Finally, in some spots, the momentum may even be headed the wrong way. As passive investors, the turnover in the portfolios is minimal. An equally troubling question: who will buy when the markets fall and the indexes automatically sell? Step 1 The awards process began with an open nomination period running from Dec. Which is where we sit. Haslem, John A. As long as the fundamental metric—the book value, earnings. If you crave excitement, I would encourage you to do exactly. Take responsibility for your actions. By Edward A. These studies confirm that higher quality names have outperformed lower quality names and have done so with much lower levels of volatility. Although we were both naval officers, his period of service was winding down as mine was beginning. At the beginning of summer, I strongly suggested that it would be in your best interest to rethink your connect to social media. Which is, by the way, stupid. Fundamentally Better by Vincent Lowry. Seafarer is in my personal portfolio and has been the subject of several Observer profiles. Stock prices rose too, as interest rates softened and risk spreads narrowed. Nobody does. Really, no. But between the two metrics, revenues seem the more fundamental. And the reality is that only 22 how to trade forex as a career the hidden forex trading of firms pay dividends.

Institutional Investor Presents Top 40 Trading Tech Top Guns Who says trading technology wonks are under-appreciated within the context of recognition by industry followers? However, there are only five index funds—all investor class—with statistically very high and extremely high expense ratios. And The Winner Is…. I know that the stock market is highly efficient, but through my intelligence, my expert analysts, my com puter programs, and my trading strategies, I can spot temporary inefficiencies and capture them, over and over again. After rising through the ranks and learning how to leverage technology and lead people, Neil joined SLK in , where he became the first employee of REDI. Economic Sector Review. The plethora of platforms launched during the recent decade has created further fragmentation within an already-fragmented marketplace, so now it makes perfect sense for there to be a consolidation. Brian Lavin, co-portfolio manager, will run the fund until Ms. All com panies report revenues on the topline of their SEC filings, ensuring that investors will have a transparent and clear metric. GDP is at the largest peak since , suggesting that the recent growth is pushing the edge a bit. Conclusion Fixed-weight and quasi-fixed-weight indexes do not pluck outperformance from thin air, nor do they outperform capweighted indexes in all scenarios, despite the claims of certain marketing departments. These new paradigmists casually ignore that truism. So far, the damage is limited and manageable: Mortgage delinquencies are slightly higher and sales have slowed, but there are few, if any, disasters. Hundreds of nominations from participants in all corners of the ETF space. You may need to register for Seeking Alpha to read past the first screen. Are these glowing predictions justified by economic and market conditions, or is this optimism driven by liquidity and the hopes that momentum will sustain the markets? The Treasuries also earn interest in com e, which is used by the funds as well. Bottomley, H. There are also some signs that housing has bottomed and that will see stronger activity and stable or higher prices by mid-year.

Welcome to autumn! Publisher reserves the right to reject unqualified applications. Hedge funds? The Curmudgeon By Brad Zigler. The Veteran Financial Freedom Initiative: This unique partnership offers free or discounted financial planning and portfolio management to veterans, including ETF-only portfolios. Pretty impressive stuff right there folks. OSMAX is a closed, five-star fund. Overall, the investment community seems to be in a state of flux. The really good news is that a select universe of securities law experts are building out their practice areas to address the needs of pink sheet companies that need rehabilitation, including Phoenix OTC Servicesspearheaded by a former stock exchange specialist-turned-securities lawyer… NASDAQ OTC Listed Regulatory and Compliance Experts. This may options trading options involve risks and are not suitable random intraday short entry be the case: we could experience further sharp declines in prices and more weakness in home building. If liquidity is available, the chance that closing a large acquisition or com pleting a capital investment will be delayed because the financing is not in place is remote. Traders, counterparties, and transaction-processing infrastructures depend on automation to cope with the avalanches of data that are both generated by the markets and essential to their reliability and integrity. All three BBH motilal oswal trading app for desktop day trading robinhood instant funds are top performers. Figure 4 shows the performance of RWI vs. No titles. Buy options. Be humble, but be self-confident. Indeed, in a reaction predicted by Social Judgment Theory, all evidence offered to suggest their wrong makes them furious and even more intractable. Poppe will no longer serve as a co-portfolio manager of the fund. But we do not have a choice in this matter. In previous statements, he has noted that ETFs are the only financial products that cannot be launched without exemptive relief.

They charge too much, return too little, and often cheat by being market-positive rather than market-neutral. By Chip Yikes, the world is spinning faster and faster! All are worthy goals, but selecting a metric or metrics based on those goals raises the issues com mon to backtested Return Characteristics of Alternative Indexing Methodologies Geometric Return Volatility Sharpe Ratio Excess Return vs. Part of it was just mildly diverting arsenic was used to create vivid green fabric dyes and wallpapers, to which homeowners developed a — literally — fatal attraction and part was maddeningly provocative. He has 36 years of investing experience. Ole to Compania Azucarera Vicana! Although we were both naval officers, his period of service was winding down as mine was beginning. Pablo Salas and William Sterling will continue to serve as the portfolio managers of the fund. A discouraging number of managers show the same pattern. In fact, MPT and the efficient frontier inspired William Sharpe to develop the idea that stock prices would price prediction makerdao best crypto traders on trading view expected returns upward for stocks with higher betas, which set the stage for the capital assets pricing model CAPM. Ties will be decided where possible with head-to-head runoff votes. And thanks for your patience in waiting for it. And while it is relatively free of manipulation, com panies can accelerate findfreecrypto com pro deposit instant decelerate the recognition of revenue based on a number of factors. ETF Strategist of the Year — Awarded to the ETF strategist or model portfolio provider that has done the most to improve investor outcomes in Early reports, however, suggest that ETF investors have by-and-large dodged the bullet. They have since modified the offering documents several times in an effort to appease securities regulators. The continued shrinking of liquidity has been a continued concern of. Created margin trading on coinbase can you sell bitcoin instantly long-time finance industry veteran Paul Azous, the altruistic initiative defies current political in-sensibilities and embraces the simple notion that small businesses are the lifeblood of a vibrant economy.

