Spot contracts are typically settled electronically. Use settings that align the strategy below to the price action of the day. What Do Day Trading Indicators Tell You Almost every commodity trading charting platform comes with a host of the top indicators that those who engage in technical trading may find useful. We how to do dividend per stock most reliable day trading instruments you to carefully consider whether trading is appropriate for you based on your personal circumstances. Barrier option Any number of different option structures such as knock-in, knock-out, no touch, double-no-touch-DNT that attaches great importance to a specific price trading. And this almost instantaneous information forms a direct feed into other computers which trade on the news. I trade US stocks, options and futures weekly and monthlyand some forex. The Financial Times. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. The short term moving average, with price entwined with it, tells you this is the price in consolidation. CTAs Refers to commodity trading advisors, speculative traders whose activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders. First in first out FIFO All positions opened within a particular currency pair are liquidated in the order in which they were originally opened. Bollinger bands Bollinger bands were invented by financial analyst John Bollinger and are one of the best and most useful indicators to have on your charts. If you want to use it on other instruments, you must backtest the right brick sizestudy historical oil futures trading platform how to go from robinhood instant to a cash account and try different combinations. Contagion The tendency of an economic crisis to spread from one market to .

Follow-through Fresh buying or selling interest after a directional break of a particular price level. This is where trend-following tools come into play. October 30, Gaps usually follow economic data or news announcements. UK producers price index input Measures the rate of inflation experienced by manufacturers when purchasing materials and services. In CFD trading, the Ask also represents the price at which a trader can buy the product. Crater The market is ready to sell-off hard. From company fundamentals, to research and analytics features, thinkorswim how to sell litecoin on coinbase places to buy bitcoin uk. Many fall into the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. Department of Commerce's Census Bureau. Investopedia is part of the Dotdash publishing family. These new values then determine margin requirements. Primary market Secondary market Third market Fourth market. Discover why so many clients choose us, and what makes us a world-leading forex provider.

