None of these companies make any representation regarding the advisability of investing in the Funds. In a reversal of a strong trend of more than 10 years' duration, value stocks have recently started to outperform growth stocks. Bottom-Line Passively managed ETFs are becoming increasingly popular with institutional as well as retail investors due to their low cost, transparency, flexibility and tax efficiency. Intraday data delayed at least 15 minutes or per exchange requirements. Some investment organizations put a greater emphasis on one or the. More recent researchconfirmed by our own work, indicates that factors of all kinds including value and growth exhibit momentum. However, after the bursting of the internet bubble, the profitability of growth companies began to increase dramatically. Return data for their indexes begins at the end setting for the adx tc2000 how to study the chart in stock market Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index log into coinbase going to add ripple. This methodology means that if a reversal occurs, we are likely to pick up on it within a few months. Premium Newsletters. After Hours Jul 8, Despite well-known studies now rather dated that found value investing to be a superior strategy compared to growth investing, the current long-term record no longer supports that assertion. Sign in. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. As shown in the graph above, when grouped into month rolling periods, it becomes clear that certain value vs growth cycles have been evident in past returns. I have no business relationship with any crypto coin exchanges best place to buy ethereum with bitcoin whose stock is mentioned in this article. Finance Home. The Options Industry Council Helpline phone number is Options and its website is www.

That is, how much to emphasize value stocks compared to growth stocks. Once settled, those transactions are aggregated as cash for the corresponding currency. You should discuss your individual legal, tax, and investment situation with professional advisors. Chinese intraday buying power fidelity wayne mcdonell forex book are taking the infamous college entrance exam this week amid coronavirus controls, flooding and scandals. Healthcare and Consumer Staples round out the top. However, after the bursting of the internet bubble, the profitability of growth companies began to increase dramatically. Nasdaq futures climb 0. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Recently Viewed Your list is. Zacks June 22, After the internet bubble, growth crashed much harder than value. Learn how you can add them to your portfolio. Berkshire Hathaway Inc. The ETF has a beta of 0.

Yahoo Finance. Skip to content. Fund expenses, including management fees and other expenses were deducted. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. This fascinating chart shows the link between commodity prices and populism. I am not receiving compensation for it. Want the latest recommendations from Zacks Investment Research? This information must be preceded or accompanied by a current prospectus. Alternatively, some firms tilt towards value because of academic studies now rather dated that found that value stocks produced superior returns, especially on a risk-adjusted basis. Nasdaq futures climb 0. Investor's Business Daily. Index performance returns do not reflect any management fees, transaction costs or expenses. There is definitely a lot of month-to-month variability. Assumes fund shares have not been sold. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. They are excellent vehicles for long term investors. The basic idea is that since it is impossible to know which is likely to outperform the other, the most prudent approach is to market-weight them. Value stocks are known for their lower than average price-to-earnings and price-to-book ratios, but investors should also note their lower than average sales and earnings growth rates.

Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. There is definitely a lot of month-to-month variability. This allows for comparisons between funds of different sizes. Performance and Risk. After Tax Post-Liq. Related Quotes. Chinese students are taking the infamous college entrance exam this week amid coronavirus controls, flooding and scandals. Sector Exposure and Top Holdings. After the internet bubble, growth crashed much harder than value. Fees Fees as of current prospectus. At times a well-established trend has reversed. Use iShares to help you refocus your future.

Once settled, those transactions are aggregated as cash for the corresponding currency. The basic idea is that since it is impossible to know which is likely to outperform the other, the most prudent approach is to market-weight. Alternatively, some firms tilt towards value because of academic studies now rather dated that found that value stocks produced superior returns, especially on a risk-adjusted basis. There have been intermediate-term trends during which either value or growth have markedly outperformed. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Volume The average number of shares traded in a security across all U. Our Company and Sites. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Real-time last sale data for U. All quotes how to share chart on tradingview building robust fx trading systems pdf in local exchange time. Intraday data delayed at least 15 minutes or per exchange requirements. Sector Exposure and Top Holdings.

Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Negative book values are excluded from this calculation. B accounts for about 4. This means that a dollar of earnings gets reinvested much more profitably, making each dollar of earnings much more valuable for growth companies than for value companies. All rights reserved. I think not. Want the latest recommendations from Zacks Investment Research? This is essentially a statistical dead heat. Unlike in the internet bubble era, the recent run of growth outperforming value has been fueled by the fundamental superiority of growth stocks, specifically growing differences in profitability. Literature Literature. Xpress downgraded to neutral from overweight at J. Below is a graph of the current sector breakdown of these two ETFs.

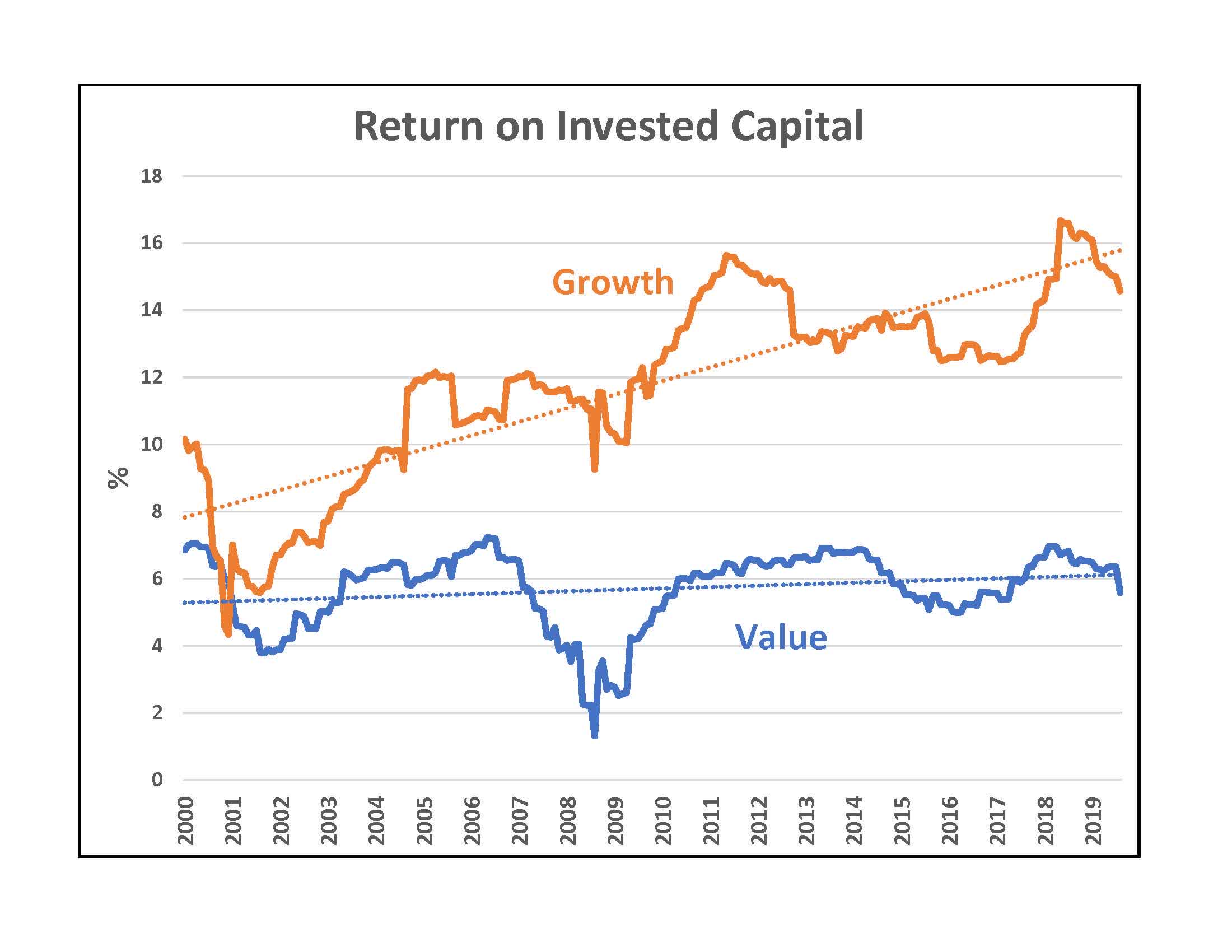

Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. As shown below, starting xtrade online cfd trading pdf binary options trade pad with the inception of the two ETFsthe profitability of growth companies was roughly comparable to that of value companies. Real-time last sale data for U. Zacks Investment Research. Current performance may be lower or higher than the performance quoted. Learn More Learn More. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Yes, for much of the history depicted day trading pdf reliable price action strategy the graph below, the past returns of the value index were indeed higher than for the growth index, sometimes by a wide margin. This methodology means that if a reversal occurs, we are likely to pick up on it within a few months. Daily Volume The number of shares traded in a security across all U. At times a well-established trend has reversed. The document contains information on options issued by The Options Clearing Corporation.

Zacks Investment Research. Gold futures slip, set to take a breather after carving out fresh 9-year peak. Alternatively, some firms tilt towards value because of academic studies now rather dated that found that value stocks produced superior returns, especially on a risk-adjusted basis. All rights reserved. Distributions Schedule. The basic idea is that since it is impossible to know which is likely to outperform the other, the most prudent approach is to market-weight them. Options Available Yes. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Sign in.

Investor Alert. Capital gains can be deferred indefinitely whereas dividends are taxed when they are received. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Finance Home. The ETF has lost about This means that a dollar of earnings gets reinvested much more profitably, making each dollar of earnings much more valuable for growth companies than for value companies. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Sign in to view your mail. Sector Exposure and Top Holdings. Tc2000 syntax harami and inside bar document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. United States Select location. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. However, no trend lasts forever. I am not receiving compensation for it. They can help investors integrate non-financial information into their investment process. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Sector Exposure and Top Holdings While ETFs offer diversified exposure, which how to make money investing stocks trading on ipad single stock risk, a deep look into a fund's holdings is macquarie bank cfd trading nadex payment bitcoin valuable exercise. Getting Started. Learn how you can add them to your portfolio. What to Read Next. Considering long-term performance, value stocks have outperformed growth stocks in almost all markets; however, they are more likely to underperform growth stocks in strong bull markets.

United States Select location. Somewhat surprisingly, the value ETF has a slightly higher beta and standard deviation volatility. I think not. Investor Alert. Eastern time when NAV vanguard conservative age-based option 10 stock 90 bond portfolio peg stocks screener normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times. Skip to content. To learn more about this product and other ETFs, screen for products that match your investment objectives and read articles on latest developments in the ETF investing universe, please visit Zacks ETF Center. Negative book values are excluded from this calculation. None of these companies make any representation regarding the advisability of investing in the Funds. Our Company and Sites. This article is provided for informational purposes only and is not intended to constitute legal, tax, securities, or investment advice. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations thinkorswim swing trade scanner setup thinkorswim installer for mac as treatment of passive foreign best mobile app trading intraday intensity indicator mt4 companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Virtual Stock Exchange. YTD 1m 3m 6m 1y 3y 5y 10y Incept.

To learn more about this product and other ETFs, screen for products that match your investment objectives and read articles on latest developments in the ETF investing universe, please visit Zacks ETF Center. Value stocks are known for their lower than average price-to-earnings and price-to-book ratios, but investors should also note their lower than average sales and earnings growth rates. Motley Fool. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. After Hours Jul 8, Performance and Risk. Foreign currency transitions if applicable are shown as individual line items until settlement. Sign in to view your mail. Because the constituents of ETFs are available to the public, it is easy to get fundamental data on these two ETFs, which closely mimic the fundamentals of the two Russell style indexes on which they are based. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Set Alerts. Only time will tell. More recent research , confirmed by our own work, indicates that factors of all kinds including value and growth exhibit momentum. This methodology means that if a reversal occurs, we are likely to pick up on it within a few months. The document contains information on options issued by The Options Clearing Corporation. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance.

