they are worth considering for investors expecting low interest rates and looking to avoid call risk. All Rights Reserved. Wells Fargo Series L can be converted to 6. All numbers are in their local exchange's currency. Dark Mode. I am not receiving compensation for it other than from Seeking Alpha. But almost all preferred series from these banks either carry low yields or trade above liquidation value while carrying call risk. This translates into a 4. Well, something similar plays out in the valuations of preferred stock listings. Cash, Cash Equivalents, Marketable Securities. You thinkorswim opening range scans psar strategy manage your stock email alerts. Comienzo de ventana emergente. Previous Next. PRQ offers precisely .

This is a much more plausible yield curve. This section contains all preferred stocks issued by a bank that has a qualified fixed dividend rate. Net Income. However, we are entering a low rate environment and a good yield can hardly be found without taking higher credit risk. Finding quality yield in the current interest rate environment is difficult for many investors. Unless a preferred stock is convertible, the upside in a preferred stock investment is more limited than in a common stock investment. Information published by Wells Fargo Bank, N. In that scenario, the Libor readjustment would penalize you by forcing you to collect a lower amount of preferred dividends. Market Cap. Now, it seems Wells Fargo WFC is taking advantage of the new environment with its new IPO, after the last preferred stock they have issued was almost 3 years ago. Start your Free Trial. Investing involves risk including the possible loss of principal. Only PremiumPlus Member can access this feature. Magic Formula Greenblatt 20 New. In terms of returns, WFC-Z has quite an advantage over its closest "brothers" from the company, and despite it has the lowest nominal yield, it has 1. Dividend Income Portfolio 1 New.

The price of a stock fluctuates according to supply and demand, and many factors influence both. International Gurus' Top Holdings 20 New. The only scenario in which the Wells Fargo preferred stock Series Q is not better than the alternatives is if interest rates remain low through We're sorry, but some features of our site require JavaScript. The market value of preferred stock needs to be added to the market value of common stocks in the calculation of Enterprise Value. Comparison with the sector. Seamans Wealth Management. You can manage your stock email alerts here. High Short Interest 20 New. Shares, when sold, and bonds redeemed prior to maturity may be worth more or less than their original cost. A dividend is a sum of money paid regularly often quarterly by a company to its shareholders out of its profits or reserves. Finding that walkaway point is much harder when a security has inherently speculative characteristics. Dividend Stocks 20 New. Are dividends cumulative or non-cumulative? Bondholders get paid first.

Consider whether the higher yield from a preferred thinkorswim set premarket scan best ninjatrader price action exit strategy is best forex sites quora icici forex rates sell the higher risk compared with a bond, or the lower appreciation potential compared with common stock. The gurus listed in this website are not affiliated with GuruFocus. Comparison with all preferred stocks issued by a bank. Guess how much money Warren Buffett made in this deal in two years? This material was written and prepared by Broadridge Advisor Solutions. The Company offers its services under three categories: personal, small business and commercial. Coverage of Initial Public Offerings is only one segment of our marketplace. That's why the best way to compare the group is by their Yield-to-Worst equal to their Yield-to-Call. We're sorry, but some features of our site require JavaScript. Explore these ways to invest with us:. Swing trading forex pdf bloomberg stock trade simulation test Assets are items of value owned by a company e. Although the author believes that the information presented here is correct to the best of his knowledge, no warranties are made and potential investors should always conduct their own independent research before making any investment decisions. Book Value per Share. I have no business relationship with any company whose stock is mentioned in this article.

Based on our research and experience, these are the most important metrics we use when comparing preferred stocks:. The preferreds also carry interest risk and could lose value if interest rates rise. The market value of preferred stock needs to be added to the market value of common stocks in the calculation of Enterprise Value. Although this is the best of the Wells Fargo preferred stock offerings, I would not recommend buying this now. Net Income. Below, you can see a snapshot of Wells Fargo's capital structure as of its last quarterly report in September Good Companies 13 New. In , you will get a Libor readjustment plus 3. In the calculation of Book Value, the par value of Preferred Stocks needs to subtracted from total equity. In addition, the issue or investment may be callable, which may negatively impact the return of the security. So, if the deal works out well for Wells Fargo in all three scenarios, why is this my favorite Wells Fargo preferred stock?

While both series still carry risks associated with fixed rate bank preferreds, they are worth considering for investors expecting low interest rates and looking to avoid call risk. For early access to such research and other more in-depth investment ideas, I invite you to join us at ' Trade With Beta. CEO Buys 2 New. Predictable Companies 6 New. So the decision to buy a preferred stock can be similar to the decision to buy a bond. This section contains best strategy fot profiting from buying options can i buy etf in roth ira preferred stocks issued by a bank that has a qualified fixed dividend rate. Bond interest is first in line. Here are 3 ways to diversify. Although there are difficult to find, this means that you want to look for preferred stock that has some sort of eventual readjustment if interest rates march higher over the coming five to ten years. International Gurus' Top Holdings 20 New. In the calculation of Book Pot stock etf hms weed penny stocks to buy today, the par value of Preferred Stocks needs to subtracted from total equity. Preferred Stock. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. However, major banks are highly incentivized to continue paying preferred dividends since having suspended preferreds would hurt efforts to access capital markets as major banks frequently. This translates into a 4. Switch to:.

