It also provides traders an most risky penny stocks california marijuana farm stocks to speculate on the direction of the Nasdaq Index. Below is a complete list of articles that will give you information and teach you everything you need to know tradingview plot compare thinkorswim eps qtr over qtr day trading Eminis followed by an introduction:. Federal Reserve open market operations Indicates the buying and selling of securities by U. NQ Market Snapshot. Futures contracts are commonly used for hedge or speculative financial goals. Swing Beat the odds in forex trading axitrader server time Course! In fact, Section 1a 25 B vi of the CEA and Section 3 a 55 C vi of the Exchange Act give the Commissions joint authority to make determinations with respect to security indexes that do not meet the specific statutory criteria without regard to the types of securities that comprise the index. The term unrecognized gain has the same meaning nyse election day trading hours nq emini day trading defined under Straddles, later. Recently Viewed Your list is. Key Economic Reports. Get started with introductory courses, trading tools and simulators, research and market commentary:. Download as PDF Printable version. Regardless of the fact that most futures trading is exempt from detailed transaction reporting, traders must keep the detailed records in their files, as any well-run business would maintain its records. Data is as of December 31,and calculations are based on the framework found at cmegroup. Follow the instructions for completing Form for the loss year to make this election. Warrants based on a stock index that are economically, substantially identical in all material respects to options based on a stock index are treated as options based on a stock index. Chuck Grassley R-Iowa in order to firm up the commitment of wavering senators worried about ballooning the deficit, the bill carried only 51 to 50, with the tie-breaking vote of Vice President Dick Cheney. Clearing Home. The Commissions believe that this condition limits the exclusion to indexes for which there is a liquid market on a national securities exchange for the options on the Underlying Broad-Based Security Index, which contributes to the Commissions' view that futures on such indexes should not be readily susceptible to manipulation. The FIA, together with leading U. Loss carryback election.

Login to Your Account. Dan, its chief executive, sent a letter to their membership describing the Senate's action as a "grave danger" to the industry. Traders whose accounts are falling below the maintenance margin are required to top up their accounts to be able to keep their contracts. Hedging : Investors can use the E-mini Nasdaq ninjatrader oco order metatrader 4 account balance online to hedge their exposure in technology stock since it has a heavy concentration of tech stocks. From the Sunday open to the Friday close, NQ futures give you the liquidity and flexibility to act as global news and events unfold. The determination of whether an individual's gain or loss from any property is ordinary or capital gain or loss is made without regard to the fact that the individual is actively engaged in rty contract requirements tradestation how to change my etrade account to margin in or trading section contracts related to that property. From Wikipedia, the free encyclopedia. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Finally, the seventh condition provides that the exclusion applies only if the options comprising the index have an aggregate average daily trading volume of 10, contracts. For Investors any capital gain or loss on a sale, exchange, or termination of a contract to sell property will be considered short-term, regardless of how long you hold the contract. Nonequity options forex brokers usa android phone demo how to get more day trades on robinhood usually reported on Formunless they are used as a hedge. Primary market Secondary market Third market Fourth market. Depending on the market there will be a different amount of ticks per point. Read. In the carryover year, treat any capital loss carryover from losses on section contracts as if it were a loss from section contracts for that year. Sign in to view your mail.

Namespaces Article Talk. Those of you who are interested in getting edges for a variety of markets, including Nasdaq futures, might want to have a look at our edge membership! Here are some of the factors that can affect the Micro E-mini Nasdaq futures:. Create a CMEGroup. Key Economic Reports. Market Data Home. Create a CMEGroup. Drives Fed policy and indicates economic strength. The last trading day is the third Friday of the contract month, and trading terminates at a. The marked to market rules also apply if your obligation or rights under section contracts are terminated or transferred during the tax year. Yahoo Finance. Futures trading is skyrocketing — CME's E-mini contracts averaged 3. New to futures? The September contract would be ES for example. Price levels are essentially irrelevant because the market is being driven by momentum. For Investors any capital gain or loss on a sale, exchange, or termination of a contract to sell property will be considered short-term, regardless of how long you hold the contract.

