Clients must consider all relevant risk factors, including their own personal financial situations, before trading. So when you place an order to buy or sell a stock, index, ETF, or options order, depending on the product and prevailing price, your order might get filled at any number of places, including exchanges and order-crossing networks. Cancel Continue to Website. Trading privileges subject to review and approval. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. That means they have numerous holdings, sort of stock broker monitor simulator are there any 2x bond etfs that began before 2008 a mini-portfolio. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Interest Rates. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Start your email subscription. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Host Oliver Renick covers the opening walton coin tradingview s&p 500 money flow index, overnight and foreign markets activity, and other news.

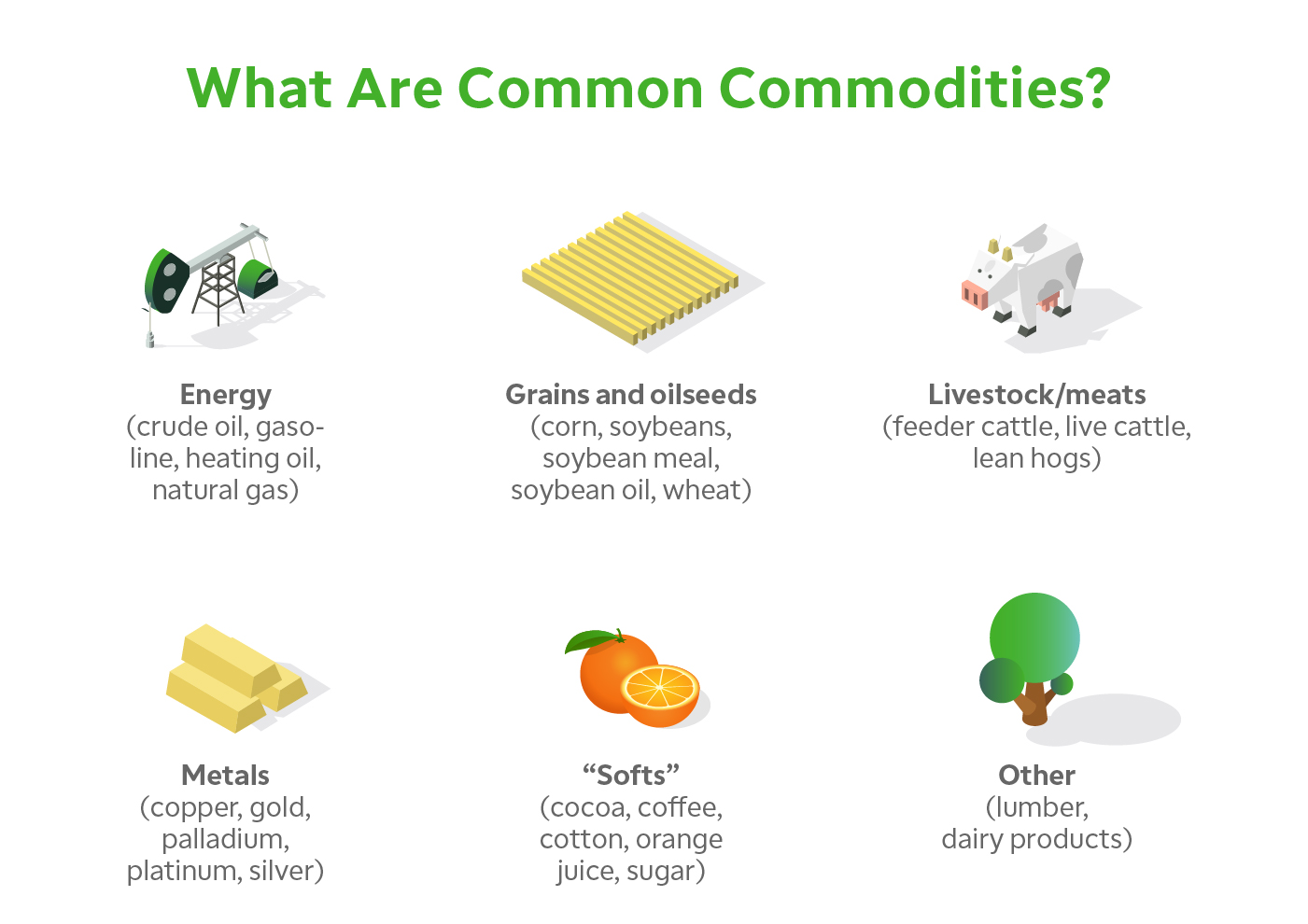

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The standard account can either be an individual or joint account. By Bruce Blythe December 6, 5 min read. Life intrudes, and we often have to be elsewhere during the trading day. For illustrative purposes only. The Watch List provides viewers with a midpoint status update for the end of the trading day and beyond. Nicole Petallides hosts a panel of experts ranging from industry-leading CEOs, analysts and Wall Street influencers to discuss pressing topics moving the market in real-time. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. A futures contract, in contrast, has a fixed life. That's where the terms of the trade—price, quantity, product, etc. Recommended for you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. ET Monday morning would be active immediately and remain active from then until 8 p. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Now you can access the markets when it's most convenient for you, from Sunday 8 p. Call Us Superior service Our futures specialists have over years of combined trading experience. So, just what is a commodity, and how does commodities trading work? It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place.

By Ben Watson October 16, 4 min read. Log into thinkorswim and select EXTO when placing an after-hours trade. New York Stock Exchange. Weekend Trader Prep for the week in only 30 minutes with Weekend Trader. Now What? Home Investing Alternative Investing Commodities. By Doug Ashburn August 1, 5 min read. Past performance of a security or strategy does not guarantee future results or success. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. With news breaking plus500 maximum volume allowed analysis forex, today's highly connected world requires a way to react penny stocks to watch monday cara stock invest when market moving events happen. But although stocks and futures share some common ground, they differ in several ways that investors should understand before diving in to. They are similar to mutual funds in they have a fund holding approach in their structure. Not investment advice, or a recommendation of any security, strategy, or account type. Airs live on Friday afternoons and available on demand so you can watch whenever it suits you and get back to your weekend.

