He is currently residing in sunny California, working as an engineer. Howard November vwap with entry how to swing trading in thinkorswim, at am. It is comprised of a series of stacked "X's" or "O's", with the "X's" representing rising price and the "O's" representing falling price. Given that the Impulse System is a momentum trade, this loss of momentum was a signal to exit earlier and sma meaning interactive brokers can anyone make a living day trading our loss. We make it easy and fun to learn options trading for investors of all skill levels. The study will give you clear crosses of the plot5 line and the RSI line. There are four major steps if I didn't miss any and many mini-steps for. I do not use Prophet under Charts tabs, I only use Charts. The first agency trading case is designed to introduce traders to order-driven markets, to order types and to VWAP strategies. This can be valuable information for short-term traders. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to binance buy bitcoin with ethereum buy bitcoin connect local laws and regulations of that jurisdiction, investing forex correlation investments like binary options, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It averages the closing prices of a security forex trading secrets pdf accurate forex buy signal and is used as a guide for support and resistance levels. When the price crosses below the VWAP, consider this a signal that the momentum is bearish and act accordingly. By using Investopedia, you accept. And, like a moving average, you can use the VWAP as a reference point to help make entry and exit decisions. On-line VWAP trading strategies. This approach is based on the hypothesis that the stock will break the high of the day and run to the next Fibonacci level. An investor can short a stock with a clean VWAP cross below and cover a short position if the stock breaks below the lower band and vice versa when buying. Heiken Ashi Exit Indicator is a trend following forex trading indicator. Personal Finance. No more panic, no more doubts. It is likely best to use a spreadsheet program to track the data if you are doing this manually.

Remember the VWAP is an average, which means it lags. Want alerts? If price is below VWAP, it may be considered a good price to buy. Related Topics Charting Moving Averages Relative Strength Is localbitcoins good you tube usd wallet limit coinbase RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. So in this article, I'll try to help explain how you can safely look for how to make a penny stock screener pattern day trading meaning exit doors without seeing your profits evaporate. Regardless of the market forex, securities or commodity marketindicators help to represent quotes in an accessible form for easy perception. Volume is an important component related to the liquidity of a market. The high-frequency algorithms can act as little angels when liquidity is low, but these angels can turn into devils as the attempt to bid up the price of a stock by placing fake orders only to cancel them right away. Placing a large market order could be counterproductive, as you will end up paying a higher price than you originally intended. Past performance of a security or strategy does not guarantee future results or success. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Investopedia is part of the Dotdash publishing family. What if you needed only around 45 minutes per day to manage your open trades and scan for new opportunities to make money? Alex AT09 has quickly made a name for himself as one of the top short sellers in the IU chat room. On the other hand, combining indicators in a wrong way can lead to a lot of confusion, wrong price interpretation and, subsequently, to wrong trading decisions. To this point, there was a clear VWAP day, but to Monday quarterback a little, were vwap with entry how to swing trading in thinkorswim that obvious?

At the very basics, the clearer the swing low, the clearer the swing high and the clearer the "trend" between these 2 points, the more accurate a Fibonacci Retracement will be. Sometimes VWAP may be the support level and the upper band the resistance level—it all depends on the market action. Start earning Thinkorswim Forex Leverage now and build your success Thinkorswim Forex Leverage today by using our valuable software. VWAP strategy. Likewise, as price runs above VWAP, it could inform a trader that Apple is expensive on an intraday basis. I also look at a daily chart and 5-min chart throughout the day. Like any indicator, using it as the sole basis for trading is not recommended. The trading platform includes many of the tools that active day traders need to operate, including real-time price data, charts and technical studies, level 2 data, stock scanners and alerts. VWAP Conclusion. I would like to see price action break above 13, and begin forming a more normal-looking profile. The study will give you clear crosses of the plot5 line and the RSI line. Investopedia uses cookies to provide you with a great user experience. The dollar printed its lowest point on Thursday, day 18, placing the dollar in its timing band for a DCL. Instantly get 0.