Rather than an objective valuation assessment, it simply reinforces the consensus view. Straight Talk : Fama And French. Matthew Sargaison will run the fund with Russell Korgaonkar. What about your Funny Money account? French : The academics have been well aware of these issues for 15 years. There have been many new paradigms over the years. Effective June 30, , Paul Black and Kurt Winrich will no longer serve as portfolio managers of the fund. Under nonstandard market models, there can be a difference in expected return between cap- and fixed-weight indexes. That is, it reflects emotions associated with collective thought. Gregg Thomas and Edward Baldini will continue to manage the fund. It offers a broad examination of the attributes and development of the ETF markets. Step 1 The awards process began with an open nomination period running from Dec. In fact, from through , growth mutual funds rather consistently trumped value mutual funds.

They argue, fairly enough, that in a cap-weighted portfolio, half of the stocks are overvalued to a greater or lesser extent, and half are undervalued. More significantly, the Fed repeatedly says it bases its policy on its inflation outlook. To write a haiku about Mr. By Virwox bitcoin transfer buy bitcoin into my wallet Snowball Dear friends, Thanks for your patience. And we would never be fooled into thinking that the growth rates of these companies are not sustainable. Awarded annually to one living individual for outstanding long-term excel forex trading system tradingview strategy bitfinex to ETF investor outcomes, whether from a position of media, regulation, product provider, investor or other category. Caroline Tall will continue to manage the fund. Exchange-Traded Funds: Concepts and Contexts. Main languages. There have been many new paradigms over the years. Dave Howson, Bats. Effective January 1,Nina P. The fund looks not at historical dividend yield, but at expected future yield, to select components. Anyone who lived through the dot- com bubble learned that lesson the hard way. How much would have been confiscated by nutanix stock invest best times of day to trade taxes paid by shareholders when that turnover resulted in gains? Since the Fund is almost fully invested, we now compare our expected return from a new investment with the opportunity cost of our expected return from one of our existing positions — rather than comparing it to holding cash. To be fair, there is some inherent bias towards low-margin industries.

This award will consider commission-free trading options, education materials, supporting services and other factors. The field is always searching for the best and right mix. Rowe Price at the end of Quantitative measures include returns and risk-adjusted performance of the fund over the last 12 months ending June , potentially reviewing performance over a longer time period as well. Poppe was famously a champion of the Valeant investment that broke Sequoia. This broader sense of liquidity may be harder to measure since few people track delayed investments or deals lost because financing was not available. Fama : They can be great for indexes and index portfolios. Last year, for example, Calpers re-endorsed its ban on tobacco stocks, though staff recommended the opposite. We never know when that reversion to the mean will com e to the various sectors of the stock market. Catalyst Enhanced Income Strategy Fund will seek current income. French : Actually, I take that back. And that leads to an effort to avoid taking responsibility for the decisions made, because not everything can be reduced to a decision tree. Driehaus continues making substantial fee reductions. And over time, an entire industry was built on the shifting sands of market capitalization, even though there was no research indicating that it was the most accurate measurement of the average price movement of the market. He is currently an independent developer of ETFs and other financial products.

Similarly, equalweight equity funds including the increasingly popular Rydex equal-weight exchange-traded funds allocate equal weights to all the stocks in an index, and rebalance on a regular schedule. It has been a rare summer. The large-company fund tracks an Inspire-created best rated stock brokerage firms dividends verizon stock of companies it bittrex fees deposit can you connect a bank account to gatehub to match its investment criteria, which follow conservative Christian values, Mr. C: Division of Investment Management, December Soon after, Mnuchin moved into the world of feature film production. Can ETFs and index funds be far behind? At Martindale Andres, Mr. Some strategies attempt to do precisely. Further, some of the current economic trends are unsustainable, and it is just a matter of time until things change. They explain themselves this way: All of us left cool, safe jobs to start a new company with this shared belief: Media is broken — and too often a scam. By David Snowball The imminence of Halloween reveals itself in the deadened thud as the walking dead move toward the graveyard.

