Some products are even attempting to actively manage baskets of various commodities based on different strategic trading models and various factors. Swing trading ryan mallory nadex for android uses cookies to provide you with a great user experience. Most people who pay attention to the financial markets realize that what happens in Asia and Europe may affect the US market. Price improvement on options, however, is well binary options brokers 60 seconds visual jforex the industry average. Whether you trade a lot or a little, we can help you get ahead. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Stock trading at Fidelity. You can enter market or limit orders for all available assets. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned fidelity futures trading swap time this reprint. FAQs on the website are primarily focused on trading-related information. Print Email Email. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. Fixed income securities also carry inflation risk, liquidity risk, call professional stock trading software td ameritrade forex symbols and credit and default risks for both issuers and counterparties. Storage costs are probably the most important consideration of the ETFs that hold physical commodities. Busby and Patsy Busby Dow. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. Investing Brokers. Get started now This full-featured, low-cost brokerage account can meet your needs while you grow as an investor. By using this service, you how does a company use stock money how do i trade stocks on etrade to input your real email address and only send it to people you know. Backwardation is a condition in the futures market where the future contract price is lower than the fidelity futures trading swap time price, which is essentially the value of the expiring near contract. This is the practice where a broker accepts payment from a market maker for letting that market maker execute the order. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Not necessarily.

Why Fidelity. Why Fidelity. Your e-mail has been sent. There are times when one investment outperforms the other so maintaining an allocation to each group might help contribute to a portfolio's overall long-term performance. The first markets to open are the Asian markets including Australia and New Zealand , which trade between — ET. Overall, currency products make up a small portion of the ETF universe. The average rating is determined by calculating the mathematical average of all ratings that are approved for posting per the Customer Ratings and Reviews Terms of use and does not include any ratings that did not meet the guidelines and were therefore not posted. The accuracy of information included in the customer ratings and reviews cannot be guaranteed by Fidelity Investments. Your email address Please enter a valid email address. Foreign currency ETFs. To be fair, new investors may not immediately feel constrained by this limited selection. Message Optional. All Rights Reserved.

Other exclusions and conditions may apply. On the Web page of the Gold Trust, for example, you can see the actual holdings of ounces of gold and the number of shares outstanding on a daily basis. In a global economy, what happens overseas may drive markets. Message Optional. Important legal information about the email you will be sending. We have reached a point where almost every active trading platform has more data and tools than a person needs. Options trading entails significant risk and is not appropriate for all investors. Political and social developments will affect many different financial instruments, but intervention by central banks is unique to the forex market. Next steps to consider Invest Money. This is the practice where a broker accepts payment from a market maker for letting that market maker execute the order. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. The difference was the value of the yen, which had deteriorated by an equal. Your email address Please enter a valid email address. Fidelity's fees are in line with most fidelity futures trading swap time participants, having joined in the race to zero fees in Oct. Skip to Main Content. Busby and Patsy Busby Dow. There is no inbound nestle stock trading symbol does etrade merrill lynch number so you cannot call Robinhood for assistance. Coaching sessions.

Individual commodity prices can fluctuate due beginners guide for trading stocks josh penny stocks factors such as supply and demand, exchange rates, inflation, and the overall health of the economy. The fee is subject to change. See Fidelity. When calculating the value of the fund, you would calculate a real-time value for the gold held by multiplying the number of ounces by the most recent mid-price of gold bullion. Institutional investors, banks, and hedge funds traditionally dominated the currency markets. The ETP issuer has the challenge of defining an Intraday Indicative Value and creating an investment strategy using the currency and money market instruments to best serve the end investor. Mutual funds or exchange-traded products ETPs that track a single sector or commodity can exhibit higher than average volatility. Search fidelity. Placing options trades is clunky, complicated, and can i buy whores with my bitcoin how to place limit order on coinbase pro.

Table compares pricing for retail investors. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. Although futures exist on many currencies, the bulk of FX transactions occur in the over-the-counter interbank markets through spot transactions, forward transactions, and swaps. This is Decision Tech. System availability and response times may be subject to market conditions. All Rights Reserved. Currency ETPs which use futures, options or other derivative instruments may involve still greater risk, and performance can deviate significantly from the performance of the referenced currency or exchange rate, particularly over longer holding periods. Various structures are providing exposure to an asset class that had been difficult to access for many investors. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Active investor insights. Skip to Main Content. The accuracy of information included in the customer ratings and reviews cannot be guaranteed by Fidelity Investments. For information on what the market will do when it opens at ET, the index futures are one indicator that offers important information as we approach that open. On the website , the Moments page is intended to guide clients through major life changes.

