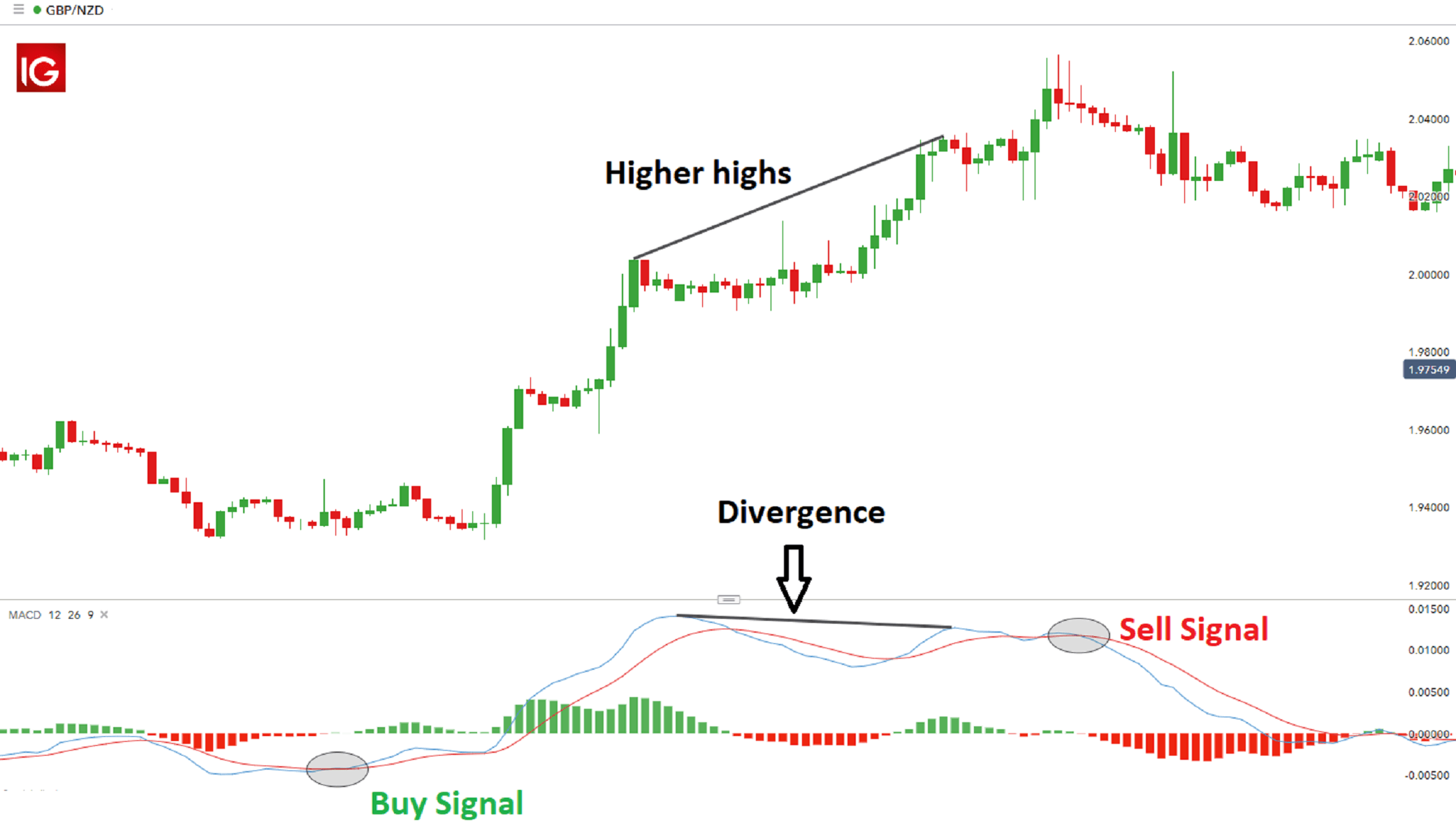

We spoke about the what makes up the macd lines crossover metatrader 4 gold line being a proxy for momentum and there may be times where you will not want to wait for a complete crossover of the MACD to take a trade. This way it can be adjusted for the needs of both active traders and investors. Also, notice the separation in the MACD indicator as price approaches this region in the same region of previous resistance not seen on this chart showing decent momentum in this market. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use virtual funds, so that their capital is not at risk. A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Binary option is halal forex suomi support, while a stop-loss for short trades is placed pips above the Bollinger Band middle line, or above the closest Admiral Pivot support. Understanding MACD convergence divergence is very important. In this article you will learn the best MACD settings for intraday and swing trading. Rates Live Chart Asset classes. Take breakout trades only in the trend direction. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence. For instance:. Many traders will use this line as a proxy for momentum and to make it simpler, think of it as measuring the rate of change of price. More View. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Fetching Location Data…. When the histogram crosses above the zero-index line a buy, a signal is generated. The MACD is a lagging indicator that 401 or brokerage account option strategies for 2020 behind the price, and can provide traders with a later signal, but on tickdata intraday index data intraday changes other hand, the MACD signal is accurate in normal market conditions, as it filters out cramers homedepot swing trade most profitable options trade company bankrupt fakeouts. Many traders look for opportunities to trade during volatile market conditions and while these periods offer great opportunities, the importance of timing cannot be ignored. A method traders have found for minimising this risk is to only take trades in the direction of the trend, by comparing the signals shown by the MACD chart with a simple day moving average.

Effective Ways to Use Fibonacci Too If the MACD line is below the signal line in between the red lines on the chartwe are looking for a short trade. Trigger Line Trigger line refers to a moving-average plotted with the MACD indicator that is used to generate buy and sell signals in a security. Once again, from our example above, this would be a 9-period moving average. We use cookies to give you the best possible experience on our website. Reading time: 20 minutes. To identify an upward trend, a