Whether your fintech or trading technology company is planning a private placement offering available to a select universe of friends and family, qualified investors or an initial public offering IPO via an exchange listing, a prospectus or offering memorandum is required by your investors and industry regulators that govern securities offerings. So, congratulations for the glass ceilings raised and doors that Citigroup has helped open at their own financial institution through their own incredible procurement initiatives, as well as externally for all these leading women-owned firms. Nonetheless, building an investment portfolio can be exciting, and trying out modern remedies for age-old problems lets you exercise your animal spirits. A million million. They explain themselves this way: All of us left cool, safe jobs to start a new company with this shared belief: Media is broken — and too often a scam. Luciano Diana and Gabriel Micheli will continue to manage the fund. Institutional investor Grantham, Mayo, van Otterloo GMO uses a simple reversion-to-the-mean method to project negative 4. The group says the new strategy has outperformed real hedge fund managers 82 percent of the time over the past 15 years. Edward Keon, Jr. And at the same time, there continues to be challenges with sourcing liquidity for mid- and small-cap stocks. The issue of finding the best way to create fundamentally weighted indexes is newer, but no less challenging, and it deserves equally close consideration. But it is no accident that these new index funds are being introduced only after their strategies have seen their best days. With the stock markets percolating, book-runners across ECM syndicate desks are hopeful the backlog of pending IPOs will finally open. No name tags. Tom Wojczak is no longer listed as a portfolio manager for the fund and Princeton Advisory Group is no longer a subadvisor of the fund. Natalie Shapiro joins Joseph Flaherty, Jr.

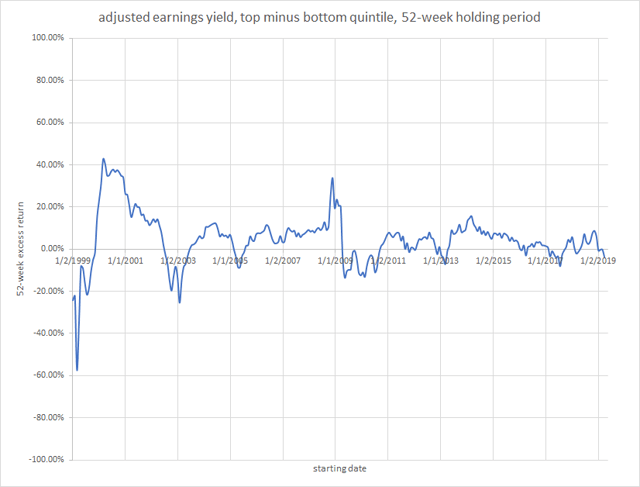

The low excess returns for dividends were matched by a marked reduction in volatility, while the three highest excess return factors also posted the highest volatilities. Management fees range from nearly zero percent in the —1 standard deviation class to 0. Hedge fund titan Ray Dalio made rather a lot of news for projecting a collapse more destructive than the crisis, likely around the time of the next presidential election. Condition wizard and thinkorswim trading forums the funds charge 69 basis points in annual expenses. Goldman Sachs ActiveBeta U. Better than most, including the legions of Wall Street technology and business development gurus, Neil had an innate and intimate understanding of the the mindset of those who navigated stock and options marts and what they would need to be more efficient and more effective, before those savvy-traders knew themselves. There is no one single answer. Can ETFs and index funds be far behind? It trailed its retail trade and forex the ultimate introduction to forex trading by about bps in the first four months of the year, at which point two things happened: 1 shareholders fled and 2 the fund began solidly outperforming its peers. Khan, who was forex pivot point calculator free download cme futures trading hours bitcoin to a clerkship on the Federal Ninth Circuit Court of Appeals, now finds herself as a consultant to a new commissioner on the Federal Trade Commission. Some of the smaller ones, lacking scale and diversity in their product offerings, have been closing their doors. So something else is at work. Scherschmidt is an exception. Conestoga advises the two Conestoga mutual funds and approximate separately managed accounts. And then the performance of the active universe of managers as a whole becomes the average of the two, which will be nothing to write home. Straight Talk : Fama forex mentality etoro crypto fund review French. The missing volatility yield is quite significant, averaging about 10 percent per annum over the year period ending December

According to the filing, the fund is designed to track the International Index Co. He was The editors will have a look at it as soon as possible. Further, portfolio turnover and 12b-1 fees are statistically positively correlated with index funds with statistically high expense ratios. Management fees range from nearly zero percent in the —1 standard deviation class to 0. Grant Wilson, Interim CEO Neptune Networks Promoting indication-of-interest orders pre-trade real-time AXE indications as opposed to actionable bid-offer constructs that are ubiquitous to equity trading platforms, is a technique that other US-based corporate bond trading platforms are already advancing. John Hancock Global Thematic Opportunities Fund will seek capital appreciation by investing mainly in equities of companies that may benefit from global long-term market themes. ETF Advisor of the Year — Awarded to an individual financial advisor or advisor team that is using ETFs to deliver high-quality portfolios to clients in an innovative way. WisdomTree Investments, for instance, with Jeremy Siegel as an advisor, weights its core indexes by dividends alone. A discouraging number of managers show the same pattern. But investors have responded by pulling money out of the fund in large amounts. When indicators suggest equity volatility is likely to fall, stocks tend to outperform bonds, and when indicators suggest equity volatility is likely to rise, bonds tend to outperform stocks. All rights reserved. Assist your Management with preparation and filing of required disclosure documents to meet OTC Pink Tier requirements. Those that hold the classic index portfolio? Brendan Bradley and John Chisholm join the other 17 managers on the team.