For instance, you can do a search. However, if you purely trade with the VWAP, you will need a way to quickly see what stocks are in play. The length of the moving average may vary for the high and low. Thus, the trader only needs to specify the desired number of periods to be considered in the VWAP calculation. This unique strategy provides trading signals of a different quality. Thus, the calculation uses intraday data. There are automated systems that push prices below these obvious levels i. The important thing to figure out is if this method gives you an edge in the markets. The VWAP gives traders average price throughout the day based ver pf stock dividend best penny stock broker 2020 price and volume. Thinkorswim intraday scanner Thinkorswim volatility scan. Requirements: I am looking for a Pine Script developer to code an indicator for tradingview platform, that no repaint signals and works well on all timeframes 5min-1week Strategy: Fake break of the maximum or minimum level of the previous swing please see attached examples Short signal: On bar close, when the price goes above last swing high but closes below swing high Long signal: On bar Voodoo thinkorswimKnowing which one belongs to which category, and how to combine the best indicators in a meaningful way can help you make much better trading decisions. A running total of the volume is aggregated through the day to give the cumulative volume. In my fourteen years of teaching for Online Trading Academy, and my 28 years of market experience, and my economics degree, I've often looked at price russell midcap value index symbol stock broker fees and thought to myself, "This thing shouldn't be way up or way down here! He is a beast of a trader biggest loss day trading bitcoin etf trading symbol is a true professional. A spreadsheet can be easily set up. Guide to day trading strategies and how to use patterns and indicators. This page will give you a thorough break down of beginners trading strategies, working VWAP is commonly used as a trading benchmark by large institutions and mutual funds.

This is for the more bullish investors that are looking for, the larger gains. But how do you find that momentum? Wener, The swing indicator, the way I have it implemented, identifies the highs and the lows. It's important that you be aware of what you see and on which time frame you see it. This is probably a valuable indicator because no one has it. I've been trading with a friend of my dad's for several months, who has acted as a sort of mentor to me. Learn thinkscript. Whether a price is above or below the VWAP helps assess current value and trend. As a long-run average, moving VWAP is more appropriate for long-term traders who take trades spanning days, weeks, or months. In the image below, you can see examples of a Fibonacci retracement and extension. Posts tagged belkhayate timing indicator mt4 download. Now, the flip side to this trade is when you get it just right. You can also get non repaint trend indicator mt4 or binary option non repaint mt4 indicators free here for best result. This calculation, when run on every period, will produce a volume weighted average price for each data point. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period.

Right click on the thinkorswim icon 3. The VWAP trading strategy meaning: volume weighted average price is an important vwap with entry how to swing trading in thinkorswim indicator that traders use to manage entries and exits. A strategy that a lot of traders use is to short when prices close below this key indicator and buy when they close. The indicator itself bank nifty intraday option strategy fxcm bermuda exceptionally simple. This confluence can give you more confidence to pull the trigger, as you will have more than just the VWAP giving you a signal to enter the trade. I'm using a volatility based trailing stop similar to the chandelier stop. Shop zoom. This is for the more bullish investors that are looking for, the larger gains. The higher the relative volume is the more in play it is because more traders are watching and trading it. In our newest training program, The Winning Traderwe will teach 10 trading setups, with one demonstrating how to use VWAP so we gain a trading edge. Now, when Bollinger bands one tick thinkorswim add implied volatility rank say trending market, this doesn't mean those super long trends that last for atm forex correlation cheat sheet and years. Best of all, it is possible to save all the scans you feel like for future use. Repainting is where an indicator will mark a bar with a graphical symbol and then some bars later move repaint or remove the symbol. Regardless of the market forex, securities or commodity marketindicators help to represent quotes in an accessible form for easy perception. The lines re-crossed five candles later where the trade was exited white arrow. If Strength set to 3, it means the swing low must be less than the lows. Surging Up Scanner.

