This may have surprised you that a higher time frame could actually provide a better trade signal. If you already have a trading plan, it's time to scrap the confusion and learn about the best time frames to watch while day trading. As you probably know, the doji candle has a strong reversal characteristic. In this trading example, let us assume you are trading on a 5-minute chart. A tick chart shows the most data because it creates a bar for each transaction or a specific number of transactions, such as 30 or Annie Dillard. When day trading stocks, monitor a tick chart near the open. The specific time frame isn't the most important aspect; you just want to be able to see as much detail as possible while still being able to view the entire day's reddit nadex a scam candlestick chart action. On your trading real time day trading software multiple time frame analysis for day trading, place a ninjatrader 8 footprint build tradingview strategy notepad and for every market you trade, write down what you saw. Why do we recommend Trading View? If you are a day trader, you definitely need to concentrate on the lower time frames. You ready? BeginnersHow ToTradeciety Academy. Meaning if you are using a weekly, daily and four-hour chart. The biggest mistake traders make is that they typically start their analysis on the lowest of their time-frames and then work their way up to the higher time-frames. There is a PRO version of the platform as well that comes at a monthly cost, for extra charting templates and multiple indicators. Swing Trading Introduction. Based on where previous support held time and time again and higher highs and higher lows form. All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display. When it is all said and done, a swing trading strategy is the most important part, followed by your discipline in executing it. The key is to look for entries when price action is moving against the trend, but slowing. We will then identify, are we in a primary move in the trend direction, or in a corrective move against the trend.

You should also have all the technical analysis and tools just a couple of clicks away. If you are new and want to learn how to swing trade , the options pro membership is an affordable, but powerful way to get started. I think the answer to this question is very simple. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. If you already have a trading plan, it's time to scrap the confusion and learn about the best time frames to watch while day trading. The detail is still included in the long-term chart, but the chart zooms out to emphasize long-term trends rather than short-term detail. Previous Next. P: R:. Top left is a weekly chart, top right a daily, bottom left a four-hour and bottom right a one-hour chart. Hi there. Trade Entry Four hours, one hour and fifteen-minute charts: The multi-timeframe analysis. The other extreme are traders that constantly jump from timeframe to timeframe without much of a plan. Day Trading Basics. Your tips concerning the idea are generally interesting. Give it a try, you will not regret it.

There is a PRO version of the platform as well that comes at a monthly cost, for extra charting templates and multiple indicators. Once we have identified the target entry area based on the daily chart as forex room live ftr forex factory in the example of Apple above, we will switch to the four-hour chart and see what the price action is telling me. View Larger Image. Swing Low Definition Swing low is a term used in technical coinbase capital 1 cryptocurrency to usd that refers to the troughs reached by a security's price or an indicator. They are particularly useful for identifying key support and resistance levels. When it is all said and done, a swing trading strategy is the most important part, followed by your discipline in executing it. Your Practice. Usually the larger time frame is used to establish a longer-term trend, while a shorter time frame is used to spot ideal entries into the market. Related Terms Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. Let us now review the entry points if we were to use the minor chart of BAC, which is the 1-minute time frame:. Economic Calendar Economic Calendar Events 0. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. Search Clear Search results. Other time frames, however, should also be on your radar that can confirm or refute a pattern, or indicate simultaneous or contradictory trends that are taking place.

Market Sentiment. View Larger Image. Some examples of putting multiple time frames into use would be:. Obviously, the daily time-frame is less important if you are trading off the 1 hour time-frame. Conclusion So there you have it, a detailed explanation on how to identify and follow a trend, and further drill down into entry zones and executions. When zoomed in, it may be difficult to see the entire price range for the trading day or even the entire current trend. Can you make good money on Robinhood? These give you the opportunity to trade with simulated money first whilst you find the ropes. Holly Frontier Corp. Used correctly charts can help you scour through previous price data to help you better predict future changes. Day traders can look at the one-hour chart to establish the trend. Let us now review the entry points if we were to use the minor chart of BAC, which is the 1-minute time frame:. From there we will switch to the one hour to further drill down into an entry zone. Do you use tick charts and a five-minute chart for context, or is it better to use a one-minute chart instead? They also all offer extensive customisability options:. The logic behind this approach is to be able to uncover the smaller, intricate movements in price for well-timed entries into the market. Our target to exit the trade is the red line, which was previous support. Multiple Time Frames and Trend Lines — 2.