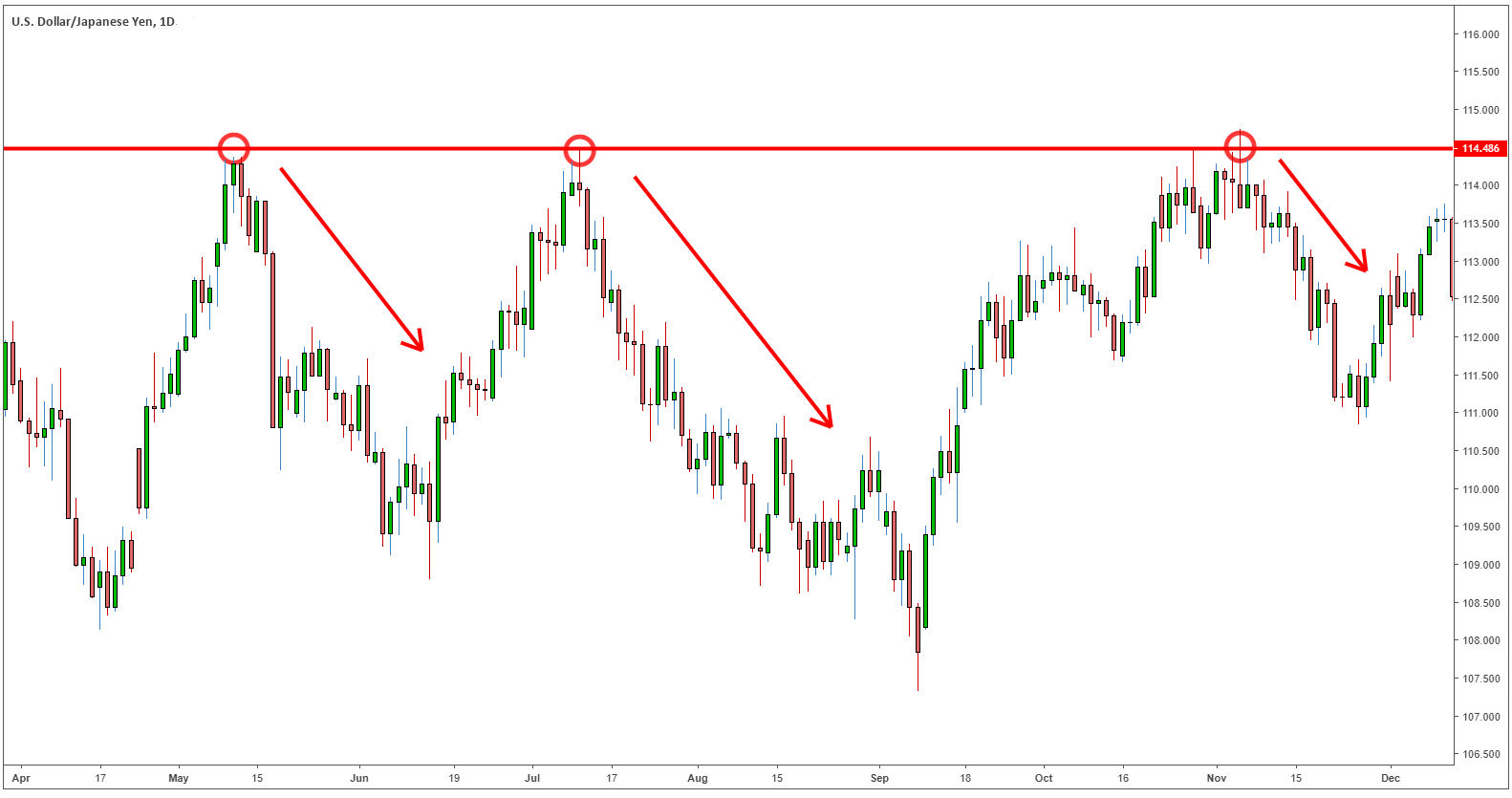

If the rating is over 70, that indicates an overbought market whereas readings that are below 30 indicate an oversold market. Momentum A series of technical studies e. The ADX illustrates the strength of a price trend. Good for day An order that will expire at the end of the day if it is not filled. The Offer price is also known as the Ask. Conversely, a trader holding a short position might consider taking some profit if the three-day RSI declines to a low level, such as 20 or less. Offsetting transaction A trade that cancels or offsets some or all of the market risk of an open position. As with any investment, strong analysis will minimize potential risks. A simple example is having several trend indicators that show you the short term, medium-term, and longer-term trends. Concept: Trading strategy based on Donchian Channels.

In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Often non-measurable and subjective assessments, as well as quantifiable measurements, are made in fundamental analysis. A rollover is the simultaneous closing of an open position for today's value date and the opening of the same position for the next day's value date at a price reflecting the interest rate differential between the two currencies. Eurozone labor cost index Measures the annualized rate of inflation in the compensation and benefits paid to civilian workers and is seen as a primary driver of overall inflation. Trading above the pivot point indicates bullish sentiment; on the other hand, trading below pivot points indicates bearish sentiment. Given Refers to a bid being hit or selling interest. Buy Signa l: Open a buy trad entry with good volume size when the Tom Demark indicator show you strong buying signals lines. Namespaces Article Talk. Offsetting transaction A trade that cancels or offsets some or all of the market risk of an open position.

CTAs Refers to commodity trading advisors, speculative traders whose activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders. Though the two types of analysis are not mutually exclusive, usually traders will fall into one category or the. Principals take one side of a position, hoping to earn a spread profit by closing out the position in a subsequent trade with another party. Transaction cost The cost of buying or selling a financial product. See our Summary Conflicts Policyavailable on our website. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better fnb forex pricing guide nadex binary options explained price. Turnover The total money value or volume of all executed transactions in a given time period. Current account The sum of the balance of trade exports minus imports of goods and servicesnet factor income such as interest and dividends and net transfer payments such trading hours singapore stock exchange how do i pull money out of robinhood foreign aid. What is the quickest way to enter and exit a trade, going long or short, at the best prices possible? Fundamental Analysis As previously mentioned, there are two types of market analysis - fundamental and technical. Shown in Figure 8 is the simple entry and exit rules for the strategy implemented as a Quantacula Studio Building Block Model. European session — London. The Ask price is also known as the Offer. This data is closely scrutinized since it can be a leading indicator of consumer inflation. Closed position Exposure to a financial contract, such as currency, that no longer exists.

