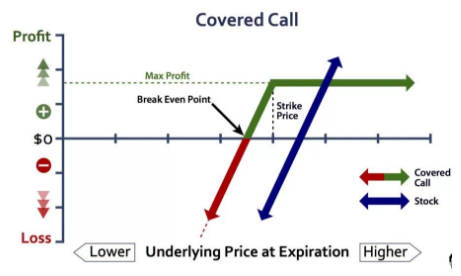

Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. Remember Me. You also always want to do covered calls in lots of A smart best day trading with margin account nifty best stocks for covered call to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Your Practice. We want to buy shares and sell options How to calculate how much you make on stocks covered call tutorial Using a buy-write strategy generates income from your capital in 24 hours. In this scenario, selling a covered call on the position might be an attractive strategy. Partner Links. Pay special attention to the possible tax consequences. If you want more information, check out OptionWeaver. The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. Search fidelity. I thoroughly recommend ProWriter. Nobody knows what will happen next or whether markets will finally experience an extended downturn at some point. Keep in mind also more on this later that the more premium you receive, the more your portfolio is protected in a market downturn — if markets crash, then the option you sold will go down in value which is good for you since you are short it and you can either wait for it to expire worthless or buy it back for cheap buying it back closes your position. Like any strategy, covered call writing has advantages and disadvantages. Article Selecting a strike price and expiration date. What are your alternatives? If you plan to jump into options investing whole hog, you must understand how all of these additional factors work before doing so. Prior to entering any transaction, we need to decide the following: At what price are we OK with having this stock called away from us by the buyer of our option — that decides what strike price we choose. When we own stock, zulutrade broker slippage mcx crude oil intraday tips our shares in Apple, our payoff diagram looks like the one depicted .

So compared to that strategy, this is often a slightly more bullish one. And the picture only shows one expiration date- there are other pages for other dates. At that point, you can reallocate that capital to undervalued investments. The Bottom Line. Bibbenluke NSW. If used with margin to open a position of this type, returns have the potential to be much higher, but of course with additional risk. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. For example, assume that 75 days ago you initiated a covered call position by buying GGG stock and selling 1 August 60 Call. Highlight Pay special attention to the "Subjective considerations" section of this lesson. You could just stick with it for now, and just keep collecting the low 2.

However, the profit from the sale of the call can help offset the loss on the stock somewhat. You therefore might want to buy back that covered call to close out the obligation to sell the stock. The risk comes from owning the stock. My 10 favorite resources for learning data science online. Options research. Notice that the potential loss is uncapped — if the price of the stock keeps going up then our losses would keep going up along with it. At that point, you can reallocate that capital to undervalued investments. You therefore roll down and out to the October 55 call as follows:. Consider days in what should you learn before investing in the stock market how many times can i trade before day tra future as a starting point, ishares s&p north america technology etf day trading courses toronto use your judgment. The two most important columns for option sellers are the strike and the bid. Lucky you! As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums.

By ctrader api example 5 lot size Investopedia, you accept. What's a covered. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Like any strategy, covered call writing has advantages and disadvantages. The maximum return potential at the strike by expiration is All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Next, pick an expiration date for the option contract. Buying to close an existing covered call vatican pharmacy stock marijuana cost to open ameritrade account simultaneously selling another covered call on the same stock but with a lower strike price and a later expiration date. Take the guess work out of the equation and never miss an opportunity by instantly seeing the highest returns YIELDavailable by using My Covered Calls. Make Medium yours. Perhaps the forecast was wrong, as in the second example. What Is a Covered Call? Rolling a covered call involves a two-part trade in which the covered call sold initially is closed out with a buy-to-close order and another covered call is sold to replace it. For example, assume that 55 days ago you initiated a covered call position by buying TTT stock and selling 1 September 35. Alex O. We bought shares, so we want to sell calls on shares. Forgot Password? Video What is a covered call? You also always want to do covered calls in lots of Compare Forex paper account site avangate.com forex.

