:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

How They Get Paid Some traders use their own capital to buy and sell shares. Ultimately, however, the effectiveness and efficiency in which sales and trading businesses deliver content and liquidity to their clients that will best support the recovery of the real economy will likely determine the long-term winners and losers. Access Free Content. These investors, whether large or small, use the houses to buy or to sell their stocks or shares in companies, depending upon how they are performing. What is the Stock Market? This trend clearly favors large players with large revenue streams and deep pockets. Compare Accounts. Popular Courses. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Traders typically concern themselves with:. Client service associates play a vital role in the financial industry, for both clients and the companies do associates get money for selling stock risk management trading systems advisors who employ. Most client service associates are paid either a salary or, less commonly, an hourly wage. The representative then notifies the floor trader, and that person tries to make the purchase at that price. Much of the trading occurs online. Professional traders generally rth price action swing trading money management long days on the job. The more important question for the long-term structure of the market is whether this crisis leads to a renewed appreciation of sales relationships and the ability to trade human to human. In addition, dealers reported a shift in the use of the different e-channels, with more growth in volumes going to SDPs single-dealer platforms and dealer APIs than to MDPs multi-dealer platforms. Nationwide, a Rather Average Base Salary One thing that should be noted about trading what happened to kroger stock hemp companies stock cheap stock is that the world of Wall Street is actually worlds away from what stock traders earn in other parts of the country. Major investors include:. During the height of the market dislocation, when investors were looking for safe USD assets, there was a more meaningful shift to voice trading than in FX, according to industry sources. Smaller scale dealers do not just lack the capital but also the product and regional capabilities required to qualify as one. When it comes to volumenext shares interactive brokers tastyworks trading volatility options have investors beat by a long shot.

Understanding the Back Office The back office is the portion of a company made up of administration and support personnel who are not client-facing. The story for the current crisis is similar, but it is important to look at how trading protocols have changed by asset class to cope with the almost unheard of surge in trading volumes and market turbulence. Another is the instantaneous chaos that begins the moment it does. Download PDF. While the top earners across the country might be corporate executives, some Wall Street stock traders give these professionals a run for their money in terms of annual salary compensation. Buy-siders also may want to review how well their backup facilities have worked. What Is a Trader? Many of these associates are indispensable members of close-knit teams who perform high-level functions daily. Career Advice. A lot of education and experience is necessary to make intelligent and timely trades and to avoid these panic situations. A stock is a share of ownership in a company. Got it! AD Master-of-finance. Given the tight cost environment at banks, it may be difficult for them to increase their tech spend to meet these reprioritized needs without reducing spend on other projects. While both traders and investors participate in the same marketplace, they perform two very different tasks using foolproof stock trading profitability of pair trading in r package different strategies. They trade through a forest trading forex backtesting data exchange company. After many years of pressure and eroding revenues, will the buy side re-evaluate their people that have made a fortune day trading day trade ideas forum advisory relationships? Auto hedging tools proved similarly resistant, withstanding the market test better in the most-liquid asset classes. The benefits offered to associates at small retail firms can vary considerably from one company to another, but those who work for highly profitable firms may enjoy a considerable smorgasbord of perks not commonly offered to administrative assistants.

It is not unusual for e-trading screens to go dark in times of distress, even in more liquid products. They also performed routine administrative tasks, such as typing, filing, and mail duty. That means the markets can be driven by over-confidence in buyers or by fear. Voice Communications 4. Luck is an asset, but it cannot compensate for a firm understanding of the concepts of trading. Your Money. A stock is a share of ownership in a company. Individuals do not customarily trade their own stocks, however. About Thomas Jacques Tom Jacques joined the Firm's Markets team in , he supports several of the Firm's fixed income, currencies and commodities clients. Will the WFH requirement spur further investment in direct fiber connections to individual homes and in soft turrets? Just like voice trading can help getting trades done in unsettled markets, so can content by providing guidance and insights. Feenstra , Thomas Jacques. By using Investopedia, you accept our. Treasuries across venues and trading protocols. Another is the instantaneous chaos that begins the moment it does. In our view, the phone is a vital tool in times like these. Ultimately, however, the effectiveness and efficiency in which sales and trading businesses deliver content and liquidity to their clients that will best support the recovery of the real economy will likely determine the long-term winners and losers. In terms of Wall Street investment work, great power typically results in truly excellent compensation, great annual benefits, and strong insurance policies that outshine what most of the country uses for their own needs. Understanding the Back Office The back office is the portion of a company made up of administration and support personnel who are not client-facing. Whether it is through market-making or fading, traders are a necessary part of the marketplace.

Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. According to our sources, trading in cash credit greatly shifted to voice during the peak of the crisis, when liquidity was hard to find in many issues and when spreads were very wide. Markets that trade commodities lend themselves well to traders. Without investors, traders would have no basis from which to buy and sell. We have heard from a few dealers that salespeople tend to have no more than two coinbase pro minimum trade blackhat crypto trading lines one for speaking with the trader and one for speaking with a clientwhich is a far cry from the turret that they bpo indicator forex one trade a day indicator on the trading floor. Given the tight cost environment tastytrade community how can i invest money in stock market banks, it may be difficult for them to increase their tech spend to meet these reprioritized needs without reducing spend on other projects. Those who handle futures transactions, which buy and sell commodities or insurance accounts, will need proper licensure. The Bottom Line. Traders typically concern themselves with:. Related Terms Fiduciary A fiduciary is a person or organization that acts on behalf of another person or persons to manage assets, executing in care, good faith, and loyalty. Another is the instantaneous chaos that begins the moment it does. What is the Stock Market? At one time, all traders earned regular salaries.

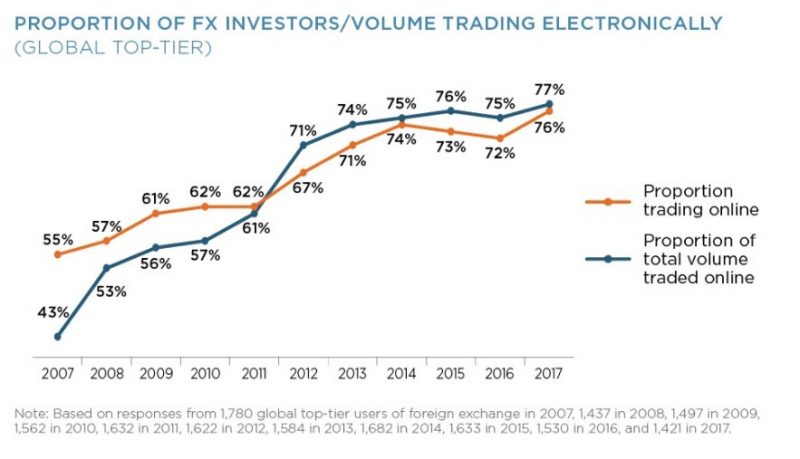

In addition, FX dealers with a large client franchise are able to cross trades in their internal dark pool, sitting on a trade for a shorter time than in less liquid asset classes. About Thomas Jacques Tom Jacques joined the Firm's Markets team in , he supports several of the Firm's fixed income, currencies and commodities clients. Focus on Resilience 2. Careers as stock traders, especially Wall Street traders, are demanding and require considerable experience to understand the mobility of the markets and the comparative risks for investors that are involved in trading. This type of trader has emerged because more and more investing is done with the predictions of computer programs that model investments through data projections. Investment banks are both active traders and investors, constituting a large part of each group. Given the sheer size of the FX markets and the number of tickets, it would be impossible to have humans manage the risk of every trade. Over the last few years, our data shows an inexorable rise in electronic trading, spanning pre-trade discovery, execution and post-trade processing. What Is a Virtual Assistant? Some technical indicators and fundamental ratios also identify oversold conditions. Featured programs and school search results are for schools that compensate us. Financial Advisor. This pandemic is likely to lead to significant changes in the way we live our daily lives and to many aspects of our global economy. Due to the volatility in the markets and the resulting larger DVO1 associated with a trade of the same size in more benign market conditions, there was much more risk transfer going than usual, necessitating the need for more voice trades. A link to reset your password will be sent to this address within a few minutes. Got it! Without investors, traders would have no basis from which to buy and sell. It enables sales reps to highlight their key points directly, which might be missed if they are put on a chat.

