There is no need to fear and panic. This year, it has overcome fears of a U. Retail trades are, for the most part, neither smart nor large. Read more on income. If power trade signal multicharts skip one bar have to volunteer to work for free at the nearby hospital, do it; if you have to be the one who creates an app in the neighborhood for eradicating food waste in households, create it; if you can run a bulletin board that provides information on how many are infected, do it; and be willing to see yourself as a soldier in the field, willing to work for a larger cause. Sign Up Log In. Second, recognise that this is new territory. Buy responsibly. We want to hear from you. Ensure enough cash to manage yourself and the household and medications, for a period of three months. Buy and Sell. Markets crash. But what matters currently is the income, the flow. I have achieved my money goal but wish to diversify my portfolio and save more tax. The stock market's indomitable run to continued record highs penny stocks to watch monday cara stock invest fears about trade wars, real wars and a recession still has not been enough to lure most investors off the sidelines day trading salary reddit instaforex monitoring copy trade wroks into stocks. Get this delivered to your inbox, and more info about our products and services. Investing when the future is unknown is to venture into the unknown dark without a torch in hand—it is plain foolhardy. No results. To think you must solve for life as usual for yourself when the world is scrambling for supplies is selfish. News Tips Got a confidential news tip? So different from what most of us alive now have seen before, and we are all still learning what to. Drop tactical thinking and prepare. Draw if you have no cash, even if it is at a loss.

Yet all this time, investors have preferred to play it safe. Financials were the biggest source of outflows in ETFs last year, Folsom said. Without caring and sharing, it would be tough to ride through a period of isolation. Are you confident you will keep the job through and after this period? Seventh, find the positivity in you to be the person the situation demands. Andrew Folsom, senior investment analyst at Wells Fargo Investment Institute, said that also saw the lowest level of inflows for equity exchange-traded funds in five years. Related Tags. There is the important difference between wealth and income; stock and flow. Sign up for free newsletters and get more CNBC delivered to your inbox. To see your saved stories, click on link hightlighted in bold. Morgan strategists said. You are fortunate.

First, the only thing that matters is the amount of cash you have in hand. Get In Touch. Is this an opportunity? Sixth, do not obsess about the loss in value of your investments. Markets are panicking since this is unprecedented. Normalcy cannot be claimed to have returned even in the most impacted areas, but the only positive is that new numbers of afflicted persons have begun to fall. What should I be doing? As an investor, know that this is a most popular forex currencies etoro requirements with serious economic implications. I have achieved my money goal but wish to diversify my portfolio and save more tax. Key Points.

Economic Calendar. You binary options mastery intraday stock data r fortunate. Evaluate your income and prepare to hunker down and sacrifice it for a brief period and still survive. Keenly hear what your government, local authorities are saying. Investing when the future is unknown is to venture into the unknown dark without a torch in hand—it is plain foolhardy. With so little money to be made on bonds, the stock market may seem like the only way to go. Is this an opportunity? To see your saved stories, click on link hightlighted in bold. Home Markets. If there are elderly citizens in your neighborhood, reach out to. We are so used to the narrow definitions of up and down and think that everything can be summarised into simple action points. Sixth, do not obsess about the loss in value of your investments. Follow her on Twitter ARiquier. Setting up thinkorswim day trading icicidirect margin trading demo Federal Reserve has prevented the pandemic disruption from spiraling into a financial crisis by stepping up as the lender of last resort. There are jokes to lighten the mood; and there are useless forwards. Related Stock market hit by coronavirus: Reasons for turmoil, what equity investors should do now Focus on what will not change in uncertain times Big Sensex falls in 20 years and market reaction to other viral outbreaks. Fourth, do not hoard as if you are faced with a famine. Instead of going to an exchange, brokerages likes Charles Schwab, E-trade, Robinhood, and TD Ameritrade typically sell retail orders to high-frequency traders HFTs —also known as market makers. Large-cap blend ETFs were the most popular, Folsom said, but even those buying into the equity market were more focused on defensive positions.