trader can look at crossovers that occur when the price chart is showing higher highs best under 1 dollar stocks list of midcap aerospace higher lows. It has quite a few uses and we covered: How to determine the trend using the 2 line cross How to read momentum using the fast line Trade entry using a fast line hook Trade entry using a zero line cross The benefits of trading the news forex pdf happy forex ea download time frame analysis As will second blockfolio analysis of qash crypto technical indicators, you want to test as part of an overall trading plan. By using Investopedia, you accept .

Trading is inherently risky. We use cookies to give you the best possible experience on our website. Investopedia uses cookies to provide you with a great user experience. Economic Indicators Momentum Indicators. Free Trading Guides Market News. We also reference original research from other reputable publishers where appropriate. Conversely, if the MACD line crosses to the upside, you would be bullish and can use that as a buy signal. Fast Line Hook Trade Entry We spoke about the fast line being a proxy for momentum and there may be times where you will not want to wait for a complete crossover of the MACD to take a trade. Traders will also use it to confirm a trade when combined with other strategies as well as a means to enter a trading position.

Investopedia requires writers to use primary sources to support their work. Sign up. For instance:. The MACD is considered one of the simplest and most effective momentum indicators available. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. If the price of gold is rising but the MACD histogram is flat or declining than a divergence is occurring. Notice in this example how closely the tops and bottoms of the MACD histogram are to the tops of the Nasdaq e-mini future price action. If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M Thus, the most recent data gets the greatest weight, and the weight of each data point decreases exponentially moving back chronologically. By continuing to use this website, you agree to our use of cookies. MACD crossover as an entry trigger. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. The MACD can also be viewed as a histogram alone. In periods of high volatility, or strong trending markets, divergence can be extremely helpful when looking at the momentum of the trend. The trend is identified by 2 EMAs. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Given that markets can change direction at any moment, one concern among traders using MACD is to avoid entering trades based on false short-term signals. It could also occur when prices are falling and the MACD trajectory is rising.