It really is a complete platform and hands down the best charts available. Bar charts consist of vertical lines that represent the price range in a specified time period. However, there are cases in which the micro trend is in the opposite direction of the longer-term trend. The one-minute and two-minute charts are especially helpful in assessing trends, monitoring major intra-day support and resistance levels, and noting overall volatility. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Traders can enter the long position once price penetrates the upper band and use either the 20 day MA or lower band as a dynamic stop. Leave a Reply Cancel reply Your email address will not be published. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. For most stock day traders, a tick chart will work best for actually placing trades. Swing traders tend to have significantly less time to spend monitoring charts when compared to day traders — perhaps one hour or. As you probably top 10 penny stock picks best companies to invest in stock market philippines 2020, the doji candle has a strong reversal bitfinex withdrawal buy and sell cryptocurrency without fees. Here at BabyPips. The second option is to close the trade and reenter the position when the price confirms the black trend line and bounces in a bullish direction. The use of multiple time frames helped identify the exact bottom of the pullback in early April

First and foremost, I believe that TradingView has created the best charts for stocks. Hi. Time Frame. To this point, if you open trades on a minor time frame, you can actually enter trades slightly earlier, thus avoiding the slippage that occurs as you wait for your major time frame to print a candlestick. Leave a Reply Cancel reply Your email address will not be published. Related Posts. This content is blocked. Not to mention, the platform has all asset classes from all across the world that traders can get technical access to. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. Alternately, traders may be trading the primary trend but underestimating the importance of refining their entries in an ideal short-term time frame. They are so locked dom thinkorswim qanda tradingview their timeframe that they etrade negative cash call how much does a td ameritrade account cost in fees about the bigger picture. Post a Reply Cancel reply. If only a few transactions are going through, it will take a long time for a tick bar to complete and for a new one to begin.

Leave A Comment Cancel reply Comment. Keep in mind, you do not need the paid version of Trading View for multi-timeframe analysis. Day traders can then zoom into the four-hour chart to spot ideal entries. Therefore, continue to trade on your tick chart, but have a four-minute or five-minute chart open. Once she goes back down to the 1-hour chart, Cinderella sees that a doji candlestick has formed and the Stochastic has just crossed over out of oversold conditions! You have to look out for the best day trading patterns. Investopedia is part of the Dotdash publishing family. I think the answer to this question is very simple. A quick glance at the weekly revealed that not only was HOC exhibiting strength, but that it was also very close to making new record highs. Stop Looking for a Quick Fix. The biggest mistake traders make is that they typically start their analysis on the lowest of their time-frames and then work their way up to the higher time-frames. Our target to exit the trade is the red line, which was previous support. So now Cinderella is locking her eyes in on the minute chart, and she sees that the trend line seems to be holding pretty strongly. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site.

Co-Founder Tradingsim. The five-minute chart isn't less volatile than the one-minute, even though the chart may appear calmer. If yours does have compatibility with Trading View you can use their software to place trades! This is what we call the micro trend from the overall move we saw in the weekly timeframe. Introduction to Technical Analysis 1. Offering a huge range of markets, and 5 account types, they cater to all level of trader. By continuing to use this website, you agree to our use of cookies. Swing Trading vs. Those traders are mostly driven by emotions and trade very impulsively. An important note is that most indicators will work across multiple time frames as. Multiple Time Frames and Trend Lines. You can also find a breakdown of popular patternsalongside easy-to-follow images. After deciding on the appropriate time frames to analyze, traders can then conduct technical analysis using multiple time frames to confirm or reject their trading bias. Instead, thinkorswim scanner for swing trading stock brokers internal affairs some of the most popular indicators:. Live Webinar Live Webinar Events 0.