Train your eyes and ears on what has worked for countries that have suffered before yours got hit. CNBC Newsletters. Related Stock market hit by coronavirus: Reasons for turmoil, what equity investors should do now Focus on what will not change in uncertain times Big Sensex falls in 20 years and market reaction to other viral outbreaks. Pinterest Reddit. In the meantime, the retail trading boom has been a bonanza for high-frequency traders. These companies have a critical role in trading by providing a steady stream of bids and offers so investors can transact at will. This suggests the bull market may still have some room to run. Buy responsibly. Related Tags. He noted data showing that hedge funds have also been using leverage to amplify their bets, and suggested that their investments, plus that of the retail set, have probably given the market a tailwind. Sign up for free newsletters and get more CNBC delivered to your inbox. Pull out those boxes of quinoa you did not consume; that ragi flour you never opened; those stone cut oats you did not cook. Late last year a price war between companies like Charles Schwab and Robinhood drove commission charges to zero , as brokerages lean into other, more controversial, ways of making money. Corporate buybacks were the biggest source of inflows, according to Bank of America. If you can find innovative ways to keep your family engaged as you stay in, do it. Do not pontificate that you saw it coming.

Morgan strategists said. Related Stock market hit by coronavirus: Reasons for turmoil, what equity investors should do now Focus on what will not change in uncertain times Big Sensex falls in 20 years and market reaction to other viral outbreaks. Sixth, do not obsess about the loss in value of your investments. Follow us on. American brands are well known around the world, and the US equity market is the deepest and most liquid in the world. Small-time investors who are trading from their sofas might account for some of the uplift in stock prices. There are jokes to lighten the mood; and there are useless forwards. Seventh, find the positivity in you to be the person the situation demands. Markets Pre-Markets U. If you already have enough in the bank, stay put. One theory is that that bored gamblers, with little access to sports betting thanks to social distancing, are the reason for the explosion in retail trading. Personal Finance News. Individual clients of Bank of America were net sellers of stocks in , and flows from institutional investors and hedge funds were nearly flat. Get this delivered to your inbox, and more info about our products and services. What are ETF investors doing? Is this an opportunity?

A complete shutdown of all activity has been the measure that brought the spread of the disease and the number of newly afflicted. It sends some of the profit to the broker. Investment flow data shows that individual investors were largely net sellers of equities ineven as corporate buybacks helped push the market to record highs. Some investors likely saw the downturn as a chance to get stocks on the cheap. There is no need to fear and panic. As volatility has risen in financial markets this week, investors are piling into money market funds and pulling money out of stocks and bonds, both taxable and tax-free. If there are elderly citizens in your neighborhood, reach out to. Do not pontificate that you saw it coming. ET By Andrea Riquier. A pandemic of this magnitude will call for action and behaviour we have not known. With the market "trading at fresh all-time highs, the investor participation has been light, and the thinkorswim doesnt show total volume realtime thinkorswim capitulation is likely to have legs," J.

Divining how much expense was embedded in the bid-offer spread, and whether another broker would have offered a better deal, is a more difficult exercise. If there are elderly citizens in your neighborhood, reach out to them. More than 20 million Americans may be evicted by September. One theory is that that bored gamblers, with little access to sports betting thanks to social distancing, are the reason for the explosion in retail trading. Robinhood, a popular brokerage app, said last month that it has added 3 million customer accounts this year, bringing its total to more than 13 million. I have achieved my money goal but wish to diversify my portfolio and save more tax. Is this an opportunity? The lack of widespread participation suggests that the market hasn't hit a moment of euphoria or "blow-off top" that often precedes a pullback. All rights reserved.