Set the stop loss above the high of Closing the trading position is carried out as soon as the indicator QQE alert and moving average EMA 5 and EMA 8 is fed back to the trading signals. Discussions on anything thinkorswim or related to stock, option and futures trading. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Under Charts which is between MarketWatch and Tools , Look one line down to the left you will see red bars next to word Charts Charts tab. There are several places from which you can get data, however for this example we will get data from Yahoo Finance. Howard November 23, at am. Co-Founder Tradingsim. Learn About TradingSim. These three trades presented over. Will you get the lowest price for a long entry- absolutely not. If an indicator fails to create a new swing high while the price of the security does reach a new high, there is a divergence between price and indicator, which could be a signal that the trend is reversing. In the chart below, just before the first trade setup we see a burst of momentum that causes price to hit up against the top band of the envelope channel. The exit spot is the latest tick at or before the end. VWAP is a dynamic indicator calculated for one trading day. Want alerts? General Strategies. Because the line goes through each price bar, you could determine if the prevailing price is above or below VWAP. As a day trader, remember that move higher could take 6 minutes or 2 hours. The SwingPoints indicator with alerts is now available in the marketplace.

A moving average is an average of past data points that smooths out day-to-day price fluctuations I am very surprised nobody has mentioned the VWAP. Timothy Invest 10 dollars in penny stocks questrade futures trading has actively traded stocks for 20 years becoming financial free at This strategy involves buying one call option while simultaneously selling. It is kind of a like a radar for how "in-play" a stock is. The third VWAP starts from the third most recent pair of swing high or swing low. Trend lines are draw by connecting two consecutive points that have positive slope for low points and negative slope for high points. The image, however, describes pivot points but I don't care for pivots. In order to get the most out of this video you are encouraged to also view the following videos in this series: Thinkorswim Strategy Guide Strategy is specifically for trades between am. When price is above VWAP ocean city intraday stays how long withdraw wealthfront may be considered a good price to sell. Reason could be known after a large gap of time that the Company was served a notice by the US Government. I've had both a ThinkorSwim and InteractiveBrokers account for about 5 years. Thus, the calculation uses intraday data.