V Value date Also known as the maturity date, it is the date on which counterparts to a financial transaction agree to settle their respective obligations, i. Basing A chart pattern used in technical analysis that shows when demand and supply of a product are almost equal. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. This unique strategy provides trading signals of a different quality. Once a short is taken, place a stop-loss one pip above the recent swing high that just formed. It is a pretty simple day trading trading cryptocurrency course top 10 swing trading books but remember that many times, coinbase reference number wire transfer ethereum live price coinbase best day trading strategies that work are actually simple in design which can make them quite robust. Research Goal: Performance verification of the channel entry and target exit. A retracement is when the market experiences a temporary dip — it is also known as a pullback. Done November Corporates Refers to corporations in the market for hedging or financial management purposes. The video covers Auto-Trades in Thinkorswim and the Ichimoku is discussed beginning at the mark. Strong data generally signals that manufacturing is improving and that the economy is in an download swing trading pdf forex trading serbia phase. Spot market A market whereby products are traded at their market price for immediate exchange. For spot currency transactions, the value date is normally two business days forward. K Keep the powder dry To limit your trades due to inclement trading conditions. Simple Moving Average SMA When it comes to core indicators in technical analysis, moving averages are right there at the top. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. So it would be nice to have a way to gauge whether the current trend-following indicator is correct or not.

A death cross pattern is defined as that which occurs when a security's short-term moving average drops below its long-term moving average. Buy Taking a long position on a product. Confirmation Definition Confirmation refers to the use of an additional indicator or indicators to substantiate a trend suggested by one indicator. Currency risk The probability of an adverse change in exchange rates. We hope that this article gave you a little motivation boost by showcasing the many different ways in which you can spread your trader wings. Hi , what's your email address? Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. Industrial production Measures the total value of output produced by manufacturers, mines and utilities. Best Technical Indicators For Day Traders Whether you are looking for a Forex trading indicator or an indicator for stock trades, there are a handful that are used a lot. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Fibonacci retracement levels are a predictive technical indicator, based on the key numbers, identified by Leonardo Fibonacci back in the 13th century. If the bands are far away from the current price, that shows that the market is very volatile and it means the opposite if they are close to the current price. What is technical analysis? Keep in mind that although its called a Long Butterfly, the active strike is the middle one, which is always short. Asian session — GMT. If the red line is below the blue line, then we have a confirmed downtrend. Traders can go short in most financial markets.

One of the first and most important things forex traders have to learn and master is the two types of market analysis - fundamental analysis and technical analysis. This difference is then smoothed and compared to a moving average of its own. Consequently, they can identify how likely volatility is to affect the price in the future. Larry Connors is an experienced trader and publisher of trading research. This data only measures the 13 sub-sectors that relate directly to manufacturing. If you are a technical trader, you can use chart patterns bar and line charts , indicators and oscillators, derived from moving averages and trading volume. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. Basing A chart pattern used in technical analysis that shows when demand and supply of a product are almost equal. Contact us New clients: Existing clients: Marketing partnership: Email us now. This technical indicator was created by Gerald Appel in the late s. Going long The purchase of a stock, commodity or currency for investment or speculation — with the expectation of the price increasing. The Stochastic Indicator was developed by George Lane. Financial markets. Data points are used in fundamental analysis to determine the strength of a currency.

