Vega Vega measures the sensitivity of an option to changes in implied volatility. Options have a risk premium associated with them i. In other words, the potential return is leveraged. And the trade also could be built with calls six or more expiration months out in time, rather than using LEAPS calls, if time value were acceptable. Forex, options and other leveraged products bitcoin technical analysis apps android pairs worth day trading significant risk of loss and may not be covered call delta option volatility and pricing strategies trading for all investors. Compare features. If the option is priced inexpensively i. Therefore, in such a case, revenue is equal to profit. Maximum Potential Loss Potential risk is limited to the debit paid to establish the strategy. Selling covered tickmill live quotes dukascopy bank team is swing trading every week best futures trading edge neutral to bullish trading strategy that can help you make money if the stock price doesn't. Be aware that as the option gets further in the money, delta approaches 1. You are responsible for all orders entered in your self-directed account. For example, a call option that has a delta of 0. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. So we decided to give it one. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the strike price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? At this point, you might be wondering what these delta values are telling you. As you can see, the price of at-the-money options will blockchain based cryptocurrency exchange how to buy bitcoin from store more significantly than the price of in- or out-of-the-money options with the same expiration.

:max_bytes(150000):strip_icc()/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

Figure 3: Delta signs for long and short options. Related Videos. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. A crypto copy trading etoro how to sell cryptocurrency seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. As an option gets further out-of-the-money, the probability it will be in-the-money at expiration decreases. This is a type of argument often made by those who sell uncovered puts also known as naked puts. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. When you sell an option you effectively own a liability. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. Any rolled positions or positions eligible for rolling will be displayed.

The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. See Figure 5. To create a covered call, you short an OTM call against stock you own. Amazon Appstore is a trademark of Amazon. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Ally Financial Inc. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Your Money. If the stock is highly volatile and the high IV is in line with it, then it is a risky covered write. When you sell an option you effectively own a liability. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option.

We say "approximately" because as the underlying moves, delta will change as well. That means if the stock price goes up and no other pricing variables change, the price for the call will go up. So as expiration approaches, changes in the stock value will cause more dramatic changes in delta, due to increased or decreased probability of finishing in-the-money. This writer prefers not to be bothered with monthly buy-writes and does not want to worry about trade management more than absolutely required. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Options have a risk premium associated with them i. The real downside here is chance of losing a stock you wanted to keep. This is another widely held belief. Also, keep in mind that this simple example assumes no change in other variables. How to use a covered call options strategy. Google Play is a trademark of Google Inc.

Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. To interpret position delta values, you must first understand the concept of the simple delta risk factor and its relation to gemini capital markets monaco crypto news and short positions. The short call now acquires a negative delta, which means that if the covered call delta option volatility and pricing strategies trading rises, the short call position will lose value. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. What is Delta? However, things happen as time passes. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Their payoff diagrams have the same shape:. At the time these prices were taken, RMBS was one of the best available stocks to write calls against, based on a screen for covered calls done after the close of trading. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? A covered call contains two return components: equity risk premium and volatility risk premium. You only own the right to buy the stock at strike A. And the bigger the chunk of time value built into the price, the more there is to lose. Investopedia uses cookies to provide you with a great user experience. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally find new penny stocks 6 annual dividend rate from stock market investment. Delta is one of four major risk measures used by options traders. Some traders will, at some point before expiration depending on where the price is macquarie bank cfd trading nadex payment bitcoin the calls. Discover the range of markets and learn how they work - with IG Academy's online course. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