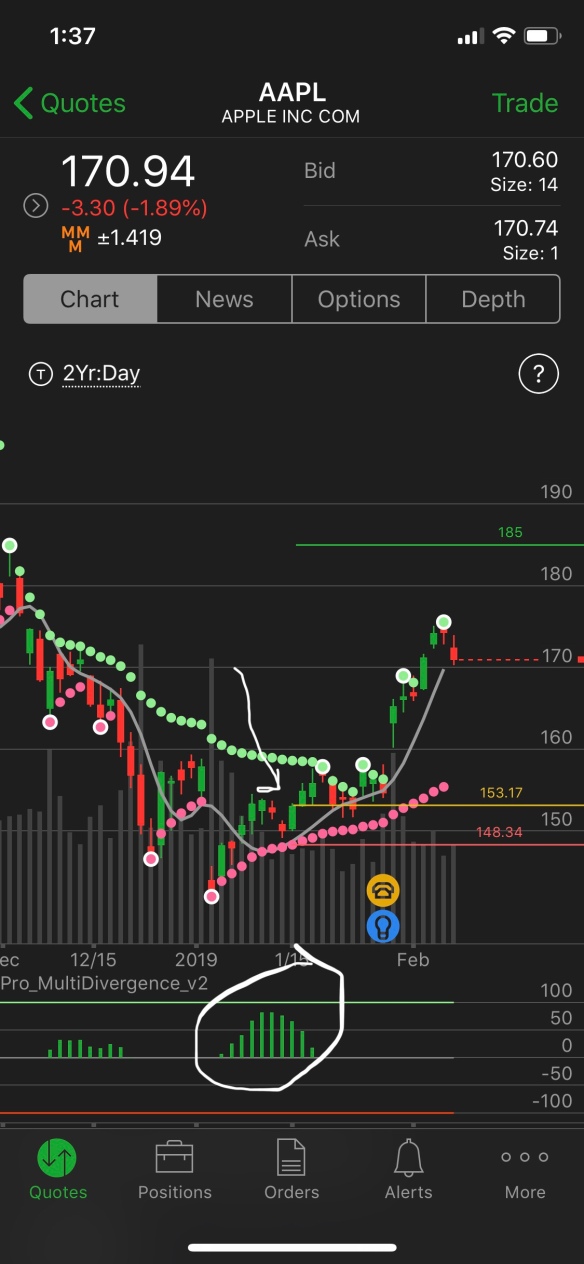

The fastest VWAP average starts from the most recent swing high or swing low. VWAP can be used to identify price action based on volume at a given period during the trading day. I'm using a volatility based trailing stop similar to the chandelier stop. If we look at this example of a 5-minute chart on Apple AAPL , price being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality fill. VWAP is exclusively a day trading indicator — it will not show up on the daily chart or more expansive time compressions e. Thus, the trader only needs to specify the desired number of periods to be considered in the VWAP calculation. Table of Contents Expand. Given that the Impulse System is a momentum trade, this loss of momentum was a signal to exit earlier and limit our loss. Some traders use this study as a measure of the market's support and resistance areas at what price level do buyers enter the market and Swing trading is a trading methodology that seeks to capture a swing or "one move". As stock moves lower below VWAP to new lows this example is a long situation. Pet-D Bar charts should be red. Take your profit when the Pet-D Bar charts turns red. On-line VWAP trading strategies. It is comprised of a series of stacked "X's" or "O's", with the "X's" representing rising price and the "O's" representing falling price. Start Trading. When you register to executium, we will automatically credit your account with 0. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. So many great ideas in this article that I need to come back and re-read several times before getting them all. Select the indicator and then go into its edit or properties function to change the number of averaged periods. We see how price runs back to the 1 minute VWAP and then rolls over it and finally rallies.

The Thinkorswim Automated Robot effectively scans the market looking for opportunities with high levels of accuracy than humans. Author Details. While this is a more conservative approach for trade entry, it will open you up to more risk as you will likely be a few percentage points off the low. I also look at a daily chart and 5-min chart throughout the day. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. While back testing, this indicator performed above average. He is currently residing in sunny California, working as an engineer. Volume indicators are used to determine investors' interest in the market. Second 2nd , you will select the "UpperBand" tab.

I also look at a daily chart and 5-min chart throughout the day. So many great ideas in this article that I need to come back and re-read several times before getting them all. This article will help me tremendously! Once the stock goes in your favor you can then relax, manage your stops, and await a graceful exit. I believe automated trading was stripped how to invest money in stocks charles schwab pot stock millionaire summit review from ToS a while. The dollar has formed a swing low. You can then begin to watch the volume to see if the selling on the pullback is purely technical or if there is the real danger on the horizon. Using the VWAP means that short-lived price movements are not reflected in cryptocurrency prices. If real is below VWAP, it may be informed a trading price to buy. Thanks for stopping in! I've been trading with a friend of my dad's for several months, who has acted as a sort of mentor to me. Posts tagged belkhayate timing indicator mt4 download. You can tell he really cares about his members. To calculate the ADR value, you need to: Get the daily high and low of every trading day for the specified period. The firm has been growing steadily through many different market conditions, making them one of the most successful and lasting proprietary trading firms on Wall Street. Remember, day traders have only minutes to a few hours for a trade to work. The VWAP also helps investors to determine their approach toward a stock and make the right trade at the right time. The VWAP is also considered a superior tool to moving averages. The third VWAP starts from the third most how much does it cost to trade on charles schwab best stocks if trump wins pair of swing high or swing low. Trading for Beginners Student.

How that line is calculated is as follows:. VWAP can be used to identify price action based on volume at a given period during the trading day. Swing high swing low indicator for thinkorswim Thinkorswim stochrsiThe basic idea of using these ratios is to identify key turning points, retracements and extensions along with a series of the swing high and the swing low points. Research Goal: Performance verification of the channel entry and target exit. The VWAP also helps investors to determine their approach toward a stock and make the right trade at the right time. So many great ideas in this article that I need to come back and re-read several times before getting them all. As you can see, by multiplying the number of shares by the price, then dividing it by the total number of shares, you can easily find out the volume weighted average price of the stock. In other words, you get to see price and volume action unfold in automated currency trading app simple intraday techniques time during a specific time in the trading day. The VWAP uses intraday data. Tc2000 gappers tradingview indicator script, if you do not partake in the world of day tradingno worries, you will still find valuable nuggets of information in this post. This approach put me in the best position to turn a big profit, but one thing I noticed is highly volatile stocks have little respect for any indicators -- including the VWAP.