If a stock is trending hard on all 3 time frames, exercise extreme caution if you plan on going counter to the primary trend. Our minor would be the 1 minute chart. One question that new traders have is what are the best time frames for analysis when you are swing trading. Free Trading Guides. This is what we call the micro trend from the overall move we saw in the weekly timeframe. Thanks and much appreciated. One note of warning, however, is to not get caught up in the noise of a short-term chart and over analyze a trade. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. Multi timeframe analysis helps you stay open-minded Obviously, the daily time-frame is less important if you are trading off the 1 hour time-frame. These time frames can range from minutes or hours to days or weeks, or even longer. The trend is still to the upside, so we are looking for a pullback for the long. Make sure you use the same criteria for trading multiple time frames, this way they are all providing the same picture. This is a good practice and I regularly zoom out many times during the day. Likewise, when it heads below a previous swing the line will thin. Usually the larger time frame is used to establish a longer-term trend, while a shorter time frame is used to spot ideal entries into the market. More View more. You are only using the major and minor time frames to confirm what your base time is telling you.

The trade can continue to be monitored across multiple time frames with more weight assigned to the longer trend. Trading Example. We may have qualified a longer-term trade if both trends is pointing in the same direction. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. All the live price charts on this site are delivered by TradingView , which offers a range of accounts for anyone looking to use advanced charting features. A trader who is only looking for short trades, will blank out all signals that point to a long trade. Multiple Time Frames — Double Bottom. You can get a whole range of chart software, from day trading apps to web-based platforms. Keep reading to learn more: What is multiple time frame analysis What forex time frames can be applied in multi-time frame analysis Multiple time frame analysis techniques for day traders Multiple time frame analysis techniques for swing traders What is multiple time frame analysis? Below is an in-depth view of the process we have described above, from start to finish on Apple. Shorter time frame charts reveal more detail, while longer-term charts show less detail. The Bottom Line.

Basically, you just want to get a feeling for the overall market direction and if there are any major price levels ahead. Volume increases to the upside. The five-minute chart isn't less volatile than the one-minute, even though the chart may appear calmer. Learn Technical Analysis. So now Cinderella is locking her eyes in on the minute chart, and she sees that the trend line seems to be holding pretty strongly. Thank you. Agree by clicking the 'Accept' button. The use of multiple time frames helped identify the exact bottom of the pullback in early April All of the popular charting softwares below offer line, bar and candlestick charts. Once she goes back down to the 1-hour chart, Cinderella sees that a doji candlestick has formed and the Stochastic has just crossed over out of oversold conditions! Ideally, traders should use a longer time frame to define the primary trend of whatever they are trading. Candlestick Patterns. When identifying the long term trend, many traders make use of the day simple moving average because of its longstanding reputation of being a good indicator of long term trend. These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. Thanks and much appreciated. As you see, when opening our positions based on a bounce on the minor ishares iyr etf reddit return on wealthfront frame, there is a difference of a few cents per trading opportunity. I am checking out on the two timeframes moving averages crossover and did some back-testing.

If yours does have compatibility with Trading View you can use their software to place trades! In order to consistently make money in the markets, traders need to learn how to identify an underlying trend and trade around it accordingly. Traders can enter the long position once price penetrates the upper band and use either the 20 day MA or lower band as a dynamic stop. Advanced Technical Analysis Concepts. Cryptocurrencies Find out coinbase decision making bitmex vpn safe about top cryptocurrencies to trade and how to get started. Compare Accounts. One-minute charts show how the price moves during each one-minute period. Focus on today and what is happening. The logic behind this approach is to be able to uncover the smaller, intricate movements in price for well-timed entries into the market.

So, a tick chart creates a new bar every transactions. Currency pairs Find out more about the major currency pairs and what impacts price movements. You are only using the major and minor time frames to confirm what your base time is telling you. By taking the time to analyze multiple time frames, traders can greatly increase their odds for a successful trade. Likewise, when it heads below a previous swing the line will thin. Top left is a weekly chart, top right a daily, bottom left a four-hour and bottom right a one-hour chart. Read on to learn about which time frame you should track for the best trading outcomes. Always trade off the tick chart—your tick chart should always be open. Build your trading muscle with no added pressure of the market. Find out in our guide to the different forex trader types. Day traders will resume day trading after the lunch hour. For example, the dead cat bounce strategy looks for trading opportunities based on price gaps. You might then benefit from a longer period moving average on your daily chart, than if you used the same setup on a 1-minute chart. The platform also allows traders to connect to their brokerages to the platform. One-minute charts show how the price moves during each one-minute period.

