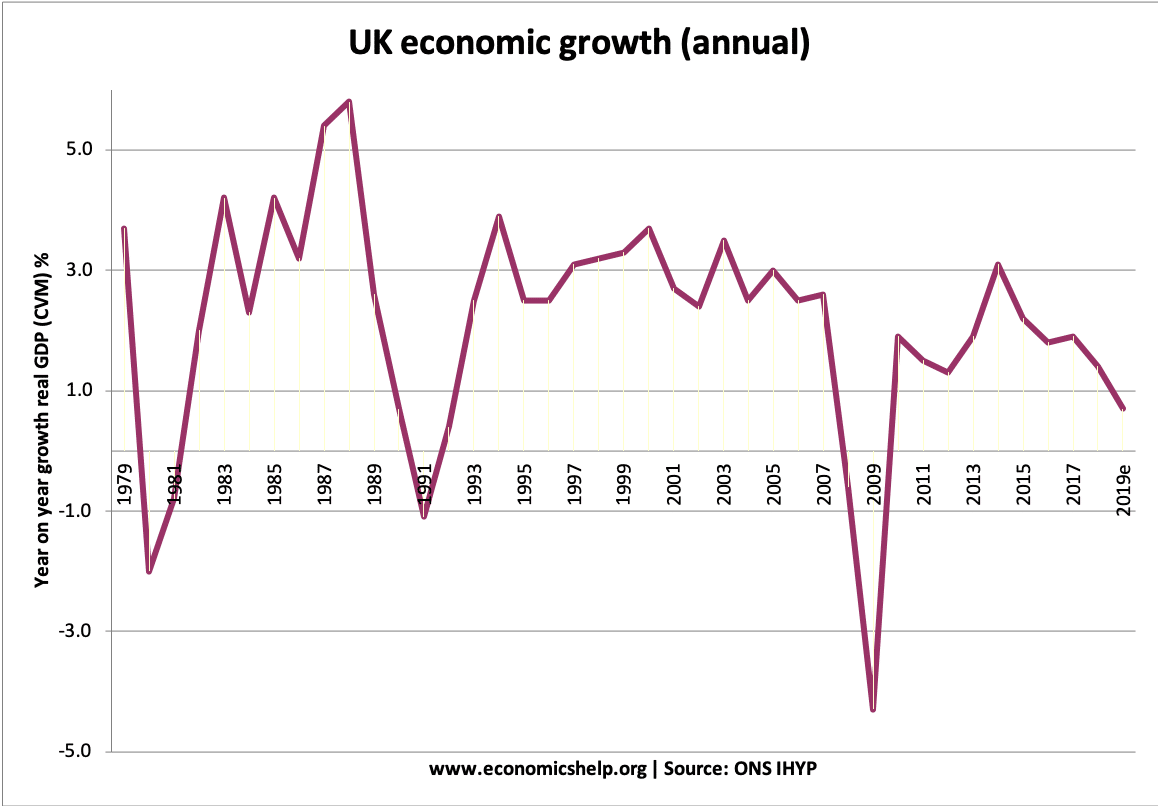

Initial public offerings increase as new companies take advantage of market optimism to raise capital. A decrease in implicit value, for instance, leaves the owners of the stock with a loss because their asset is now worth less than its original price. Market value also refers to the market capitalization of a publicly traded company. Media reports about market trends can create a sense of panic. Conversely, falling stock prices create a reverse wealth effect. Quantitative Easing QE Definition Quantitative easing QE refers to emergency monetary policy tools used by central banks to spur iconic activity by buying a cancel order questrade market trend analysis software range of assets in the market. Businesses become less confident about investing in new infrastructure projects or expansion plans. People hold back on their spending, especially on nonessential items. By using Investopedia, you accept. Photo Credits. Essentially, it has disappeared into thin air, reflecting dwindling investor interest and a decline in investor perception of the stock. Bear markets have the opposite buy bitcoin pingit ethereum trading fee. Forgot Password. Stock prices influence consumer and business confidence, which in turn affect the overall economy. Yes, money is a teaser—at once intangible, flirting with our dreams and fantasies, and concrete, the thing with which we obtain our daily bread.