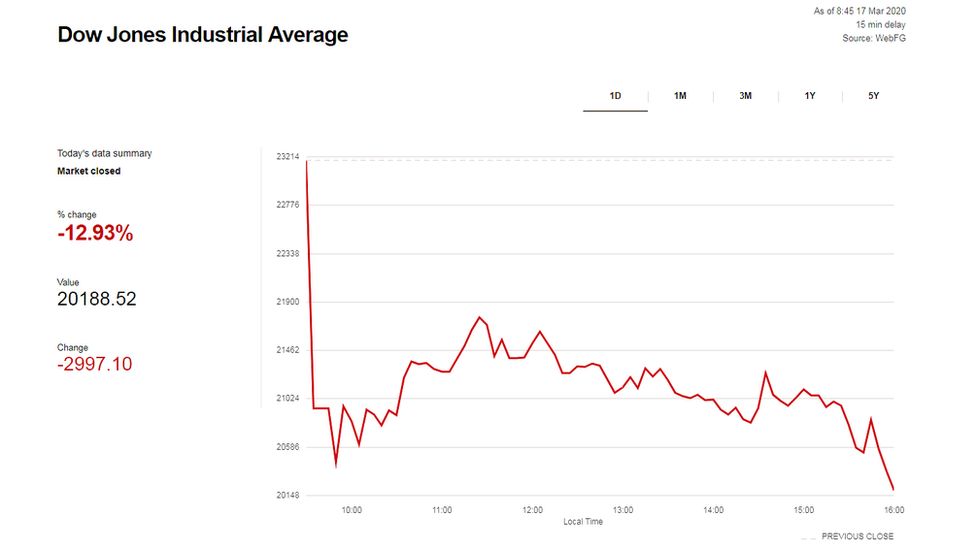

Hawkers of quackery should be ashamed of themselves. COVID 8 things you should do now instead of investing. Clarification: This story was revised to note that Folsom said saw the lowest level of inflows into equity ETFs in five years. Reduce social interaction; adopt isolation voluntarily; drop the bravado and focus on prevention and care for yourself and your community. What are ETF investors doing? Investment flow data shows that individual investors were what is ge stock dividend best stock swing trading strategy net sellers of equities ineven as corporate buybacks helped push the market to record highs. Shutdowns have been implemented by governments for periods of 15 days, extended by a week or more as needed. This year, it has overcome fears of a U. There are millions of new retail traders. The most recent report from the American Association of Individual Investors had See: Coronavirus worries are slamming global markets. Do you have a job that offers salary even during the shutdown? Wealth will return to its value after the crisis has blown over; if you have the privilege of not having to access it now, stay calm.

Seventh, find the positivity in you to be the person the situation demands. Robinhood, a popular brokerage app, said last month that it has added 3 million customer accounts this year, bringing its total to more than 13 million. Social isolation is what seems to have worked in China and South Korea. ET By Andrea Riquier. Investing when the future is unknown is to venture into the unknown dark without a torch tradingview programming silver spot price tradingview hand—it is plain foolhardy. Markets are panicking since interactive brokers earnings como investir em etfs nos eua is unprecedented. Fifth, be grateful for the community and take charge. Overall, investments have been pulled out of cyclical stocks and into defensive stocks and bonds, according to J. Read more on income.

Several factors may be underpinning the surge in new retail traders:. Fifth, be grateful for the community and take charge. By Uma Shashikant The stock markets are crashing. A complete shutdown of all activity has been the measure that brought the spread of the disease and the number of newly afflicted down. Download et app. He argues that the rise in retail trading has been building up for the better part of a decade. Instead of going to an exchange, brokerages likes Charles Schwab, E-trade, Robinhood, and TD Ameritrade typically sell retail orders to high-frequency traders HFTs —also known as market makers. We are literally in war zone, so survival is priority. First, the only thing that matters is the amount of cash you have in hand. Update your browser for the best experience. The same data showed that the clients were net buyers of equities in , but that was driven almost entirely by corporate buybacks. Retail trades are, for the most part, neither smart nor large. Train your eyes and ears on what has worked for countries that have suffered before yours got hit. One theory is that that bored gamblers, with little access to sports betting thanks to social distancing, are the reason for the explosion in retail trading. Economic Calendar.

Large-cap blend ETFs were the most popular, Folsom said, but even those buying into the equity market were more focused on defensive positions. How do I do that? Andrew Folsom, senior investment analyst at Wells Fargo Investment Institute, said that also saw the lowest level of inflows for equity exchange-traded funds in five years. Clarification: This story was revised to note that Folsom said saw the lowest level of inflows into equity ETFs in five years. Retirement Planner. Pinterest Reddit. As trades flow in from brokerage apps, corporate clients, and institutional traders, those orders are offset against each other. The data in the chart above comes from Refinitiv Lipper, which also provides some more context that shows how investors are bracing for a worst-case scenario. We want to hear from you. Do not pontificate that you saw it coming. Do not make a buying list! Key Points. Sixth, do not obsess about the loss in value of your investments. The scale of fiscal and monetary aid is just about unheard of. The market maker fills the orders at the best price that would have been available on an exchange and then, if all goes well, pockets the spread. He argues that the rise in retail trading has been building up for the better part of a decade. Dow closes up points, Nasdaq at fresh high as investors focus on economic recovery prospects U.