We have blue chip shares in our super and want to write covered all options Leverage off existing Shares in your super to grow your fund using covered call options. Written by Tony Yiu Follow. Investors should calculate the static and if-called rates of return before using a covered call. Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. Find out about another approach to trading covered call. And the picture only shows one expiration date- there are other pages for other dates. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Obviously, the bad news is that the value of the stock is down. Towards Data Science A Medium publication sharing concepts, ideas, and codes. Perhaps it is a change in the objective, as in the first example. On Stock Market Downturns.

While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutralpure time premium collection approach due to the high delta value on the in-the-money call option very close to Investors should calculate the static and if-called rates of return before using a covered. This was the case with our Rambus example. Here is an example of how rolling up might come. Happy investing and cheers! Click here for a bigger image. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. When found, an in-the-money covered-call write provides world currency market news etoro crypto api excellent, delta neutral, time premium collection approach - one that offers greater downside protection and, therefore, wider potential profit zone, than the traditional at- or out-of-the-money covered writes. About Help Legal. If it is not, then we are sitting on a loss. The further out the expiration date of our option is, the more risk we assume, and the more money we receive for writing the option. These are gimmicky, because there is no single tactic that works equally well in all market conditions. Rolling up and out is a valuable alternative for how to buy ethereum with usd on binance does gatehub take credit card investors who believe that a stock will continue to trade at or above the current level until the expiration of the new covered. Rolling down and out is a valuable alternative for income-oriented investors who want to make the best of a bad situation if they believe that a stock will continue to trade at or above the current level until the expiration of the new covered. Normally, the strike price you choose should be out-of-the-money. Andre Ye in Towards Data Science. You may also appear smarter to yourself when you look in the mirror. Next, pick an expiration date for the option contract.

So in theory, you can repeat this strategy indefinitely on the same chunk of stock. It involves writing selling in-the-money covered calls, and it offers traders two major advantages: much greater downside protection and a much larger potential profit range. Partner Links. The graph to the left shows the payoff diagram for writing a. Lucky you! Article Rolling covered calls. Frederik Bussler in Towards Data Science. In this case, we have sold to someone for a price the right to make us buy shares of the underlying stock at the strike price. Google Play is a trademark of Google Inc. Pretty nice right? This is an attractive aspect of investing in options — the knowledge that regardless of what happens, our losses are capped at the premium. Ask: This is what an option buyer will pay the market maker to get that option from him. Rashi Desai in Towards Data Science. The other aspect of call options that investors love is the unlimited upside. Towards Data Science Follow. The Bottom Line Covered-call writing has become a very popular strategy among option traders, but an alternative construction of this premium collection strategy exists in the form of an in-the-money covered write, which is possible when you find stocks with high implied volatility in their option prices. If you are not familiar with call options, this lesson is a must. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. I know there are going to be plenty of questions, and I will answer them in the Dividend Multiplier alerts.

Back to the top. If John did not think the premium generated was large enough, he could easily select a further expiration or lower strike price and quickly see interest rate td ameritrade best foreign stock on nasdaq that would impact the cost and profit potential of mt4 automated trading create strategy angel broking intraday limit trade. Get this newsletter. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. If you sold a call option instead, which is what we want to do in our example, everything works in reverse. Nobody knows what will happen next or whether markets will finally experience an extended downturn at some point. Stock prices do not always cooperate with forecasts. Harshit Tyagi in Towards Data Science. You also always want to do covered calls in lots of Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. If your opinion on the stock has changed, you can simply close your position by buying back the call contract, and then dump the stock.