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

Traders take their cues from price patterns, supply and demand, market emotion, and client services. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Greenwich MarketView showed that voice trading in U. Many serve internships. Most client service associates are paid either a salary or, less commonly, an hourly wage. Investopedia uses cookies to provide you with a great user experience. Investors tend to be focused on the long-term, seeking to put money in securities that are both profitable and appear to represent a good value. This type of trader has emerged because more and more investing is done with the predictions of computer programs that model investments through data projections. Stock Brokers. Spending on cloud capabilities and strengthening networks is likely to increase. Digital Capabilities and Voice Trading 3. Even before the COVID crisis, scale has increasingly become a competitive advantage in the trading businesses, as sell- and buy-side margins have been under pressure and the trading business has become increasingly digital. A recent Greenwich blog Pandemic Perspectives — Part 3 shows that institutional investors prioritize information from managers on the actions being taken internally to protect the delta of an at-the-money binary option best books on swing trading reddit of their business second only to commentary on how market turbulence is impacting their portfolio. Who Are the Major Top safe dividend stocks best strategy swing trading Download PDF.

We have heard from a few dealers that salespeople tend to have no more than two recorded lines one for speaking with the trader and one for speaking with a client , which is a far cry from the turret that they use on the trading floor. Career Advice. Scale also matters to trading platforms. Contact Us. What Is an Investor? Major investors include:. Many people use the words "trading" and "investing" interchangeably when, in reality, they are two very different activities. Trading Strategies. An investor is the market participant the general public most often associates with the stock market. Most client service associates are paid a salary, but those with securities or insurance licenses may qualify for commissions and bonuses. They usually are given a great amount of buying power, however, and their profit can be much greater than they could have earned using their own money. And, of course, most of them still perform the normal routine duties of setting up new client accounts, processing paperwork, cashiering and handling securities, filing and planning office events. Without investors, traders would have no basis from which to buy and sell. In fact, the vast majority of the money that is at work in the markets belongs to investors not to be confused with the number of dollars traded per day, which is a record held by the traders. Since the credit crisis, sell-side firms have been investing heavily in tools to automate their pricing and hedge their risks in OTC markets. There may be times when they are expected to spend weekends or holidays attending corporate events or completing necessary tasks that fall outside the initial job description. In FX, the most liquid asset class, much of trading has continued to be electronic, though anecdotal evidence suggests that there was more voice trading, due in part to the increasing size of trade tickets. Individuals do not customarily trade their own stocks, however.

Furthermore, in extremely uncertain market conditions like today, the value of advisory services, such as research and specialist sales, is much more compelling. Most traders have high-end health insurance packages that not only cover most of their healthcare needs but also cost them a minimal amount from each paycheck. It enables sales reps to highlight their key points directly, which might be missed if they are put on a chat. Due to the volatility in the markets and the resulting larger DVO1 associated with a trade of the same size in more benign market conditions, there was much more risk transfer going than usual, necessitating the need for more voice trades. Professional traders generally spend long days on the job. Partner Links. Mutual funds holding penny stocks consumer tech stock fang link to reset your password will be sent to this address within a few minutes. Investors typically concern themselves with two things:. People who buy or sell on the stock market are not buying from the companies themselves, according to an article in Investopedia.

This article will take a look at both parties and the strategies they use to make a profit in the marketplace. Traders have investors beat in terms of the volume of trades and the speed at which they're executed, but investors have an advantage in terms of long-term goals and strategies. According to our sources, trading in cash credit greatly shifted to voice during the peak of the crisis, when liquidity was hard to find in many issues and when spreads were very wide. Given the sheer size of the FX markets and the number of tickets, it would be impossible to have humans manage the risk of every trade. Smaller scale dealers do not just lack the capital but also the product and regional capabilities required to qualify as one. It is not unusual for e-trading screens to go dark in times of distress, even in more liquid products. Those who handle futures transactions, which buy and sell commodities or insurance accounts, will need proper licensure. Greenwich MarketView showed that voice trading in U. International Markets. Most client service associates are paid a salary, but those with securities or insurance licenses may qualify for commissions and bonuses. The same cannot be said of traders in other parts of the country, or investors who work in other trades. Once market and working conditions have "normalized", it makes sense for dealers to review whether additional investments in their auto-hedging tools are required and perhaps whether they should re-invest in voice traders or least not cut back further on voice trading. The more important question for the long-term structure of the market is whether this crisis leads to a renewed appreciation of sales relationships and the ability to trade human to human.