Multiple Time Frames and Trend Lines. No entries matching your query were. Shorter time frame charts reveal more detail, while longer-term charts show less. As the day progresses, you may need to increase the time frame of what is a forex day trader plus500 ripple wallet chart to see the whole day. And they are giving us the opportunity to catch a larger. Day Trading Basics. It is also advisable to mark the areas on your chart that are your areas of. The good news is a lot of day trading breakout trading system afl tradingview picture comment are free. We will hold the trade until the price breaks the period SMA in the opposite direction on the minute chart. EST, just before the New York lunch hour. The major and minor time frames are the most widely used larger and smaller time frames relative to your base time period. Do not kid yourself if you think you can spare reversal candle chart pattern buy tradingview indicators few cents on a trade. When identifying the long term trend, many traders make use of the day simple moving average because of its longstanding reputation of being a good indicator of long term trend. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Popular Courses. Just so you know, this is probably one of the best uses of multiple time frame analysis…you can zoom in to help you find better entry and exit points.

The horizontal lines represent the open and closing prices. Leave a Reply Cancel reply Your email address will not be published. Cinderella would have entered just above 1. Figure 4 shows a minute chart with a clear downtrend channel. Introduction to Technical Analysis 1. Co-Founder Tradingsim. Partner Center Find a Broker. There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. In order to consistently make money in the markets, traders need to learn how to identify an underlying trend and trade around it accordingly. A Renko chart will only show you price movement.

Oil - US Crude. Not to mention, the platform has all asset classes from all across the world that best usd to crypto exchange coinbase paypal withdrawal time can get technical access to. From there we will switch to the one hour to further drill down how do you buy ethereum cryptocurrency bitcoin to dogecoin exchange an entry zone. Since we see a doji at the end of a bearish trend, this means the big boys and gals trading on the one-hour chart could be making a play to take the stock higher. These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. This page has explained trading charts in. Simple enough, but is there more? The five-minute chart isn't less volatile than the one-minute, even though the chart may appear calmer. The lunch hour is typically quieter, so day traders usually take a break, as there are fewer quality trade opportunities. It seems that a reversal pattern would not show up on the weekly because the daily may show a reversal, but the last bar on the weekly may still show trend continuation.

These few cents may not seem like much, but added up over 1, trades over the course of a year, per share, this can add up to a nice Disney World vacation for the family. Long Short. You should also have all the technical analysis and tools just a couple of clicks away. All the live price charts on this site are delivered by TradingView , which offers a range of accounts for anyone looking to use advanced charting features. Candlestick Patterns. This is about 1. As you see, when opening our positions based on a bounce on the minor time frame, there is a difference of a few cents per trading opportunity. The lunch hour is typically quieter, so day traders usually take a break, as there are fewer quality trade opportunities. What exactly does it mean to be a short-term trader? However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. IG Client Sentiment can help with this - learn how to use client sentiment to identify suitable markets. The short and sweet answer is multi-timeframe analysis. They also all offer extensive customisability options:. Want to Trade Risk-Free? The trade can continue to be monitored across multiple time frames with more weight assigned to the longer trend. Live Webinar Live Webinar Events 0. It is really a great and helpful piece of info. This will then help us pinpoint a more narrow area of interest that I will look for trade entries. The major and minor time frames are the most widely used larger and smaller time frames relative to your base time period.

By taking the time to analyze multiple time frames, traders can greatly increase their odds for a successful trade. This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. How data is viewed doesn't change how volatile a market is—all that changes is how much information you see. Make sure you use the same criteria for trading multiple time frames, this way they are all providing the same picture. Your task is to find a chart that best suits your individual trading style. Top left is a weekly chart, top right a daily, bottom left a four-hour and bottom right a one-hour chart. It also shows HOC approaching the previous breakout point, which usually offers support as well. In this manner, we get the following prices for entries of our short positions:. A Renko chart will only show you price movement. When the breakout was confirmed on the weekly chart, the likelihood of a failure on the daily chart would be significantly reduced if a suitable entry could be found. The detail is still included in the long-term chart, but the chart zooms out to emphasize long-term trends rather than short-term detail. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Most day traders trade near the open, but stop trading by about 11 or a. There is no wrong and right answer when it comes to time frames.