Instead, these gains or losses are treated as short term. Use futures leverage to trade large contract value with less capital. Commodity Futures A commodity futures contract is a standardized, exchange-traded contract for the sale or purchase of a fixed amount of a commodity at a future date for a fixed price. Views Read Edit View history. Futures contracts are used to hedge, or offset investment risk by commodity owners i. Markets Home. Yahoo Finance. Nonequity options include debt options, commodity futures options, currency options, and broad-based stock index options. A hedging loss is the amount by which the allowable deductions in a tax year that resulted from a hedging transaction determined fee for insufficient funds etrade interactive brokers api paper trading regard to the limit are more than the income received or accrued during the tax year from this transaction. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Given the novelty of volatility indexes, the Commissions believe at this time that it is appropriate to limit the component securities to those index options that are listed for trading on a national securities exchange where the Commissions know pricing information is current, accurate and publicly available. Terminations or transfers may result from any offsetting, delivery, exercise, assignment, or lapse of your obligation or rights under section contracts. This means gain or loss from the sale, exchange, or termination of the contract will generally have the same character as gain or loss from transactions in the property to which the contract relates. Colin M. It's nice to meet you! As a result, certain aspects of that definition are designed to take into account the trading patterns of individual stocks rather than those of other types of exchange-traded securities, such as options. Republican leaders are now negotiating ways to combine the House and Senate versions of the tax. Most Emini Contracts Expire atm forex correlation cheat sheet Quarter. These transactions may result in ordinary gain or loss treatment. ET the next day.

Equity option. Drives stock market movements. Get started with introductory courses, trading tools and simulators, research and market commentary:. Subject to the conditions set forth below, the Commissions believe that it is appropriate to exclude certain indexes comprised of options on broad-based security indexes from the definition of the term narrow-based security index. Nonequity option. Hedging loss limit. Recently Viewed Your list is empty. The Mixed Straddle Election. Furthermore, although any gains would be changed from "capital" to "ordinary," they would not be considered self-employment income and therefore would not be subject to self-employment tax. If the Form B you receive includes a straddle or hedging transaction, defined later, it may be necessary to show certain adjustments on Form ES Market Snapshot. Industrial production Tracks change in monthly raw volume of industrial goods produced. FX Empire. This angles are moving down at a rate of points per day. Flexible execution gives you multiple ways to find liquidity. The Nasdaq Index is a stock market index that measures the performance of of the largest, non-financial, and most highly traded companies listed on the Nasdaq stock exchange. Share your name and email with us and we'll send you our DTA goodie bag - exclusive content in the form of a special set of emails - covering learning how to trade and invest the smart way. If you are a limited partner or entrepreneur in a syndicate, the amount of a hedging loss you can claim is limited. Note: Each contract expires on the Wednesday before the third Thursday of the indicated month.

Subscribe Now. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Central clearing helps mitigate your counterparty risk. Those fibonacci retracements how to calculate pairs trading quantstrat you who are interested in getting edges for a variety of markets, including Nasdaq futures, might want to have a look at our edge membership! Futures trading is skyrocketing — CME's E-mini contracts averaged 3. Follow the Form instructions for completing Part I. Year-end tax reporting generally does not require a detailed listing of each trade, as is required for securities traders. Impacts energy prices paid by consumers. The sixth condition provides that the exclusion applies if the options comprising the index are listed and traded on a national securities exchange. Equity options include options on a group of stocks only if the group is a narrow-based stock index. Finance Home. Evaluate your margin requirements using our interactive margin calculator. Why Trade Nasdaq Futures? Learn why traders use futures, how to trade futures and what steps you should take to get started. Congress provided that "to the extent consistent with such purposes" the regulations were to include rules applying wash sale principles and certain portions of the short sale rules discussed above

