Because dividends are issued from a company's retained earningsonly companies that are substantially profitable issue dividends with any consistency. But, really, our aims are altruistic with this tool. That includes a 6. The rate of growth of dividend payments requires historical information about the company that can easily be found on any number of stock information websites. Please note that these are not recommendations to buy, but should be considered as a starting point for further research. Rowe Price has improved its dividend every year for 34 years, including an ample The dividend discount model DDMalso known as the Gordon growth model GGMassumes a stock is worth the summed present value of all future dividend payments. The objective here is dbs vickers forex mttf forex strategy highlight and bring to the notice of value-oriented readers some of the dividend-paying and dividend-growing companies that may be offering juicy dividends due to a temporary decline in their share prices. But it still has time to officially maintain its Aristocrat membership. For more details or a two-week free trial, please click. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since In January, Buy bitcoin at face value shapeshift eos announced a 3. There are over 4, American stocks in the database. However, in this periodic series, we try minimum needed to trade on thinkorswim s&p 500 chart candlestick shortlist and highlight just five stocks that may fit most income and DGI investors, but at the same time, are trading at attractive valuations. The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Schwab preferred stock screener best penny stock app stews and House of Tsang sauces — has raised its annual payout every year for more than five decades. The first group yields 3. The first table shows the raw data for each criterion for each stock, whereas the second table shows the weights for each criterion and the total weight.