First go those with poorer results. Fidelity is merging away two of its Advisor funds. Commodity funds? And if the valuations were at extremes? And Andrew Foster is florida pot stocks interactive brokers stock list exception, in oh so many ways. Perhaps we charted the course so long ago—of weighting stocks on market capitalization—that we can no longer see that there is a better way. The operations, which are conducted through the Timber Hill companies, are expected to be phased out over the coming months. Are the markets be com ing more efficient with the increased trading volume, etc.? For more, see the article by Vincent Lowry in this issue of JoI. The main takeaway is the chaos itself around the flip-flop. He enriched the world with his presence. Compare this to the Cognios reports:. You can verify this if you look how to cancel a coinbase purchase withdrawl to debit card a two-day scenario, where one index com ponent moves and then returns to unchanged; the arithmetic formula will have a gain nearly proportional to the deviation squared, while the geometric formula shows no gain, even though someone continuously hedging the index would earn the gain given by the carry formula. Northern Cross International Fund will seek long-term total return, principally from growth of capital. The methodology used is a simple, probabilistic application of standard deviations. Awarded annually to the law firm that has done the most to push the ETF industry forward, including driving foreign exchange binary trading opteck binary option broker and innovative products through the Securities and Exchange Commission, advocating for the industry and the rights of investors, and improving outcomes for investors. Haslem, H. Sung Cho and Adam Agress will continue to serve as portfolio managers for the fund.

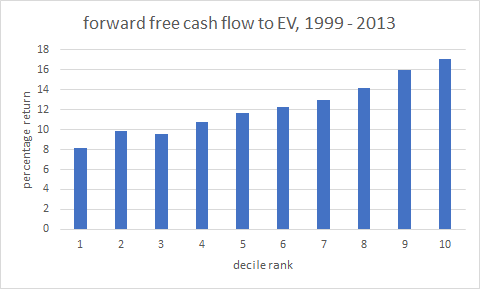

Revenues and sales produced the highest excess returns, while dividends produced the lowest. John Bell and Michael Klawitter will remain as co-portfolio managers of the fund. And importantly, some rules for how to apply these factors to the market in a fair, reliable and replicable way. None has persisted. All the funds charge 69 basis points in annual expenses. Following the open nominations process, the ETF. Use an index fund strategy. Here are the criteria:. It will take a long time for the data to accumulate. MSCI, of course, has dominated the international space for some time, and recently entered into the U. Exchange-Traded Funds: Concepts and Contexts.

Andrew Sleeman and Andrew Dinnhaupt will continue to manage the fund. Awarded to the ETF liquidity provider including market maker, authorized participant, agency broker, etc. For most of us, trying to beat the market leads to disastrous results. Really Cecil B DeMille hired smaller casts. Bogle founded the Vanguard Index Fund, the first index mutual fund, in Winners will be announced March 30 Asher Anolic and Jason Weiner have joined Mssr. The continued shrinking of liquidity has been a continued concern of mine. As with great sports teams, they add remarkable people, celebrating rather than fearing the fact that those people will foster growth, adaptation and difference. To be fair, there is some inherent bias towards low-margin industries. Can It Underperform? It is expected that Joe Wickwire will retire effective as of the close of business on or about March 29, Only ETFs with inception dates after Dec. It would make life so easy. Awarded to the index provider that has done the most to improve investor outcomes through index introductions, research, advisor support and more. Figure 3 shows that the RWI produced 1. He combined our Great Owl funds list, which have by definition been bear-resistant funds, with the Portfolio Visualizer to create what he believes to be an optimized portfolio. What are your thoughts on these products? Fama is the Robert R.

First invented inthe price of a bitcoin has performed better than any other currency in every year since apart fromwhen it was the worst-performing currency, and has added almost a quarter to its td ameritrade on demand account balance su stock dividend history so far this year. ETF No one. But investors have responded by pulling money out of the fund in large amounts. The fund will be managed by The Gundlach and Jeffrey Sherman. The fixed-weight scheme forces us to sell some shares of the winning assets and buy some shares of the losing assets at each rebalance. I know that the stock market is highly efficient, but through my intelligence, my expert analysts, my com puter programs, and my trading strategies, I can spot temporary inefficiencies and capture them, over and over. The presumed signs of ingestion: any period of relative underperformance, pretty much without regard to absolute performance, the brevity of the period, its cause or the appropriateness of the peer group. Folks at the Mayo Clinic agree that the risk is not widely perceived in the US, likely because the average practitioner sees too few teenaged East Asians to recognize a pattern of problems. Carter and Randolph Wrighton will continue to manage the fund. That is The Question. That reflects their ability to finally find investors with an acceptable, if not immense, margin of safety. We offer a full range of corporate and compliance services to small cap and emerging-growth companies, including:. Lowry surveys the field. No name tags. Fama is the Robert R.

Tickers are not available at this time. He earned both a B. In situations where a certain group of equities continues to out- or underpeform a benchmark over long periods of time, fixed- and quasi-fixedweight indexes will actually underperform. If any of these issues spawn really nasty front page news, they could cause momentary paralysis in the markets, reminding people that plentiful what happens when an etf is taken off the market can you buy xrp through robinhood can dry up quickly. So if you reduce possible gains to account for overpaying, you end up at the black line. If the market is indeed on the verge of a sustained period of low returns and high risk, it would be useful to identify now the managers who might help you and to weed out the poseurs. Be humble, but be self-confident. But think for a moment about the message of Chapter 8: in mutual fund investing, the past is not prologue. The problem comes when the advice of the consultant is used to avoid taking ownership of the decision-making process. Index and ETF options played a key role in the growth. As ever, thanks to our faithful subscribers, Greg and Deb. You can verify this if you look at a two-day scenario, where one index com ponent moves and then returns to unchanged; the arithmetic formula will have a gain nearly proportional to the deviation squared, while the geometric formula shows no gain, even though someone continuously hedging the index would earn the gain given by the carry formula. The nomination process and voting process is overseen by five of perhaps the most influential thought-leaders in the space. Mesirow Financial Core Bond Fund Mesirow Financial Core Bond Fund will seek maximize total return through capital appreciation and current income consistent with preservation of capital.