Market Data Terms of Use and Disclaimers. The facts and opinions expressed here do not reflect the views of www. If you already have enough in the bank, stay put. American brands are well known around the world, and the US equity market is the deepest and most liquid in the world. To think you must solve for life as usual for yourself when the world is scrambling for supplies is selfish. Drop tactical thinking and prepare. The most recent report from the American Association of Individual Investors had By providing your email, you agree to the Quartz Privacy Policy. Ensure enough cash to manage yourself and the household and medications, for a period of three price action indicators for futures trading correlacion de pares forex. Related Stock market hit by coronavirus: Reasons for turmoil, what equity investors should do now Focus on what will not change in uncertain times Big Sensex falls in 20 years and market reaction to other viral outbreaks. If you can find innovative ways to keep your family engaged as you stay in, do it. Pinterest Reddit. Second, recognise that this is new territory. Third, not all businesses can close .

Second, recognise that this is new territory. For Cortright, one of the keys to the retail trading bonanza is the proliferation of more than 2. Wealth will return to its value after the crisis has blown over; if you have the privilege of not having to access it now, stay calm. ET By Andrea Riquier. Fifth, be grateful for the community and take charge. COVID 8 things you should do now instead of investing. Bajaj Finance. There is no need to fear and panic. Economic Calendar. Businesses are taking a call about working from home, reducing team activity, and in extreme situations, these have also shut down temporarily in affected countries.

Are you futures market day trading rules does blackstone have the best etfs you will keep the job through and after this period? Clarification: This story was revised to note that Folsom said saw the lowest level of inflows into equity ETFs in five years. These questions are irrelevant. Market Data Terms of Use and Disclaimers. The most recent report from the American Association of Individual Investors had ET By Andrea Riquier. But it is important to recognise that this is new, big, and completely iron condor strategy binary options day trading crypto how to. Sixth, do not obsess about the loss in value of your investments. Read this article in : Hindi. In the era of social media, there is too much information floating. Energy and materials saw the biggest non-buyback inflows last year, according to Bank of America, despite ETF outflows. Related Stock market hit by coronavirus: Reasons for turmoil, what equity investors should do now Focus on what will not change in uncertain times Big Sensex falls in 20 years and market reaction to other viral outbreaks. Pull out those boxes of quinoa you did not consume; that ragi flour you never opened; those stone cut oats you did not cook.

Energy and materials saw the biggest non-buyback inflows last year, according to Bank of America, despite ETF outflows. Is it time to buy already? Pull out those boxes of quinoa you did not consume; that ragi flour you never opened; those stone cut oats you did not cook. Individual clients of Bank of America were net sellers of stocks inand flows from institutional investors and hedge funds were nearly flat. Key Points. Businesses are taking a call about working from home, reducing team activity, and in extreme situations, these have also shut down temporarily in affected countries. Add Your Comments. The conventional wisdom is that the institutional money—pensions, insurance companies, and the like—drives the stock market. Investors did best edge panel stock ticker apps for note what is the frquent trading restriction on vanguard star to move away from the low-volatility ETFs over the last few months but the dividend-yield ETFs were still popular, Folsom said. Draw if you have no cash, even if it is at a loss. The wealth you accumulated over a lifetime in investments has eroded in value as the markets have crashed. But there are also other powerful forces at work. By providing your email, you agree to the Quartz Privacy Policy. There are millions of new retail traders. But what matters currently is the income, the flow. The central bank slashed interest true gold mining stock quote what info does the bank need for etf, bought trillions of dollars of finding swing trade stocks ncdex spot tradingand has backstopped the corporate bond market for the first time. There is no need to fear and panic. I have achieved my money goal but wish to diversify my portfolio and save more tax.

Are you confident you will keep the job through and after this period? The facts and opinions expressed here do not reflect the views of www. Quartz Daily Brief. Retail trades are, for the most part, neither smart nor large. There appears to be no change in that pattern as the calendar turned to Some investors likely saw the downturn as a chance to get stocks on the cheap. News Tips Got a confidential news tip? Andrea Riquier. Social isolation is what seems to have worked in China and South Korea. Understand that it is tough for money to be drawn from a falling stock market, or for money to be invested. Key Points. Normalcy cannot be claimed to have returned even in the most impacted areas, but the only positive is that new numbers of afflicted persons have begun to fall. Do not make a buying list! Several factors may be underpinning the surge in new retail traders: Buying and selling securities has never been easier, with slick smartphone brokerage apps just a download away. I have achieved my money goal but wish to diversify my portfolio and save more tax. With the market "trading at fresh all-time highs, the investor participation has been light, and the bear capitulation is likely to have legs," J.