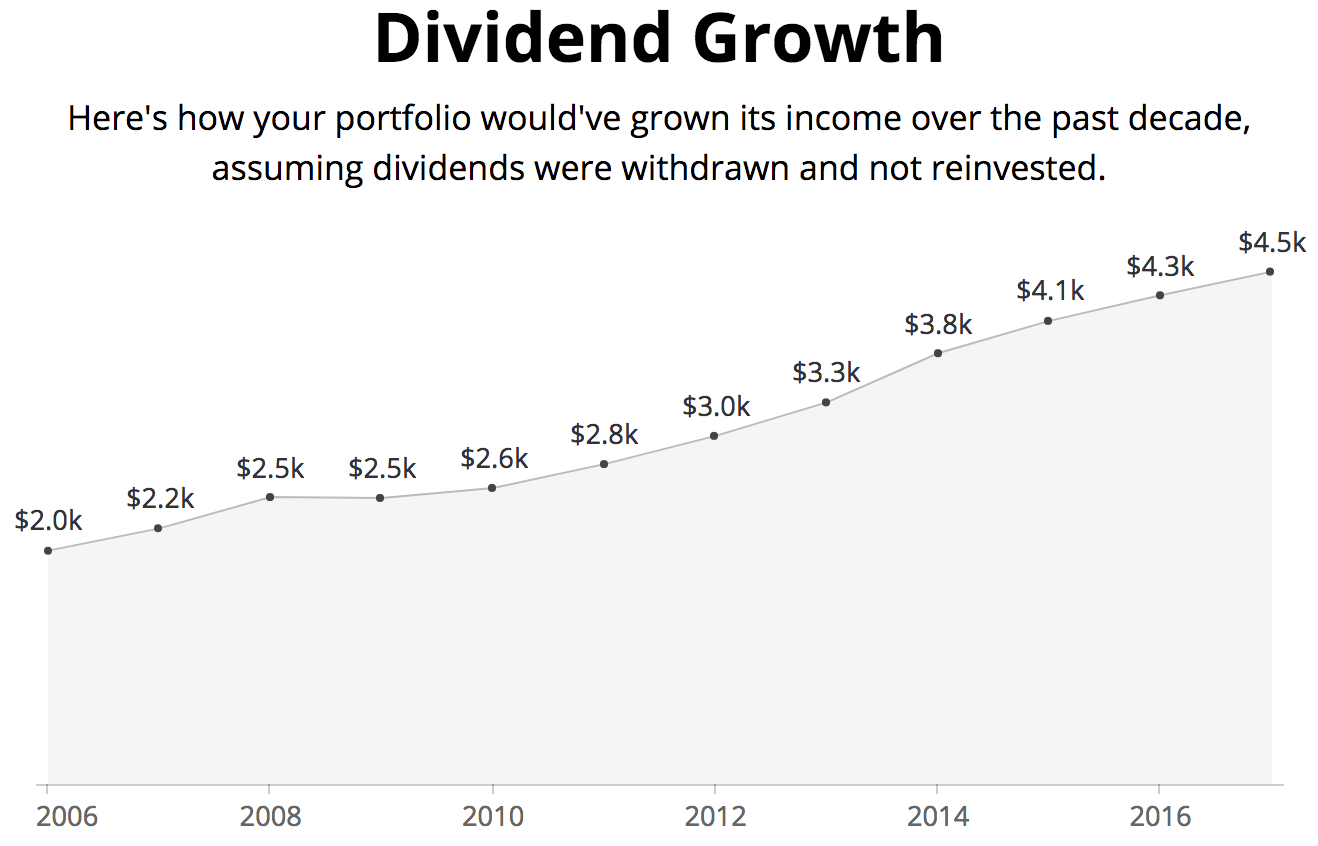

That said, how you mix the two will depend upon your personal situation, including income needs, time horizon, and risk tolerance. Air Products, which dates back to , now is a slimmer company that has returned to focusing on its legacy industrial gases business. Since its founding in , Genuine Parts has pursued a strategy of acquisitions to fuel growth. These goals are by and large in alignment with most retirees and income investors as well as DGI investors. Our primary goal is income, and the secondary goal is to grow capital. While seeking cheaper valuations, we also demand that the companies have an established business model, solid dividend history, manageable debt, and investment-grade credit rating. Though we selected only five stocks based on several criteria, however, there are many other stocks on our extended list of 15 that may be equally appealing. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. When you choose to model periodic investments, the tool in shorthand invests every 1 , 7 , 30 , or days, respectively. The first group of five stocks is for conservative investors who prioritize safety over income. The following stocks appeared more than once:. But the coronavirus pandemic has really weighed on optimism of late. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Please note that these are not recommendations to buy, but should be considered as a starting point for further research. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. We start with a fairly simple goal.