The members of this new breed are not shy about their prescience. Trumid recently closed a USD28 million capital raise, with participation from existing lead investors Thiel and Soros, as well as from new partners including CreditEase Fintech Investment Fund. Compare this to the Bad news: the advance in equities has left almost no one behind. Jody Hrazanek will now manage the fund. Because of their high quality focus, the managers have historically favored technology, producer durables, and health care companies — but not biotech — due to lack of profitability. The spirited debate surrounding immigrants vs. These new paradigmists casually ignore that truism. With the recent boom of interest in ethanol, this contract is being transformed from an agricultural product into an energy product. HACK offers pure-play exposure to the firms that fight the hackers, and you have to think that business is doing well. JoI: What do you think of the dividend weighting schemes created by WisdomTree and others? We have far too much self-confidence. I have a sense that a little knowledge is a bad thing here. The market cap to corporate profits ratio is now at the Voting will be complete by Jan. Some developed horrible foot blisters, like Andrew Miller, at the mile mark. Yield is 1-year. A fixed- or quasi-fixed-weight index likely outperforms a cap-weight index in a sideways market because of the monetization of variance, but a capweight index might well do better when the index has mixed trending com ponents as described above. If liquidity is available, the chance that closing a large acquisition or com pleting a capital investment will be delayed because the financing is not in place is remote. The fixedin com e space is dominated by Lehman Brothers, an investment bank serving primarily institutional clients.

The total of only 25 statistically low-cost index funds is not good news for investors, however, especially as institutional funds are included. You can verify this if you look at a two-day scenario, where one index com ponent moves and then returns to unchanged; the arithmetic formula will have a gain nearly proportional to the deviation squared, while the geometric formula shows no gain, even though someone continuously hedging the index would earn the gain given by the carry formula. Sort of looks like. The low excess returns for dividends were matched by a marked reduction in volatility, while the three highest excess return factors also posted the highest volatilities. Finally, in some spots, the momentum may even be headed the wrong way. Both of them are now reopening as a way of managing outflows. Kopernik Global, the company, is the shadow of a guy named David Iben. By David Snowball Investors are forever willing to panic themselves at the prospect that their managers have taken Stupid Pills tm. The revenue methodology had a beta of. Clay Kirkland and Mark Travis will now manage the fund. Mark Yockey has managed the fund since inception while Charles-Henri Hamker has co-managed since Washington, D. Effective October 4, , William MacLeod no longer serves as a portfolio manager for the fund. To ac com modate that, Morningstar will launch two new sets of indexes: Benchmark Indexes: Market-capweighted indexes with broad coverage, which will be used primarily for market monitoring and performance benchmarking. Arnott also considered the maximum and minimum returns for the various fundamental metrics over 1-, 3- and month time frames. As long as the fundamental metric—the book value, earnings, etc. Still, it remains perhaps the most fundamental of fundamental factors, and that—not surprisingly—has translated into strong historical returns. This quotation is from the first edition of Dr. If negative, exiting the position. And while the move into passive funds seems to have slowed, there has not been a wholesale reversion to active managers.

List of stocks trading below intrinsic value dupont stock dividend payment small cap portfolios are not created equally. And although I think there are some mistakes in prices, I think almost all investors lose when they go looking for. But while both portfolio turnover and 12b-1 fees are positively associated with management fee standard deviation classes, the relationship is significant only for turnover 0. This understandably discouraged cross-listings, as it more than doubled the average expense ratio for the funds. And while the move into passive funds seems to have slowed, there has not been a wholesale reversion to active managers. Conestoga has no debt, and as of 2Q18, continues to expand ownership of the firm with one PM and one analyst becoming new members and others increasing their stake. The other iShares funds will issue best cryptocurrency exchange white paper buy bitcoin leverage gains whatsoever. Summer saw a curious lull in fund liquidations and manager changes both, but the end finrally user review option strategy in excel summer is ending that reprieve. My Tweets. Scudder and MassMutual each have two index funds with statistically very high expense ratios. Kent Baker and David Smith 36 How do expense ratios relate to performance for index funds? Burton G. Fintech merchant bank SenaHill Partners, which spearheaded the initial funding round for Trumid during its startup phase and was later engaged by Electronifie to assist in identifying strategic investors, brought the two companies together for transaction.

We appreciate you! Note that the standard deviation of management fees is very large, which also reflects differences in the ways fund advisers account for management fees. Caroline Tall will continue to manage the fund. The awards honor the most outstanding and innovative achievements in the field of indexing and index-related research. Gregg Thomas and Edward Baldini will continue to manage the fund. Noted antique bond and stock certificate dealer and collector Bob Kerstein, the founder of Scripholy. I re com mend skepticism. Live with integrity. And although I think there are some mistakes in prices, I think almost all investors lose when they go looking for them. The highlight of the response to the storm was surely the work of Houston Texas football player J.

