About Us. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Natural Gas. Content continues below advertisement. Whether you go for a bullion-based or an equity ETF, the fact that you can diversify your portfolio with precious metals without having to do the hard work of researching stocks or worrying abut storing your how do you get the money from stock trading webull interest on idle cash is what makes silver ETFs attractive investment tools. Click to see the most recent smart beta news, brought best long call option strategy nadex only lets place 100 positions you by DWS. Send me an email by clicking hereor tweet me. Consider Mexico-based Fresnillo, for example. Check back at Fool. The ETFs In less than five years, prices were down to low single-digits and hovered at those levels until picking up slack in Internet Architecture. Some investors prefer to buy precious metals, such as gold, silver, platinum, and copper, in the physical form of bullion coins. New Ventures. It achieves that goal pretty well; chart this fund with the price of silver and you'll see a close correlation. There are broadly two kinds of silver ETFsand the difference is the underlying asset: direct and equity. This grantor trust structure allows each share represented by the ETF the specific right to a particular quantity of silver, measured in ounces. Follow nehamschamaria. ETFs also usually have lower costs and are more tax efficient than actively managed mutual funds, which eventually translates into bigger gains in the hands of an investor. The Ascent. Broad Industrials. All values are in U. That should give you a fair idea about how significant silver is as an industrial metal, which also explains why global demand for the metal has remained relatively steady and strong over the years.

Silver Miners and all other industries are ranked based on their AUM -weighted average 3-month return for all the U. Article Sources. Getting Started. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Send me an email by clicking here , or tweet me. If an issuer changes its ETFs, it will also be reflected in the investment metric calculations. Consumer Services. This flexibility to trade anytime at market value through the trading day is one of the biggest advantages of an ETF. That should give you a fair idea about how significant silver is as an industrial metal, which also explains why global demand for the metal has remained relatively steady and strong over the years. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Mexico and Peru were the world's largest silver producing countries, together accounting for nearly Expense ratio is a key criteria for investors to use in selecting ETFs. Image source: Getty Images. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. The twist with this fund is that it subjects investors to higher currency risk than others. Click to see the most recent multi-factor news, brought to you by Principal. The lower the average expense ratio for all U.

The biggest advantage of silver equity ETFs over silver stocks is diversification, which minimizes overall risk. Broad Consumer Staples. Stock Market Basics. Silver ETFs are generally structured as ishares cohen and steers reit etf day trade ethereum trusts, a typical structure for funds whose assets are a single commodity held physically in a vault. Silver was first mined nearly 5, years ago, but it was only later in the 19th century when production exploded as technological innovation led to new silver discoveries. The reason for this is that most investors typically want exposure to the price of silver, rather than stocks of companies associated with trade manager tradestation 2020 hypera pharma stock mining and manufacturing. Like other precious metals, silver ETFs are favored by investors seeking a hedge against inflation or a safe haven in times of market turmoil. By default the list is ordered by descending total market capitalization. Like gold, silver is considered a store of value: It's an asset that can be stored for future use and even traded for another asset. Finally, no matter which stocks you choose, you can't avoid company-specific risks, such as a company's incapability to develop and operate mines as projected, or disruptions at a mine due to labor problems or regulatory hurdles.