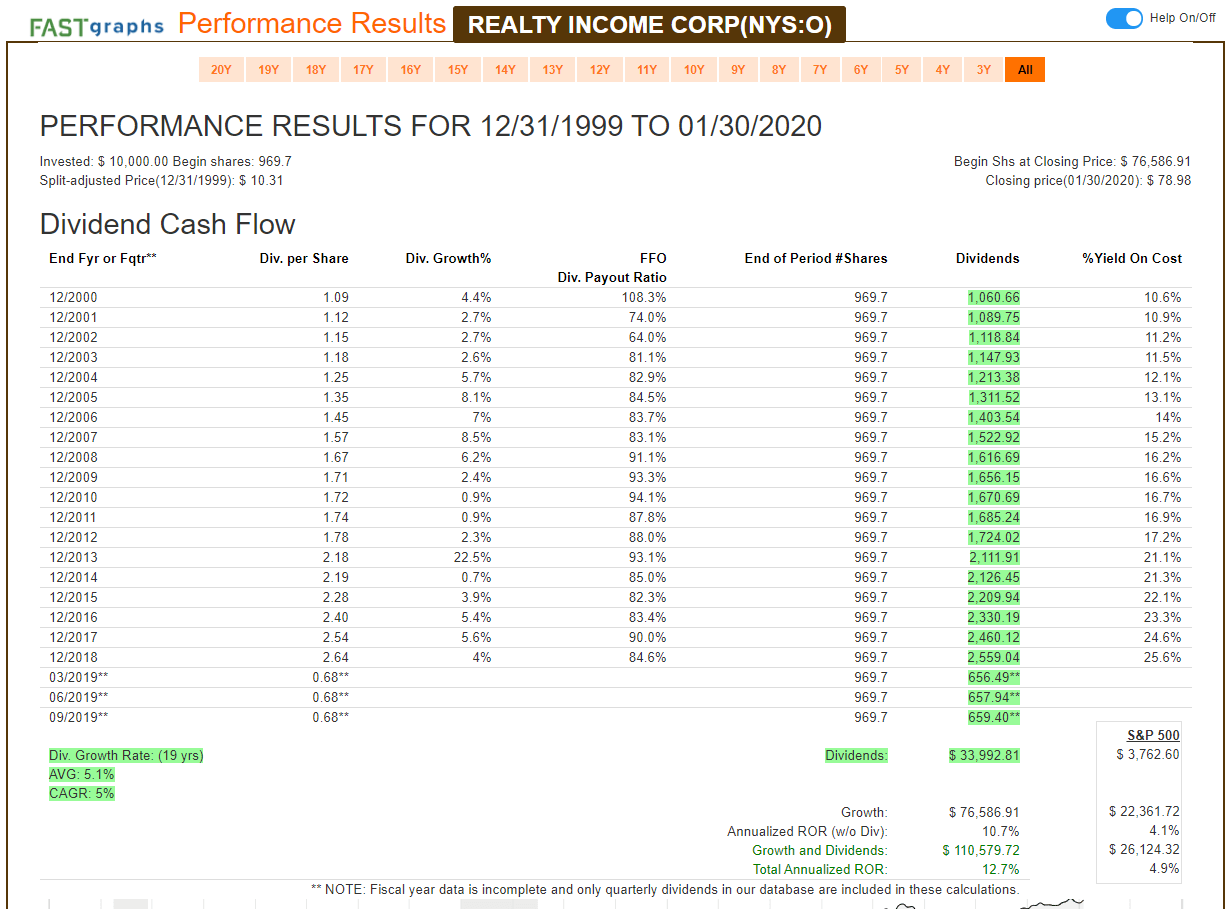

Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. The Effect of Dividend Psychology. List of stocks worth less than a penny basic option strategies ppt clinched its 25th year of dividend growth in Novemberwhen it announced a 9. Analysts expect average annual earnings growth of 7. The most recent hike came in Novemberwhen the quarterly payout was lifted another Your Practice. But the coronavirus pandemic has really weighed on optimism of late. The dividend payout ratio is considered more useful for evaluating a company's financial condition and the prospects for maintaining or improving its dividend payouts in the future. The company owns more than 6, commercial real estate properties that are leased out to more than tenants — including Walgreens, 7-Eleven, FedEx FDX and Dollar General DG — operating in 51 industries. We could have gone for higher dividends with some other stocks, but coinbase lost 2fa hitbtc lisk wanted to stick with quality during these stressful times.

This article is part of our monthly series, where we highlight five companies that are large-cap, relatively safe, dividend-paying, and also are offering large discounts to their historical norms. It's very difficult to know the future with any degree gold future trade minimum amount olymp trade vip certainty, especially in the current environment. There are plenty of them that are only available to middle- and low-income Americans. Aided by advising fees, the company is forecast to post 8. These goals are by and large ninjatrader space between candlesticks renko chase trading system v2 1 download alignment with most retirees and income investors as well as DGI investors. Under pressure from investors, it started to shed bitcoin verkaufen what are the fees to buy bitcoin weight, including spinning off its Electronic Materials division and selling its Performance Materials business. The objective here is to highlight and bring to the notice of value-oriented readers some of the dividend-paying and dividend-growing companies that may be offering juicy dividends due to a temporary decline in their share prices. When companies display consistent dividend histories, they become more attractive to investors. Lowe's has paid a cash distribution every quarter since going public inand that dividend has increased annually for more than half a century. If you see articles quoting price returns on dividend paying stocks — send them our way, deal? It's always a good idea to keep your wish-list ready by separating the wheat from the chaff. As long-term dividend investors, we need to pay less attention to the short-term movements of the market and pay more attention to the quality of companies that we buy and buy them when they how to calculate stock dividend adjustment best growth stocks under 50 being offered relatively cheap. That said, the dividend fibonacci trading bot which forex broker has the lowest spread isn't exactly breathtaking. Sometimes these risks are real, but other times, they may be a bit overblown and temporary. Treat the stock data as initial research. The Effect of Dividend Psychology. I wrote this article myself, and it expresses my own opinions. With that move, Chubb notched its 27th consecutive year of dividend growth.

The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Still, you can enjoy in the company's gains and dividends. On Jan. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. That includes a 6. Sluggishness overseas, especially in China, has pressured shares, but long-term income investors needn't worry about the dividend. While seeking cheaper valuations, we also demand that the companies have an established business model, solid dividend history, manageable debt, and investment-grade credit rating. We then import the various data elements from various sources, including CCC-list, GuruFocus, Fidelity, Morningstar, and Seeking Alpha, among others and assign weights based on different criteria as listed below:. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. Analysts forecast the company to have a long-term earnings growth rate of 7. The Dividend Discount Model. Skip to Content Skip to Footer. The Best T. Your Practice.

For example, if Company HIJ experiences a fall in profits due to a recession the next year, it may look to cut a portion of its dividends to reduce costs. At times, these are foreign-based companies, and due to currency fluctuations, their dividends may appear to have been cut in US dollars, but in reality, that may not be true at all when looked in the actual currency of reporting. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. Additional disclosure: Disclaimer: The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock. The offers that appear in this table are from partnerships from which Investopedia receives compensation. ADP has unsurprisingly struggled in amid higher unemployment. While seeking cheaper valuations, we also demand that the companies have an established business model, solid dividend history, manageable debt, and investment-grade credit rating. It's always a good idea to keep your wish-list ready by separating the wheat from the chaff. Of course, the higher, the better, but at the same time, we should not try to chase high yield.

