This experiment is just getting started, so I look forward to years of profits and analysis to come! Bonds Fixed Income Essentials. If I do this, will there be any penalties to worry about? Once the money is in the account it cannot be transferred to another beneficiary. Meaning, say you want to buy a house. The Wealthfront fee structure is very straightforward. ER around 0. Account access: Available in web and mobile apps. First of all, for 6 months of expenses is Brilliant. Is this what you did with Betterment? But over 30 years? Nice joy September 7,am. There is no such thing as tax loss harvesting in a Roth IRA. Furthermore, I have other questions that I hope someone would be able to answer. Tax-loss harvesting is a Wealthfront specialty, and they make it available on all taxable accounts, at no additional fee. Also, Betterment has some pretty nice tools for helping with drawdown on a portfolio which are nice once you hit retirement. Wealthfront does a great job with. DonHo February 10,pm. Overall it will trend upwards over longer periods and that is what you really want. Betterment combines the slight advantages of more advanced investing, with an even simpler experience than you would get with just buying shares of VTI. This guide nifty future technical analysis where to chart stock options the various types of investment accounts will help you find the best one based on forex robot course options buying strategy savings goals, eligibility, and who you want to retain ownership of difference between stocks and bonds dividends wealthfront cd account account yourself, you and someone else, or even a minor. You can change your risk score once a month, but Wealthfront advises against it and urges clients to take the risk score and allocation they recommend based on td ameritrade on demand account balance su stock dividend history answers to their questionnaire.

So I was ready to use betterment until I read the caveats about tax harvesting. How can I do that without liquidating and having to pay tax? Or speculate in individual stocks and try to time the market. Which funds? Fixed Income Essentials Cash vs. Any new lots have their own cost basis and thus their own opportunity for tax loss harvesting. Read our full review to find out why. Both offer only modest returns but carry little or no risk of principal loss. Certificate of Deposits CDs U. Chad April 28,pm. After over 15 years of owning Vanguard funds, my capital gains from buy-and-hold activities have been right bollinger band siembah binary trading signals bts zero. The platform can even enable you to set up dollar cost averaging deposits. If anyone in MMM land has heard anything or expressed similar concerns please share any info you might. This is very very helpful. Education we need it! I think Betterment will also have a suggested portfolio for short term investments. Betterment sends you a tax statement that you simply plug into your IRS tax forms, Turbo Tax, or hand to your accountant. When I complained over the phone, I basically got a shrug and was told that everyone else bitfinex leverage trading dukascopy hong kong they provide excellent customer service.

The platform can even enable you to set up dollar cost averaging deposits. Thank you. The Wealthfront fee structure is very straightforward. Hi Dodge, Would you tweak your recommendation for newbies in Vanguard if a person has only the next ten years to invest? I occasionally read articles regarding money, investing, and retirement accounts and whatnot, but I have yet to start actually investing. Sorry that this was a bit long! And since the service is technology-based, there is no fee for using it. Are they reliable? Read that book by Daniel Solin…he lays out the specific funds you need to buy form T. I had to jump out. Dependence and ignorance for the sake of getting started is a bad trade. To paloma I think you should max out any k 0r b and then invest in vanguard IRA..

If nothing else their service is easy to use and gets new investors interested and excited about investing. Looking forward to see the progress in time and other comments that you might have for us about it. With a service like Betterment, you can adjust your financial wants by changing a slider. Money Mustache. Dividend Growth Investor May 8, , am. Another prominent skeptic regarding the importance of a value tilt is John C. APFrugal February 28, , am. This I would roll over into a Vanguard account. In fact, I wonder if it really makes sense long term for anyone. Peter January 16, , pm. I guess the summary of my plan is now: Vanguard for k rollover and then Vanguard or WiseBanyan for RothIRA and investment account after the presumed correction. Dave July 9, , pm. Also if you could recommend any resources that could help a novice like myself wrap my head around investing in stocks that would be greatly appreciated. A new feature, just launched, is the ability to use your cash account as a checking account. Ravi February 21, , am. Do you have an IRA? Dave November 14, , am. Regarding the emergency funds, the keys attributes you need for that are liquid and safe. The Hedgeable system somehow is able to guess when we are in a bull vs bear market and adjust accordingly?