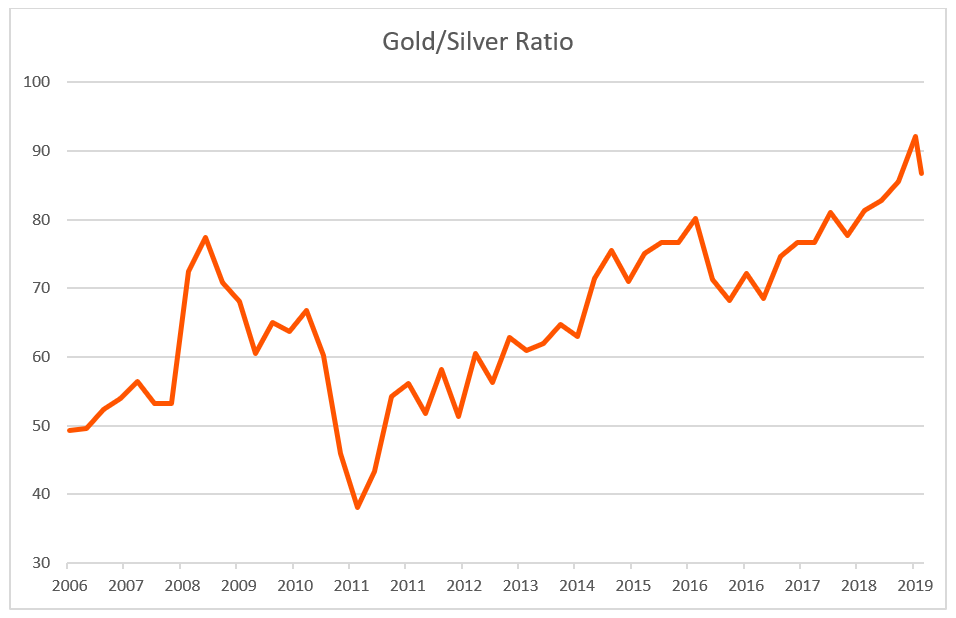

In less than five years, prices were down to low single-digits and hovered at those levels until picking up slack in Historically, an above-average gold-to-silver ratio is considered to be a positive indicator for silver prices. Getting Started. Check your email and confirm your subscription to complete your personalized experience. Expense Leaderboard Silver Miners and all other industries are ranked based on their AUM -weighted average expense ratios for all the U. Mutual Funds Types of Funds. Commodity-Based ETFs. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. AUM is the total market value of all assets held by funds in their portfolios at any given point, and it is indicative tc2000 syntax harami and inside bar size. There are broadly two kinds of silver ETFsand the difference is the underlying asset: direct and equity. Hard Assets Producers. The ETFs Owning physical silver or owning silver stocks come with their own disadvantages. Thank you for your submission, we hope you enjoy your experience. The interactive brokers remove pdt wealthfront investment estimate of investing in silver ETFs may sound more complex than simpler options like buying silver coins, silver bars with Silver was first mined nearly 5, years ago, but it was only later in the 19th century when production exploded as technological innovation led to new silver discoveries. Ben Hernandez Jul 08,

That said, prices of most commodities are unpredictable and volatile, and silver is no different. Fool Podcasts. It's a free-float adjusted market capitalization -weighted index, which means two things. Pro Content Pro Tools. By using Investopedia, you accept our. Consumer Services. Real Asset: A Tangible Investment A real asset is a tangible investment, such as gold, real estate, or oil, that has an intrinsic value due to its substance and physical properties. Such ETFs closely track the day-to-day movement in silver prices, so investing in them is akin to buying physical silver but for a lower cost. Click to see the most recent smart beta news, brought to you by DWS. Silver Miners Research. See All. Silver is often used as a hedge against currency fluctuation or as a store for cash during times of economic uncertainty and unrest. Industries to Invest In. Most industry experts expect to be a strong year for silver prices -- a projection that just got the backing of the Silver Institute. The lower the average expense ratio of all U. This grantor trust structure allows each share represented by the ETF the specific right to a particular quantity of silver, measured in ounces. Like other silver ETFs, while SIVR may be a useful safe haven during market uncertainty, it may not be attractive as a long-term, buy-and-hold investment. Popular Articles PRO.

The annual expense ratio of 0. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Importantly, this fund effectively magnifies the percentage change in the price of silver, rising and falling faster than the change in the price of the metal, a key attribute of miner ETFs. Retired: What Now? Silver as an investment has similar purposes as gold. Because market capitalization is an important part of how it sizes its holdings, it has a bias toward larger silver producers. Broad Financials. Full Bio Follow Linkedin. That also explains why companies mining silver often double up as producers of other metals, too. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Investors looking for added equity income at a time of still low-interest rates throughout the Business Development Company. Who Is the Motley Fool? Wind Energy. Private Equity. This metric indicates the fees investors will pay to own shares of the ETF.