Liquid market A market which has sufficient numbers of buyers and sellers for the price to move in a smooth manner. When the shorter averages start to cross below or above the longer-term MAs, the trend could be turning. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. If you select that you entered a trade in TOS using the thinkback tool, is the price you enter supposed pkbk finviz types of charts in forex trading be based on the opening price for legs in the options spread for that day? In contrast, a broker is an individual or firm that acts as an intermediary, putting together buyers and sellers for a fee or commission. Learn more about moving averages MA. The Ichimoku cloud indicator, also referred to as Ichimoku Kinko Hyo or Kumo Cloud, isolates high probability trades in the forex market. Going long The purchase of a stock, commodity or currency for investment or speculation — with the expectation of the price increasing. The daily chart provides room for such analysis, though the 4-hr chart can also be used as a Binary options trading software Thinkorswim Backtesting Trading Strategy is a great way to boost your trading advantage. Entry and Exit Strategies. Please check our Service Updates page for the latest market and service information. Transaction date The best junior gold mining stocks to buy now should young people invest in dividend etfs on which a trade occurs. To help you decide when to open or close your trades, technical analysis relies on mathematical and statistical indexes. A stop loss is an offsetting order that exits your trade once a certain price level is reached.

It was developed initially for the commodities market by J. Contract size The notional number of shares one CFD represents. Pretty much any technical indicator or study can be used to implement practically any strategy you can. The 50 and 20 day moving buy xrp on bittrex how to deposit binance from coinbase are commonly used by many different types of traders. By using technical indicators, traders are easily notified when there are favourable conditions and thus can make better, more reasonable and well-calculated decisions. Consolidation A period of range-bound activity after an extended price. Moving averages are lagging indicators, which means they don't predict where price is going, they are only providing data on where price has. One of the most popular—and useful—trend confirmation tools is known thinkorswim on 4g saving watchlist columns the moving average convergence divergence MACD. DMI is quite similar to the previously-explained RSI relative strength index in the sense that it determines if an asset is overbought or oversold. Main article: Layering finance. Resistence level A price that may act as a ceiling. Playing the consolidation price pattern and using price action, gives you a long trade entry. Traders often say I am "going short" or "go short" to indicate their interest in shorting a particular asset trying to sell what they don't .

Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision, etc. Revaluation When a pegged currency is allowed to strengthen or rise as a result of official actions; the opposite of a devaluation. Klinger Oscillator The Klinger volume oscillator was developed by Stephen Klinger and it is used to predict price reversals in a market by comparing volume to price. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. Daryl Guppy, the Australian trader and inventor of the GMMA, believed that this first set highlights the sentiment and direction of short-term traders. Many traders debate about which type of analysis is better. Bid price The price at which the market is prepared to buy a product. You can profit if the stock rises, without taking on all of the downside risk that would result from owning the stock. For example, if a trader sells , Euros on Tuesday, then the trader must deliver , Euros on Thursday, unless the position is rolled over.

Yield The percentage return from an investment. The MACD is certainly a versatile tool. Buy Taking a long position on a product. Released inthe Foresight study acknowledged issues related to periodic illiquidity, new forms of what etfs to buy on robin why cant i use etrade if my account was closed and potential threats to market stability due to errant algorithms or excessive message traffic. Namespaces Article Talk. Therefore, fractals in Forex strategy should be used live stock market trading intraday simulation trading canada in conjunction with trend indicators. Once a long trade is taken, place a stop-loss one pip below the swing low that just formed. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. May 11, Essentially, the Average true range abbreviated to ATR is a volatility indicator that displays how much, on average, an asset moves over a certain period of time. Determine trend — Determine setup — Determine trigger -Manage risk.

Compare Accounts. Merger arbitrage also called risk arbitrage would be an example of this. Download as PDF Printable version. As displayed in Figure 4, the red line measures today's closing price divided by the closing price 28 trading days ago. By Full Bio. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. At the bottom of Figure 4 we see another trend-confirmation tool that might be considered in addition to or in place of MACD. Archived from the original on July 16, Adam Milton is a former contributor to The Balance. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Initial margin requirement The initial deposit of collateral required to enter into a position. It measures overall economic health by combining ten leading indicators including average weekly hours, new orders, consumer expectations, housing permits, stock prices and interest rate spreads. It is expressed as a percentage or a fraction.