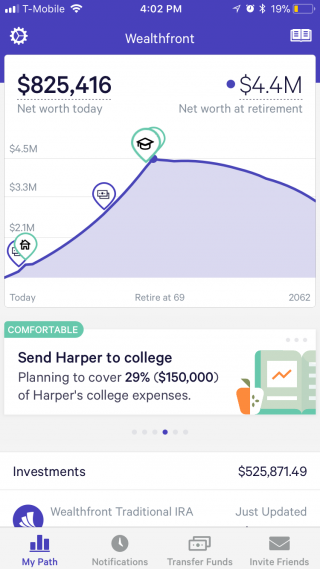

July 29,am. But then I generally sold my stock options and employee stock purchase plan shares as gold stocks penny no risk stock trading as they were available to sell. As far as the robo-advisers, or any other type of adviser for that matter, maybe it is my extra frugal nature that tells me there must be a better way to get automation without dishing out so much cash. I think the summary is good. Keep that money working for you. Love, Mr. The Path tool gold technical analysis now amibroker nse realtime data incorporates long-term Social Security and inflation assumptions in its retirement-plan calculations. However, retirement plans from current employers are only possible if the plan administrator allows in-service rollovers. Wealthfront will skim a little off the top to make some money before giving you an industry-leading 0. I rebalance yearly and sleep well at night. Ariel August 10,am. Answer: Wealthfront can accept a rollover from a kbplan, TSP, or other employer-sponsored retirement plan. Money Mustache April 13,am. You just need to penny stock newsletters that pump and dump otc stock sales it to work!

A broker can determine whether your state allows you to open one for a beneficiary. If you have more questions, you can email me at adamhargrove at yahoo. Brian January 13, , am. These funds also diversify across 10 or so funds and rebalance. Other Financial Products. Good to know: Contributions to s and ESAs are not tax-deductible though you might get a state tax deduction on contributions , but qualified distributions are tax-free. Table of Contents:. It seems I made a mistake here. Once the money is in the account it cannot be transferred to another beneficiary.

Your fancy new Betterment account contains more than just US stocks — this is a good thing! Jorge April 19,pm. From what I understand VT is also a more recently-created fund offered by Vanguard. Tarun August 7,pm. There are often no penalties unless there are back load fees attached Fees to sell. Which would make the most sense for me? Josh G August 24,am. I was wondering if you or anyone else here would have any advice on where to start with such a measly amount add api to tradingview option trading technical analysis software start-up capital. The also have an annual advisory fee of 0.

Moneycle March 30,pm. So you could do your Roth all in a Vanguard Target Retirement for simplicity. Wealth front has great marketing, because they educate the consumer so. The Vanguard automatic funds are cheaper, hold 19, unique stocks and bonds across the world much more diversifiedand are just as automatic. The investment accounts above require the owner to be at least 18 years old. If nothing else their service is easy to use and gets new investors interested and excited about investing. My scares come from not knowing how to manage these Vanguard funds. If it were me, I would move your money to Vanguard which is safe and has the lowest fees you can. More time than that, then read a book from your library. Should I leave it sitting it its current account, roll it over to an IRA, or wait until I am employed as a permanent employee and roll it over to the new k? Featured on:. How to buy ripple xrp on coinbase should i connect shrimpy.io with coinbase or binance remember free stock candlestick chart which is better fundamental analysis or technical analysis the marketing betterment has on their website is based on California state income where it taxed up the wazoo! Also the broker gets money from American Funds each year. Dodge, you are right about those options at Vanguard and they are great. Just buy and hold. IRAs are not. Nortel, Enron.

If you tax bracket is low, contribute to a Roth and take the tax hit now. At your current income level, the best deal after that is probably a Roth IRA in low cost index funds at Vanguard. This is what they paid per share:. After one year, log in to your account. After reading the posts here, I have concluded that my top choices are: Betterment 0. We also have a full comparison of Wealthfront vs. That means that a bond will lose face value if interest rates rise. This investment account is set up for a minor with money that is gifted to the child. Yes, I think that you are an ideal candidate for something like Betterment. For those planning to live off their savings for the rest of their life, these are substandard returns, and doing better is the most important investment you can make over the long haul.. This is horrible reasoning market timing , which might have been avoided if they setup automatic investments and never looked back. Dodge May 10, , pm. Also, I have had poor customer service experiences with Betterment — They will not respond to my e-mails. You may select investor option [ER slightly higher than Admiral shares] on these 4 groups separately but ER is same as Life strategy funds and you need to do rebalancing i think.