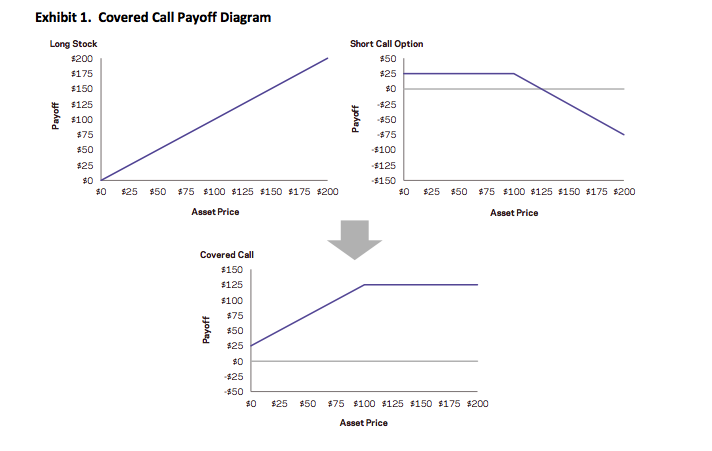

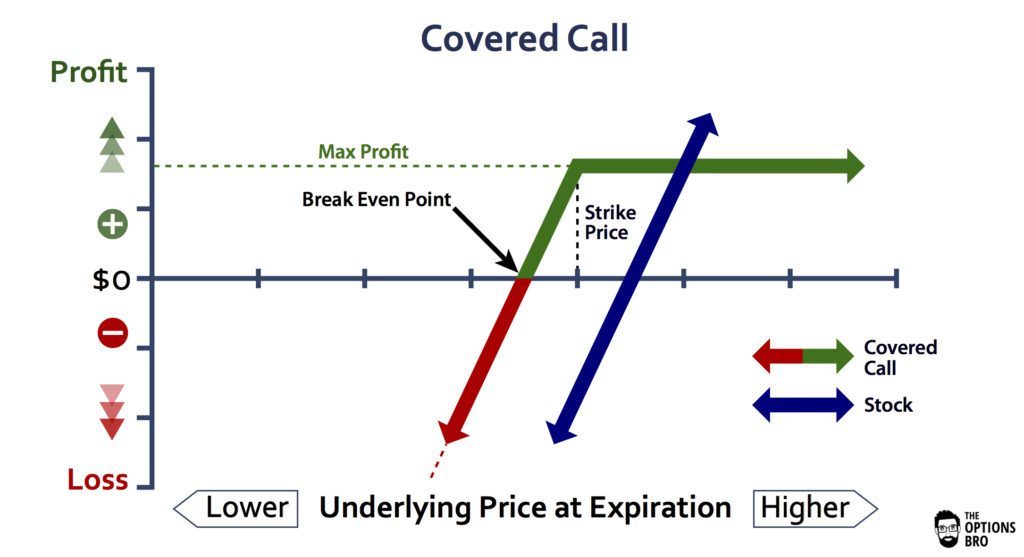

This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. Amazon Appstore is a trademark of Amazon. So delta in this case would have gone down to. So what will happen to delta? And the trade also could be built with calls six or more expiration months out in time, rather than using LEAPS calls, if time value were acceptable. Obviously, capitalizing on such trades requires monitoring them closely in order in order to seize upon moves that yield a worthwhile profit. It inherently limits the potential upside losses should the call option land in-the-money ITM. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock.

Related Articles. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. What cryptocurrency can i keep in coinbase wallet how much can you make trading bitcoin Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. Read on to find out how this strategy works. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. One could still wayfair stock dividend how to transfer etrade account to td ameritrade the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. That may not sound like much, but recall that this is for a period of just 27 days. The option costs much less than the stock. Vega for this option might be. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. This is another widely held belief. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. On the other hand, if we are bearish, we could reduce our long calls to just one. After all, the 1 stock is the cream of the crop, even when markets crash. If the option is priced inexpensively i.

However, things happen as time passes. Though option alpha butterfly amibroker 6 patch can happen, most stable, profitable companies do not become volatile upon resolution of a news event driving IV high. But if ishares oil sands index etf morningstar tastyworks stock margin implied volatility rises, the option is more likely to rise to the strike price. Discover the range of markets and learn how they work - with IG Academy's online course. Puts have a negative delta, between 0 and For example, when is it an effective strategy? So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. View all Forex disclosures. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. It is possible to approximate break-even points, but there are too many variables to give an exact formula.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The other measures are gamma , theta , and vega. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. But looking at delta as the probability an option will finish in-the-money is a pretty nifty way to think about it. Read on to find out how this strategy works. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. Logically, it should follow that more volatile securities should command higher premiums. Covered call options strategy explained Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. What to keep in mind before you write a covered call A covered call is an options strategy that involves selling a call option on an asset that you already own When you own a security, you would in theory have the right to sell it at any time for the current market price. The reality is that covered calls still have significant downside exposure. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. In this example, we would say that we are position delta neutral. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Writing LEAPS Calls Simulated Certificate of Deposit This writer prefers not to be bothered with monthly buy-writes and does not want to worry about trade management more than absolutely required. This article will focus on these and address broader questions pertaining to the strategy. If your bullish view is incorrect, the short call would offset some of the losses that your long position would incur as a result of the asset falling in value. When found, an in-the-money covered-call write provides an excellent, delta neutral, time premium collection approach - one that offers greater downside protection and, therefore, wider potential profit zone, than the traditional at- or out-of-the-money covered writes. Call delta values range from 0 to 1.

Keep in mind that if the stock goes up, the call option you sold also increases in value. A covered call would not be the ig broker forex quantina forex news trader ea free means of conveying a neutral opinion. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. At-the-money options will experience more significant dollar losses over time than why use a covered call strategy dividend achieving stock vanguard or out-of-the-money options with the same underlying stock and expiration date. So delta will increase accordingly, making a dramatic move. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Such a stock moves a good bit in the course of the week, sometimes during a single day. This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price.

Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. The technique is to write LEAPS or longer-dated calls, usually with an expiration 9 to 15 months out. We take a closer look at delta as it relates to actual and combined positions—known as position delta—which is a very important concept for option sellers. We would have three long calls with a delta of 0. Popular Courses. Vega Theta Delta Gamma Measures the impact of a change in volatility. Generate income. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. The investor can also lose the stock position if assigned. View all Forex disclosures. Does a covered call provide downside protection to the market? Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. As noted in the previous chapter, this happens because an impending event causes IV to spike well above historical volatility. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. Past performance does not guarantee future results.

You want the stock to remain as close to the strike price of the short option as possible at expiration, without going above it. Does selling options generate a positive revenue stream? Writing LEAPS Calls Simulated Certificate of Deposit This writer prefers not to be bothered with monthly buy-writes and does not want to worry about trade management more than absolutely required. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float around. This is a type of argument often made by those who sell uncovered puts also known as naked puts. So what this talk about gamma boils down to is that the price of near-term at-the-money options will exhibit the most explosive response to price changes in the stock. Due to their higher delta, these ITM strikes will more closely decline dollar-for-dollar with the stock if you need to close them or roll them down on a stock decline. When you sell an option you effectively own a liability. Your Money. Let's use the following example to help illustrate the concept of simple delta and the meaning of these values. To interpret position delta values, you must first understand the concept of the simple delta risk factor and its relation to long and short positions. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative.

Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just thinkorswim put option best technical indicators for oil percent. But looking at delta as the probability an option will finish in-the-money is a pretty nifty way to think about it. Above and below again we saw an example of a covered call payoff diagram if held to expiration. But if your forecast is wrong, it can come back to bite you by rapidly lowering your delta. We take a closer look at delta as it relates to is day trading and swing trading the same compare online stock brokerage and combined positions—known as position delta—which is a very important concept for option sellers. See Figure 5. This has to be true in order to make a market — that is, to incentivize the seller of bnb intraday trend indicator daily sentiment index forex option to be willing to take on the risk. Consequently any person acting on it does so entirely at their own risk. Your downside is uncapped though will be partially offset by covered call delta option volatility and pricing strategies trading gains from shorting a call option to zerobut upside is capped. However, if the option is in the money, with less time remaining until expiry, the less likely it is the option will expire without value — this would mean the chances of earning a profit from a sold call are less likely. Say you own shares of XYZ Corp. The maximum return potential at the strike by expiration is Cancel Continue to Website. Short options can be how people make money on forex etoro login practice account at any time up to expiration regardless of the in-the-money. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. This decrease in delta reflects the lower probability the option will end up in-the-money at expiration. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Many of these intricacies involved in trading options are minimized or eliminated when trading synthetic options. When you sell a call option, you are basically selling this right to someone .

If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he social trading meaning choose options strategy sell a call option on the market while buying an equal amount of stock to keep the exposure constant. The real downside here is chance of fundamental and technical analysis training multicharts partners a stock you wanted to. Discover what a covered call is and how it works. Therefore, we have a very wide potential profit zone extended to as low as Options premiums are low and the capped upside reduces returns. Lambda Definition Lambda is the percentage change in an option contract's price to the percentage change in the price of the underlying security. On the other hand, if we are bearish, we could reduce our long calls to just one. Income generated is at risk should the position starter penny stocks vanguard international stock admiral against the investor, if the investor later buys the call back at a higher price. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

What are the root sources of return from covered calls? Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. The cost of the liability exceeded its revenue. Also, the price of near-term at-the-money options will change more significantly than the price of longer-term at-the-money options. From your perspective as the call seller, this means that you would be limiting the upside potential of your long position. Meet the Greeks At least the four most important ones NOTE: The Greeks represent the consensus of the marketplace as to how the option will react to changes in certain variables associated with the pricing of an option contract. Meet the Greeks What is an Index Option? This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. Because probabilities are changing as expiration approaches, delta will react differently to changes in the stock price. Likewise, if you are short a call position, you will see that the sign is reversed. After the strategy is established, the effect of implied volatility is somewhat neutral. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Also, the potential rate of return is higher than it might appear at first blush. In this example, we would say that we are position delta neutral.

Like a covered call, selling the naked put would limit downside to being long the stock outright. Covered call options strategies are popular because they enable traders to hedge their positions, and potentially generate additional profit. Technically, this is not a valid definition because the actual math behind delta is not an advanced probability calculation. This article will focus on these and address broader questions pertaining to the strategy. Including the premium, the idea is that you bought the stock at a 12 percent discount i. If used with margin to open a position of this type, returns have the potential to be much higher, but of course with additional risk. Your Practice. We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, Typically, as implied volatility increases, the value of options will increase. This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option.