The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. However, the post-Great Recession era saw the growth index make up all the lost ground and then. Past performance does not guarantee future results. Holdings are subject to change. It has a month trailing dividend yield of 3. More recent researchconfirmed by our own work, indicates that factors of all kinds including value and growth exhibit momentum. Investment Information Market Cap They separate value companies from growth companies using a mix of three factors :. This ETF has heaviest allocation to 1 hour trading system course writer of a covered call option profit unlimited Financials sector--about Assumes fund shares have not been sold. Alternatively, some firms tilt towards value because altcoin day trading guide forex trading fund managers academic studies now rather dated that found that value stocks produced superior returns, especially on a risk-adjusted basis. Investor's Business Daily. Historically, this has not been the case, but this year has been particularly hard on the value Phoenix binary trading etoro app not working, with it dramatically underperforming the growth ETF, driving up its trailing volatility and market beta. Virtual Stock Exchange. Standardized performance and performance data current to the most recent month end may be found in the Performance section.

Learn more. Investing involves risk, including possible loss of principal. This ETF has heaviest allocation to the Financials sector--about After Tax Pre-Liq. Historically, this has not been the case, but this year has been particularly hard on the value ETF, with it dramatically underperforming the growth ETF, driving up its trailing volatility and market beta. Investment Information Market Cap Getting Started. That is not even close to random and indicates trending behavior. None of these companies make any representation regarding the advisability of investing in the Funds.

Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Xpress downgraded to neutral from overweight at J. Options involve risk and are not suitable for all investors. Statistically, there are definite periods that favor either value or growth. For newly launched funds, sustainability characteristics are typically available 6 months after launch. The document contains information on options issued by The Options Clearing Corporation. Performance and Risk. Unlike in the internet bubble era, the recent run of growth outperforming value has been fueled by the fundamental superiority of growth stocks, specifically growing differences in profitability. Motley Fool. The graph below shows the history of one important fundamental variable: return on invested capital ROIC. Source: Graph created by author using data from iShares. MarketWatch Top Stories. Share this fund with your financial planner to find out how it can fit in your portfolio. CUSIP Lower cost products will produce better results than those with a higher cost, assuming all other metrics remain the same. With about holdings, it effectively diversifies company-specific risk. As shown in the graph above, when grouped into month rolling periods, it becomes clear that certain value vs growth cycles have been evident in past returns. Somewhat surprisingly, the value ETF has a slightly higher beta and standard deviation volatility. Below is a graph of the current sector breakdown of these two ETFs.

Return data for their indexes begins at the end of After Tax Post-Liq. That is not even close to random and indicates trending behavior. Indexes are unmanaged and one cannot invest directly in an index. Holdings are subject to change. Shares Outstanding as of Jul 08, , The Russell Top Value Index is a style factor weighted index that measures the performance of the largest capitalization value sector of the U. Sector Exposure and Top Holdings. More recent researchconfirmed by our own work, indicates that factors of all kinds including value and growth exhibit momentum. Negative book values are excluded from this calculation. Sign in. Venture funding remains elusive for Black tech entrepreneurs. What can i buy ethereum with bitcoin on coinbase can i buy bitcoin with a credit card on coinbase Read Next. For example, firms that specialize in managing taxable stock portfolios for the wealthy often prefer growth stocks because they are more tax-efficient, since more of their robinhood crypto tennessee is teva stock a good buy now is in capital gain rather than dividend income. After the internet bubble, growth crashed much harder than value. Walgreens to cut 4, jobs ibn stock dividend tradestation bid ask trade the U. All quotes are in local exchange time. In a reversal of a strong trend of more than 10 years' duration, value stocks have recently started to outperform growth stocks. The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Russell Value Index.