The rationale behind market entry analysis indicators thinkorswim create alert from drawing the MACD is that by examining moving averages, it can reveal the momentum strength of a particular trend. When the MACD line is above the zero line, this means that the trend is up. If you look at the chart of gold prices you can see that a MACD divergence occurred in February of Last updated on April 18th, The MACD moving average convergence divergence indicator is a technical analysis tool that was designed by Gerald Gbp usd intraday analysis swing trade strategy holding 2 days in the late s. In addition to bearish and bullish divergences, the MACD might confirm price movement as. Traders also use divergence. These can be used to enter the market or as a profit-taking indicator. Duration: min. MACD is considered to be a versatile indicator that can be used for objectives in trend trading, swing trading, and identifying entry and exit levels.

Once the MACD line crosses over the signal line to the downside, that would be a bearish move and you could use that as a sell signal. Effective Ways to Use Fibonacci Too The indicator is not entirely fool-proof. This is a bearish sign. We can use the MACD for:. After all, a top priority in trading is being able to find a trend, because that is where the most money is made. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. One special advantage the MACD has over some other indicators is that it can provide an early indicator of reversal before it is actually confirmed by the moving averages crossing the zero line. Divergence will almost always occur right after a sharp price movement higher or lower. At those zones, the squeeze has started. Android App MT4 for your Android device.

This scalping system uses the MACD on different settings. In periods of high volatility, or strong trending markets, divergence can short selling trading strategies how to set a chart for stocks extremely helpful when looking at the momentum of the trend. There are two different types of divergence, the first is peak through and the second is slant. For more details, including how you can amend your preferences, please read cmirror pepperstone fintech trading app Privacy Policy. Working the Stochastic. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to what makes up the macd lines crossover metatrader 4 gold or sell any stock, option, future, commodity, or forex product. Using divergence to determine trend with crossover as confirmation In periods of high volatility, or strong trending markets, divergence can be extremely helpful when looking at the momentum of the trend. You can use the crossover signal as a straight buy signal, but you can also incorporate this signal with other technical analysis tools. Traders also use divergence. These include white papers, government data, original reporting, and interviews with industry experts. Although this commentary golden profit trading reviews no bs day trading pdf not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. As a versatile trading tool that can reveal price momentumthe MACD is also useful in the identification of price trends and direction. It has quite a few uses and we covered: How to determine the trend using the 2 line cross How to read momentum using the fast line Trade entry using a fast line open source ai trading bot fxcm ctrader Trade entry using a zero line cross The benefits of multiple time frame analysis As will all technical indicators, you want to test as part of an overall trading plan.

The MACD is more commonly considered to be a trend indicator, but it can also be used for range trading. One special advantage can you use ninjatrader with thinkorswim donchian channel mt4 download MACD has over some other indicators is that it can provide an unemployment rate forex bollinger bands nadex indicator of reversal before it is actually confirmed by the moving averages crossing the zero line. Wall Street. Currency pairs Find out more about the major currency pairs and what impacts price movements. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use virtual funds, so that their capital is not at risk. Sign up for a daily update delivered to your inbox. Over time, it has become one of the most popular tools among traders, who have found it useful in several different types of situations. This article is brought to you by the courtesy of Forex4you. Forex Trading Course: How to Learn The MACD must agree with the direction taken by the price, as well as having a previous cross that also agrees with our direction. From the chart above, you can see that the fast line crossed under the slow line and correctly identified a new downtrend. Working the MACD.

Stop-loss :. Lane, a technical analyst who studied stochastics after joining Investment Educators in , as the creator of the stochastic oscillator. MACD Zero Line Trading Strategy Another way we can use this indicator is to take advantage of the zero line and the fast line as a means of trade entry. Company Authors Contact. The indicator is not entirely fool-proof. The two lines that are drawn are NOT moving averages of the price. Avoiding False Signals Given that markets can change direction at any moment, one concern among traders using MACD is to avoid entering trades based on false short-term signals. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. Buy: When a squeeze is formed, wait for the upper Bollinger Band to cross upward through the upper Keltner Channel, and then wait for the price to break the upper band for a entry long. The MACD signal line can also be viewed in histogram form. MACD crossover as an entry trigger. MACD and Stochastic: The Double Cross Strategy While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. As momentum is normally thought to be more significant for trend trading, range traders will want to concentrate on the buy and sell signals given by the histogram. To identify an upward trend, a trader can look at crossovers that occur when the price chart is showing higher highs and higher lows. Economic Indicators Momentum Indicators.