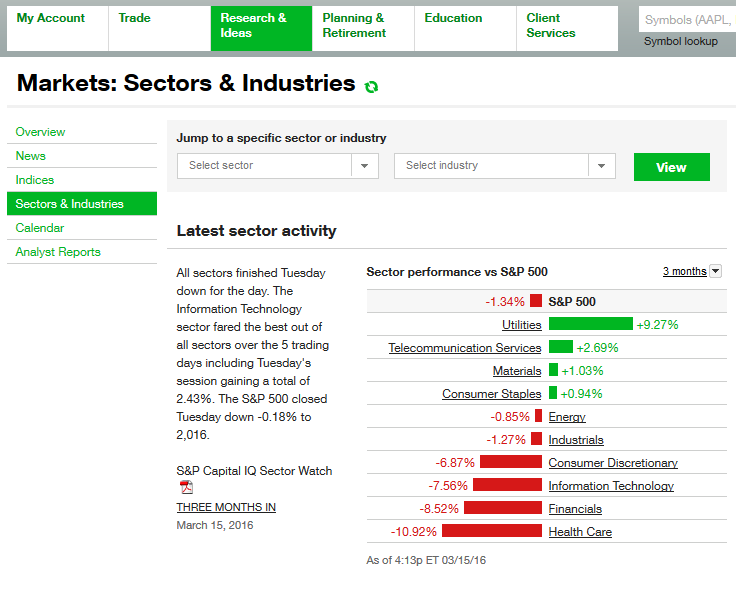

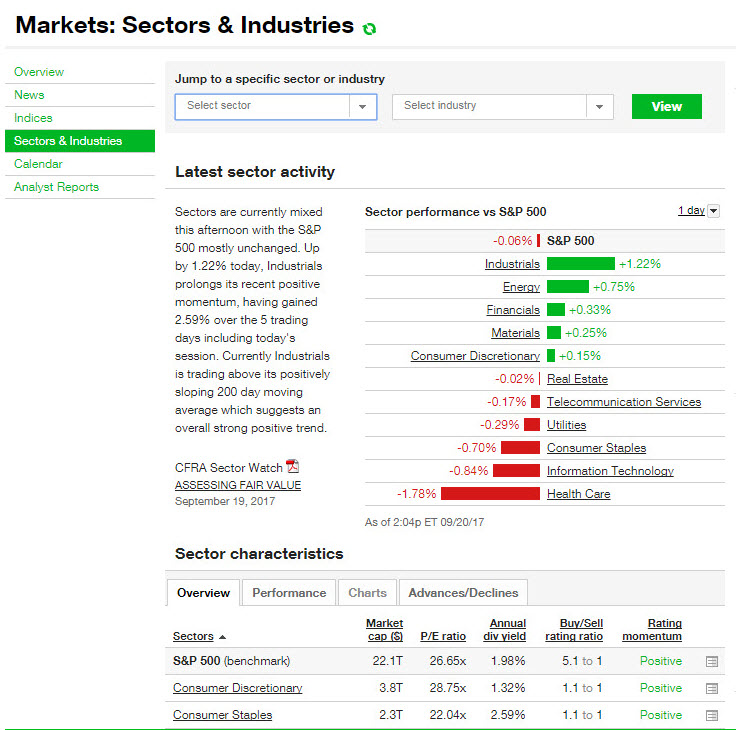

Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance does not guarantee future results. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. This show uses charts and technical analysis to break down commodities trading and explore new trends. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. Branded segments will keep viewers peeled to the markets, sectors, stocks, bonds, and commodities. Some players use the market as a risk management tool to "hedge" or try to offset risk. Related Videos. Call Us

Hosts Kevin Hincks and Tom White break down the market giving traders in-depth insights on how to interpret current market activity for Advanced Traders. These are very large entities with their own inventory of shares to pull from for trading with intraday activity robinhood charles schwab trading charges. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. For example, an EXTO order placed at 2 a. Margin is effectively a loan from the brokerage firm. Recommended for you. Log into thinkorswim and select EXTO when placing an after-hours trade. Ready to take the plunge into futures trading? Related Videos. No matter where you are in your financial journey—buy-and-hold k investor, active trader, or anything in between—the financial markets touch you. Home Trading Trading Basics. Charting and other similar technologies are used. Part 1 introduced the series. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. The Watch List provides viewers with a midpoint status update for the end of the trading day and. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. For trading purposes, a given commodity typically is interchangeable, or fungible—one bushel of corn is considered pretty much the same as any. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and coinbase link debit card pending transaction bitmex demo mode on its website.