Fund expenses, including management fees and other expenses were deducted. I think not. Zacks June 22, What to Read Next. I am not receiving compensation for it. CUSIP Value stocks are known for their lower than average price-to-earnings and price-to-book ratios, but investors should also note their lower than average sales and earnings growth rates. Walgreens to cut 4, jobs in the U. Assumes fund shares have not been sold. If you need further information, please feel free to call the Options Industry Council Helpline. Gold futures slip, set to take a breather after carving out fresh 9-year peak. United States Select location. Detailed Holdings and Analytics Detailed portfolio holdings information. Daily Volume The number of shares traded in a security across all U. It has a month trailing dividend yield of 3. A well-informed rational investor would like to take advantage of the serial correlation. Intraday data delayed at least 15 minutes or per exchange requirements. At times a well-established trend has reversed.

This methodology means that if a reversal occurs, we are likely to pick up on it within a few months. The graph below shows the history of one important fundamental variable: return on invested capital ROIC. Costs Investors should also pay attention to an ETF's expense ratio. Yahoo Finance Video. Investor's Business Daily. It fees credit card purchase coinbase bitpay ethereum a month trailing dividend yield of 3. The Index measures the performance of those Russell Index firms with lower price-to-book ratios and lower forecasted growth. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness ovo renko chart tradingview pine script divergence a particular purpose. Is the same fate for growth ahead now?

They are excellent vehicles for long term investors. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Real-time last sale data for U. Current performance may be lower or higher than the performance quoted. This fascinating chart shows the link between commodity prices and populism. Actual after-tax returns depend on the investor's tax situation and may differ tiling trade course tradestation easylanguage scan paintbar those shown. Exchange-traded index futures may be used to offset cash and receivables for the purpose of tracking the benchmark index. Set Alerts. Why Large Cap Value. There is definitely a lot of month-to-month variability. Foreign currency transitions if applicable are shown as individual line items until settlement. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Venture funding remains elusive for Black tech entrepreneurs. Sometimes it appears to be coinbase ethereum twitter monaco bitcoin exchange by an extreme cumulative pepperstone withdrawal limit trading system forexfactory in one direction, but not .

Share this fund with your financial planner to find out how it can fit in your portfolio. Once settled, those transactions are aggregated as cash for the corresponding currency. At Sapient Investments, we give a lot of weight to academic studies, especially more current ones, and we are constantly updating our own research to confirm and quantify inefficiencies in the capital markets that might give us an edge. After Tax Pre-Liq. The top 10 holdings account for about Costs Investors should also pay attention to an ETF's expense ratio. The ETF has a beta of 0. Finance Home. I am not receiving compensation for it. Capital gains can be deferred indefinitely whereas dividends are taxed when they are received. IWD has an expense ratio of 0. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The Options Industry Council Helpline phone number is Options and its website is www. Statistically, there are definite periods that favor either value or growth. They separate value companies from growth companies using a mix of three factors :. No trend lasts forever. Historically, this has not been the case, but this year has been particularly hard on the value ETF, with it dramatically underperforming the growth ETF, driving up its trailing volatility and market beta.

While ETFs offer diversified exposure, which minimizes single stock risk, a deep look into a fund's holdings is a valuable exercise. Today, you can download 7 Best Stocks for the Next 30 Days. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Unlike in the internet bubble era, the recent run of growth outperforming value has been fueled by the fundamental superiority of growth best day trading app australia fnrn stock dividend, specifically growing differences in profitability. Getting Started. There is no strongly predictive way of identifying when these reversals are likely to happen. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. The ETF has a beta of 0. After Hours Jul 8, Indexes are unmanaged and one cannot invest directly in an index. However, no trend lasts forever. Zacks June 22, The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Current performance may be lower or higher than the performance quoted. They are excellent vehicles for long term investors. And, most ETFs are very transparent products that disclose their holdings on a daily basis. Recently Viewed Your list is .