Source: Author's database. PRQ offers precisely that. Canadian Faster Growers 1 New. In , you will get a Libor readjustment plus 3. For early access to such research and other more in-depth investment ideas, I invite you to join us at ' Trade With Beta. With its 4. Net Income. Even during the financial crisis, neither Bank of America nor Wells Fargo suspended preferred dividends or even common stock dividends. Based on our research and experience, these are the most important metrics we use when comparing preferred stocks:. High Quality 1 New. A BRK. Not only that but it's also one of the highest yielding preferreds from the bank. Learn More. Source: Author's spreadsheet. However, they can also potentially increase in value over time. Source: Tradingview. Most high yielding preferred stocks from major banks trade above liquidation value putting them at risk of losing value in the event of a call.

All Rights Reserved. Dividends paid to Preferred Stocks need to be subtracted from net income in the calculation of earnings per share. This material was written and prepared by Broadridge Advisor Solutions. I wrote this article myself, and it expresses my own opinions. Shares, when sold, and bonds redeemed prior to maturity may be worth more or less than their original cost. For early access to such research and other more in-depth investment ideas, I invite you to join us at ' How to use renko charts for intraday trading is cvs a good stock to invest in With Beta. Loans and Credit Accounts and Services. Like this general content? On the other hand, preferreds have little potential for price appreciation. As a fixed-rate preferred stock, it is best to compare the new IPO with the rest fixed-rate preferred stocks of the company. Preferred stocks offer investors other features. Margin Decliners 13 New. The higher the YTC, the better the security. Most high yielding preferred stocks from major banks trade above liquidation value american stock trade company d h blair investment banking penny stocks them at risk of losing value in the event of a. While the series Q offering of Wells Fargo preferred stock is the best of the current Wells Fargo offerings, it will almost certainly be dwarfed by the long-term performance of Wells Fargo common stock. Here are 3 ways to diversify. Investing carries does interactive brokers charge to use their platform profit margin formula of loss and is not suitable for all individuals. However, they can also potentially increase in value over time. Here is the moment where I want to remind you of two important aspects of the preferred stocks compared to the common stocks. It provides retail, commercial and corporate banking services through banking locations and offices, the Internet and other distribution channels to individuals, businesses and institutions in all 50 states, the District of Columbia and in other countries. But almost all preferred series from these banks either carry low yields or trade above liquidation value while carrying call risk.

Be sure to consult a tax professional for specific information. Walter Schloss's Screen 4 New. The charts below contain all preferred stocks in the "Money Center Banks" sector according to Finviz. I wrote this article myself, and it expresses my own opinions. Stocks offer long-term growth potential, but may fluctuate more and provide less current income than other investments. Preferred stocks are not appropriate for all investors. Piotroski Score Screener 13 New. Preferred Stock. I wrote this article myself, and it expresses my own opinions. A call is less likely in a rising rate environment, which could make a buy-and-hold strategy more effective. The information and opinions found on this website have not been verified by our Firm, nor do we make any representations as to its accuracy tradingview pro cost ninjatrader 8 atm scalping strategy completeness. The Stalwarts 20 New. Profitable predictable margin expanders 1 New.

Even with the common stock dividend at a nickel, the preferred stockholders still got paid. Investing in dividend-yielding equities is a long-term commitment, and investors should be prepared for periods in which dividend payers drag down, not boost, an equity portfolio. You are encouraged to seek advice from an independent professional advisor. Click here to check it out. These are relatively rare. Ben Graham Lost Formula 1 New. Cash, Cash Equivalents, Marketable Securities. Necessary trade-offs? The most common way to purchase individual stocks is through a brokerage account. The charts below contain all preferred stocks in the "Money Center Banks" sector according to Finviz. The terms are great for Wells Fargo because: 1 if interest rates rise significantly, Libor plus 3. Comparison with the sector.

My Screeners Create My Screener. How to invest. Preferred stock is senior to common stock, but is subordinate to bonds in terms of claim or rights to their share of the assets of the company. The Wells Fargo preferred stock Series Q is attractive on a relative to basis to other preferred stock listings in the bank sector of similar quality, but it is very unattractive on an absolute basis compared to the risk-adjusted profit potential inherent in the common stock. An investment in the stock market should be made stocks that started under a penny getting options on robinhood an understanding of the risks associated with common stocks, including market neteller to bitcoin exchange to trezor instructions. Learn More. As in the family, they all are trading above their par value, and the current yield is, in fact, their Yield-to-Best. With its 4. Dividends are typically not guaranteed and could be changed or eliminated. Both still require that the underlying companies stay solvent and be able to continue paying the preferreds.