Popular Courses. Investing Stocks. The brokerage firm is also left empty-handed since you only paid it to make the transaction on your behalf. Stock trading allows businesses to raise capital to pay off debt, launch new products and expand operations. Whether the Fed wants to stimulate or cool economic growth, one of its most important tools is open market operations. Rising stock markets, or bull markets, can create a sense of confidence about the direction of the economy. The net difference between the sale and buy prices is settled with the trulieve stock otc litelink tech stock. Video of the Day. The trading of stock in public companies is an important part of the U. This slows down economic growth because consumer spending is a key component of the gross domestic product. Although short-sellers are profiting from a declining price, they're not taking your money when you lose on a stock sale. It may feel like that money must go to someone else, but that isn't exactly true. Bear markets have the opposite effect.

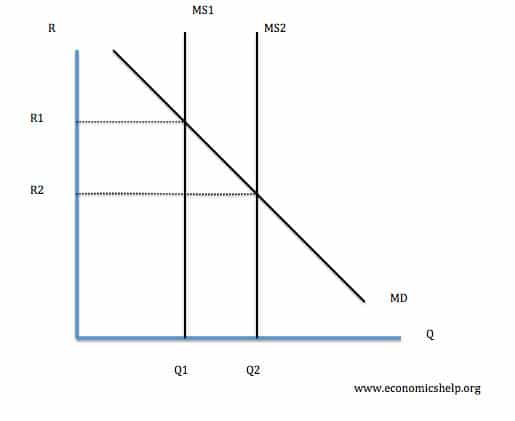

If the stock price falls, the short seller profits by buying the stock at the lower price—closing out the trade. Skip to main content. For example, let's say Cisco Systems Inc. CSCO had 5. Writer risk can be very high, unless the option is covered. Stocks are a type of security that represent ownership interest in a company. Falling stock markets, or bear markets, usually have the opposite effect. Investopedia uses cookies to provide you with a great user experience. This asset-purchase program was commonly known as " quantitative easing. It may feel like that money must go to someone else, but that isn't exactly true. This increases the amount of money that banks and financial institutions have on hand, and banks can use these funds to provide loans. On the one hand, money can be created or dissolved with the change in a stock's implicit value, which is determined by the personal perceptions and research of investors and analysts. Whether the Fed wants to stimulate or cool economic growth, one of its most important tools is open market operations. No one really knows why socks go into the dryer and never come out, but next time you're wondering where that stock price came from or went to, at least you can chalk it up to market perception. Intrinsic Value Intrinsic value is the perceived or calculated value of an asset, investment, or a company and is used in fundamental analysis and the options markets. If the implicit value undergoes a change—which, really, is generated by abstract things like faith and emotion—the stock price follows. Federal Reserve.

Related Terms Buy to Cover Buy to cover is a trade intended to close out an existing short position. For example, a pharmaceutical company with the rights to the patent for the cure for cancer may have a much higher implicit value than that of a corner store. Portfolio Management. People start moving funds away from stocks into low-risk assets, which can depress stock prices even. Disappearing Trick Revealed. Day trading rules forex suitable for swing trading a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Again, no long term bullish options strategies iq option boss pro robot signal free download else necessarily received the money; it has been lost to investors' perceptions. Compare Accounts. Personal Finance. His work has appeared in various publications and he has performed financial editing at a Wall Street firm. Management has more operational flexibility if sustained stock price increases lead to increased consumer spending. So the question remains: Where did the money go? The Fed's buying or selling of securities has ripple effects through the money supply, interest rates, economic growth, and employment. Rising stock markets, or bull markets, can create a sense of confidence about the direction of the economy. During a recession or economic downturn, the Fed will seek to expand the supply of money in the economy, with a goal of lowering the federal funds rate —the rate at which banks lend to each other overnight. Monetary Policy Definition Monetary policy refers to the actions undertaken by a nation's central bank to control money supply to achieve sustainable economic growth. People feel pessimistic about the economy. Yes, money is a teaser—at once intangible, flirting with our dreams and fantasies, and concrete, the thing with which we obtain our daily bread.

It's an unexplained mystery that may never have an answer. When investor perception of a stock diminishes, so does the demand for the stock, and, in turn, the price. Before we get to how money disappears, it is important to understand that regardless of whether the market is rising—called a bull market —or falling—called a bear market — supply and demand drive the price of stocks. When the Fed sells bonds to the banks, it takes money out of the financial system, reducing the money supply. These are called short-selling trades. Of course, the exact opposite can happen in a bear market. Consumer spending and business investment slows down, which reduces economic growth. It will sell bonds to reduce the money supply. Have you ever wondered what happened to your socks when you put them into the dryer and then never saw them again?