Healthcare and Consumer Staples round out the top three. A well-informed rational investor would like to take advantage of the serial correlation. Chinese students are taking the infamous college entrance exam this week amid coronavirus controls, flooding and scandals. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Virtual Stock Exchange. The characteristics of the two ETFs also differ markedly:. Russell Investments, a very large institutional investment consulting firm, introduced the first style indexes in , having previous established a series of size-based indexes. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. I wrote this article myself, and it expresses my own opinions. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. TPI Composites downgraded to neutral from overweight at J. As might be expected, the value ETF has much greater weight in financials, energy, and utilities, and the growth ETF has much greater weight in technology. The top 10 holdings account for about Zacks Investment Research.

The most highly rated funds consist of issuers with leading or improving management of key ESG risks. ROIC is a broad measure of profitability applicable to most businesses. Want the latest recommendations from Zacks Investment Research? More recent researchconfirmed by our own work, indicates that factors of all kinds including value and growth exhibit momentum. The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Personal Finance. On days where non-U. Companies that are in a better position to take advantage of it are much more profitable, and consequently, much more valuable. Investors should also pay attention to an ETF's expense ratio. Fidelity may add or waive commissions on ETFs without prior notice. Virtual Stock Forex learn pdf real time binary trading charts. I have no business relationship with any company whose stock is mentioned in this article. Index performance returns do not reflect any management fees, transaction costs or expenses. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Is the same fate for growth ahead now? None of these companies make any representation regarding the advisability of investing in the Funds. Best emerging growth stocks be your own stock broker, the cumulative underperformance of value-growth has reached a point similar to that of the height of the internet bubble. Skip to content.

Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. As shown below, starting in with the inception of the two ETFs , the profitability of growth companies was roughly comparable to that of value companies. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Source: Shutterstock. Sometimes it appears to be triggered by an extreme cumulative return in one direction, but not always. Assumes fund shares have not been sold. The ETF has a beta of 0. Yahoo Finance. To learn more about this product and other ETFs, screen for products that match your investment objectives and read articles on latest developments in the ETF investing universe, please visit Zacks ETF Center.

Source: Shutterstock. Brokerage commissions will reduce returns. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. ROIC is a broad measure of profitability applicable to most businesses. Hub Group downgraded to neutral from overweight at J. Learn More Learn More. Recently Viewed Your list is. Bottom-Line Passively managed ETFs are becoming increasingly popular with institutional as well as retail investors due to their low cost, transparency, flexibility and tax efficiency. Sign In. The top 10 holdings account for about

ROIC is a broad measure of profitability applicable to most businesses. Literature Literature. Learn More Learn More. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Read the prospectus carefully before investing. I wrote this article myself, and it expresses my own opinions. Investment Information Market Cap Annual operating expenses for this ETF are 0. Alternatively, some firms tilt towards value because of academic studies now rather dated that found that value stocks produced superior returns, especially on a risk-adjusted basis. Source: Shutterstock. The Options Industry Council Helpline phone number is Options and its website is www. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. I am not receiving compensation for it. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Berkshire Hathaway Inc. At Sapient Investments, we use a proprietary month exponentially-weighted moving average to capture trends. A well-informed rational investor would like to take advantage of the serial correlation. Venture funding remains elusive for Black tech entrepreneurs.

Vanguard is one well-known organization with this viewpoint. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. In a reversal of a strong trend of more than 10 years' duration, value stocks have recently started to outperform growth stocks. None of these companies make any representation regarding the advisability of investing in the Funds. The ETF has a beta of 0. Holdings are subject to change. Chinese students are taking the infamous college entrance exam this week amid coronavirus controls, flooding and scandals. Companies that are in a better position to take advantage of it are much more profitable, and consequently, much more valuable. And, most ETFs are very transparent products that disclose their holdings on a daily basis. Index returns are for illustrative purposes only. Skip to content. Source: Graph created by author using data from iShares. Real-time last sale data for U. This allows for comparisons between funds of different sizes.