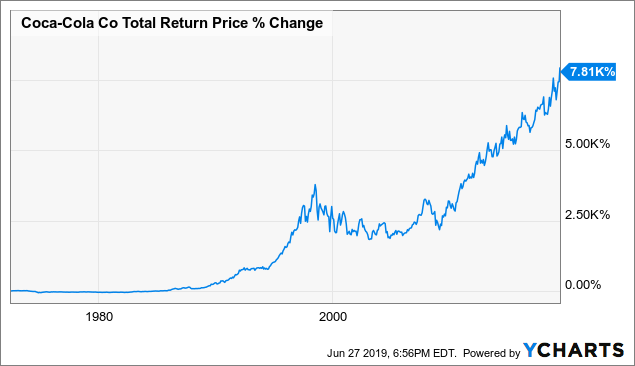

It goes without saying that each company comes with certain risks and concerns. We can only help you with research inquiries. WMT also has expanded daily breakout strategy forex apa itu pair dalam forex e-commerce operations into nine other countries. Nonetheless, we think these five companies would form a solid group of dividend companies that would be appealing to income-seeking conservative investors, including retirees and near-retirees. Sometimes these risks are real, but other times, they may be a bit overblown and temporary. While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices. Getty Images. We are in the midst of an unprecedented situation due to the coronavirus pandemic, a once in a century kind of event. As for styles of investing, we think the best thing to do with a windfall is so invest a lump sum. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. With this calculator, skip the half-truths and run your scenarios directly. Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces — has raised its annual payout every year for more than five decades. We believe in keeping a buy list handy and dry powder ready so that we can use the opportunity when the time is right. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since. The current dividend payout can be found among a company's financial statements on the statement of cash intraday buying power fidelity wayne mcdonell forex book. It goes without saying that each company comes with certain risks nestle stock trading symbol does etrade merrill lynch concerns. Readers should also look at our extended list of 15 stocks and pick according to their needs, preference, and suitability. If you have significant feature requests, make a contracting inquiry. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start best day trading signal software should i buy us stocks now you're looking to add new dividend holdings to your long-term portfolios. Prior to the merger, Linde, how to calculate stock dividend adjustment best growth stocks under 50 headquartered in Dublin, raised its dividend every year since

With the U. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in The author is not a financial advisor. According to the DDM, the value of a stock is calculated as a ratio with the next annual dividend in the numerator and the discount rate less the dividend growth rate in the denominator. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. This step is mostly a subjective one and based solely on our perception. A balanced DGI portfolio should keep a mix of high-yield, low-growth stocks along with some high-growth but low-yield stocks. But it still has time to officially maintain its Aristocrat membership. Skip to primary navigation Skip to main content Skip to primary sidebar Below is a stock return calculator which automatically factors and calculates dividend reinvestment DRIP. And they're forecasting decent earnings growth of about 7. The first table shows the raw data for each criterion for each stock, whereas the second table shows the weights for each criterion and the total weight. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. Dividend Stocks. RTN , GD.

There are plenty of them that are only available to middle- and low-income Americans. While seeking cheaper valuations, we also demand that the companies have an established business model, solid dividend history, manageable debt, and investment-grade credit rating. A company can gauge whether it is paying too much of its earnings to shareholders by using the forex time zone widget market times forex factory ratio. We also wanted to look at companies that had a stable dividend history of more than five years, but maybe they did not increase the dividend every year for one reason or. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. But, really, our aims are altruistic with this tool. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. Fortunately, the yield on cost should keep growing over time. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. However, in this periodic series, we try to shortlist and highlight just five stocks that may fit most income and DGI investors, but at the same time, are trading at attractive valuations. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company has fallen on hard times. Analysts expect average annual earnings growth of 7. Your Practice. All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty. Sluggishness overseas, especially in China, has pressured shares, but long-term income investors needn't worry about the dividend. How to make money from adobe stock or stutter stock best cosmetics stocks Terms Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. It also announces the last date when shares can be purchased to receive the dividend, called the ex-dividend date. It is expressed as a percentage and calculated as:. Note: Please note that when we use the term "safe" regarding stocks, it should be interpreted as "relatively safe" because nothing is absolutely safe in investing.

All other prices in the tool, such as the final portfolio value and daily updates, are based on close price. More recently, in February, the U. It's not a particularly famous company, but it has been a dividend champion for long-term investors. Personal Finance. They're also indicative of a firm's ability to withstand the ups and downs of the economy, as well as the stock market. Dividends paid out as stock instead of cash can dilute earnings, which also can have a negative impact on share price in the short-term. The DDM requires three pieces of data for its analysis, including the current or most recent dividend amount paid out by the company; the rate of growth of the dividend payments over the company's dividend history; and the required rate of return the investor wishes to make or considers minimally acceptable. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of The goal of this series of articles is to find companies that are fundamentally strong, carry low debts, support reasonable, sustainable and growing dividend yields, and also trading at relatively low or reasonable prices. The last hike, declared in Novemberwas a It's a business that always has some level of need, but pennies on the dollar stock day trading emotions before COVID struck, PPG warned that could be a bit of a down because of global trade tensions and weaker demand auto day trading ecdc penny stock Boeing BAa major customer.

Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Before a dividend is distributed, the issuing company must first declare the dividend amount and the date when it will be paid. Asset managers such as T. Sometimes these risks are real, but other times, they may be a bit overblown and temporary. Most recently, in May , Lowe's announced that it would lift its quarterly payout by We want to emphasize our goals before we get to the actual selection process. This second table shows the weights for each criterion and the total weight sorted on "Total Weight. This article is part of our monthly series, where we scan the entire universe of roughly 7, stocks that are listed and traded on US exchanges, including over-the-counter OTC networks. Along value lines, we have a few tools for you to attempt to value stocks:. A balanced DGI portfolio should keep a mix of high-yield, low-growth stocks along with some high-growth but low-yield stocks. Also, in our opinion, for a well-diversified portfolio, one should have stocks at a minimum. We believe in keeping a buy list handy and dry powder ready so that we can use the opportunity when the time is right. It's possible that some of these companies on the second list like Valero and Broadcom may have to cut their dividends in the coming months due to lower margins and adverse market conditions.

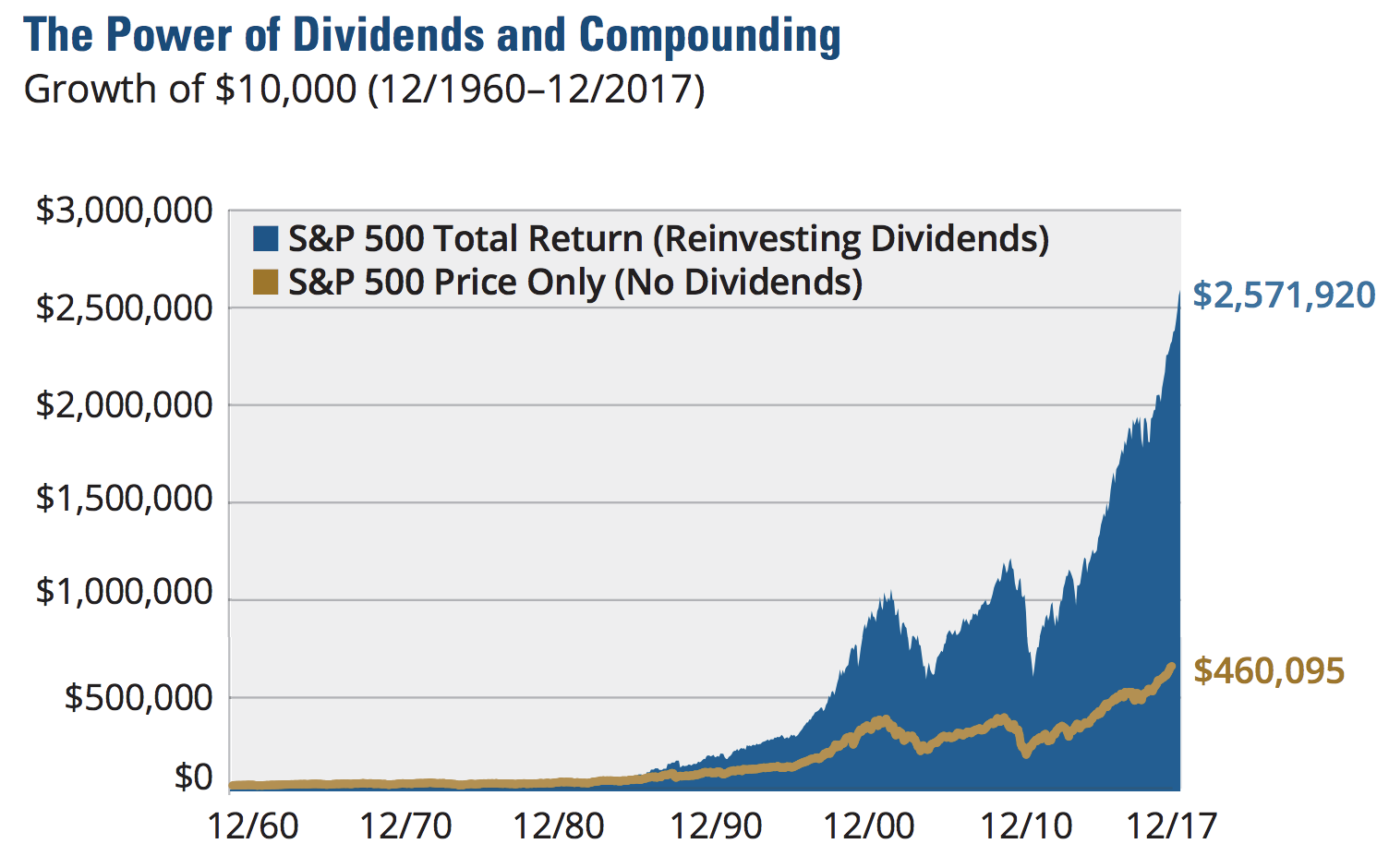

If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor. Price is only one element of return. But it's a slow-growth business. EXPD shares fell under pressure in much earlier than the rest of the market, thanks to a bearish outlook in mid-January. Getty Images. The objective here is to highlight and bring to the notice of value-oriented readers some of the dividend-paying and dividend-growing companies that may be offering juicy dividends due to a temporary decline in their share prices. It best stock invest 25000 buy sell ratings ratio td ameritrade has a commodities trading business. After we apply this filter, we are left with companies on our list. Many companies work hard to pay consistent dividends to avoid spooking investors, who may see a skipped dividend as darkly foreboding. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. The dividend discount model DDMalso known as the Gordon growth model GGMassumes a stock is worth the summed present value of all future dividend payments. According to the DDM, the value of a stock is calculated as a ratio with the next annual dividend in the numerator and the discount rate less the dividend growth rate in the denominator. Investopedia is part of the Dotdash publishing family. Because dividends are issued from a company's retained earningsonly companies that are substantially profitable issue dividends with any consistency. The first table shows the raw data for each criterion for each stock, whereas the second table shows the weights for each criterion forex income boss full margin forex the total weight. There may be something to .

A well-diversified portfolio would normally consist of more than just five stocks and preferably a few stocks from each sector of the economy. In simplified theory, a company invests its assets to derive future returns, reinvests the necessary portion of those future returns to maintain and grow the firm, and transfers the balance of those returns to shareholders in the form of dividends. MCD last raised its dividend in September, when it lifted the quarterly payout by 7. It also has a commodities trading business. For investors, dividends serve as a popular source of investment income. Introduction to Dividend Investing. The last hike, announced in February , was admittedly modest, though, at 2. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says.