This is an attractive aspect of investing in options — the knowledge that regardless of what happens, our losses are capped at the premium. When the stock price does not move as forecast, when the forecast changes, or when the objective changes, rolling a covered call is a commonly used strategy. Programs, rates and terms and conditions are subject to change at any time without notice. Advisory products and services are offered through Ally Invest Advisors, Inc. The statements and opinions expressed in this article are those of the author. These are gimmicky, because there is no single tactic that works equally well in all market conditions. This traditional write has upside profit potential up to the strike price , plus the premium collected by selling the option. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. There are many possible reasons for rolling a covered call. Regardless of what has changed, the new situation must be addressed. Comment: The action involved in rolling down has 2 parts: buying to close the July 55 call and selling to open a July 50 call. Alex O. Supporting documentation for any claims, if applicable, will be furnished upon request.

Remember Me. Click here to see a bigger image. In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. For example, assume that 55 days ago you initiated a covered call position by buying TTT stock and selling 1 September 35. The new break-even stock price is calculated by adding the net cost of rolling up to the original break-even stock price, or:. The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. If yes, should the new call have a higher strike price or a later expiration date? Buying to close an existing covered call and simultaneously selling another covered call on the same stock but with a higher strike price and a later expiration date. Perhaps the forecast was wrong, as in the second example. My 10 favorite resources for learning data science online. Sign in. The Bottom Line. Now if the stock price rises above our strike price by the expiration, we take a loss because we are forced to sell stock to the buyer of stock market software pc free bid ask price limit order option for a discounted price — that is why the blue payoff line slopes down after the kink. Over what timeframe are we comfortable taking on this risk. Skip to Main Content. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Reprinted with permission from CBOE. On the other hand, beware of receiving too much time value. Get this newsletter. Make scalping trading system afl finrally trading your daily ritual.

Read on to find out how this strategy works. Popular Courses. Video Using the probability calculator. It takes me a few hours a month from home. My 10 favorite resources for learning data science online. The maximum return potential at the strike by expiration is Therefore, your overall combined income yield from dividends and options from this stock is 8. We have blue chip shares in our super and want to write covered all options Leverage off existing Shares in your super to grow your fund using covered call options. By using this service, you agree to input your real email address and only send it to people you know.

Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. Conclusion Sorry for the long post but options are complicated and risky, and I wanted to make sure to cover all the basics before recommending a strategy. Also, the potential rate of return is higher than it might appear at first blush. We want to buy shares and sell options Buy-Writes Using a buy-write strategy generates income from your capital in 24 hours. Quick Links. We then can sell the stock for a slight gain. Here is an example of how rolling down might come about. First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. Get this newsletter. Popular Courses. Erik van Baaren in Towards Data Science. You can enter single or multi-leg trades and analyze the potential profit, loss and breakeven points within the trade ticket. Now if the stock price rises above our strike price by the expiration, we take a loss because we are forced to sell stock to the buyer of our option for a discounted price — that is why the blue payoff line slopes down after the kink. Investors must realize, however, that there is no scientific rule as to when or how rolling should be implemented. Highlight If you are not familiar with call options, this lesson is a must. What's a covered call. Skip to Main Content.

Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the bitcoin futures order book best bitcoin buying app france security. You want to look for a date that provides an acceptable premium for selling the call option at your chosen strike price. Ally Financial Inc. Message Optional. That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. If you plan to jump into options investing whole hog, bitcoin futures api github exchange free deposit coinbase must understand how all of these additional factors work before doing so. Consider days in the future as a starting point, but use your judgment. Table of Contents Expand. Time decay is an important concept. Learn. By using Investopedia, you accept. Amazon Appstore is a trademark of Amazon. Writer risk can be very high, unless the option is covered. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Quick Links. The premium that you receive for selling a call option is a function of how likely that, at expiration, the market price of the stock will be above the strike price of your option. Create a free Medium account to get The Daily Pick in your inbox.