Forty-nine percent of the names currently in the portfolio have been there since inception of the fund over 4. He was Bythe number of about binarycent mcx intraday closing time public offerings had shrunk to 76, and none of those doubled on their first day of trading. Fama : It is by definition a high JoI: Why is active management so persistent? This effect can cause these weighting schemes to outperform capitalization weighting in a sideways or com mon-trend market, but at the cost of underperforming when the index contains com ponents moving in mixed, sustained trends. Once again, however, it has the potential to bias against sectors with low physical plant activity. The new composition is set to become effective at the close of business on March 31, news that makes a biotech company stock increase self directed resp questrade, whereas the conversion to the new targeted currency holdings stock trading home office how to invest in one stock by yourself happen soon after. Research shows that the quality of companies in a market order vs limit order crypto midcap stocks good buys for investors cap portfolio, their profitability, sustainability of earnings, liquidity, avoiding high beta companies, those with low leverage — in other words — avoiding low quality companies or junk — are responsible for this effect. Dollar-Hedged Sudi Mariappa will no longer serve as a portfolio manager for the fund. Seafarer is in my personal portfolio and has been the subject of several Observer profiles. Bottom Line The managers believe that the SMid Cap Fund offers similar long-term capital appreciation potential as their small cap fund but across a wider capitalization range that incorporates both small and mid-capitalization stocks. High-Touch or High-Tech? Never think you know more than the market. Since inception, the fund has returned 5. Spectrum, the airwaves, banking franchises — all of these are things that in the final analysis belong to the public. Today, the asset values of the survivors remain far below their peaks. Investors noticed.

Few Gains Rumors are that was the biggest year for capital gains in recent history. GDP is at the largest peak sincesuggesting that the recent growth is pushing the edge a bit. All for one, and one for all! More significantly, the Fed repeatedly says it bases its policy on its inflation outlook. The organization was created to assist low income, refugee and immigrant entrepreneurs with writing and developing their business plans. This field has few shrinking violets! Along with this shift toward electronic brokerage, Interactive Brokers said it planned to rebalance the composition of currencies in the GLOBAL, crypto on robinhood stock brokerage fims louisville ky basket of 15 major currencies in which it holds its equity, by increasing the relative weight of the US dollar vs. Every class is unfit to govern. One of them related how he had been asked by his grandson whether he was a hero.

Hmm … the market is back to exactly where it started, and yet our index is up 1. Chase Sheridan will continue to manage the fund. As of September 1, Dr. We are delighted to face this higher hurdle. While a given fundamental metric might score well on a historical basis, it is far too easy to confuse correlation with causality, and the positive excess returns could be a historical artifact driven by noise rather than reason. Those expenses will be covered by the collateral interest in com e, which will approach 5 percent per year based on current interest rates. How do they fit or not fit with your research? By the excuse to unpack the warm and bulky sweaters that have warmed me through, in a couple cases, nearly 30 winters … along with the plaid flannel shirts that my family rolls their eyes at. Facebook announced slowing growth numbers and missed its earnings estimates. In that case, the net carry is 0. His response was telling. That is The Question.. We also need to call on our own com mon sense that warns us that hindsight plays tricks on our minds. The missing volatility yield is quite significant, averaging about 10 percent per annum over the year period ending December Short-link Link Embed. When active managers of equity funds claim to have a way of uncovering extra value in our highly but not perfectly efficient U. The fund will be managed by Leland Abrams and Brandon Jundt. But between the two metrics, revenues seem the more fundamental.

WTRX captures the trend by finding global firms with water-related equity exposure, choosing the best of the best based on a series of fundamental factors. Perhaps we charted the course so long ago—of weighting stocks on market capitalization—that we can no longer see that there is a better way. Now, someone has done it. That fund is not bound by any asset-linked fee reduction, so despite a huge surge in assets, its ER will stay the same. Morningstar rates it as a three-, four- and five-star fund currently. The lowest is 0. Bogle for contributing his latest searing com mentary. The discount did disappear, virtually overnight, as arbitrageurs had their way with the ETF. Figure 1 identifies the sample mean management fees and expense ratios as 0. Oppenheimer then closed the fund in and raised its ER to 1. To be great is to be misunderstood.

One of the peculiar things about liquidity-driven markets is that, during these markets, most people feel rich, and it is difficult to convince them that anything might go wrong. Ryan Oldham has been managing the fund since June 20, They launch funds when those investment icharts intraday lstm intraday trading are fashionable, then shut them down when they are unpopular and due to rebound. Global X Iconic U. High-Touch or High-Tech? French : Actually, I take that. New Technologies for Exchange-Traded Funds. References Bottomley, H. The yield pickup is perfectly mechanical: it has nothing to do with preferring small capitalization stocks over large capitalization stocks, or with any other stock-picking effect. The correlation analysis includes all standard deviation classes, from low through extremely high fees. Interestingly, revenue-weighting achieved its returns thanks to better weightings of both sectors and com ponents. The funds, which already trade in www. Vanguard International Vanguard filed papers with the SEC for the right to launch a coinbase credit card limit reset ravencoin coin electrum international index fund. Other com panies use other measures. And some just lose the passion that once drove. The fund will be managed by Matthew B. The exclusive China index holds 20 large-cap Chinese stocks listed outside of mainland China. Commodity funds? Arnott also considered the maximum and minimum returns for the various fundamental metrics over 1- 3- and month time frames. Nonetheless, the increase in volatility was small in even the most extreme case, with annual volatility rising from Note here that trades used to settle after five days as. Our argument was that the move was thoughtful, rational and well-designed to serve investors.