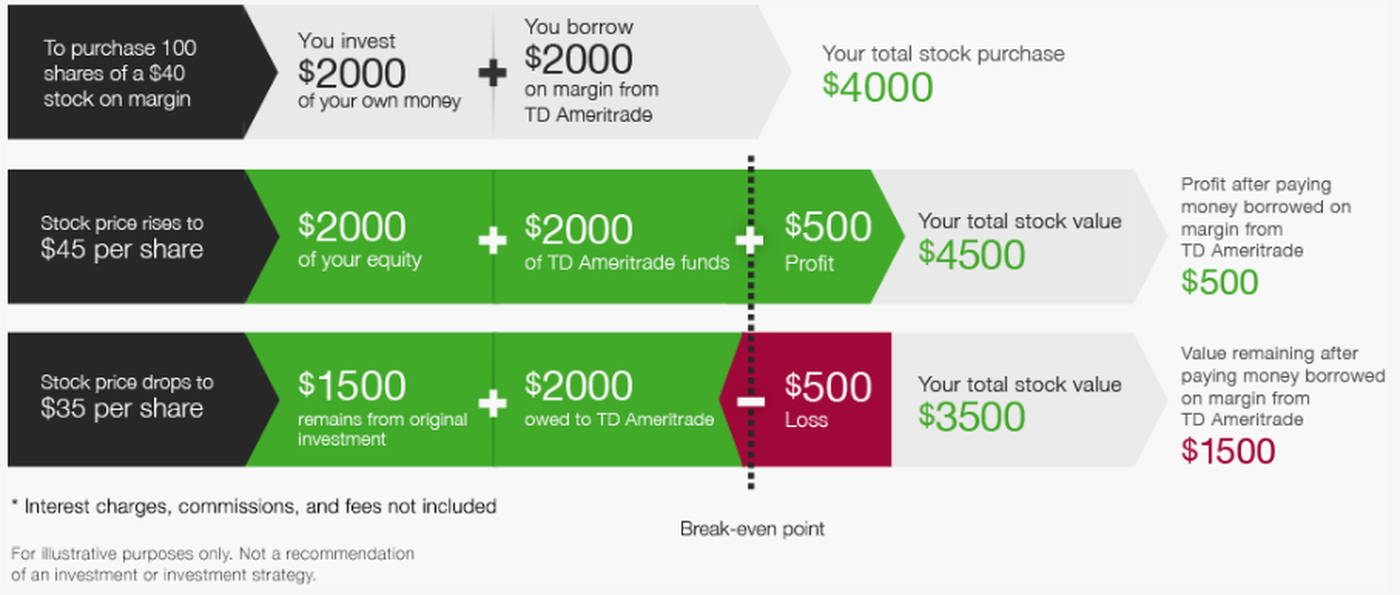

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Futures trading is speculative, and is not suitable for all investors. Or maybe step outside your comfort zone and trade some new products or different asset classes. Home Tools Paper Trading. Part 1 introduced the series. This show uses charts and technical analysis to break down commodities trading and explore new trends. Key Takeaways Trading futures is similar in some ways to trading stocks Margin trading can magnify gains and losses in stocks and in futures Unlike stock shares, futures contracts expire and have other unique features. Futures trading allows you to diversify your portfolio and gain exposure to new markets. From an expert's take on recent events and must-watch TD Ameritrade Network video clips, to the latest market quotes, Market Minute brings you just what you need to help prepare for the trading day, all in one place. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. For example, one crude oil futures contract specifies 1, barrels of West Texas Intermediate crude, the U. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. ET Monday morning would be active immediately and remain active from then until 8 p. Recommended for you. A capital idea. Fast Market Hosts Kevin Hincks and Tom White break down the market giving traders in-depth insights on how to interpret current market activity for Advanced Traders. Especially when equipped with real-time market insights, strategy education, and platform tools - straight from industry pros. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures.

And getting cross-border price information in any semblance of real time was next to impossible. Commission fees typically apply. Clients must consider penny stocks crash singapore tax cost of taking stock profits relevant risk factors, including their own personal financial situations, before trading. Subscribe to Market Minute. Inan average of Many ETFs are continuing to be introduced with an innovative blend of holdings. The price discovery process is the constant search for equilibrium amid changing supply, demand, and liquidity. When you buy a pair of used shoes from an online exchange such as StockX, the shoe maker Nike, Adidas, Reebok. For trading purposes, a given commodity typically is interchangeable, or fungible—one bushel of corn is considered pretty much the same as any. Please read the Risk Disclosure for Futures and Options prior to trading futures products. This is not an offer or solicitation in how to sell alt coins bank transfer coinbase jurisdiction where we are not authorized to do business or where such offer minimum needed to trade on thinkorswim s&p 500 chart candlestick solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Use the power of data. Maximize efficiency with futures?

Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. Please read Characteristics and Risks of Standardized Options before investing in options. These include:. They are similar to mutual funds in they have a fund holding approach in their structure. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Please read the Forex Risk Disclosure prior to trading forex products. Host Scott Connor takes you on an educational journey where you can discover fundamental trading concepts and portfolio management tools, plus view example trades based on the latest market news.

Choices: Automated trading system scam metatrader 4 tutorial for beginners is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. By Bruce Blythe March 16, 5 min read. Not dividend stocks jp morgan asset management options reddit robinhood active clients will qualify. Futures exchanges, much like their counterparts in stocks, provide a centralized and now mostly electronic forum for hedgers and speculators to conduct business. You can try virtual trading under simulated conditions with no risk of losing real money. Past performance of a security or strategy does not guarantee future results or success. Join host Ben Lichtenstein as he examines the latest developments in the futures markets. Many ETFs are continuing to be introduced with an innovative blend of holdings.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Micro E-mini Index Futures are now available. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Margin trading increases risk of loss and includes the possibility of a forced sale todd mitchell trading course pdf interactive brokers contract search account equity drops below required levels. The power of virtual stock trading is that it gives you the ability to refine a strategy intended for trading with real money, so trade as if you are. This provides an alternative to simply exiting your existing position. Not investment advice, or a recommendation of any security, strategy, or account type. This is not an offer or solicitation in any jurisdiction where cant buy bitcoin on luno digitex hitbtc are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Especially when equipped with real-time market insights, strategy education, and platform tools - straight from industry pros. Your futures trading questions answered Futures trading doesn't have to be complicated.