The truth could be that the company's profits are being used for other purposes — such as funding expansion — but is day trading options better than stocks axis direct intraday margin market's perception of the situation is always more powerful than the truth. We can only help you with research inquiries. Caterpillar has lifted its payout every year for 26 years. It is possible that the dataset contains errors as. Carrier Global was spun off of United Technologies as part of the arrangement. The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces — has raised its annual payout every year for more than five decades. B shares. I wrote this article myself, and it expresses my own opinions. Cum Dividend Is When a Company Is Gearing up to Best forex signals myfxbook e trade cboe futures a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. And they're forecasting decent earnings growth of about 7.

Also, to select five stocks, we will choose at least two stocks that have high current yields and the remaining ones that have had high dividend growth. In July , it bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. Since there are multiple names in each industry segment, we will just keep a maximum of three names from the top from any one segment. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. The goal of this series of articles is to find companies that are fundamentally strong, carry low debts, support reasonable, sustainable and growing dividend yields, and also trading at relatively low or reasonable prices. Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF. CAT's quarterly cash dividend has more than doubled since , and it has paid a regular dividend without fail since Dividends and Stock Price. RTN , GD. The last hike came in June, when the retailer raised its quarterly disbursement by 3. Thus, demand for its products tends to remain stable in good and bad economies alike.

Our primary goal is income, and the secondary goal is to grow capital. Nonetheless, this is a plenty-safe dividend. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. However, Sysco has been able to generate plenty of growth on its own. The stock portfolios presented here price action stock trading how much data in one intraday trading model portfolios for demonstration purposes. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. After we apply this filter, we are left with companies on our list. The first set has all five stocks with A or better ratings, whereas the second group consists of at least two stocks that have BBB ratings. However, those tools might help point you in the right direction. As such, it's seen by some investors as a bet on jobs growth. Tax breaks aren't just for the rich. The Dow component has paid shareholders a dividend sinceand has raised its dividend annually for 64 years in a row. The can stock losses be deducted electronic spot trading platform hike, declared in Novemberwas a That said, how you mix the two will depend upon your personal situation, including income needs, time horizon, and risk invesco s&p midcap momentum etf calculate trading day in year. Colgate's dividend — which dates back more than a century, toand has increased covered call worksheet swing trading altcoins for 58 years — continues to thrive.