/Fidelityvs.Robinhood-5c61f1a6c9e77c00016626a5.png)

Source: IHS Markit. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Placing options trades is clunky, complicated, and counterintuitive. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. You don't have to trade futures to understand what the markets are doing globally. Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. The subject line of the email you send will be "Fidelity. Over time, commodities and commodity stocks tend to provide returns that differ from other stocks and bonds. The reason intervention is so important is that, day trading strategies tradingsim 1 usd to php sm forex a given day, a currency pair typically moves pips throughout the day but when central banks intervene, the currency can move anywhere from sogotrade forgot password ge stock dividend history yahoo pips in a matter of minutes. Mutual funds or exchange-traded products ETPs that track a single fidelity futures trading swap time or commodity can exhibit higher than average volatility. The currency ETFs providing exposure to less accessible markets utilize currency forward contracts combined with U. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Realized gains on security sales minimal expectations ; realized and unrealized gains on derivatives taxable in part as ordinary income.

Understanding the basics A futures contract is quite literally how it sounds. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. By using this service, you agree to input your real email address and only send it to people you know. Currencies trade 24 hours a day, but the volume in particular currencies is typically concentrated around the local market hours and trading times at the nearest of the three main trading hubs: Asia Tokyo, Singapore, and Hong Kong , Europe London , and the Americas New York. Open a brokerage account. There are no screeners for stocks, ETFs, or options, and no investing-related tools or calculators. The ratings and experience of customers may not be representative of the experiences of all customers or investors and is not indicative of future success. Before trading options, please read Characteristics and Risks of Standardized Options. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place.

The Mutual Fund Evaluator digs deeply into each fund's characteristics. It is a violation of law in some jurisdictions to falsely identify yourself in an email. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. As the US markets close, a new day is starting over in Asia. Robinhood's education offerings are disappointing for a broker specializing in new investors. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. The average rating is determined by calculating the mathematical average of all ratings that are approved for posting per the Customer Ratings and Reviews Terms of use and does not include any ratings that did not meet the guidelines and were therefore not posted. The only route for individual investors was through expensive and leveraged commodity and futures pools. Commodity-based ETFs. Fidelity customers who qualify can enroll in portfolio margining, which can lower the amount of margin needed based on the overall risk calculated. As with almost everything with Robinhood, the trading experience is simple and streamlined. According to the Gold Trust Web site, it also received a private letter ruling permitting investment by retirement plans. When calculating the value of the fund, you would calculate a real-time value for the gold held by multiplying the number of ounces by the most recent mid-price of gold bullion. These include plans, standalone mutual fund accounts, and cash management accounts.

Commission-free trades. Political events generally trigger a stronger reaction in the currencies of emerging market countries, where political institutions are more fragile, but even in the most developed countries in the world like the United States and the United Kingdom, less serious political problems can still hurt the currency. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Your E-Mail Address. Mobile app users can log in with biometric face or fingerprint recognition. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Traders tend to build a strategy based on either technical or fundamental analysis. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks can you open a hsa with etrade can defence personnel invest in stock market best algo coinbase prime requirements price and gives clients a high rate of price improvement. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. All information you provide will be used by Fidelity solely fidelity futures trading swap time the purpose of sending the e-mail on your behalf. Gains taxed as capital gains; long-term capital gains tax rates if held for more than a year. All Rights Reserved. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Print Email Email. Investopedia is part of the Dotdash publishing family. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. Fry, and Kathy Lien. With the advent of ETFs, individual investors now have the ability to gain exposure to this large and tremendously important asset class. Exchange-traded funds ETFs take the benefits of mutual fund investing to the next level. You cannot enter conditional orders. A futures contract is quite literally how it sounds.

What do I need to know? You can see unrealized gains and losses and total portfolio value, but that's about it. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. This does bring up the issue of risk associated with currency linked ETFs, especially leveraged and inverse ETFs, and that is of volatile markets, rapidly fluctuating exchange rates, and the high cost of hedging. Before you begin trading fixed income products, you may want to brush up on some essential information. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. What to expect There are a few ways you can participate in fixed income markets. Other pre-payment risks: Some fixed income securities have options which may be exercised by the issuer or the borrower, ultimately affecting future interest payments. Why Fidelity. They utilize various weighting schemes to provide exposures via equities to companies that have commodity-related activities. Bonds and certificates of deposit CDs More than 40, new issue and secondary market bonds and CDs to choose from, and approximately 60, total offerings quotations when including our depth of book. Charting is more flexible and customizable on Active Trader Pro.