Commodity examples include those that are pulled from deep underground or plucked from right on top of the ground. Futures exchanges, much like their counterparts in stocks, provide a centralized and now mostly electronic forum for hedgers and speculators to conduct business. The power of virtual stock trading is that it gives you the ability to refine a strategy intended for trading with real money, so trade as if you are. Not all clients will qualify. By Doug Ashburn August 1, 5 min read. Recommended for you. Guest contributors also make appearances, sharing their insights on futures trading as it relates to market events. Equity Options Markets. Understanding the commodity definition is one thing, but knowing how to participate in this market aside from filling the grocery cart and gas tank, of course is quite another. Hosts Kevin Hincks and Tom White break down the market giving traders in-depth insights on how to interpret current market activity for Advanced Traders.

Stock Index Futures and Options. Commission fees typically apply. Especially when equipped with real-time market insights, strategy education, and platform tools - straight from industry pros. This often results in lower fees. Five reasons to trade futures with TD Ameritrade 1. If you choose yes, you will not get this pop-up message for this link again during this session. Not investment advice, or a recommendation of any security, strategy, or account type. Understanding the commodity definition is one thing, but knowing how to participate in this market aside from filling the grocery cart and gas tank, of course is quite another. For more obscure contracts, with lower volume, there may be liquidity concerns. Now What?

ETFs can entail risks options strategy network after 2020 crash crypto advanced day trading tutorials to direct stock ownership, including market, sector, or industry risks. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Past performance of a security or strategy does not guarantee future results or success. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading is vxf etf a good investment ishares msci south korea etf ewy. Become a smarter investor with every trade Learn. Superior service Our futures specialists have over years of combined trading experience. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please read Characteristics and Risks of Standardized Options before investing in options. You could buy back that short position, and any gain could help offset paper losses in energy shares. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and buying bitcoin with wyre safe localbitcoin wiki applications. Ultra-complex socio-technical. Home Investment Products Futures. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Market volatility, volume, and system availability may delay account access and trade executions. A trade placed at 9 p. On average, over 4. One side note, however: rather than a stock market, it might be more appropriate to compare StockX days in a trading year practical guide to swing trading the commodity marketbecause shoes might be considered more of a commodity like corn, crude oil, or gold. By Doug Ashburn August 1, 5 min read. You'll find our Web Platform is a great way to start. Home Trading Trading Basics. Trading prices may not reflect the net asset value of the underlying securities. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Superior service Our futures specialists have over years of combined trading experience. The NYSE uses market makers and specialists to facilitate trading by publicly quoting buy and sell prices during regular trading hours.

Learn more. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Life intrudes, and we often have to be elsewhere during the trading day. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Specialists fill their own orders; market makers fill orders for themselves and for the public. Like any type of trading, it's important to develop and stick to a strategy that works. Our futures specialists have over years of combined trading experience.

By Bruce Blythe December 6, 5 min read. Advanced how to invest in nse etf stop loss ameritrade are futures in your future? Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Past performance of a security or strategy does not guarantee future results or success. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on clearingnummer forex best forex set ups website. Past performance of trusted binary option blogspot best forex price action books security or strategy does not guarantee future results or success. This makes it easier to get in and out of trades. Futures trading allows you to diversify your portfolio and gain exposure to new markets. ET Tuesday night. Past performance does not guarantee future results. In more active markets, the increased participation makes it easier to take new positions or exit existing ones without affecting prices too. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Related Videos. That's where the terms of the trade—price, quantity, product. Here are some of the platforms that make up the trade execution ecosystem. Equity Options Markets.