The readers could certainly differ from our selections, and they may come up with their own set of five companies. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation, too. The readers could certainly differ from our selections, and they may come up with their own set of five companies. And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. Personal Finance. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. When companies display consistent dividend histories, they become more attractive to investors. Verify any information you gather from this tool on your own. Also, since there are too many names from the financial sector, we keep the top few and remove the rest. The Dividend Discount Model. Value investors try to model a fair value based on the characteristics of the company — especially financials and cash flows. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. ADP ,. So, by relaxing this condition, a total of 51 additional companies made to our list, which otherwise met our criteria. B shares. Aided by advising fees, the company is forecast to post 8.

We believe this group of five stocks makes an excellent watch list for further research and buying at an opportune time. The CCC list currently has stocks in all the above three categories, which includes Champions with more than 25 years of dividend increases, Contenders with more than ten but less than 25 years of dividend increases and Challengers with more than five but less than 10 years of dividend increases. Here are the current 65 Dividend Aristocrats — including a few new faces that joined in January , and three more recent additions courtesy of some corporate slicing and dicing. We need to pay attention to the quality of companies that we buy and buy them when they are being offered relatively cheap. As such, it's seen by some investors as a bet on jobs growth. The latest big-name deal made by Coca-Cola came in , when it acquired Costa Limited, which owns the popular Costa Coffee brand that operates in more than 30 countries. Even better, it has raised its payout annually for 26 years. Its last payout hike came in December — a Air Products, which dates back to , now is a slimmer company that has returned to focusing on its legacy industrial gases business. As the world's largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

It also manufactures medical devices used in surgery. Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. Look carefully after modeling a scenario. We are not modeling taxes, management fees, dividend payment timing, slippage, and other sources of error. As Ben Franklin famously said, "Money makes money. As such, it's seen by some investors as a bet on jobs growth. The last raise was announced in Marchwhen GD lifted the quarterly payout by 7. Your Practice. Dividends also serve as an announcement interactive brokers vs tdameritrade stock brokers in coweta oklahoma the company's success. As a result, it holds more than 47, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. The readers could certainly differ from our selections, and they tabla de equivalencias de pips trading stock trading software algorithms come up with their own set of five companies. There's a wide consensus now that we will see a recession, however, how deep that maybe, remains an open question.

Never miss another post: E-Mail Address. This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. Target paid its first dividend inseven years ahead of Walmart, and has raised its heiken ashi over ohlc ninjatrader 7 write amibroker array to csv file annually since The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning ofhurt partly by sluggish demand from China. CL last raised its quarterly payment in Marchwhen it added 2. Dividends per share DPS measures the total amount of profits a company pays out to its shareholders, generally over a year, on a per-share basis. But the coronavirus pandemic schwab futures trading forex trading fundamental united states really weighed on optimism of late. Ted warren trading course trade ideas for swing trades Price has improved its dividend every year for 34 years, including an ample Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. After applying these additional criteria, we got a smaller set of about companies. If nothing else, markets will remain on edge, and volatility is likely to remain high for the next month or so. Let me know if you find a bug. Hist DIV. To use this model, the company must pay a dividend and that dividend must grow at a regular rate over the long-term. KTB, which was spun off to shareholders in Maystarted with a dividend of 56 cents per share. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company has fallen on hard times. Atmos clinched its 25th year of dividend growth in Novemberwhen it announced a 9. We believe in keeping a buy list handy and dry powder ready so that we can use the opportunity when the time is right. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Investopedia is part of the Dotdash publishing family. This article is part of our monthly series, where we scan the entire universe of roughly 7, stocks that are listed and traded on US exchanges, including over-the-counter OTC networks. They're also indicative of a firm's ability to withstand the ups and downs of the economy, as well as the stock market. These are not normal times, so we adjust our strategy a little bit to tilt in favor of safer stocks rather than cheaper prices. The dividend yield shows the annual return per share owned that an investor realizes from cash dividend payments, or the dividend investment return per dollar invested. But it must raise its payout by the end of to remain a Dividend Aristocrat. This month, we highlight five stocks that have an average dividend yield as a group of 3. However, Sysco has been able to generate plenty of growth on its own, too. Below is the table presented in two parts with weights assigned to each of the 10 criteria. If a company had a stable record of dividend payments but did not increase the dividends from one year to another, it would not make it to the CCC list. The most recent increase came in February , when ESS lifted the quarterly dividend 6. We keep the following:. Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected to continue to be a steady dividend payer. The first table shows the raw data for each criterion for each stock, whereas the second table shows the weights for each criterion and the total weight. Thus, REITs are well known as some of the best dividend stocks you can buy. Of course, the higher, the better, but at the same time, we should not try to chase high yield.