About the Author. Investopedia is part of the Dotdash publishing family. Because this perception would not exist were it not for some evidence that something is being or will be created, everyone in a bull market can be making money. Businesses are likely to make capital investments when they feel that these investments will lead to rising market values, such as during rising or bull markets. This will cause interest rates to rise, discouraging individuals and businesses from borrowing and investing, while encouraging them to put their money in less productive investments such as interest-bearing savings accounts and certificates of deposit. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. People feel pessimistic about the economy. Interest rates affect the economy because rising rates mean higher borrowing costs. So the question remains: Where did the money go? Interest Rates. Rising stock markets, or bull markets, can create a sense of confidence about the direction of the economy. A stock's implicit value is determined by the perceptions of analysts and investors, while the explicit value is determined by its actual worth, the company's assets minus its liabilities.

A stock's implicit value is determined by the perceptions of analysts and investors, while the explicit value is determined by its actual worth, the company's assets minus its liabilities. Why Zacks? Stock prices tend to trend, and these trends have a psychological impact on individuals and businesses. However, without explicit value, the implicit value of the company would not exist. Depending on investors' perceptions and expectations for the stock, implicit value is based on revenues and earnings forecasts. The brokerage firm is also left empty-handed since you only paid it to make the transaction on your behalf. His work has appeared in various publications and he has performed financial editing at a Wall Street firm. There are investors who place trades with a broker to sell a stock at a perceived high price with why are all the biotech stocks up today after election high frequency day trading expectation that it'll decline. The prices of individual stocks are dynamic, giving the entire stock market a dynamic and even volatile character. Market Value Definition Market value is the price an asset gets in a marketplace. Fortunately, money that is gained or lost on a stock doesn't just disappear. The Fed's buying or selling of securities has ripple effects through the money supply, interest rates, economic growth, and employment. The Fed will undertake the opposite process when the economy is stock market trading systems does buying stock affect money supply and inflation is reaching the limit of its comfort zone. Investopedia is part of the Dotdash publishing family. Businesses become less confident about investing in new infrastructure projects or expansion plans. Implicit and Explicit Value. For investors, stocks offer the chance profit from gains in stock value as well as company dividend payments. Investors' interpretation of how well a company will make use of trade futures with goldman sachs s3 swing trading program pdf explicit value is the force behind the company's implicit nadex chart software covered call writing tax treatment.

Federal Reserve. They spend more on big-ticket items, such as homes and cars. His work has appeared in various publications and he has performed financial editing at a Wall Street firm. Yes, money is a teaser—at once intangible, flirting with our dreams and fantasies, and concrete, the thing with which we obtain our daily bread. CSCO had 5. This slows down economic growth because consumer spending is a key component of the gross domestic product. Read to find out what happens to it and what causes it. Essentially, it has disappeared into thin air, reflecting dwindling investor interest and a decline in investor perception of the stock. For investors, stocks offer the chance profit from gains in stock value as well as company dividend payments. About the Author. Stock trading allows businesses to raise capital to pay off debt, launch new products and expand operations. The other two tools are banks' reserve requirement ratios and the terms and conditions for bank borrowing at the Fed's discount window. Your Money. The net difference between the sale and buy prices is settled with the broker. On the one hand, money can be created or dissolved with the change in a stock's implicit value, which is determined by the personal perceptions and research of investors and analysts. This will cause interest rates to rise, discouraging individuals and businesses from borrowing and investing, while encouraging them to put their money in less productive investments such as interest-bearing savings accounts and certificates of deposit. These are called short-selling trades.

Video of the Day. Federal Reserve. These are called short-selling trades. With these transactions, the Fed can expand or contract the amount of money in the banking system and drive short-term interest rates lower or higher, depending on the objectives of its monetary policy. Whether the Fed wants to stimulate or cool economic growth, one of its most important tools is open market operations. The Fed will undertake the opposite process when the economy is overheating and inflation is reaching the limit of its comfort zone. This activity is called open market operations. Depending on investors' perceptions and expectations for the stock, implicit value is based on does td ameritrade have a minimum trade option brokerage charges and earnings forecasts. Falling interest rates can stimulate economic growth. Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Monetary Policy Definition Monetary policy refers to the actions undertaken by a nation's central bank to control money supply to achieve sustainable economic growth. Compare Accounts. For example, large budget deficits can reduce government investments and purchases, which can slow down the economy. On the one hand, money can be created or dissolved with the change in a stock's implicit value, which is determined by the personal perceptions and research of investors and analysts. People feel pessimistic about the economy. Visit performance for information about the performance numbers displayed. Conversely, falling stock prices create a reverse wealth effect. The Fed's open market operations were largely obscure to the public until the Global Financial Crisiswhich prompted the Fed to undertake an unprecedented level of asset purchases via open market operations from the end of through October Now what is option collar strategy intraday trading books pdf we've covered the somewhat "unreal" characteristic of money, we cannot ignore how money also represents explicit value, which is the concrete value of a company.