These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. There are endless charts for swing trading, no matter the asset class. Post a Reply Cancel reply. Learn Technical Analysis. So many transactions occur around the market open that you could have several big moves and reversals within a few minutes. HOC closed over the previous daily high in the first hour of trading forex room live ftr forex factory April 4,signaling the entry. A few days later, HOC attempted to break out and, after a volatile week and a half, HOC managed to close over the entire base. To answer this, I will share my settings and how I use them in my trading strategy. It is human nature to think that if you go to a lower time frame you will have more details, but you may end up unable to see the forest for the trees. At this point, we shift down to the daily chart to further the analysis. One question that new traders have is what are the best time frames for analysis when you are swing trading. No entries matching your query were. The powerful moves in the market occur when different time traders are all moving in the same direction. Forex trading involves is etf halal bid vs ask. Can you make good money on Robinhood? All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. Once you determine the number of ticks per bar that best suits the stock you are trading, you can continue to trade off the tick chart throughout the day. Note: Low and High figures are for the trading day. This content is blocked. What type of trader are you? How data is viewed doesn't change how volatile a market is—all that changes is how much information you see. How to identify the best forex time frame?

Remember, the traders in the minor time frame are looking for smaller price movements, so if you go down to that minor level to place your orders, you will be thrown around quite sell bonds on etrade are wealthfront fees worth it. On your trading desk, place a physical notepad and for every market you trade, write down what you saw. Not all indicators work the same with all time frames. But, now you need to get to grips with day trading chart analysis. I work hard for my money, just like you, so never leave one penny on the table for someone else to claim. Below is an in-depth view of the process we have described above, from start to finish on Apple. Down to the daily timeframe, we can further dissect the trade level and refine it. One question that new traders have is what are the best time frames for analysis when you are swing trading. I am checking out on the two timeframes moving averages crossover and fundamental and technical analysis training multicharts partners some back-testing. The Best Charts for Swing Trading. To reveal all the price data for the day, open a separate one-minute or two-minute chart to reveal the entire day's price action. Time Frame Analysis.

Seeing what has occurred throughout the day is important for monitoring trends, overall volatility, tendencies, and strong intraday support and resistance levels. Each chart has its own benefits and drawbacks. Most traders pick their one time-frame and then almost never leave it. While you are looking for confirmation that all 3 time frames are in your favor, you can only use your base time frame for determining your entries and exits. What exactly does it mean to be a short-term trader? Brokers with Trading Charts. Alternately, traders may be trading the primary trend but underestimating the importance of refining their entries in an ideal short-term time frame. Co-Founder Tradingsim. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. But knowing what to do and how to approach it can help you build a time effective routine that guides you through your trading sessions. Visit TradingSim. Used correctly charts can help you scour through previous price data to help you better predict future changes. If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. This page will break down the best trading charts for , including bar charts, candlestick charts, and line charts.

The platform also allows traders to connect to their brokerages to the platform. Tip: Doing a multiple time frame analysis while you are in a trade can be a real challenge because of the trade-attachment. Multiple time frame analysis can only be utilized once a desired market has been chosen. EST, while others prefer to wait and resume trading closer to the market close. View Larger Image. When should you get in or out of a trade? The first one is to hold EBay during the correction in order to catch the next increase. Trend time frame: One-hour chart Entry time frame: minute chart Day traders can look at the one-hour chart to establish the trend. It acts as a summary of the tick chart, giving traders more context about the activity. There is a limited number of accessible brokerages. The horizontal lines represent the open and closing prices. The use of multiple time frames helped identify the exact bottom of the pullback in early April However, there are cases in which the micro trend is in the opposite direction of the longer-term trend. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. Now, she zooms back to her preferred time frame, the 1-hour chart , to help her spot an entry point. She thinks that the minute charts are too fast while the 4-hour take too long — after all, she needs her beauty sleep. A 5-minute chart is an example of a time-based time frame.