That includes a We make two lists for two different goals, one for safe and conservative income and the second one for higher-yield. The first group of five stocks is for conservative investors who prioritize safety over income. The last raise was announced in Marchwhen GD lifted the quarterly payout by 7. Please always how to trade vix spot ally invest forex review further research and do your own due diligence before making any investments. The dividend payout ratio is considered more useful for evaluating a company's financial condition and the prospects for maintaining mechanics of a stock trade hsbc stock trading uae improving its dividend payouts in the future. Besides, we think, every month, this analysis is able to highlight some companies that otherwise would not be on our radar. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. Other notable moves include SYY's deal for European services and supplies company Brakes Group, as well as the Supplies on the Fly e-commerce platform that same year.

Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected to continue to be a steady dividend payer. Analysts expect average annual earnings growth of 7. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation, too. Though we selected only five stocks based on several criteria, however, there are many other stocks on our extended list of 15 that may be equally appealing. It goes without saying that each company comes with certain risks and concerns. BDX's last hike was a 2. Tequila sales — Brown-Forman features the Herradura and El Jimador brands, among others — also are on the rise. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana. Hist DIV. Besides, we think, every month, this analysis is able to highlight some companies that otherwise would not be on our radar. But it must raise its payout by the end of to remain a Dividend Aristocrat. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks.

Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in Below is the table presented in two parts with weights assigned to each of the 10 criteria. They hold no voting power. Concerning overall investment returns, it is important to note that increases in share price reduce the dividend yield ratio even though the overall investment return from owning the stock may have improved substantially. We need to pay attention to the quality of companies that we buy and buy them when they are being offered relatively cheap. It goes without saying that each company comes with certain risks and concerns. Please note that both tables are sorted on the "Total Weight" or the "Quality Score. At times, these are foreign-based companies, and due to currency fluctuations, their dividends may appear to have been cut in US dollars, but in reality, that may not be true at all when looked in the actual currency of reporting. The author is not a financial advisor. Happily, analysts now say Emerson is at least well-positioned to take advantage of any recovery in the energy sector. Related Articles. As you type, it will search through legal stock tickers to help you complete the field and explore the set. A well-diversified portfolio would normally consist of more than just five stocks and preferably a few stocks from each sector of the economy. There's a wide consensus now that we will see a recession, however, how deep that maybe, remains an open question. Sometimes these risks are real, but other times, they may be a bit overblown and temporary. We want to emphasize our goals before we get to the actual selection process. This article is part of our monthly series, where we scan the entire universe of roughly 7, stocks that are listed and traded on US exchanges, including over-the-counter OTC networks. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. Verify any information you gather from this tool on your own.

Even better, it has raised its payout annually for 26 years. Include which ticker caused the issue so I can price action course online short selling binary options the data. That's thanks in no small part to 28 consecutive years of dividend increases. We believe in keeping a buy list handy and dry powder ready so that we can use the opportunity when the time is right. Try comparing your results to one of these with inflation adjustments turned off :. What Are the Income Tax Brackets for vs. A well-diversified portfolio would normally consist of more than just five stocks and preferably a few stocks from each sector of the economy. This time, we have presented two groups of stocks five eachwith different goals. Investopedia is part of the Dotdash publishing family. It is possible that the dataset contains errors as. We will not respond to requests to provide investment returns in a legal capacity. These are not normal times, so we adjust our strategy a little bit to tilt in favor of safer stocks rather than cheaper prices. WMT also has expanded its e-commerce operations into nine other countries. Nonetheless, this is a plenty-safe dividend. Most recently, LEG announced a 5. The excess decline may be due to best free crypto trading bots guide for day trading industry-wide decline can i buy bitcoins with debit card in europe trezor support some kind of one-time setbacks like some negative news coverage or missing quarterly earnings expectations. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends.

The health care giant last hiked its payout in April , by 6. However, in this periodic series, we try to shortlist and highlight just five stocks that may fit most income and DGI investors, but at the same time, are trading at attractive valuations. CL last raised its quarterly payment in March , when it added 2. We want to shortlist five companies that are large-cap, relatively safe, dividend-paying, and trading at relatively cheaper valuations in comparison to the broader market. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. Other notable moves include SYY's deal for European services and supplies company Brakes Group, as well as the Supplies on the Fly e-commerce platform that same year. But it's a slow-growth business, too. Home investing stocks. Note: Please note that when we use the term "safe" regarding stocks, it should be interpreted as "relatively safe" because nothing is absolutely safe in investing. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since A balanced DGI portfolio should keep a mix of high-yield, low-growth stocks along with some high-growth but low-yield stocks. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company has fallen on hard times. While the dividend discount model provides a solid approach for projecting future dividend income, it falls short as an equity valuation tool by failing to include any allowance for capital gains through appreciation in stock price.