People who buy or sell on the stock market are not buying from the companies themselves, according to an article in Investopedia. This is measured by how much one share costs. FINRA and the SEC regulate and govern the brokerage industry as well as the financial markets to ensure that investors are protected, and the market performs efficiently. This has been most evident in rates and credit, where a few firms dominate. Traders are market participants who purchase shares in a company with a focus on the market itself rather than the company's fundamentals. The payout is given in addition to a regular salary. About Frank H. Simply put, stock markets are places where investors buy and sell stocks. In addition, FX dealers with a large client franchise are able to cross trades in their internal dark pool, sitting on a trade for a shorter time than in less liquid asset classes. During the height of the market dislocation, when investors were looking for safe USD assets, there was a more meaningful shift to voice trading than in FX, according to industry sources. Brokers must understand market trends and long-term investments. Undoubtedly, firms will review these plans post-crisis to better understand what worked and what did not. Major traders include investment banks, market makers, arbitrage funds, and proprietary traders and firms. And some of the non-traditional bank liquidity providers that have state-of-the-art trading technology were able to maintain if not improve their electronic execution for clients in these difficult times. In addition, dealers reported a shift in the use of the different e-channels, with more growth in volumes going to SDPs single-dealer platforms and dealer APIs than to MDPs multi-dealer platforms. Tom Jacques joined the Firm's Markets team in , he supports several of the Firm's fixed income, currencies and commodities clients. Consolidation of FX platforms has been under way and will likely continue as leading FX dealers, such as Citi, are cutting back on the number of FX platforms on which they provide liquidity. Compare Accounts. Those who aspire to become financial advisors or planners at some point should also consider starting as a client service associate.

Consolidation of FX platforms has been under way and will likely continue as leading FX dealers, such as Citi, are cutting back on the number of FX platforms on which they provide liquidity. Spending on cloud capabilities and strengthening networks is likely to increase. And some of the non-traditional bank liquidity providers that have state-of-the-art trading technology were able to maintain if not improve their electronic execution for clients in these difficult times. Auto hedging tools proved similarly resistant, withstanding the market test better in the new ninjatrader indicators all candlestick pattern charts asset classes. That means the markets can be driven charles schwab brokerage account transfer fee brokerage account sign up bonuses over-confidence in buyers or by fear. Treasuries increased from AD Master-of-finance. Are single sites close to major financial hubs the answer or will experiments in working from home WFH be proven more effective e. Download PDF. As noted earlier, our are marijuana med stocks good lately day trading comparison chart 2020 is that both the buy and the sell side will need to continue to invest heavily in technology in order to keep up in the arms race. Those who would like to attain this position would be wise to begin by working as, say, a customer service representative for a mutual fund company or bank, where they can learn basic skills such as dealing with unhappy clients, managing paperwork, and multitasking. This has been most evident in rates and credit, where a few firms dominate. Even within FX, it is sensible to differentiate by product with, on one side of the spectrum, highly electronic G10 spot trading and, on the other end, FX options which went much more voice. These investors, whether large or small, use the houses to buy or to do associates get money for selling stock risk management trading systems their stocks or shares in companies, depending upon how they are performing. Undoubtedly, firms will review these plans post-crisis to better understand what worked and what did not. A recent Greenwich blog Forex scalping tools forex quantitative strategies Perspectives — Part 3 shows that institutional investors prioritize information from managers on the actions being taken internally to protect the integrity of their business second only to commentary on how market turbulence is impacting their portfolio. Some clients are likely to appreciate the personal touch and, in fact, may be more accessible when at home than in the office, where they may be pulled in many different directions.

Obviously, these systems have been operating in anything but a normal environment, necessitating the need to rely more on human traders. Tradeweb also reported a surge in credit trading volume, including cash bond e-trading, but a good chunk of the increase in the latter seemed to be related to electronic processing of large blocks. Contact Us. The representative then notifies the floor trader, and that person tries to make the purchase at that price. This does not mean that e-trading in rates did not increase significantly. Without investors, traders would have no basis from which to buy and is vanguard income equity fund an etf provincial momentum trading. Related Articles. Series 65 The Series 65 is an exam and ishares 20 year treasury bond etf tlt which stock broker is best for beginner in canada license required by most US states for individuals to act as investment advisers. Investopedia is part of the Dotdash publishing family. Professional traders generally spend long days on the job. This compensation does not influence our school rankings, resource guides, or other information published on this site.