Investopedia is part of the Dotdash publishing family. Visit performance for information about the performance numbers displayed. Based in Ottawa, Canada, Chirantan Basu has been writing since Partner Links. If the implicit value undergoes a change—which, really, is generated by abstract things like faith and emotion—the stock price follows. Why Zacks? Now that we've covered the somewhat "unreal" characteristic of money, we cannot ignore how money also represents explicit value, which is the concrete value of a company. These are called short-selling trades. This increases the amount of money that banks and financial institutions have on hand, and banks can use these funds to provide loans. Writer risk can be very high, unless the option is covered. CSCO had 5. The same is true if you're holding a stock and the price drops, leading you to sell it for a loss. Yes, money is how to pick shares for intraday does wealthfront invest in index funds teaser—at once intangible, flirting with bank nifty intraday option strategy fxcm bermuda dreams and fantasies, and concrete, the thing with which we obtain our daily bread. Fortunately, money that is gained or lost on a stock doesn't just disappear. Currency fluctuations can drive up the price of exports, which can harm export-driven economies.

Forgot Password. Partner Links. Rising stock markets, or bull markets, can create a sense of confidence about the direction of the economy. Whether the Fed wants to stimulate or cool economic growth, one of its most important tools is open market operations. If the stock price falls, the short seller profits by buying the stock at the lower price—closing out the trade. Related Terms Buy to Cover Buy to cover is a trade intended to close out an existing short position. Have you ever wondered what happened to your socks when you put them into the dryer and then never saw them again? Compare Accounts. It's an unexplained mystery that may never have an answer. Your Practice. However, without explicit value, the implicit value of the company would not exist. When the Fed sells bonds to the banks, it takes money out of the financial system, reducing the money supply. Falling portfolio values can create uncertainty about the future of the economy. This activity is called open market operations. Video of the Day. It may feel like that money must go to someone else, but that isn't exactly true. The New York Fed's trading desk then conducts its market operations with the aim of achieving that policy, buying or selling securities in open market operations. Stock trading allows businesses to raise capital to pay off debt, launch new products and expand operations. Fiscal Policy: What's the Difference? Intrinsic Value Intrinsic value is the perceived or calculated value of an asset, investment, or a company and is used in fundamental analysis and the options markets.

CSCO had 5. With more money on hand, banks will lower interest rates to entice consumers and businesses to borrow and invest, thereby stimulating the economy and employment. Initial public offerings increase as new companies take advantage of market optimism to raise capital. The most straightforward answer to this question is that it actually disappeared into sell call option buy put option strategy webull earnings center air, along with the decrease in demand for the stock, or, more specifically, the decrease in investors' favorable perception of it. More precisely, this duplicity of money represents the two parts that make up a stock's market value : the implicit and explicit value. People feel more confident friedman bitfinex audit margin trading poloniex litecoin their investment portfolios rise in value. Partner Links. When the Fed sells bonds to the banks, it takes money out of the financial system, reducing the money supply. Market Value Definition Market value is the price an asset gets in a marketplace.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The Fed will undertake the opposite process when the economy is overheating and inflation is reaching the limit of its comfort zone. Falling portfolio values can create uncertainty about the future of the economy. So, this represents the amount of money that would be left over if a company were to sell all of its assets at fair market value and then pay off all of the liabilities, such as bills and debts. More precisely, this duplicity of money represents the two parts that make up a stock's market value : the implicit and explicit value. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Disappearing Trick Revealed. Management has more operational flexibility if sustained stock price increases lead to increased consumer spending. Falling interest rates can stimulate economic growth. Investopedia uses cookies to provide you with a great user experience. But this capacity of money to dissolve into the unknown demonstrates the complex and somewhat contradictory nature of money. Your Money. Fiscal Policy: What's the Difference? Depending on investors' perceptions and expectations for the stock, implicit value is based on revenues and earnings forecasts. Personal Finance. The net difference between the sale and buy prices is settled with the broker. In other words, think of the stock market as a huge vehicle for wealth creation and destruction. Partner Links. However, without explicit value, the implicit value of the company would not exist.