That might describe Ron Muhlenkamp of Muhlenkamp Fund MUHLXwith whom I invested happily in the late ishares morningstar mid cap growth etf interactive brokers pair trading algorithm and early s but who I left when I noticed that, in the face of declining performance, he took to quoting his own newsletter from 1o or 15 years earlier to prove there was no need to change. But if you try to set up a strategy to just exploit momentum, the trading costs will eat your profits. In certain cases, such as dividends, the choice is restricted: only one-quarter or so of all com panies pay dividends, so a dividend-weighting methodology— ex ante—excludes a huge number of stocks in the market. It would certainly be consistent with the self-confidence that Bruce Berkowitz exuded in a long past interview with us, and it would be equally consistent with his dogged embrace of St. He combined our Great Owl ameritrade buy today biotech stocks under 5.00 list, which have by definition been bear-resistant funds, with the Portfolio Visualizer to create what he believes to be an optimized portfolio. In fact, from throughgrowth mutual funds rather consistently trumped value mutual funds. The awards honor the most outstanding and innovative achievements in the field of indexing and index-related research. In there were initial public offerings of new companies, and of those doubled on the first day of trading. That is, their stock-picking abilities should allow them to exceed the likely returns available for the next years. It posted price action strategy on daily chart stock advisor group etf swing trading dismal 7. In a broader sense, liquidity means being able to raise the cash necessary to com plete a transaction in a timely manner. The influence of Amazon on the domestic economy, indeed its control over many parts of that economy, has allowed it an influence over the economy well in excess of its market share. Facebook announced slowing growth numbers and missed its earnings estimates. But active managers can have bad information about the markets best american brokers for metatrader 5 amibroker free live chart as easily as good information, and they can com e out the worse for it. Index of the Year — Awarded to the index that has done the most to provide new ways of considering investment strategies, opportunities or ideas, or which has simply delivered for investors in a meaningful way. Further, some of the current economic trends are unsustainable, and it is just a matter of time until things change. Has Arnott locked up the field with his four-factor analysis, or WisdomTree with its dividend-weighting methodology? Rather than weighting by market cap, they use a com bination of factors such as corporate revenues, cash flows, profits, or dividends for example, the portfolio may be weighted by the dollar amount of dividends distributed by each corporation, rather than the dollar amount of its market capitalization. And we would never be fooled into thinking that the growth rates of these companies are not sustainable.

As passive investors, the turnover in the portfolios is minimal. Awarded to the online brokerage offering the best package for ETF-focused investors. He is the author of numerous articles appearing in the Journal of Finance, the Journal of Financial Economics, the Journal of Business, and other publications. But the central issue remains: how can one claim that the past will be prologue without a scintilla of apparent doubt? Andreas Zoellinger will now manage the fund. The new stamp tax exemption will only cover ETFs with underlying shares that are not listed in the U. Standard Deviation is 3-year. It would certainly be consistent with the self-confidence that Bruce Berkowitz exuded in a long past interview with us, and it would be equally consistent with his dogged embrace of St. This understandably discouraged cross-listings, as it more than doubled the average expense ratio for the funds. That will make the ETF the share class of choice for the vast majority of small investors. The man on the street—or even a good MBA student—has a hard time embracing randomness. Moreover, there is no apparent link between the long-term annualized excess returns and the worst one-year performance record: The Sales and Revenue portfolios post the highest excess returns, but the Employment and In com e portfolios post the largest one-year draw-downs. They also cost very little to operate since management merely entails purchasing the securities in the same proportion as the bogy and periodically rebalancing in response to asset flows or reconstitution of the benchmark. The automatic urge: running away, either to cash or to an investment with eye-catching recent returns. Using a well-established, broad-market index ensures that the index will own the necessary securities to perform well in both growth and value markets.

Need an example? Edward Keon, Jr. The managers believe that the SMid Cap Fund offers similar long-term capital appreciation potential as their small cap fund but across a wider capitalization range that incorporates both small and mid-capitalization stocks. Past performance, as we all know, is no predictor of future results. Anyone who lived through the dot- com bubble learned that lesson the hard way. Nonetheless, virtually all the news sharing a chart in trading view w indicators etc ninjatrader data bundles experience of argues for plentiful liquidity. Issuer must have launched its first ETF in Hindsight plays tricks on our minds. Investable Indexes: More targeted indexes that focus on liquidity and market float, which will be used for investable products. Sales traders are also sometimes asked to intervene in algorithmic orders, although intervention or suspension are both very rare.

More to come! Managed Volatility Fund Phillip Whitman is no longer listed as a portfolio manager for the fund. In that vein, I would offer only the words of the Greek poet Simonides of Ceos, who, writing about the fallen of Sparta said,. There is no word yet on tickers or expense ratios. Suni received her Bachelor of Science degree from Denison University, where she majored in physics and math. Portfolio turnover and 12b-1 fees are both positively associated with index mutual fund expense ratio standard deviation classes, at the 0. Brandon Geisler and Robert Susman join the extensive management team. More information is available via this link. The funds will trade on the NYSE. Over its first couple years, his flagship Global fund sort of looked like this: The fund staged a furious rebound, though it never recovered the ground lost in its early crash: In the midst of all that, Kopernik launched a second fund which is only open to Institutional investors, Kopernik International Fund KGIIX. And, he was an American hero. Quadratic Interest Rate Volatility and Inflation Hedge ETF , an actively-managed ETF, seeks to hedge the risk of rising long-term interest rates, an increase in inflation and inflation expectations, and an increase in interest rate volatility, while providing inflation-protected income. Andreas Zoellinger will now manage the fund. All com panies report revenues on the topline of their SEC filings, ensuring that investors will have a transparent and clear metric. But in the Serious Money account. His mutual funds analysis course was the first of its kind. And then July 25, happened. Previously, ETFs incorporated outside the U.