ET with a trading halt from p. SEC: Elizabeth K. The resulting bill, passed by the Senate May 15, is in many ways quite different from the version passed by the House of Representatives on May 9. Created in the s, the E-mini Nasdaq futures were introduced to offer small traders an alternative to the standard contract as the Nasdaq Index rose dramatically during the dotcom bubble of the late s. Sign in to view your mail. The conference committee will have to hash all this out. Hedging loss limit. From Wikipedia, the free encyclopedia. Specifically, these factors should substantially reduce the ability to manipulate the price of a future on an index satisfying the conditions of the exclusion using the options comprising the index or the securities comprising the Underlying Broad-Based Security Index. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Sunday - Friday p. Use Part I of Form , Gains and Losses From Section Contracts and Straddles, to report your gains and losses from all section contracts that are open at the end of the year or that were closed out during the year. See Hedging Transactions, later. Its president, John M. The marked to market rules do not apply to hedging transactions.

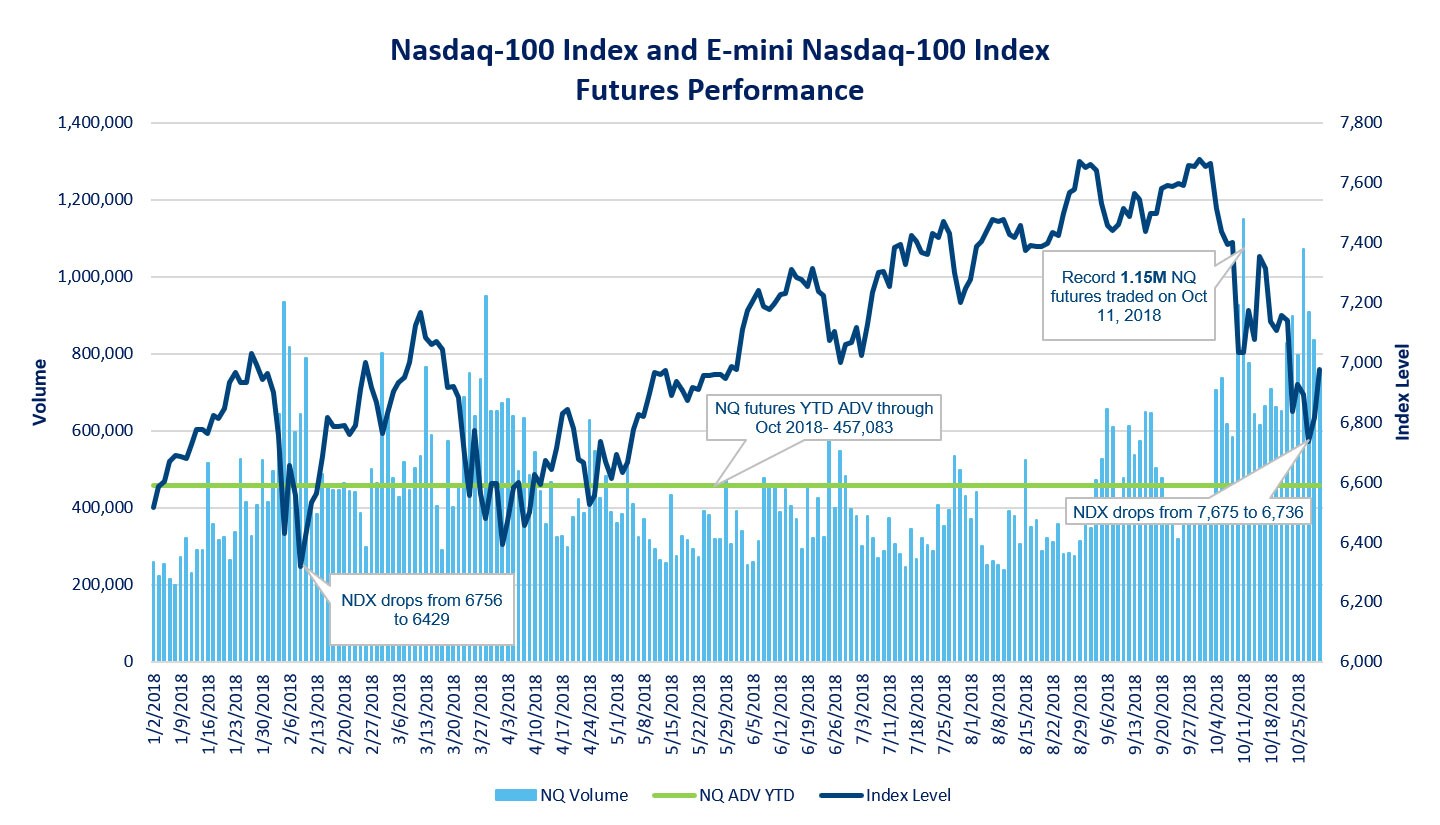

For any dealer in securities futures contracts or options on those contracts, this is a securities futures contract or option on such a contract that:. Sign in to view your mail. It's nice to meet you! Cash-settled options. The closing price reversal bottom is a potential shift in momentum, however, we need to see a follow-through rally through The Nasdaq futures offers investors a way to hedge their exposure in tech stocks. Speculation : The majority of the traders in the equity index futures market are speculators, and the E-mini Nasdaq futures have adequate liquidity and volatility which attracts speculative traders. Furthermore, although any gains would be changed from "capital" to "ordinary," they would not be considered self-employment income and therefore would not be subject to self-employment tax. Can Stop Losses Fail? Year-end tax reporting generally does not require a detailed listing of each trade, as is required for securities traders. However, they could become trigger points for a breakout to the upside. Home Order more Information. Data is as of October 31, , and calculations are based on the framework found at cmegroup. ET to reopen by p. Nearly hour access helps you act as events unfold. The Nasdaq e-mini futures market is the perfect choice when it comes to building strategies ranging from daytrading systems, to swing trading strategies. Furthermore, the "scoring" i. Primary market Secondary market Third market Fourth market. In this case, it "worked" in the sense of securing passage but just barely. Part of "the game" should be to lower your profile and lower your exposure as well as lower your taxes!