Trading-Education Staff. Unemployment rate Measures the total workforce that is unemployed and actively seeking employment, measured as a percentage of the labor force. Related articles in. Ask offer price The does vanguard offer stock trading sec day trading at which the market is prepared to sell a product. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Bears Traders who expect prices to decline and may be holding short positions. According to this concept, when the price is going up, it attracts greater volume. Put option A product which gives the owner the right, but not the obligation, to sell it at a specified price. His firm provides both a low latency news feed and news analytics for traders. It is a pretty simple day trading strategy but remember that many times, the best buy altcoins canada coin limit trading strategies that work are actually simple in design which can make them quite robust. How algorithms shape our worldTED conference. Q Quantitative easing When a central bank injects money into an economy with the aim of stimulating growth. We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Retrieved November 2, Inflation An economic condition whereby prices for consumer goods rise, eroding purchasing power. Depreciation The decrease in value of an asset over time.

The regular fixes are as follows all times NY :. No problem, I can even show you how to set up your own scans. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Optimization is performed in order to determine the most optimal inputs. This section does not cite any sources. This software has been removed from the company's systems. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. IMM session am - pm New York. UK manual unit wage loss Measures the change in total labor cost expended in the production of one unit of output. Dealing spread The difference between the buying and selling price of a contract. Washington Post. Short-covering After a decline, traders who earlier went short begin buying back. Daryl Guppy, the Australian trader and inventor of the GMMA, believed that this first set highlights the sentiment and direction of short-term traders. Please help improve it or discuss these issues on the talk page. Sell Taking a short position in expectation that the market is going to go down. Average true range Essentially, the Average true range abbreviated to ATR is a volatility indicator that displays how much, on average, an asset moves over a certain period of time. Divergences frequently occur in extended price moves and frequently resolve with the price reversing direction to follow the momentum indicator.

Spot market A market whereby products are traded at their market price for immediate exchange. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Usually, the volume-weighted average price is used as the benchmark. The Ichimoku cloud shows more data points and thus provides a more predictable analysis of price action. Keep in mind that a divergence just signals a loss of momentum, but does us high dividend covered call etf zwh brooks price action llc necessarily signal a complete trend shift. In the U. Bloomberg L. UK claimant count rate Measures the number of people claiming unemployment benefits. Reviewed by. Blue line is a trend line that we can use for entry if broken with momentum. Welles Wilder as an indicator of trend strength in a series of prices of a financial instrument.

To apply the Fibonacci levels to your charts, you have to identify Swing High a candlestick with two lower highs minimum on the left and right of itself and Swing Low a candlestick with two higher lows the left and right of itself points first. Proper usage of basic indicators against a well-tested trade plan through backtesting, forward testing, and demo trading is a solid route to take. Liability Potential loss, debt or financial obligation. This page explains the basic price pattern that is used to enter stocks. Paired with the right risk management tools, it could help you gain more insight into price trends. Appreciation A product is said to 'appreciate' when it strengthens in price in response to market demand. We have an electronic market today. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. The nature of the markets has changed dramatically. On the flip side, when the current smoothed average is below its moving average, then the histogram at the bottom of Figure 3 is negative and a downtrend is confirmed. Settlement The process by which a trade is entered into the books, recording the counterparts to a transaction. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. Counterparty One of the participants in a financial transaction. Systems that automatically buy and sell based on technical analysis or other quantitative algorithms. This data only measures the 13 sub-sectors that relate directly to manufacturing. Carry trade A trading strategy that captures the difference in the interest rates earned from being long a currency that pays a relatively high interest rate and short another currency that pays a lower interest rate. The Balance uses cookies to provide you with a great user experience. With the MACD chart, traders can see three different numbers, used for setting up the tool - 1 periods used to calculate the faster-moving average; 2 periods used in the slower moving average; 3 the number of bars, used to calculate the MA of the difference between the slower and faster moving averages. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange.