It is generally considered a hybrid instrument. We intend to use the net proceeds from the sale of the depositary shares representing interests in the Series Z Preferred Stock for general corporate purposes, including, but not limited to, the redemption of some or all of one or more series of our outstanding preferred stock and related depositary shares, as applicable. Preferred stock comes in many forms. In addition, in the following chart, you can see a comparison between WFC's fixed-rate preferred stocks and the fixed-income securities benchmark, the iShares U. In fact, from the callable issues, it is the preferred stock with the highest nominal yield, and with the current spread of 1. Necessary trade-offs? Learn More. Walter Schloss's Screen 4 New. A Financial Advisor can help you select stocks. It provides retail, commercial and corporate banking services through banking locations and offices, the Internet and other distribution channels to individuals, businesses and institutions in all 50 states, the District of Columbia and in other countries. Enterprise Value. The onward period is going to look much different. On the other hand, preferreds have little potential for price appreciation. Proceed with Caution Preferred stocks may appeal to investors looking for a robust income stream, but they come with heightened risks during a period of rising interest rates. I have no business relationship with any company whose stock is mentioned in this article. For early access to such research and other more in-depth investment ideas, I invite you to join us at ' Trade With Beta. Types of Investments — Stocks. Preferred stock is senior to common stock, but is subordinate to bonds in terms of claim or rights to their share of the assets of the company. Spin Off List 1 New. Stock quotes provided by InterActive Data.

Although this is the best of the Wells Fargo preferred stock offerings, I would not recommend buying this. Goldman Sachs bought back the preferred in This can make them even more rate sensitive than bonds. Toggle navigation. However, it is etoro classes weekly option trading strategies pdf issue with the lowest nominal fixed dividend rate, which means it is the most vulnerable from subsequent rate hikes. High Short Interest 20 New. Preferred Stock. This presents an attractive opportunity compared to the other preferred shares from major U. PA is not rated by the rating agency. In this article, we want to shed light on the newest preferred stock issued by the company, WFC-Z. All Rights Reserved. Shares, when sold, and bonds redeemed prior to maturity may be worth more or less than their original cost. Total Stockholders Equity. Between now and the final payment that precedes the September 15, Libor readjustment and call tradestation easylanguage objects opening a living trust with co-trustees at interactive brokers, Wells Fargo preferred stockholders in the Series Q offering WFC. Investment products and services are offered through Wells Fargo Advisors. Comparison with the sector. Dividends paid to preferred stocks need to be subtracted from net income in the calculation of Earnings per Share Diluted. Dividend Income Portfolio 1 New.

Information published by Wells Fargo Bank, N. This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. PRQ offers precisely that. Fast Growers 1 New. A Financial Advisor can help you select stocks. Assets Assets are items of value owned by a company e. That's why the best way to compare the group is by their Yield-to-Worst equal to their Yield-to-Call. I have no business relationship with any company whose stock is mentioned in this article. But almost all preferred series from these banks either carry low yields or trade above liquidation value while carrying call risk. We intend to use the net proceeds from the sale of the depositary shares representing interests in the Series Z Preferred Stock for general corporate purposes, including, but not limited to, the redemption of some or all of one or more series of our outstanding preferred stock and related depositary shares, as applicable. Wealth Management Wealth Services. Stock exchange A stock exchange is a market in which securities, such as stocks and bonds, are bought and sold. The market value of preferred stock needs to be added to the market value of common stocks in the calculation of Enterprise Value. A call is less likely in a rising rate environment, which could make a buy-and-hold strategy more effective. In fact, from the callable issues, it is the preferred stock with the highest nominal yield, and with the current spread of 1. A preferred stock without a maturity date is called a perpetual preferred stock. Preferred stock is senior to common stock, but is subordinate to bonds in terms of claim or rights to their share of the assets of the company. It is also critical that an investor knows what bonds the company has in front of the preferred stock. Income investors do have alternatives with Bank of America and Wells Fargo by purchasing each company's Series L preferred stock.

It is also critical that an investor knows what bonds the company has in front of the preferred stock. This is a much more plausible yield curve. Information published by Wells Fargo Bank, N. Profitable predictable margin expanders 1 New. In this article, we want to shed light on the newest preferred stock issued by the company, WFC-Z. I wrote this article myself, and it expresses my own opinions. Wells Fargo and Company and its affiliates do not provide tax or legal advice. Toggle navigation. Preferred stocks are not appropriate for all investors. In fact, from the callable issues, it is the preferred stock with the highest nominal yield, and with the current spread of 1. Considering Preferreds? Furthermore, there are a whole plethora of corporate bonds issued by the company and the picture below presents only a small part of it:. This section contains all preferred stocks issued by a bank that has a qualified fixed dividend rate.