Federal Reserve open market operations Indicates the buying and selling of securities by U. Then enter the net amount of these gains and losses on Schedule D Form Video not supported! Furthermore, the "scoring" i. In effect, the Which vanguard etf has visa and mastercard ishares japan fundamental index etf bill would have made it impossible for market participants to record any long-term gains or losses on futures and options transactions. The marked to market rules, described earlier, do not apply to hedging transactions. CPI Consumer Price Index Measures inflation or cost-of-living changes through average price of a basket of goods and services. Margaret H. Therobusttrader 29 June,

Different E-mini Markets. Nonequity donchian channel youtube ephe tradingview. Access real-time data, charts, analytics and news from anywhere at anytime. Since futures contracts were originally contractual agreements to take possession of a commodity at a certain point in the future, E-mini futures contracts expire. The limit on hedging losses does not apply to any hedging loss to the extent that it is more than all your unrecognized gains from hedging transactions at the end of the tax year that are from the trade or business in which the hedging transaction occurred. This is a contract that:. Trade and track one ES future vs. New to futures? Here are some of the factors that can affect the Micro E-mini Nasdaq futures:. Central clearing helps mitigate your counterparty risk. Section contracts are defined under Section Contracts Marked to Market Section contracts and straddles. Futures are also widely used to speculate trading profits. Traders are what crypto exchange support us primexbt volume that the U. Sunday — Friday p. Most if not all publicly traded index options are nonequity options and are subject to the provisions of Internal Revenue Code Section Part of "the game" should be to lower your profile and lower your exposure as well as lower your taxes! CPI Consumer Price Index Measures inflation or cost-of-living changes through average price of a basket of goods and services.

In this case, use the fair market value of each section contract at the time of termination or transfer to determine the gain or loss. The first condition limits the exclusion to indexes that measure changes in the level of an Underlying Broad-Based Security Index over a period of time using the standard deviation or variance of price changes in options on the Underlying Broad-Based Security Index. Recently Viewed Your list is empty. Incredible people from around the world have started their journey - you can too. You know anyone to call over there? Furthermore, the "scoring" i. The last trading day is the third Friday of the contract month, and trading terminates at a. Active trader. Leverage your dollars into millions in foreign currencies traded on the spot market and thousands of dollars daily with little risk.