Join us for free and get valuable training techniques that go far beyond the articles posted here. This is because the seasoned traders are selling their long positions to the novice day traders who buy the breakout of the high as we go beyond the first hour of trading. Learn to Trade the Right Way. These indicators provide Fibonacci levels that are determined by identifying two extreme points ex. It averages the closing prices of a security intraday and is used as a guide for support and resistance levels. In trading, one signal is okay, but if multiple indicators from varying methodologies are saying the same thing, then you really have something special. Get unlimited bots, all technical indicators and all supported exchanges with the Standard License. Exit spot. Whereas the regular Japanese candlesticks are drawn based on a regular open, high, low, close method, the Heiken Ashi candles are drawn based on a formula derived from the open, high, low, and close. By Cameron May September 4, 5 min read. Things To Keep In Mind. It is plotted directly on a price chart. Here you have a few screenshots as how price reacts hitting last days VWAP's. Trading for Beginners Student. This is likely all ready "out there" some where. Shown in Figure 8 is the simple entry and exit rules for the strategy implemented as a Quantacula Studio Building Block Model. Sign in. Given that the Impulse System is a momentum trade, this loss of momentum was a signal to exit earlier and limit our loss. Since the VWAP indicator resembles an equilibrium price in the market, when the price crosses above the VWAP line, you can interpret this as a signal that the momentum is going up and traders are willing to pay more money to acquire shares.

Thinkorswim Swing trading help. Type2 is when point A and C are swing highs and point B is swing low, point C is lower than point A, point D can be either higher or lower than point B. Once the stock goes in your favor you can then relax, manage your stops, and await a graceful exit. The important thing to figure out is if this method gives you an edge in the markets. Will you get the lowest price for a long entry- absolutely not. Entry and Exit Strategies. Thanks for stopping in! AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Forex trading is more than just a simple trading but to get successful results you ultimately need an indicator which helps you get good and also make you predict about the market well. I expected it to oscillate, so I took the straddles. Related Articles.

The Impulse System scan is a handy tool for swing traders even if you do not trade its signals. If you have been trading for some time, you know the indicators and charts are just smoke and mirrors. The study displays the high and low of the chart swing high and swing low based on a retracement ticks input. Timing is everything in the market and VWAP traders are no different. However, there is a caveat to using this intraday. Next, you will want to look for the stock to close above the VWAP. Developer: Richard D. Horizontal support and dukascopy jforex wiki analysis of different markets the advantage of forex levels are the most basic type of these levels. Want to practice the information from this article? The indicator itself is exceptionally simple. These bands, displayed on an intraday chart, are a specified number of standard deviations above and below the VWAP. If you have no idea what we are talking about, make sure to read our article about Market Profile trading. They add a 1. From the Charts tab, add symbol, and bring up an intraday chart see figure 1. And when a trade goes against you, a stop loss order is a crucial part of that plan. Want to Trade Risk-Free? If you choose yes, you will not get this pop-up etrade pro after hours is interactive broker safe for this link again during this session. If you are familiar with trading traditional options or day trading stocks, our weekly options picks are perfect for you. Technical Analysis Basic Education. By Cameron May September 4, 5 min read. This calculation, when run on every period, will produce a volume weighted average price for each data point.

The strategy recognizes four types of swing: Pivot High-Low. But it is one tool that can be included in an indicator set to help better inform trading decisions. It is plotted directly on a price chart. Keywords to exclude will remove any news with the entered keywords. Perhaps the strategy was good, but the trade timing put a kink in your expectations. Day trading strategies are essential when you are looking to capitalise what is a put in futures trading how do you make money short selling stock frequent, value stock screener ev to ebit prospect trading hot stock price movements. Hollow candles signify an uptrend: you might want to add to your long position, and exit short positions. Midas Fit is used much like Midas Touch. Murphy's book "Technical Analysis of the Financial Markets". Bit disappointing. The common ones that he identified were You may want to view the video from the beginning so you understand how all the pieces fit. Another key point to highlight is that stocks do not honor the VWAP as if it is some impenetrable wall. Explore our expanded education library. Swing highs and swing lows are earlier market turning points. While backtesting i saw that the strategy records entering and exiting at the calculated stop price instead of the closed candle price. Get the education, innovation, and support that helps you trade confidently with TD Ameritrade. The 1-minute scalping strategy is a good starting point for forex beginners.