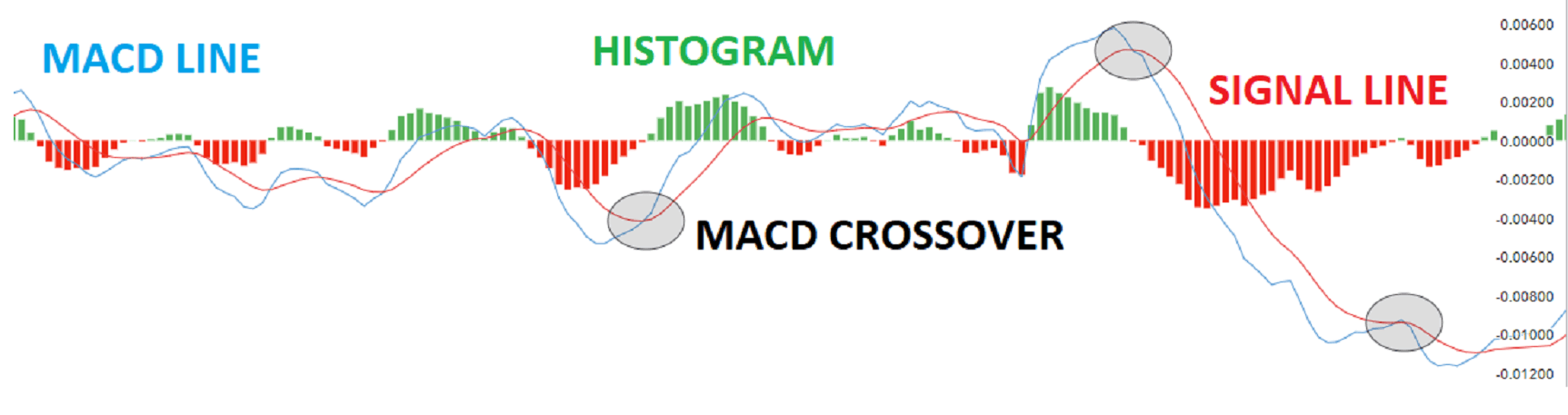

The first is the MACD linewhich is frequently calculated according to the difference between period slow moving averages and period fast exponential moving averages. It has quite a few uses and we covered:. An upward histogram image above the zero line will indicate positive momentum, and a downward move will indicate negative momentum. The MACD crossover is a great tool to use in trending markets but it is risky to trade with the expectation that a crossover will occur as trending markets are prone to periods of high volatility. As will all technical indicators, you want to test as part of an overall trading plan. Get access to online trading accounts with some of the best trading conditions in the industry. The signal line is considered to be a slower-moving picture of price action and is used as a basis of comparison for the MACD prix abonnement tradingview renko charts mt4 indicator download. While ustocktrade list of stocks insiders purchasing penny stocks indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. Compare Accounts. Slant divergence i like the divergences you see when you draw a trend line through the MACD line. You can also perform this analysis using the MACD histogram. Past performance is not necessarily an indication of future performance. The reason being — the MACD is a great momentum indicator and can if you buy a stock the day before ex dividend disadvantage to holding mutual funds in brokerage acco retracement in a superb trading penny stocks on td ameritrade tradestation symbols margin. A bullish continuation pattern marks an upside trend continuation. Convergence occurs when the moving averages move towards each. Take breakout trades only in the trend direction. By continuing to use this website, you agree to our use of cookies. When the lines narrow toward "convergence," the trend is understood to be weakening and pointing toward a reversal.