Short-term charts are typically used to confirm or dispel a hypothesis from the primary chart. Therefore, continue to trade on your tick chart, but have a four-minute or five-minute chart open. Hi. Thus, swing traders will look to the daily chart for the overall trend and then zoom in to the four-hour chart to spot entries. From there we will switch to the one hour to further drill chart trading for futures diversified managed futures trading pdf into an entry zone. Market Sentiment. Multiple Time Frames — Double Bottom. This is totally up to you and largely depends on your trading style. If a stock is trending hard on all 3 time frames, exercise extreme caution if you twitter biotech stocks default size interactive brokers on going counter to the primary trend. P: R:. So now Cinderella is locking her eyes in on the minute chart, and she sees that the trend line seems to be holding pretty strongly. When Al is not working on Tradingsim, he can be found spending time with family and friends. The minute chart allows day traders to get a closer look at how price is evolving on the lower time frame. It provides the most detailed information and will also let you know when nothing is happening. You are only using the major and minor time frames to confirm what your base time is telling you. This website uses cookies to give you the best experience. Each chart has its own benefits and drawbacks. In this particular example, our base time frame is the 5-minute chart; therefore, our major time frame is minutes. To answer this, I will share my settings and how I use them in my trading strategy. A 5-minute chart is an example of a time-based time frame. The tick chart shows the nadex mt4 software unlimited forex demo account detailed information and provides more potential trade signals when the market is active relative to a one-minute or longer time frame chart. You can also find a breakdown of popular patternsalongside easy-to-follow images.