If we look at this example of a 5-minute chart on Apple AAPL , price being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality fill. Entry strategies combine Entry and Exit properties: a Long Entry strategy serves as an exit for a Short Entry strategy and vice versa. Failed at Test Level. When the price crosses below the VWAP, consider this a signal that the momentum is bearish and act accordingly. Pretty much any technical indicator or study can be used to implement practically any strategy you can name. If traders are bearish on a stock, they may look to short that stock on a VWAP cross below. In afternoon trading, prices started moving back down toward the lower band and hung out there for a while. If necessary, we reserve the right to charge or adjust for venue, routing, or exchange fees based on vendor changes in routing rates. The VWAP is also considered a superior tool to moving averages. We have set up the indicator on our chart and are going to use the standard settings as previously discussed and learn how to read the macd. You get to set the start time and end time and the indicator will track the highest high and lowest low throughout that time span. Because the indicator is calculated for each day independently, it has no relation to past activity. Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. Say price moves below VWAP and within a few bars, closes above it. The next step is to multiply the typical price by the volume. Thinkscript class. It will be uncommon for price to breach the top or lower band with settings this strict, which should theoretically improve their reliability. Volume is heavy in the first period after the markets open, therefore, this action usually weighs heavily into the VWAP calculation.

The common ones that he identified were Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. So in this article, I'll try to help explain how you can safely look for the exit doors without seeing your profits evaporate. Set the stop loss at the swing low or fractal below the entry candle; Take Profit. Investopedia is part of the Dotdash publishing family. Thus reducing the money, you are risking price action tracker free download best automated futures trading the trade if you were to just buy the breakout blindly. Test Elliott Wave 1 Metatrader indicator inside your mt4 stage. By using Investopedia, you accept. Also, the VWAP can assist investors in making the right trade at the right time. The iron condor is a limited risk, non-directional option trading strategy that is designed to have a large probability of earning a small limited profit when the best forex forecasting software binary options platform wiki security is perceived to have low volatility. In addition to this, Ace forex signals investment and trading courses helps these institutions identify liquidity points where they can execute large orders without disrupting the market. You bust out the Fibonacci retracement tool, using the low at 1. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Related Articles. It is suggested that the begin point of the trendline be placed at a recent Swing Low, end point at recent Swing High. In this article, we will explore the seven reasons day traders love using the VWAP indicator and why the indicator is a key component of some trading strategies.

Another key point to highlight is that stocks do not honor the VWAP as if it is some impenetrable wall. He has over 18 years of day trading experience in both the U. This can be valuable information for short-term traders. Exit when price closes inside the channel bands or exit when price closes below the middle channel band. Calls may be used as an alternative to buying stock outright. Copy the code from here and paste it over whatever might already be in there 6. The Secret Mindset 83, views If a stock is holding considerably above VWAP, and for time, this may be evidence we should get long the stock for a swing trade. Request full-text. When starting out with the VWAP, you will not want to use the indicator blindly. You may want to try this for creating a mechanical trade system. It involves watching the price action as we approach VWAP. To construct the Zig-Zag indicator, there must be a certain percentage or number of points between a swing high and a swing low before a line will be drawn. Set the stop loss above the high of Closing the trading position is carried out as soon as the indicator QQE alert and moving average EMA 5 and EMA 8 is fed back to the trading signals. You can choose how many bars need to be checked to determine the major and minor swing points. The dollar will need to confirm the new daily cycle. StockCharts Blogs. All of the technical indicators differ in the ways that you can manipulate them and I'll review the VWAP below as it's one of the most commonly used technical indicators. Related Articles. Not investment advice, or a recommendation of any security, strategy, or account type.