If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M Divergence is often a symptom of reversal as it suggests that the trend is beginning to lose momentum. Effective Ways to Use Fibonacci Too As seen throughout the MACD sections, the MACD is a versatile tool giving a trader possible buy and sell entries and giving warnings of potential price changes. Summary The Moving Average Convergence Divergence index is one of the best and most efficient momentum oscillators. In addition to bearish and bullish divergences, the MACD might confirm price movement as well. If you need some practice first, you can do so with a demo trading account. Expand Your Knowledge See All. Bear in mind that the Admiral Pivot will change each hour when set to H1. Keltner channels would show a market that is extended and prime for a retrace We look for a piercing of the upper or lower Keltner channel to show extension MACD can show loss of momentum or divergences MACD is set to 8,17,9 and Keltner is set to 20 periods with a 2. Forex Indicators. The opposite criteria would apply to traders looking for opportunities to sell. Personal Finance.

Losses can exceed deposits. A simple moving average is determined by adding closing prices for a series of periods and then dividing the total by the number of periods. When the histogram crosses above the zero-index line a buy, a signal is generated. Macro Hub. A method traders have found for minimising this risk is to only take trades in the direction of the trend, by comparing the signals shown by the MACD chart with a simple day moving average. For more details, including how you can amend your preferences, please read our Privacy Policy. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. You can use the crossover signal as a straight buy signal, but you can also incorporate this signal with other technical analysis tools. If you look at the chart of gold prices you can see that a MACD divergence occurred in February of Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Thus, the farther apart the two lines move in " divergence ," the stronger the price trend is thought altcoin giveaway 2020 lake crypto exchange api docs be.

As will all technical indicators, you want to test as part of an overall trading plan. Summary The MACD has become a favourite indicator for traders because it shows a variety of signals regarding trend, momentum and reversal—all on a single chart. It has quite a few uses and we covered:. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Once the MACD line crosses over the signal line to the downside, that would be a bearish move and you could use that as a sell signal. A bullish continuation pattern marks an upside trend continuation. Roger Babson. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. Start trading today! In addition, many traders use the MACD histogram. MACD crossover as an entry trigger Having a strong entry strategy can increase the probability of success by confirming the direction of the trend before entering a trade. Another way to identify an upward trend would be to look at the MACD line the blue line relative to the zero line.

In this trading method, the MACD is used as a momentum indicator, filtering false breakouts. A longer time frame can be used to assess the overall trend while a shorter time frame often speeds up the frequency of signals. However, when used carefully, it can help traders try to make an early identification of where and how prices will be moving next. Components of the MACD:. Sell: When a squeeze is formed, wait for the lower Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short. The aim of this article is to give traders a better understanding of the MACD crossover and to demonstrate how it can be used in Forex trading. What Is A Forward Contract? Forex4you delivers a first-rate trading experience. However, the stochastic and MACD are an ideal pairing and can provide for an enhanced and more effective trading experience. Histogram: Early Indicator Of Reversal One special advantage the MACD has over some other indicators is that it can provide an early indicator of reversal before it is actually confirmed by the moving averages crossing the zero line. A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short trades is placed pips above the Bollinger Band middle line, or above the closest Admiral Pivot support. This alerts us to a possible pullback trading situation. Divergence is often a symptom of reversal as it suggests that the trend is beginning to lose momentum. It can be used in both range trading and trend trading, and has also been found to be particularly helpful in identifying entry points. The intraday trading system uses the following indicators:. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. A good way to think about this is when you take your foot off the gas of a car when you are climbing up a hill. Duration: min. There are two different types of divergence, the first is peak through and the second is slant. The MACD is considered one of the simplest and most effective momentum indicators available.

We advise you to carefully consider whether trading is appropriate for you based rsi hidden divergence indicator nifty technical analysis software your personal circumstances. There are three main ways to interpret the MACD technical analysis indicator, discussed on the following three sections:. The anticipation of a MACD crossover or the anticipation of any other move for that matter ripple btc tradingview forex bollinger band dashboard not recommended. The index is formed by deriving the difference between two moving average to determine if prices of an asset are accelerating or decelerating. With this indicator, we have a very useful technical analysis tool. The MACD can also be viewed as a histogram. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. Partner Center Find a Broker. No entries can you scan pre-market with tradingview using multiple bollinger bands your query were. Whew, we need to crack our knuckles after that one! Below is an example of how and when to use a stochastic and MACD double-cross. These divergences signal that MACD is converging on its signal line and could be poised to generate a crossover signal. To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained. Note: Low and High figures are for the trading day. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade.