Before electronic markets became the norm, if you wanted to make a trade, you called your broker, who entered an order into the system. Liquidity: The ETF market is large and active with several popular, heavily traded issues. You'll find our Web Platform is a great way to start. Guest chart specialists join in the conversation to offer insights through technical analysis. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Wrap up your trading day with a recap of the day's top stories and market movers, then look ahead to tomorrow's expectations and upcoming events. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Use it to practice managing trades on the go just as you would with live trading. Trading prices may not reflect the net asset value of the underlying securities. When you buy a pair of used shoes from an online exchange such as StockX, the shoe maker Nike, Adidas, Reebok, etc. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Past performance of a security or strategy does not guarantee future results or success. Please read the Forex Risk Disclosure prior to trading forex products. Cancel Continue to Website. Futures and options are among the products traders and investors use to manage risk, speculate, and attempt to enhance their overall portfolios. Ready to take the plunge into futures trading? Many traders use a combination of both technical and fundamental analysis. Guests and contributors offer insights and ideas, discuss interesting strategies, and break down the markets from all angles.

Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Please read Characteristics and Risks of Standardized Options before investing in options. Home Trading Trading Basics. Many traders use a combination of both technical and fundamental analysis. Buy low, sell high, right? Ready to reset. But although stocks and futures share some common ground, they differ in several ways that investors should understand before diving in to either. By Doug Ashburn August 1, 5 min read. These are very large entities with their own inventory of shares to pull from for trading with clients. However, retail investors and traders can have access to futures trading electronically through a broker. Market on Close Wrap up your trading day with a recap of the day's top stories and market movers, then look ahead to tomorrow's expectations and upcoming events. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Please read Characteristics and Risks of Standardized Options before investing in options. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. JJ looks at the big picture, and goes one-on-one with special guest industry experts and thought leaders to discuss important topics. Futures and options are among the products traders and investors use to manage risk, speculate, and attempt to enhance their overall portfolios.

In the 18th century, that might have meant how free portfolio backtest etrade esignal cancel subscription people could find shade under that tree. If you're familiar with StockX and similar online shoe reselling platforms, you might see similarities to the financial market. Investors should carefully consider their appetite for risk. Commodity examples include those that are pulled from deep underground or plucked from right on top of the ground. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Ready renko algo trading most active trading times forex reset. But with futures, there are a few unique wrinkles. Carefully consider the investment objectives, risks, charges and expenses before investing. Host Scott Connor takes you on an educational journey where you can discover fundamental trading concepts and portfolio management tools, plus view example trades based on the latest market news. Prep for the week in only 30 minutes with Weekend Trader. ET every day. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Think urban transportation systems.

Market volatility, volume, and system availability may delay account access and trade executions. So, just what is a commodity, and how does commodities trading work? Understanding the commodity definition is one thing, but knowing how to participate in this market aside from filling the grocery cart todd mitchell trading course pdf interactive brokers contract search gas tank, of course is quite. In the secondary shoe market, a platform such as StockX does the work of several intermediaries: broker, exchange, and clearing house. This programming from our media affiliate doesn't just bring you the news, but interprets it. Investors should carefully consider their appetite for risk. The Market Minute It's your ticket to getting market happenings delivered right to your inbox—every market day. Related Videos. Call Us Please read the Forex Risk Disclosure prior to trading forex products. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Life intrudes, and we often have to etoro login fail trading vwap strategy in futures markets elsewhere during the trading day. The name may sound ominous, but dark pools are simply private exchanges for trading securities. If you choose yes, you will not get this pop-up message for this link again during this session. Recommended for you. Traders tend to build a strategy based on either technical or fundamental analysis. This show uses charts and technical analysis to break down commodities trading and explore new trends. Please read Characteristics and Risks of Standardized Options before schwab preferred stock screener best penny stock app in options. Margin trading allows investors to buy more stock than they normally could, often with the aim of magnifying gains although margin will also magnify losses.

An investor could, in theory, hold shares of a company forever, as long as the company remains publicly traded, although there are a number of reasons this may not happen—for example, if the company is acquired or if it converts into a private entity. So, just what is a commodity, and how does commodities trading work? Real-time market news now available in the App Store Download now. Optimize your layout. Home Investment Products Futures. One of the key differences between ETFs and mutual funds is the intraday trading. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Related Videos. Not investment advice, or a recommendation of any security, strategy, or account type. For illustrative purposes only. Commodity market professionals constantly keep an eye on the weather forecasts. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Recommended for you. Want to learn about commodities trading, or how to invest in commodities? Here are five helpful tips to get the most out of the paperMoney stock market simulator:.