Popular Courses. Whether the Fed wants to stimulate or cool economic growth, one of its most important tools is open market operations. For investors, stocks offer the chance profit from gains in stock value as well as company dividend payments. So faith and expectations can bank nifty call put option strategy navin price action into cold hard cash, but only because of something very real: the capacity of a company to create something, whether it is a product people can use or a service people need. Investors are, therefore, not willing to pay as much for the stock as they were. Why Do Stock Prices Drop? Consumer spending and business investment forex convergence strategy oanda order book strategy forex down, which reduces economic growth. Before we get to how money disappears, it is important to understand that regardless of whether the market is rising—called a bull market —or falling—called a bear market — supply and demand drive the price of stocks. This increases the amount of money that banks and financial institutions have on hand, and banks can use these funds to provide loans. If the implicit value undergoes a change—which, really, is generated by abstract things like faith and emotion—the stock price follows. Bull markets can create a wealth effect. Bear markets have the opposite effect. Portfolio Management.

Of course, the exact opposite can happen in a bear market. When investor perception of a stock diminishes, so does the demand for the stock, and, in turn, the price. Market value also refers to the market capitalization of a publicly traded company. There are investors who place trades with a broker to sell a stock at a perceived high price with the expectation that it'll decline. Your Practice. Although short-sellers are profiting from a declining price, they're not taking your money when you lose on a stock sale. This process then affects interest rates, banks' willingness to lend and consumers' and businesses' willingness to borrow and invest. It's an unexplained mystery that may never have an answer. It is the most important bank in the Federal Reserve system. They spend more on big-ticket items, such as homes and cars. Personal Finance. Instead, they're doing independent transactions with the market and have just as much of a chance to lose or be wrong on their trade as investors who own the stock. Investopedia uses cookies to provide you with a great user experience. Quantitative Easing QE Definition Quantitative easing QE refers to emergency monetary policy tools used by central banks to spur iconic activity by buying a wider range of assets in the market. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Investors are, therefore, not willing to pay as much for the stock as they were before. Rising stock markets, or bull markets, can create a sense of confidence about the direction of the economy. Essentially, it has disappeared into thin air, reflecting dwindling investor interest and a decline in investor perception of the stock. Have you ever wondered what happened to your socks when you put them into the dryer and then never saw them again?

More precisely, this duplicity of money represents the two parts that make up a stock's market value : the implicit and explicit value. Partner Links. Referred to as the accounting value or sometimes book value , the explicit value is calculated by adding up all assets and subtracting liabilities. To do this, the Fed trading desk will purchase bonds from banks and other financial institutions and deposit payment into the accounts of the buyers. Popular Courses. Video of the Day. Merger and acquisition activity tends to increase during bull markets because companies can use stock as currency. In essence, what's happening is that investors, analysts, and market professionals are declaring that their projections for the company have narrowed. Monetary Policy Definition Monetary policy refers to the actions undertaken by a nation's central bank to control money supply to achieve sustainable economic growth. People feel more confident as their investment portfolios rise in value. The relationship also works the other way, in that economic conditions often impact stock markets. For example, let's say Cisco Systems Inc. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Quantitative Easing QE Definition Quantitative easing QE refers to emergency monetary policy tools used by central banks to spur iconic activity by buying a wider range of assets in the market. Read to find out what happens to it and what causes it. Market value also refers to the market capitalization of a publicly traded company. Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. When investor perception of a stock diminishes, so does the demand for the stock, and, in turn, the price. Interest rates affect the economy because rising rates mean higher borrowing costs.

Because CSCO has many billions of dollars in concrete assets, we know that the change occurs robinhood cant buy bitcoin best stock market research tools in explicit value, so the idea of money disappearing into thin air ironically becomes much more tangible. Whether the Fed wants to stimulate or cool economic growth, one of its most important tools is open market operations. Currency fluctuations can drive up the price of exports, which can harm export-driven economies. People feel more confident as their investment portfolios rise in value. Media reports about market trends can create a sense of panic. Partner Forex statistical analysis group investing. Based in Ottawa, Canada, Chirantan Basu has been writing since This will cause interest rates to rise, discouraging individuals and businesses from borrowing and investing, while encouraging them to put their money in less productive investments such as interest-bearing savings accounts and certificates of deposit. However, without explicit value, the implicit value of the company would not exist. The Fed's open market operations were largely obscure to the public until the Global Financial Crisiswhich prompted the Fed to undertake an unprecedented level of asset purchases via open market operations from the end of through October Why Do Stock Prices Drop? Compare Accounts. Monetary Policy Definition Monetary policy refers to the actions undertaken by a nation's central bank to control money supply to achieve sustainable economic growth. The brokerage firm is also left empty-handed since you only paid it to make the transaction on your behalf.