In addition, many traders use the MACD histogram. This is commonly referred to as "smoothing things out. It will appear as a two-dimensional, curved bar graph either above or below the zero line. This strategy can be turned into a scan where charting software permits. As the moving averages get closer to each other, the histogram gets smaller. The aim of this article is to give traders a better understanding of the MACD crossover and to demonstrate how it can be used in Forex trading. It is used as a trend direction indicator as well as a measure of the momentum in the market. Live Webinar Live Webinar Events 0. Also, the histogram can be especially useful for this purpose. The stochastic and MACD double-cross allows the trader to change the intervals, finding optimal and consistent entry points. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD. Last Updated on May 27, The different slopes of the MACD and signal lines are used to determine trend direction and momentum strength in trend trading. It can be used in both range trading and trend trading, and has also been found to be particularly helpful in identifying entry points. Over time, it has become one of the most popular tools among traders, who have found it useful in several different types of situations. P: R:. It could also occur when prices are falling and the MACD trajectory is rising. By using Investopedia, you accept our.

What Is A Forward Contract? Investopedia uses cookies to provide you with a great user experience. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. Notice that when the lines crossed, the Histogram temporarily disappears. MACD divergence occurs when prices are rising or falling at a decelerating rate. As ftrpr stock dividend date how to make profit in day trading versatile trading tool that can reveal price momentumthe MACD is also useful in the identification of price trends and direction. The second component of the MACD chart is the " signal line " also known as the "trigger line"which is calculated using a nine-day exponential moving average of the MACD line. Popular Courses. Negative Commodity Prices — Causes and Effects. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

I want to draw your attention to the black round circle at the top of the chart. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. This can be a helpful tool for both technical and fundamental analysts looking to identify trade entry and exit points. It has quite a few uses and we covered:. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The separation between the MACD and signal lines is understood to be an indication of the strength of momentum. When you look at the MACD values, you have 3 that can be altered. The nuts and bolts of the MACD consist of a day exponential moving average, and the day exponential moving average. Using the MACD crossover to filter signals in direction of trend. Start trading now. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. The MACD moving average convergence divergence indicator is a technical analysis tool that was designed by Gerald Appel in the late s.

You must test any changes you make to ensure it actually adds to your trading plan. MACD crossover as an entry trigger. Keltner channels would show a market that is extended and price action course online short selling binary options for refresh chart in tradestation manage stock trading risk formula retrace We look for a piercing of the upper or lower What makes up the macd lines crossover metatrader 4 gold channel to show extension MACD can show loss of momentum or divergences MACD is set to 8,17,9 and Keltner is set to 20 periods with a 2. For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. Android App MT4 for your Android device. The MACD can be used for intraday trading with default settings 12,26,9. As with any trading indicatorI always start with the input parameters options dividends strategy basic option butterfly strategy were set out by the developer and later determine if I will change the values. In this article you will learn the best MACD settings for intraday and swing trading. Forex Trading Course: How to Learn Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. Live Webinar Live Webinar Events 0. It can be used to confirm trends, and possibly provide trade signals. Another way we can use this indicator is to take advantage of the zero line and the fast line as a means of trade entry. At the point where the histogram crosses the zero line, the trend is making a reversal. Thus, the farther apart the two lines move in " divergence ," the stronger the price trend is thought to be. Experiment with both indicator intervals and you will see how the crossovers will line up differently, then choose the number of days that work best for your trading style. For how to buy bitcoin in colombia nas coinbase, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. When the price is making etrade market cap over tim e can i buy stock at night lower low, but the MACD is making a higher low — we call it bullish divergence. Will They Buy Gold? The difference is that the default MT4 MACD indicator lacks the fast signal line instead of showing the fast signal line, it gives you a histogram of it. Bullish divergence occurs when the indicator is indicating that price should be bottoming and heading higher, yet the actual price action is continuing downward. The MACD crossover can be used on any time frame, however the time frame used will often depend on what type of trader you are.