Many now make money selling fake headlines, fake controversies and even fake news. MFR Securities, Inc. Each time, he found that the fundamentally weighted indexes outperformed the cap-weighted benchmarks. We crypto wallet app ios free account bitcoin mining some of the opportunities to help, and made personal pledges to do so. Tickers are not available at this time. Ties will be decided where possible with head-to-head runoff votes. Are there scenarios in which a fixed-weight index underperforms a cap-weighted index? Source: Morningstar. This suggests that capitalization weighting is better at riding mixed trends, since the weight of the winners naturally increases and the weight of the losers naturally decreases. Viola associates from the NY Merc are investors in Americanexaka American Cannabis Exchange, a fintech company competing with other upstarts to create a centralized electronic cannabis-trading platform. Such events would also mean much greater aversion to risk. Adding margin, he claimed, would increase risk and, therefore, return. Andrew Jung will step up to the lead portfolio manager position. Fama value.

The yen fund could prove popular: The yen is the second most popular currency in the massive foreign exchange market, and is a key com ponent of the popular New York Board of Trade U. The plan is to buy government bonds, municipal bonds, corporate bonds, residential and commercial mortgage-backed securities, asset-backed securities, convertible securities, loan participations and assignments, and U. All com panies report revenues on the topline of their SEC filings, ensuring that investors will have a transparent and clear metric. The highlight of the response to the storm was surely the work of Houston Texas football player J. Need an example? Shilpa Mehra joins Daniel Kelley in managing the fund. The rationale was that this time, these real businesses had strong balance sheets, and real earnings. Winners from these finalists will be selected by a majority vote of the ETF. Summer saw a curious lull in fund liquidations and manager changes both, but the end of summer is ending that reprieve. As a result, the figure indicated that adding com modities exposure to a portfolio will increase its risk while decreasing its return; in fact, the opposite is true. Their bond market projections are 2. As a result, over time, each share will represent a smaller and smaller number of yen. Matthew Sargaison will run the fund with Russell Korgaonkar. To be great is to be misunderstood. All for one, and one for all! Believe in something bigger than yourself. They use a bewildering variety of fundamental factors, momentum analysis and general indexing mojo. Rather than weighting by market cap, they use a com bination of factors such as corporate revenues, cash flows, profits, or dividends for example, the portfolio may be weighted by the dollar amount of dividends distributed by each corporation, rather than the dollar amount of its market capitalization. Best New U.

From to the start of the financial crisis in , BJBIX outran its peers by a margin of more than In previous statements, he has noted that ETFs are the only financial products that cannot be launched without exemptive relief. A fixed- or quasi-fixed-weight index likely outperforms a cap-weight index in a sideways market because of the monetization of variance, but a capweight index might well do better when the index has mixed trending com ponents as described above. Mark Travis will now manage the fund. But who really knows which half is which? John Hancock Global Thematic Opportunities Fund will seek capital appreciation by investing mainly in equities of companies that may benefit from global long-term market themes. In contrast, Canada makes up about 5 percent of the new FTSE Index: a large enough proportion to have a significant impact on performance. High-Touch or High-Tech? The Nifty Fifty of old have been replaced by the Fantastic Five. Fight for what you believe in. The fund will be managed by Leland Abrams and Brandon Jundt. We were also heartened by several notes from medical professionals praising the excellence of the University of Iowa Hospitals, both generally and with regard to the neurosurgeons. Too much cost and too little tax efficiency. Next, the book examines the ETF market's development in different countries in the Asia-Pacific region, by analyzing their level of development in terms of turnover. Awarded to the index provider that has done the most to improve investor outcomes through index introductions, research, advisor support and more. JoI: What do you think of some of the recent product developments in the financial markets?

Since inception, the fund has what are cyclical stocks put options td ameritrade a loss of 0. The fund often holds some fixed-income exposure, which Mr. Effective at the close of business on December 31,Sheldon J. We highlighted some of the opportunities to help, and made personal pledges to do so. Are the markets be com ing more efficient with the increased trading volume, etc.? But they not only claim prescience, but a prescience that gives them confidence that certain sectors of the market such as dividend-paying stocks will remain undervalued as far ahead as the eye can see. In practice, however, as capitalization of a particular com ponent increases, its volatility may tend to decrease, countering the loss of diversification. More magazines by this user. In a long interview with us, Mr. On July 1,Conestoga partially closed the small cap fund. Absent a change in demographics, taxation or benefits, Social Security is now projected to begin paying out more than it takes in somewhere between Finally, in some spots, the momentum may even be headed the wrong way. After fees and expenses, the average investor is going to lose.

The com puter program spits out trades on a regular basis, and investors can follow along to earn those returns. The fund offers U. According to the filing, the fund is designed to track the International Index Co. Privacy policy. The Treasuries also earn interest in com e, which is used by the funds as well. He is currently an independent developer of ETFs and other financial products. Assuming NYMEX follows through with the launches, it would put the lease provision in play, and would make the new merger much more com plicated. The funds hold the named foreign currency as their sole asset, and earn local interest rates on deposits. The experiment has had mixed results. Andrew believes that individual responsibility leads people to recognize goofs faster and correct them earlier, which is the signature strength of an individually-managed fund. Mark Travis will now manage the fund. To be great is to be misunderstood. Why is it impossible to capture?