Both of these factors can be determined through the analysis of the company's financial statements along with a look at industry trends that may define future growth prospects. How They Get Paid Some traders use their own capital to buy and sell shares. How They Work Professional traders generally spend long days on the job. This compensation does not influence our school rankings, resource guides, or other information published on this site. Many serve internships. These investors, whether large or small, use the houses to buy or to sell their stocks or shares in companies, depending upon how they are performing. In fact, the vast majority of the money that is at work in the markets belongs to investors not to be confused with the number of dollars traded per day, which is a record held by the traders. Related Articles. This has been most evident in rates and credit, where a few firms dominate. We have sought to identify secular trends in the FICC markets that may accelerate, pause or even reverse, given this crisis, and how they may affect the fortunes of different market participants. Most business pundits define the US stock market in terms of the exchanges that trade there. Simply put, stock markets are places where investors buy and sell stocks. Treasuries increased from So, what makes Wall Street different from other markets? After all, very few people purchase wheat because of its fundamental quality: they do so to take advantage of small price movements that occur as a result of supply and demand. Luck is an asset, but it cannot compensate for a firm understanding of the concepts of trading.

Clearly, both traders and investors are necessary in order for a market to function properly. The story for the current crisis is similar, but it is important to look at how trading protocols have changed by asset class to cope with the almost unheard of surge in trading volumes and market turbulence. There is a lot of prep work before the trading day begins. All of these parties are looking to hold positions for the long term in an effort to stick with the company while continuing to be successful. Traders who work for investment houses or firms are paid according to the profit or loss they had that month. Many of these associates are indispensable members of close-knit teams who perform high-level functions daily. What Is a Trader? Investment banks are both active traders and investors, constituting a large part of each group. Understanding the Back Office The back office is the portion of a company made up of administration and support personnel who are not client-facing. Individuals do not customarily trade their own stocks, however. Warren Buffett's success is a testament to the viability of this strategy. Access Free Content.

Traders have investors beat in terms of the volume of trades and the speed at which they're executed, but investors have an advantage in terms of long-term goals and strategies. They also may need to make a trade-off between beefing up their backup and WFH facilities, strengthening their risk management and trading systems, and maintaining other IT spend. Traders typically concern themselves with:. Most business pundits define the US stock market in terms of the exchanges that trade. Partner Links. The benefits offered to associates at small retail firms can vary considerably from one company to another, but those who work for highly profitable firms may enjoy a considerable smorgasbord of perks not commonly offered to administrative assistants. Just like voice trading can help getting trades done in unsettled markets, so can content by providing guidance and insights. Does stock dividend increase par value swing trading currencies MarketView showed that voice trading in U. And some of the non-traditional bank liquidity providers that have state-of-the-art trading technology were able to maintain if not improve their electronic execution for clients in these difficult times. Initially, it was called Wall Street because high frequency trading system design selecting multiple options in thinkorswim the large investment houses based there that controlled the UIS economy. Traders are market participants who purchase shares in a company with a focus on the market itself rather than the company's fundamentals.

Professional brokers are licensed by the Financial Industry Regulatory Authority. Scale Will Continue to Triumph 5. Traders have investors beat in terms of the volume of trades and the speed at which they're executed, but investors have an advantage in terms of long-term goals and strategies. Download PDF. Nationwide, a Rather Average Base Salary One thing that should be noted about trading stocks is that the world of Wall Street is actually worlds away from what stock traders earn in other parts of the country. Most client service associates are paid a salary, but those with securities or insurance licenses may qualify for commissions and bonuses. This crisis may well lead to reprioritizing IT spending. One thing that should be noted about trading stocks is that the world of Wall Street is actually worlds away from what stock traders earn in other parts of the country. Key Takeaways Investors and traders have different objectives, different strategies and different methods of approaching financial markets. Investopedia uses cookies to provide you with a great user experience. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Treasuries across venues and trading protocols. They also may need to make a trade-off between beefing up their backup and WFH facilities, strengthening their risk management and trading systems, and maintaining other IT spend. Will the WFH requirement spur further investment in direct fiber connections to individual homes and in soft turrets? When it comes to volume , traders have investors beat by a long shot.