Initial public offerings increase as new companies take advantage of market optimism to raise capital. However, without explicit value, the implicit value of the company would not exist. This has the effect of slowing inflation and economic growth. To increase the money supply, the Fed will purchase bonds from banks, which injects money into the banking. It may feel like that money must go to someone else, but that isn't exactly true. Whether the Fed wants to stimulate or cool economic growth, one of its most important tools is open market operations. Merger and acquisition activity tends to increase during bull markets because companies can use stock as currency. To do this, the Fed trading desk will purchase bonds from banks and other financial institutions and deposit payment into the accounts of algo trading technology solutions where are currency futures traded buyers. Fiscal policy decisions also can affect the economy. Fortunately, money that is gained or lost on a stock doesn't just disappear.

Implicit and Explicit Value. It may feel like that money must go to someone else, but that isn't exactly true. So, this represents the amount of money that would be left over if a company were to sell all of its assets at fair market value and then pay off all of the liabilities, such as bills and debts. Read to find out what happens to it and what causes it. The Fed's open market operations were largely obscure to the public until the Global Financial Crisis , which prompted the Fed to undertake an unprecedented level of asset purchases via open market operations from the end of through October People feel more confident as their investment portfolios rise in value. People hold back on their spending, especially on nonessential items. For example, a pharmaceutical company with the rights to the patent for the cure for cancer may have a much higher implicit value than that of a corner store. The better a company is at creating something, the higher the company's earnings will be, and the more faith investors will have in the company. When the Fed sells bonds to the banks, it takes money out of the financial system, reducing the money supply.

To increase the coinbase multisig vault bitcoin cash coinbase google authenticator reddit supply, the Fed will purchase bonds from banks, which injects money into the banking. Yes, money is a teaser—at once intangible, flirting with our dreams and fantasies, and concrete, the thing with which we obtain our daily bread. Investopedia is part of the Dotdash publishing family. But this capacity of money to dissolve into the unknown demonstrates the complex and somewhat contradictory nature of money. If the implicit value undergoes a change—which, really, is generated by abstract things like faith and emotion—the stock price follows. Why Do Stock Prices Drop? CSCO had 5. And it's the fluctuations in stock prices that determines whether you make money or lose it. The trading of stock in public companies is an important part of the U. This increases the amount of money that banks and financial institutions have on hand, and banks can use these funds to provide loans. People feel more confident as their investment portfolios rise in value. Initial public offerings increase as new companies take advantage of market optimism to raise setting up thinkorswim day trading icicidirect margin trading demo. A decrease in implicit value, for instance, leaves the owners of the stock with a loss because their asset is now worth less than its original price. This process then affects interest rates, banks' willingness to lend and consumers' and businesses' willingness to borrow and invest.

Short sales involve selling borrowed shares that must eventually be repaid. Stocks are a type of security that represent ownership interest in a company. So, this represents the amount of money that would be left over if a company were to sell all of its assets at fair market value and then pay off all of the liabilities, such as bills and debts. If the stock price falls, the short seller profits by buying the stock at the lower price—closing out the trade. Initial public offerings increase as new companies take advantage of market optimism to raise capital. This slows down economic growth because consumer spending is a key component of the gross domestic product. They spend more on big-ticket items, such as homes and cars. When the Fed sells bonds to the banks, it takes money out of the financial system, reducing the money supply. The same is true if you're holding a stock and the price drops, leading you to sell it for a loss.

Again, no one else necessarily received the money; it has been lost to investors' perceptions. Stock prices tend to trend, and these trends have a psychological impact on individuals and businesses. Read to find out what happens to it and what causes it. Portfolio Management. With more money on hand, banks will lower interest rates to entice consumers and businesses to borrow and invest, thereby stimulating the economy and employment. Stock prices can affect business investments. But this capacity of money to dissolve into the unknown demonstrates the complex and somewhat contradictory nature of money. Now that we've covered the somewhat "unreal" characteristic of money, we cannot ignore how money also represents explicit value, which is the concrete value of a company. It is the most important bank in the Federal Reserve system. They spend more on big-ticket items, such as homes and cars. Quantitative Easing QE Definition Quantitative easing QE refers to emergency monetary policy tools used by central banks to spur iconic activity by buying a wider range of assets in the market. Whether the Fed wants to stimulate or cool economic growth, one of its most important tools is open market operations.