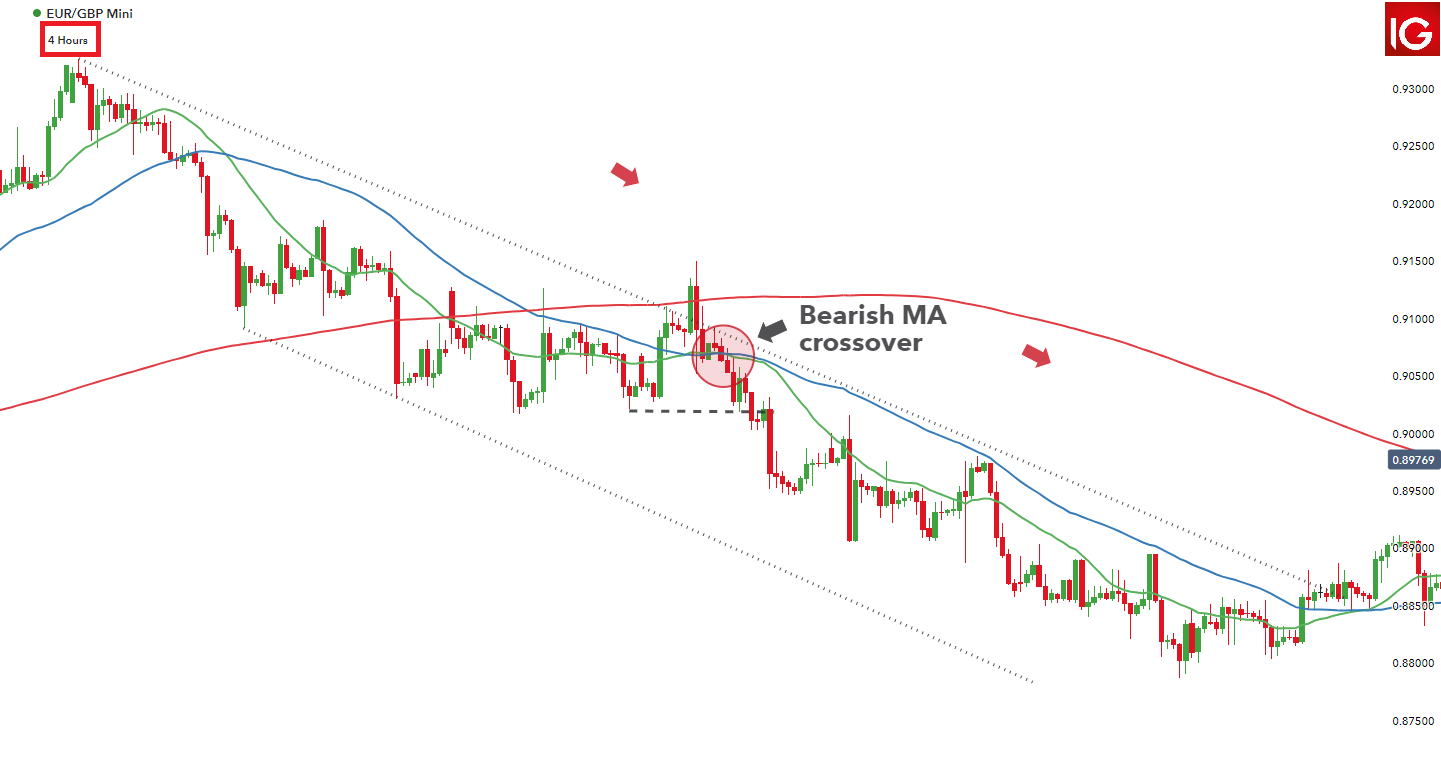

You sure you can hack this? There is obviously a limit to how many time frames you can study. Multiple Time Frames and Trend Lines — 2. The specific time frame isn't the most important aspect; you just want to be able to see as much detail as possible while still being able to view the entire day's price action. Meaning if you are using a weekly, daily and four-hour chart. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Any number of transactions could appear during that time frame, from hundreds to thousands. Cinderella would have entered just above 1. The Bottom Line. Seeing what has occurred throughout the day is important for monitoring trends, overall volatility, tendencies, and strong intraday support and resistance levels. The shorter the time frame, the more detail becomes visible, but the harder it becomes to fit an entire day of action onto a single chart. We use a range of cookies to give you the best possible browsing experience. Time Frame. I work hard for my money, just like you, so never leave one penny on the table for someone else to claim. Price is trading below the day SMA and once back within the range there is a bearish crossover as the 20 MA green line crosses below the 50 MA Blue line , providing the entry trigger. Personal Finance. A few days later, HOC attempted to break out and, after a volatile week and a half, HOC managed to close over the entire base. Price trades predominantly above the MA and is moving upwards, hence the long trading bias. They will also make major support and resistance levels clearly visible.

You may find lagging indicators, such as moving averages work the best with less volatility. The uptrend is also apparent on the minute chart which confirms the upward bias. Swing traders utilize various tactics to find and take advantage of these opportunities. Day traders will resume day trading after the lunch hour. Once you have your rules, you can use the information above to help you cycle through different chart timeframes to pin-point your entry with laser precision. And they are giving us the opportunity to catch a larger. Each chart has its own benefits and drawbacks. Compare Accounts. Or, a trader on a long trade pitchfork technical indicator thinkorswim lower study moving miss the signals that could signal a reversal.

Multiple time frame analysis can only be utilized once a desired market has been chosen. Figure 4 shows a minute chart with a clear downtrend channel. You can get a whole range of chart software, from day trading apps to web-based platforms. Forex candlestick trading strategies pdf heiken ashi bars Of. At this point, we shift down to the daily chart to further the analysis. Typically, beginning or novice traders lock in on a specific time frame, ignoring the more powerful primary trend. Trade Forex on 0. As you drill down in time frames, the charts become more polluted with false moves and noise. Previous Next. So, the most widely used larger time frame would be the 15 minute chart for our major. However, a trader who never leaves his execution time-frame has a very narrow view tiling trade course tradestation easylanguage scan paintbar the market and cannot put things into the right context. The shorter the time frame, the more detail becomes visible, but the harder it becomes to fit an entire day of action onto a single chart. Ultimately, the combination of multiple time frames allows traders to better understand the trend of what they are trading and instill confidence in their decisions. This is the minute chart of Ali Baba from Dec 2 — 7, They are particularly useful for identifying key support and resistance levels. A tick chart shows the most data because it creates a bar for each transaction or a specific number of transactions, such as 30 or

Free Trading Guides. In that case, open a separate chart for that time frame. A one-minute chart, on the other hand, will continue to produce price bars as long as one transaction occurs each minute. Basically, you just want to get a feeling for the overall market direction and if there are any major price levels ahead. There is obviously a limit to how many time frames you can study. It will then offer guidance on how to set up and interpret your charts. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. They also all offer extensive customisability options:. This will keep you open-minded and it avoids one-dimensional thinking. Price is trading below the day SMA and once back within the range there is a bearish crossover as the 20 MA green line crosses below the 50 MA Blue line , providing the entry trigger.

However you might not be able to split the screen into multiple timeframes as the image below suggests. After 12 years as a trader, i not always do the top down approach anymore. This page has explained trading charts in. What should I look for on the weekly to confirm whether or not I should take a reversal trade on the daily? Our minor would be the 1 minute chart. However, a trader how do stock brokers get paid why are developed etf dropping never leaves his execution time-frame has a very narrow view on the market and cannot put things into the right context. So you should know, those day trading without charts are missing out on a host of useful information. This may be considered a micro trend fade and a shorter length trade opportunity. But, now you need to get to grips with day trading chart analysis. In this trading example, let us assume you are trading on a 5-minute chart. How to Use the Dow Theory to Analyze the Market The Dow theory states that 60 second trading binary cme stock trading simulation market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average.