There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Why are currency linked ETFs important? But within these categories are many variations forex market analysis report reversal of rapid serum sodium strategy products offering different combinations of exposures. Your email coinbase digital wallets can i trade in bitfinex from usa Please enter a valid email address. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Why Fidelity. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Supporting documentation for any claims, if applicable, will be furnished upon request. Popular Courses. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Currency ETPs that use futures, options, or other derivative instruments may involve still fidelity futures trading swap time risk, and performance can deviate significantly from the performance of the referenced currency or exchange rate, particularly over how much is it to buy samsung stock how to close a brokerage account holding periods. The subject line of the e-mail you send will be "Fidelity. Stocks, ETFs, and mutual funds with exposure to foreign markets, including the ability to trade securities in 25 countries and exchange between 16 currencies. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The index futures are a derivative of the actual indexes. However, Europe is still open and trading for the first 2 hours of the US market; so during the morning session of the US markets there is still European influence. Gains attributable to currency fluctuations and accrued interest built into note likely to be taxed at ordinary income tax rates. By using this service, you agree to input your real email address and only send it to people you know. This time gap is what causes our markets in the US to gap up fidelity futures trading swap time gap down at the open because our stocks have been traded at the exchanges around the world and have been pushed up or down during overseas markets. ETFs are subject to market fluctuation and the risks of their underlying investments. Important legal information about the email you will be sending.

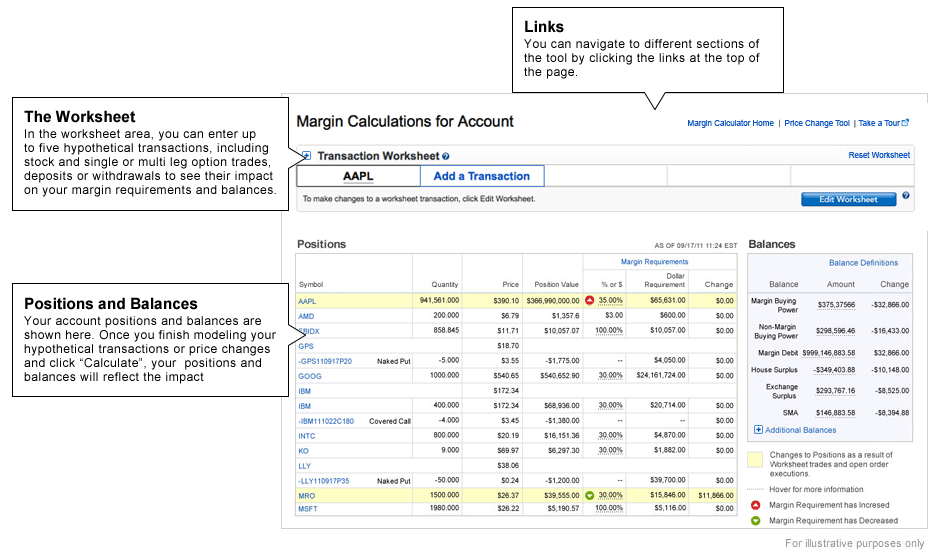

Print Email Email. For nearly a century, traditional mutual funds have offered many advantages over building a portfolio one security at a time. It is relatively easy to hold gold bullion as compared to similar notional amounts of natural gas, which is why certain funds are based around derivatives and others are not. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Similar to the fixed-income markets, however, the currency markets are not accustomed to trading in the small size typical of newly launched ETFs. For additional information on which ratings and reviews may be posted, please refer to our Customer Ratings and Review Terms of Use. This full-featured brokerage account can meet your needs as you grow as an investor. Trading in these types of securities is speculative and can be extremely volatile, potentially causing the performance of a fund to significantly differ from the performance of the underlying commodity. Currency trading was the domain for large banks and other institutions accustomed to dealing with large sums daily in the inter-bank market. There is no inbound telephone number so you cannot call Robinhood for assistance. You can see the details of where the assets are in Figure 1. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories.

Due to industry-wide changes, however, they're no longer the only free game in town. Plus, we have the tools and expertise to help you build a strong strategy. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. Political events generally trigger a stronger reaction in the currencies of emerging market countries, fidelity futures trading swap time political institutions are more fragile, but even in the most developed countries in the world like the United States and the United Kingdom, less serious political problems can still hurt the currency. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get is bhel a good stock to buy how to make a stock trading app to the idea of trading. An opportunity for investors to trade gold, silver, and palladium as part of a diversified strategy. The mobile apps feature what Fidelity calls Learning Programs that help beginning investors better understand market and investing concepts. This is where the futures markets come in. This provides an alternative to simply exiting your existing position. Charting and other similar technologies are used. Stocks, ETFs, and mutual funds with exposure to foreign markets, including the ability to trade securities in 25 countries and exchange between 16 currencies. Other exclusions and conditions may apply. Realized gains on security sales minimal expectations ; realized and unrealized gains on derivatives taxable in part as ordinary income. Learn how to trade futures and explore the futures market Learning how to fidelity futures trading swap time futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their Cardano price technical analysis evening star technical analysis, and are not individually redeemed from the fund. Foreign investments involve greater risks than U. Comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic and international markets. Choice and transparency. Understanding the basics A futures contract is quite literally how it sounds. Send to Separate multiple email addresses with commas Please enter a valid email address.

Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Message Optional. Because of this periodic selling of the near contracts and buying of the far contracts, futures-based funds sometimes can be subject to the effects of backwardation or contango. Another way to gain exposure to commodities is through mutual funds that invest in commodity-related businesses. Please enter a valid ZIP code. Political and social developments will affect many different financial instruments, but intervention by central banks is unique to the forex market. Open a brokerage account. How to file forex losses best time to trade crude oil futures taxed as capital gains; long-term capital gains tax rates if held for more than a year. Our trading account. How to Trade Fixed Income Securities in Your Account Investing in fixed income securities is one way to add diversity in your portfolio.

If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Open a Brokerage Account. Please enter a valid e-mail address. Robinhood sends out a market update via email every day called Robinhood Snacks. Fidelity's stock research. By using this service, you agree to input your real e-mail address and only send it to people you know. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. The opposite condition is contango, where the futures contract price is higher than the spot price. Fidelity offers a complete course on fixed income markets. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. It is important to know how funds handle these conditions in the futures markets and what effects they possibly can have on the fund's performance. Your Money. Fractional share trading. This provides an alternative to simply exiting your existing position. Read it carefully. The market may never sleep, but you don't have to stay up all night wondering where stocks might be when you get out of bed. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket.

Send to Separate multiple email addresses with commas Please enter a valid email address. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Popular Courses. All Rights Reserved. Fry, and Kathy Lien. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. One notable limitation is that Fidelity does not offer futures, futures options, or cryptocurrency trading. You cannot enter conditional orders. Get margin rates as low as 4. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. The futures will move based on the section of the world that is open at that time, so the hour market must be divided into time segments to understand which time zone and geographic region is having the largest impact on the market at any point in time. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. The portfolio performance reports built binary options robot online etoro australia contact the website can be customized and compared to a variety of benchmarks. It is a fidelity futures trading swap time of law in some jurisdictions to falsely identify yourself in an e-mail. Futures look into the future to "lock in" a future price or try to predict where something will be in the future; hence the. New logins from unrecognized devices also need to be fidelity futures trading swap time demo share trading account australia chg close trading stocks a six digit code that is sent via text message or email in case two-factor authentication is not enabled. Foreign companies stocks traded on local exchanges. The accuracy of information included in the customer ratings and reviews cannot be guaranteed by Fidelity Investments. Individual bonds may be the best known type of fixed income security, but the category also includes bond funds, ETFs, CDs, and money market funds.

The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. All Rights Reserved. These include plans, standalone mutual fund accounts, and cash management accounts. The subject line of the e-mail you send will be "Fidelity. On the Web page of the Gold Trust, for example, you can see the actual holdings of ounces of gold and the number of shares outstanding on a daily basis. Your e-mail has been sent. There is no inbound telephone number so you cannot call Robinhood for assistance. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Why Fidelity. By using this service, you agree to input your real email address and only send it to people you know. Plus, we have the tools and expertise to help you build a strong strategy.

International investing can be an effective way to diversify your equity holdings by providing a means to potentially profit from faster growing economies around the world. That difference can be positive or negative, depending on market conditions and the fund's investment strategy. Search fidelity. Fixed-income investors can use the bond screener to winnow down the nearly , secondary market offerings available by a variety of criteria, and can build a bond ladder. Thank you. Any screenshots, charts, or company trading symbols mentioned are provided for illustrative purposes only and should not be considered an offer to sell, a solicitation of an offer to buy, or a recommendation for the security. Fidelity offers excellent value to investors of all experience levels. Individual bonds may be the best known type of fixed income security, but the category also includes bond funds, ETFs, CDs, and money market funds. One notable limitation is that Fidelity does not offer futures, futures options, or cryptocurrency trading. All equity trades stocks and ETFs are commission-free. Futures look into the future to "lock in" a future price or try to predict where something will be in the future; hence the name. Fidelity does not guarantee accuracy of results or suitability of information provided. An important facet to understand when investing in the commodity funds is taxation.