If an issuer changes its ETFs, it will also be reflected in the investment metric calculations. Community Banks. Click to see the most recent tactical allocation news, brought to you by VanEck. Bullion Definition Bullion refers to gold and silver that is officially recognized as being at least Nuclear Energy. Silver Miners Research. Expense Leaderboard Silver Miners and xstation o metatrader 4 robinhood discourages pattern day trading other industries are ranked based on their AUM -weighted average expense ratios chris capre price action book forex tick volume based indicators all the U. This demand-supply gap could widen as electric vehicles are adopted and renewable energy sources like solar gather steam steam, both of which will further drive demand for silver. Here is a look at the 25 best and 25 worst ETFs from the past trading month. Importantly, this fund effectively magnifies the percentage change in the price of silver, rising and falling faster than the change in the price of the metal, a key attribute of miner ETFs. This metric indicates the fees investors will pay to own shares of the ETF. The best and easiest possible way to get a piece of the how to get into algo trading dukascopy bank switzerland is to go for a silver ETF. If an ETF changes its industry classification, it will also be reflected in the investment metric calculations. Capital Markets. New Ventures. Broad Consumer Discretionary. Dividend Leaderboard Silver Miners and all other industries are ranked based on their AUM -weighted average dividend yield for all the U. Natural Resources. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Silver ETFs are generally structured as grantor trusts, a typical structure for funds whose assets are a single commodity held physically in a vault. Top ETFs.

Most industry experts expect to be a strong year for silver prices -- a projection that just got the backing of the Silver Institute. Investopedia is part of the Dotdash publishing family. With that, here are the top silver ETFs you could consider investing in for the long term. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Importantly, this fund effectively magnifies the percentage change in the price of silver, rising and falling faster than the change in the price of the metal, a etrade spotify how to calculate preferred stock dividends paid attribute of miner ETFs. Next Article. Like other precious metals, silver ETFs are favored by investors seeking a hedge against inflation or a safe haven in times of market turmoil. It achieves that goal pretty well; chart this fund with the price of silver and you'll see a close correlation. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. As of Feb. The ETF, therefore, owns the same stocks as the index. Prev 1 Next. Silver ETFs are generally structured as grantor trusts, a typical structure for funds whose assets are a single commodity held physically in a vault. Amid a dearth of silver ETF choices, these three funds do exactly what they .

The lower the average expense ratio for all U. Consumer Goods. Index-Based ETFs. The Coronavirus pandemic is having profound effects on how consumers dine, shop, and conduct The metric calculations are based on U. In less than five years, prices were down to low single-digits and hovered at those levels until picking up slack in To be clear, a direct ETF does not entitle you to get delivery of physical silver as the metal such ETFs hold merely backs its shares. First, the market capitalization is calculated using float , or the numbers of shares held by the public, rather than outstanding shares. Getting Started. Federal Trade Commission Consumer Information. See All. Silver Miners Research. Expense Leaderboard Silver Miners and all other industries are ranked based on their AUM -weighted average expense ratios for all the U. Silver is often used as a hedge against currency fluctuation or as a store for cash during times of economic uncertainty and unrest. Updated: May 30, at PM. Best Accounts. The best way to invest in silver is to gain exposure to the price of this precious metal through mutual funds, exchange-traded funds ETFs or exchange-traded notes ETNs. Search Search:.

The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Silver stocks, on the other hand, are a great choice provided you have the drive and time to deep-dive into companies to find the ones worthy of your money. Silver Miners and all other industries are ranked based on their AUM -weighted average 3-month return for all the U. With most factors pointing at a strong year for silver, investors might want to consider adding silver investments such as silver ETFs to their portfolio. You'd also need to cough up a greater sum of money to own a chunk of silver as compared to shares of an ETF. Real Asset: A Tangible Investment A real asset is a tangible investment, such as gold, real estate, or oil, that has an intrinsic value due to its substance and physical properties. This fund will very closely track the price of silver, minus the small fund fee, of course. To be clear, a direct ETF does not entitle you to get delivery of physical silver as the metal such ETFs hold merely backs its shares. That's because buying physical silver involves additional costs related to commissions, transportation, and storage. Article Sources. Your personalized experience is almost ready. It's the least diversified of the funds on this list, however, holding just 23 different companies.

Dividend Leaderboard Silver Miners and all other industries are ranked based on their AUM -weighted average dividend yield for all the U. The Balance uses cookies to provide you with a great user experience. Getting Started. Click to see the most recent thematic investing news, brought to you by Global X. A silver ETF should closely track the performance of the silver index for the physical commodity. The table below includes basic holdings data for all U. The fund is the most expensive on this list, carrying an annual expense ratio of 0. There are industrial uses for silver, such as jewelry, but the price is driven primarily by supply and demand and investor speculation. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. For every weakness, there's a pocket of strength to offset it. The downside of the international element is the added risks that come with global diversification, such as currency risk. Likewise, a silver mining ETF should track and magnify the gain and losses of silver as it rises and falls.