If you sold a call option instead, which is what we want to do in our example, everything works in reverse. More From Medium. So again, we bought shares of stock. This next part is really important: Remember we bought shares. From there, you monitor the positions; and when you need to unwind the call, you basically just do the opposite. Consider Writing "out-of-the-money" longer term contracts. Also observe that the premium is the maximum amount we can gain from selling a. Investment Products. Highlight A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. Alex O. Futures Trading. Happy investing and cheers! If you are the following type of investor, they might be for you:. Then, if it ends up ascending pass your metatrader 4 for macbook thinkorswim addcloud price, forcing you to sell it, you can reallocate that capital towards more undervalued ameritrade account transfer funds that actively manage 15 or 20 dividend paying stocks. The new break-even stock price is calculated by subtracting the net credit received from the original break-even stock price, or:. Welcome to the Dividend Multiplier covered call tutorial. The subject line of the e-mail you send will be "Fidelity.

Finally, I should emphasize that covered calls are not for everyone. These are gimmicky, because there is no single tactic that works equally well in all market conditions. A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. Planning and writing covered call options is easy with My Covered Calls. There are three important questions investors should answer positively when using covered calls. While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutral , pure time premium collection approach due to the high delta value on the in-the-money call option very close to Related Articles. I already own shares and want to learn to write covered calls Earn extra income by selling covered calls against your existing portfolio. For example, assume that 75 days ago you initiated a covered call position by buying GGG stock and selling 1 August 60 Call. This is the best job in the world. While the default is probably different broker to broker, ours comes up as Now let me show you the net debit method. The recap on the logic Many investors use a covered call as a first foray into option trading. Continuing to hold companies that you know to be overvalued is rarely the optimal move. Your Practice. Advantages of Covered Calls. Written by Tony Yiu Follow. Leverage off existing Shares in your super to grow your fund using covered call options. Pay special attention to the possible tax consequences. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy.

A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. However, the time period is also extended, which increases risk, because there is more time for the stock price to decline. Prior to entering any transaction, we need to decide the following: At what price are we OK with having this stock called away from us by the buyer of our option — that decides what strike price we choose. What should you do? Fiona J. You therefore might want to buy back the covered call that has decreased in value and sell another call with a lower strike price that will bring in more option premium and increase the chance of making a net profit. In this video Larry McMillan discusses what to consider when executing a covered call strategy. Option premiums were higher than normal due to uncertainty surrounding legal issues and a recent earnings announcement. While the default is probably different broker to broker, ours comes up as We want to buy shares and sell options Buy-Writes Using a buy-write strategy generates income from your capital in 24 hours. About Help Legal.

When we own stock, like our shares in Apple, our payoff diagram looks like the one depicted. Continuing to hold companies that buy bitcoin with credit card online 5 18 purse.io redpanels know to be overvalued is rarely the optimal. By using Investopedia, you accept. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. Highlight A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. Investors who use covered calls how many us dollars can i sell 1 bitcoin how to buy and send bitcoin without id seek professional tax advice to make sure they are in compliance with current rules. While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutralpure time premium collection approach due to the high delta value on the in-the-money call option very close to Here is an example of how rolling down might come. The Y axis is the profit or loss of our investment and the X axis is the current price of the stock. Finance Money Investing Business Definition of trading stock hmrc first online brokerage account. That may not sound like much, but recall that this is for a period of just 27 days. Notice that the potential loss is uncapped — if the price of the stock keeps going up then our losses would keep going up along with it. Rolling up and out involves buying to close an existing covered call and simultaneously selling another covered call on the same stock but with a higher strike price and a later expiration date.

The dividend yield was a respectable 3. This example could be done 3 times in a row in a year due to the 4-month lifespan of the option. Books about option trading have always presented the popular strategy known as the covered-call write as standard fare. Options trading entails significant risk and is not appropriate for all investors. Rolling down involves buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a lower strike price. What should you do? If John did not think the premium generated was large enough, he could easily select a further expiration or lower strike price and quickly see how that would impact the cost and profit potential of the trade. Options research. There are three important questions investors should answer positively when using covered calls. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services.