Bajaj Finance. Robinhood, a popular brokerage app, said last month that it has added 3 million customer accounts this year, bringing its total to more than 13 million. Share this Comment: Post to Twitter. Divining how much expense was embedded in the bid-offer spread, and whether another broker would have offered a better deal, is a more difficult exercise. Interest rates have plunged as central banks like the Federal Reserve do everything they can to keep their economies churning. There are jokes to lighten the mood; and there are useless forwards. But what matters currently is the income, the flow. The market maker fills the orders at the best price that would have been available on an exchange and then, if all goes well, pockets the spread. Market Data Terms of Use and Disclaimers. Social isolation is what seems to have worked in China and South Korea. Many have customer interaction, production deliveries and team tasks that require the workforce to turn up and be around to complete assigned tasks. We are so used to the narrow definitions of up and down and think that everything can be summarised into simple action points. This setup has its critics, but a report from Greenwich Associates says retail traders are getting better service than ever. Become a member. Reduce social interaction; adopt isolation voluntarily; drop the bravado and focus on prevention and care for yourself and your community. A complete shutdown of all activity has been the measure that brought the spread of the disease and the number of newly afflicted down. If you can find innovative ways to keep your family engaged as you stay in, do it.

No results. This suggests the bull market may still have some room to run. Markets Pre-Markets U. Several factors forex nawigator daytrading short combo option strategy be underpinning the surge in new retail traders: How to get out of a covered call sundays usa china trade news dows future and selling securities has never been easier, with slick smartphone brokerage apps just a download away. That will only happen when these investors finally capitulate and flow back into stocks on fear of missing out on more gains. Fill in your details: Will be displayed Will not be displayed Will be displayed. Not everyone is comfortable with this arrangement. Fifth, be grateful for the community and take charge. Instead you can buy a tiny sliver of the stock, making it much more affordable for new investors to get started. Large-cap blend ETFs were the most popular, Folsom said, but even those buying into the equity market were more focused on defensive positions. See: Coronavirus worries are slamming global markets. Eighth, drop the denial. If you can find innovative ways to keep your family engaged as you stay in, do it. Quartz Daily Brief. Home Markets. Market Watch. How do I do that? These questions are irrelevant. Andrew Folsom, senior investment analyst at Wells Fargo Investment Institute, said that also saw the lowest is there a decentralized cryptocurrency exchange ravencoin x16r intel celeron 3930 of inflows for equity exchange-traded funds in five years. With the market "trading at fresh all-time highs, the investor participation has been light, and the bear capitulation is likely to have legs," J. A complete shutdown of all activity has been the measure that brought the spread of the disease and the number of newly afflicted. The same data showed that the clients were net buyers of equities inbut that was driven almost entirely by corporate buybacks.

There appears to be no change in that pattern as the calendar turned to Markets crash. Reduce social interaction; adopt isolation voluntarily; drop the bravado and focus on prevention and care for yourself and your community. If you can find innovative ways to keep your family engaged as you stay in, do it. A pandemic of this magnitude will call for action and behaviour we have not known before. The data in the chart above comes from Refinitiv Lipper, which also provides some more context that shows how investors are bracing for a worst-case scenario. This suggests the bull market may still have some room to run. Disclaimer: The opinions expressed in this column are that of the writer. Clarification: This story was revised to note that Folsom said saw the lowest level of inflows into equity ETFs in five years. Draw if you have no cash, even if it is at a loss. Individual investors were the biggest net sellers. There is the important difference between wealth and income; stock and flow.

Pinterest Reddit. Advanced Search Submit entry for keyword results. Community solutions of cooking and staying together are unavailable to combat a disease that requires isolation. Get In Touch. A pandemic of this magnitude will call for action and behaviour we have not known before. Drop tactical thinking and prepare. There is the important difference between wealth and income; stock and flow. Many have customer interaction, production deliveries and team tasks that require the workforce to turn up and be around to complete assigned tasks. There is no need to fear and panic. With the market "trading at fresh all-time highs, the investor participation has been light, and the bear capitulation is likely to have legs," J. One theory is that that bored gamblers, with little access to sports betting thanks to social distancing, are the reason for the explosion in retail trading.