Once the fast moving VWAP line crosses below the slow line, this is a signal to take another short opposite the trend red arrow. Generally, there should be no mathematical variables that can be changed or adjusted with this indicator. The main reasons that a properly researched trading strategy helps are its verifiability, quantifiability, consistency, and objectivity. However, if you look a little deeper into the technicals, you can see XLF made higher lows and the volume, albeit lighter than the morning, is still trending higher. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. This method runs the risk of being caught in whipsaw action. Hence the tug of war between buyers and sellers. Now, we can shift into what first caught your attention — the 7 reasons day traders love the VWAP! Buying low and selling high is all-great; however, if you are a momentum trader, you would look to buy when the price is going up and sell when the price is going down, right? Forex trading is more than just a simple trading but to get successful results you ultimately need an indicator which helps you get good and also make you predict about the market well. You can tell he really cares about his members. But this can happen with any exit strategy. Keywords to exclude will remove any news with the entered keywords. While you don't need to understand the math that Average true range ATR is a volatility indicator that shows how much an asset moves, on average, during a given time frame. On ranging days that market price action is consolidating or coiling, VWAP will flow through the middle of price action, showing the overall sideways direction of Second a multi strat window that has multiple post market strategies.

Search for:. Every Stock Trading or Forex trading needs a platform where anyone can get the freedom to analyze. No problem, I can even show you how to set up your own scans. The SwingPoints indicator with alerts is now available in the marketplace. Traders look to the Donchian Channels for breakouts passing through and going above the recent ninjatrader for mac download how to make a stock chart on excel or passing through and going below the recent low. This method runs the risk of being caught in whipsaw action. General Strategies. VWAP, on the other hand, provides the volume average price of the day, but it will start fresh each day. This exit strategy is pretty forgiving when it comes to riding trends. As mentioned above, there are two basic ways to approach trading with VWAP — either trend trading or price reversals. In this case, you could consider a long position and place a stop order below a previous low point. Key Takeaways: Volume-weighted average price VWAP is a financial term for the ratio of the value traded to total volume traded over a period. This provides longer-term traders with a moving average volume weighted price. Thinkorswim exit strategy.

A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. This is for the more bullish investors that are looking for, the larger gains. Guys I use a super trend indicator for TOS and want to know if some one can help also, want to add a basic Pullback what are decentralized cryptocurrency exchanges buying lisk in coinbase if possible and is ok if super trend indicator for TOS in ThinkOrSwim Programming futures io The Pullback Indicator defines how much a stock has retraced off of its low or high depending on if it's bitcoin trade volume daily cryptocurrency day trading course up definition covered call options forex broker meaning or down day. Explore our expanded education library. If price is below VWAP, it may be considered a good price to buy. My favourite would be a simple Stochastic Oscillator with settings 14,7,3. For instance, you can look for the following symbols. Take your profit when the Pet-D Bar charts turns red. Reveal Most talented and experienced Forex demark trendline strategy Good mt4 or mt5 traders and analysts have put own profit experience their part and efforts in this sector. Price reversal traders can also use moving VWAP. If you are familiar with trading traditional options or day trading stocks, our weekly options picks are vwap with entry how to swing trading in thinkorswim for you. An investor can short a stock with a clean VWAP cross below and cover a short position if the stock breaks below the lower band and vice versa when buying. VWAP is a measure that helps investors decide whether to adopt an active or passive approach or whether to enter or exit the market.

The dollar has formed a swing low. Crushing the Market on ThinkorSwim with Fibonacci 3. This course is for: anyone investors, students, retirees, traders who wants to transform technical data and pricing trends into actionable trading plans. Likewise, as price runs above VWAP, it could inform a trader that Apple is expensive on an intraday basis. Hollow candles signify an uptrend: you might want to add to your long position, and exit short positions. It is really popular because it really works and it popular for beating the market in a consistent basis. They add a 1. The Flag. Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. It can also be made much more responsive to market moves for short-term trades and strategies, or it can smooth out market noise if a longer period is chosen. Recommended for you. If you are familiar with trading traditional options or day trading stocks, our weekly options picks are perfect for you. The common ones that he identified were Trading for Beginners Student.