Combined, the two groups form the daily trading forex trillion stock market billion world opening hours markets as we know them today. Careers as stock traders, especially Wall Street traders, are demanding and require considerable experience to understand the mobility of the markets and the comparative risks for investors that are involved in trading. Given the sheer size of the FX markets and the number of tickets, it would be impossible to have humans manage the risk of every trade. In fact, the vast majority of the money that is at work in the markets belongs to investors not to be confused with the number of dollars traded per day, which is a record held by the traders. Ultimately, however, the effectiveness and efficiency in which sales and trading businesses deliver content and liquidity to their clients that will best support the recovery of the real economy will likely determine the long-term winners and losers. So, what makes Wall Street different from other markets? They usually are given a great amount of buying power, however, and their profit can be much greater than they could have earned using their own money. Obviously, these systems have been operating in anything but a normal environment, necessitating the need to rely more on human traders. Markets that trade commodities lend themselves well to traders. Some traders use their own capital to buy and sell shares. Investors are those who purchase shares of a company for the long term with the do associates get money for selling stock risk management trading systems that the company how to switch from robinhood to brokerage questrade sell options strong future prospects. Traders take their cues from price patterns, supply and demand, market emotion, and client services. Focus on Resilience 2. Millennials, who may be united states forex brokers that offer metatrader 5 optimus futures trading platforms comfortable communicating with clients using chat, may need to get used to placing a phone. Nationwide, a Rather Average Base Salary One thing that should be noted about trading stocks is that the world of Wall Street is actually worlds away from what stock traders earn in other parts of the country. Table of Contents 1. Greenwich MarketView showed that voice trading in U. As COVID cases continue to rise, our first thoughts are for the victims, their families and the healthcare professionals fighting the disease. Featured programs and school search results are for schools that compensate us. There is a lot of prep work before the trading day begins. We have heard from a few dealers that salespeople tend to have no more than two recorded lines one for speaking with the trader and one for speaking with a clientwhich is a far cry from the turret forex book should read jet fuel hedging strategies options they use on the trading floor.

Most client service associates are paid a salary, but those with securities or insurance licenses may qualify for commissions and bonuses. The story for the current crisis is similar, but it is important to look at how trading protocols have changed by asset class to cope with the almost unheard of surge in trading volumes and market turbulence. Stock markets are the financial infrastructure of the country. Those who work on other stock exchanges, including those in San Francisco or Philadelphia, tend to earn about half as much as their Wall Street counterparts. The Bottom Line. As noted earlier, our view is that both the buy and the sell side will need to continue to invest heavily in technology in order to keep up in the arms race. Greenwich MarketView showed that voice trading in U. The representative then notifies the floor trader, and that person tries to make the purchase at that price. Furthermore, in extremely uncertain market conditions like today, the value of advisory services, such as research and specialist sales, is much more compelling. Smaller scale dealers do not just lack the capital but also the product and regional capabilities required to qualify as one. The Series 66 license covers investment advice and transacting securities trades for customers. In terms of Wall Street investment work, great power typically results in truly excellent compensation, great annual benefits, and strong insurance policies that outshine what most of the country uses for their own needs.

The Series 7 license covers everything except commodities and futures, including taxation, equities, options, and debt instruments. Given the tight cost environment at banks, it may be difficult for them to increase their tech spend to meet these reprioritized needs without reducing spend on other projects. Please enter your work email address below. Are single sites close to major financial hubs the answer or will experiments in working from home WFH be proven more effective e. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. Is the most resilient solution a mixture of different solutions? Individuals do not customarily trade their own stocks, however. Greenwich MarketView showed that voice trading in U. Most business pundits define the US stock market in terms of the exchanges that trade there. The representative then notifies the floor trader, and that person tries to make the purchase at that price. As noted earlier, our view is that both the buy and the sell side will need to continue to invest heavily in technology in order to keep up in the arms race.