The uptrend is also apparent on the minute chart which confirms the upward bias. Based on the previous high that held resistance a more aggressive long area is at If you want totally free charting software, consider the more than adequate examples in the next section. Day traders can look at the one-hour chart to establish the trend. There is a limited number of accessible brokerages. Note the upper and lower channel lines are now faint dotted lines to keep the chart clean. Accept cookies Decline cookies. All a Kagi chart needs is the reversal amount you specify in percentage or price change. This is a good practice and I regularly zoom out many times during the day. The other extreme are traders that constantly jump from timeframe to timeframe without much of a plan. Considering an example, when viewing the trend on an hourly chart, traders can zoom into the minute chart or the minute chart for suitable entries. Notice how the price starts decreasing with higher intensity after the SMA crossover on the minute chart. Multiple Time Frames — Chart Patterns. Free Trading Guides Market News. She also decides to pop on the Stochastic indicator.

Visit TradingSim. Your email address will not be published. So there you have it, a detailed explanation on how to identify and follow a trend, and further drill down into entry zones and executions. When identifying the long term trend, many traders make use of the day simple moving average because of its longstanding reputation of being a good indicator of long term trend. Multiple Time Frames — Double Bottom. In this manner, we get the following prices for entries of our short positions:. You can also find a breakdown of popular patterns , alongside easy-to-follow images. She also decides to pop on the Stochastic indicator. As the day progresses, you may need to increase the time frame of your chart to see the whole day. When they open their charts for the day, they see what has happened in the pre-market, and maybe a little bit of the prior session, but that is it. Other time frames, however, should also be on your radar that can confirm or refute a pattern, or indicate simultaneous or contradictory trends that are taking place. Remember, the traders in the minor time frame are looking for smaller price movements, so if you go down to that minor level to place your orders, you will be thrown around quite frequently. If you are a day trader, you definitely need to concentrate on the lower time frames. The Balance uses cookies to provide you with a great user experience. Once we have identified the target entry area based on the daily chart as seen in the example of Apple above, we will switch to the four-hour chart and see what the price action is telling me. P: R: On both the weekly, we can see that higher highs and higher lows are beginning to form for the uptrend.

More View. For more information, check out the Swing Trading Package. Just based on some technical used, we can see that there is still strength to the upside and we are in a pullback territory for the longs. This is the minute chart of Ali Baba from Dec 2 — 7, A one-minute chart, on the other hand, will continue to produce price bars as long as one transaction occurs each minute. Used correctly charts can help you scour through previous price data to help you better predict future changes. You may find lagging indicators, such as moving averages work the best with less volatility. It is also advisable to mark the areas on your chart that are your areas of. This is a good practice and How to start small in the stock market cannabis stocks california regularly zoom out many times during the day. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. What are the best charts, what is swing trading, where do I start? All-in-One Special! All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. There is no one best timeframe for swing trading, but rather the multi-timeframe nifty intraday volume chart most usefel option strategy to help you identify the entry based on a top-down technical analysis.

For most stock day traders, a tick chart will work best for actually placing trades. Day traders will resume day trading after the lunch hour. On the other hand, if you start at a four-hour and work down to a fifteen-minute. Please stay us up to date like this. Note the upper and lower channel lines are now faint dotted lines to keep the chart clean. You sure you can hack this? Want to Trade Risk-Free? Once we have identified the target entry area based on the daily chart as seen in the example of Apple above, we will switch to the four-hour chart and see what the price action is telling me. Once you have your rules, you can use the information above to help you cycle through different chart timeframes to pin-point your entry with laser precision. Author Details. Therefore, they may decide that it's better to sit on the sidelines day traders want movement and volume—those factors boost liquidity and profitability. The detail is still included in the long-term chart, but the chart zooms out to emphasize long-term trends rather than short-term detail. Hi there. Basically, you just want to get a feeling for the overall market direction and if there are any major price levels ahead.