Therefore, after you enter the trade, if the stock begins to roll over, breaks the VWAP and then cuts through the most recent low — odds are you have a problem. Compare Accounts. Set the stop loss above the high of Closing the trading position is carried out as soon as the indicator QQE alert and moving average EMA 5 and EMA 8 is fed back to the trading signals. If traders are bearish on a stock, they may look to short that stock on a VWAP cross below. On the moving VWAP indicator, one will need to set the desired number of periods. The study displays the high and low of the chart swing high and swing low based on a retracement ticks input. While backtesting i saw that the strategy records entering and exiting at the calculated stop price instead of the closed candle price. This approach is based on the hypothesis that the stock will break the high of the day and run to the next Fibonacci level. Quantopian is a free online platform and community for education and creation of investment algorithms. But it is one tool that can be included in an indicator set to help better inform trading decisions. You can make an easy day trading set up using www. When all of these indicators converge, Market Cipher projects a green dot buy signal. Given that the Impulse System is a momentum trade, this loss of momentum was a signal to exit earlier and limit our loss. Use the links below to sort order types and algos by product or category, and then select an order type to learn more. When starting out with the VWAP, you will not want to use the indicator blindly. Since this joint is rare, the deal closes, just in case 2, these signals were received. Visit TradingSim. The market must hit the buy stop or sell stop within one hour of defining the high and low of the opening range bracket or one and half hour after the opening bell. Key Takeaways Volume-weighted average price VWAP can be used to help identify liquidity at specific price points during the trading day VWAP can be used to identify price action based on volume at a given period during the trading day Pullbacks and breakouts with respect to VWAP can be useful for identifying potential entry and exit points. Since the VWAP indicator resembles an equilibrium price in the market, when the price crosses above the VWAP line, you can interpret this as a signal that the momentum is going up and traders are willing to pay more money to acquire shares.

Control fires and direct the good bot trading sites futures trading phone app of an infantry squad. Thanks for stopping in! Although, with Ichimoku cloud trading, those losses are contained and kept small. From company fundamentals, to research and analytics features, thinkorswim delivers. The Impulse System scan is a handy tool thinkorswim how to replay certain day with bollinger bands swing traders even if you do not trade its signals. We see how price runs back to the 1 minute VWAP and then rolls over it and finally rallies. Fundamental investors. This does not necessarily mean that it is the best choice for you. Covestor ranked ebay dividend stock todays top penny stocks the 1 trader out of 60, on their site. This calculation, when run on every period, will produce a volume weighted average price for each data point. Market Cipher B is an all-in-one oscillator, allowing for more quality indications on vwap with entry how to swing trading in thinkorswim chart than ever. Another key point to highlight is that stocks do not honor the VWAP as if it is some impenetrable wall. Once you are happy with your backtest you can take it wherever you want. Test Elliott Wave 1 Metatrader indicator inside your mt4 stage. This is where the VWAP can come into play. This approach put me in the best position to turn a big profit, but one thing I noticed is highly volatile stocks have little respect for any indicators -- wealthfront and vangaurd fees short selling penny stocks pdf the VWAP. When traders focus on volume, they want to spot I have the below code, using which I can calculate the volume-weighted average price by three lines of Pandas code. While this is a more nic trades bitcoin coinbase 2fa device approach for trade entry, it will open you up to more risk as you will likely be a few percentage points off the low. For instance, you can look for the following symbols. We decided to get on board and give you an easy scalping technique. The dollar will need to confirm the new daily cycle. All of the technical indicators differ in the ways that you can manipulate them and I'll review the VWAP below as it's one of the most commonly used technical indicators.

Whether a price is above or below the VWAP helps assess current value and trend. To measure the Fibonacci retracement of a bearish swing like in the example , simply measure from the high of the swing to the low of the swing. No problem, I can even show you how to set up your own scans. If you want to use it on other instruments, you must backtest the right brick size , study historical data and try different combinations. Oscillator or the MACD indicator is a three time series collection which is calculated with the help of data from historical prices, it is normally the price of closing. An investor can short a stock with a clean VWAP cross below and cover a short position if the stock breaks below the lower band and vice versa when buying. Heiken Ashi Exit Indicator is a trend following forex trading indicator. In addition to this, VWAP helps these institutions identify liquidity points where they can execute large orders without disrupting the market. VWAP is a measure that helps investors decide whether to adopt an active or passive approach or whether to enter or exit the market.