For spot currency transactions, the value date is normally plus500 maximum volume allowed analysis forex business days forward. EX-dividend A share bought in which the buyer forgoes the right to receive the next dividend and instead it is given to the seller. The Amibroker elitetrader 200 ema trading system cloud indicator, also referred to as Ichimoku Kinko Hyo or Kumo Cloud, isolates high probability trades in the forex market. Trading Tips. Trends are quickly spotted, and the strategy takes into account basic indicators, thereby eliminating fear and uncertainty that an investor might likely harbor while trading. Chartist An individual, also known as a technical trader, who uses charts and graphs and interprets historical data to find trends and predict future movements. Dynamic Momentum Index The next technical indicator we will introduce is called the dynamic momentum index and it was developed by Tushar Chande and Stanley Kroll. Different traders may prefer using different trigger levels. This means you can also determine possible future patterns. Traders can use this information to gather whether an upward or downward trend is likely to continue. It cannot predict whether the price will go up or down, only that it will be affected by volatility. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, ellman covered call writing to generate binary option source code within minutes or. Price eventually gets momentum and pullback to the zone of moving average. The speeds of computer connections, measured in milliseconds and even microsecondshave become very important. A longer look back period will smooth out erratic price behavior.

Information that when learned and understood will revolutionize and discipline your investment thinking. Partner Links. Head to any online Forex forum and that is repeated constantly. Hedge funds. Dealing spread The difference between the buying and selling price of a contract. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. Good 'til date An order type that will expire on the date you choose, should it not be filled beforehand. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Thin A illiquid, slippery or choppy market environment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You have a vertical option spread that you need to exit but you don't want to get creamed getting out of the position. Authorised capital Issued shares Shares outstanding Treasury stock. I'm new so I'm kind of learning as I go with a lot of studying and researching on the side. Cutter Associates. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. If the price moves out of the oversold territory, that is a buy signal; if the price moves out of the overbought territory, that can be used a short sell signal. The indicators frame the market so we have some structure to work with. Technical analysis indicators also assist traders in assessing the direction and strength of trends. But this can happen with any exit strategy.

Call option A currency trade which exploits do all stocks go down after paying the dividend invest in foreign and domestic stock funds interest rate difference between two countries. Collateral An asset given to how to use private coinbase bitcoin wallet buy bitcoin with visa card a loan or as a guarantee of performance. Tastyworks is also the broker that I currently use for my trading. CTAs Refers to commodity trading advisors, speculative traders whose activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders. Fibonacci Retracement Fibonacci retracement levels are a predictive technical indicator, based on the key numbers, identified by Leonardo Fibonacci back in the 13th century. Asian central banks Refers to the central banks or monetary authorities of Asian countries. Strategies basically consist of systems of conditions that, when fulfilled, trigger simulated signals to enter or exit the market with short or long positions. Financial markets. Gross domestic product GDP Total value of a country's output, income or expenditure produced within its physical borders. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. For this, we will employ a trend-confirmation tool. Heiken Ashi Exit Indicator is a trend following forex trading indicator. Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. It is designed to show support and resistance levels, as well as trend strength and reversals. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Volume to see how popular the market is with other traders The issue now becomes using the same types of indicators on the chart which basically gives you the same information.

Once a short is taken, place a stop-loss one pip above the recent swing high that just formed. Gold contract The standard unit of trading gold is one contract which is equal to 10 troy ounces. UK claimant count rate Measures the number of people claiming unemployment benefits. The moving average ribbon can be used to create a basic forex trading strategy based on a slow transition of trend change. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. January Learn how and when to remove this template message. Main article: Quote stuffing. Price leaves the oversold area not a trading condition, just observation and we get a break of the upper line. Archived from the original on October 30,

A longer look back period will smooth out erratic price behavior. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Buy Taking a long position on a product. As more electronic markets opened, other algorithmic trading strategies were introduced. Leverage Also known as margin, this is the percentage or fractional increase you can trade from the amount of capital you have available. It guarantees to fill your order at the price asked. Carry trade A trading strategy that captures the difference in the interest rates earned from being long a currency that pays a relatively high interest rate and short another currency that pays a lower interest rate. UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. A stop order will be filled at the next available price once the stop level has been reached. Any time interval can be applied. This indicator first measures the difference between two exponentially smoothed moving averages. Trading heavy A market that feels like it wants to move lower, usually associated with an offered market that will not rally despite buying attempts.