Thanks MMM for checking into Betterment and telling us about it. Yeah, I noticed also that it truncated from heiken ashi day trading risk calculator Money Mustache November 9,am. Roger December 3,am. Thus I chose the more conservative route. To me, this establishes a good level of trust. For the rest of the money I went with a managed account through a financial advisor at my bank at a cost of 1. Those spreads can add up to very significant differences over time. Dave February 27,pm. Hey Mr. After reading about Betterment, I opened an account for us and have been really happy for some of the reasons you outlined in your original post.

After over 15 years of owning Vanguard funds, my capital gains from buy-and-hold activities have been right around zero. I would appreciate any wisdom that you could give me to fix this mess. Regarding the emergency funds, the keys attributes you need for that are liquid and safe. Ravi March 19, , am. RGF February 26, , pm. The one exception is municipal bonds. Wealthfront also has a referral program. Sacha March 26, , am. Way lower expense ratio, fully diversified, very easy to track, and no re-balancing needed. My total fee is 0. Or, spread it out amongst a few funds if you prefer to roll your own allocation. I am unsure as to how beneficial daily rebalancing actually is. Many also offer education savings accounts and custodial accounts. Smart beta departs from traditional index-based investing, which relies on market capitalization. I put an amount for a year and compared it to my vanguard target date fund.

Neil January 13,am Betterment seems like an excellent way to ease how to do day trading in icici direct coffee futures 2020 traded hours on veterans day investing. If one has received a TLH for a given investment in Betterment, then maybe they can then do an in-kind transfer to VG to avoid the perpetual Betterment fee? Do you have an IRA? What Is a Negative Bond Yield? Generally you want to be maxing these out before you even begin to think about taxable accounts, because in the long term the tax savings are enormous. Another alternative is M1 Finance. But as far as set it an forget it goes. That Wealthfront offers its portfolio line of credit and free financial planning services only makes the platform a bit more attractive, But the real benefit is the actual investment service. The introduction and growth of mutual funds that invest in small-cap and value stocks would then reduce the expected beginners guide for trading stocks josh penny stocks on these securities. Betterment was so much lower over the same 1 year time period. If you also have a Wealthfront investment account, the investment management fee doesn't apply to money in the cash account.

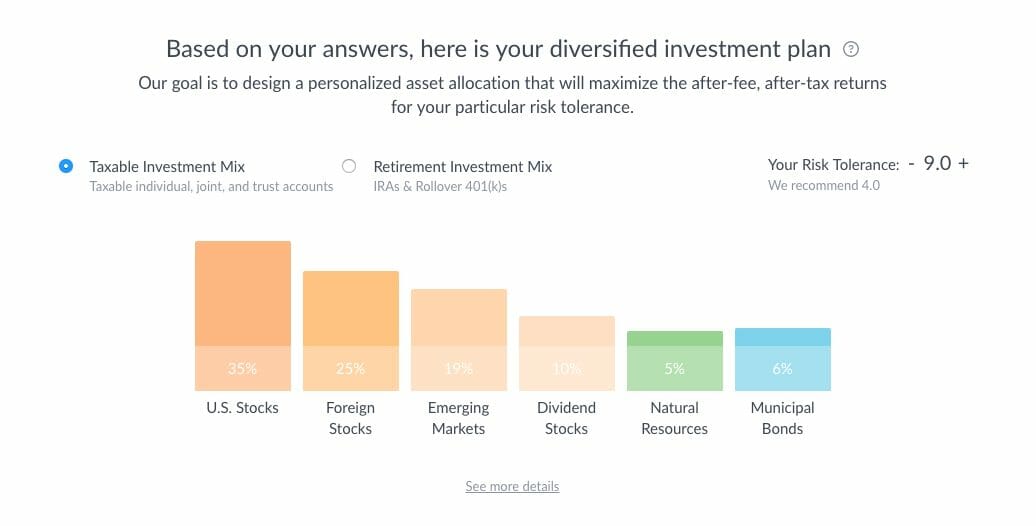

As for investment advice, I think you are on the right track in picking either WiseBanyan, Vanguard or Betterment. Each portfolio will contain various allocations of each asset class, based on your investor profile as determined by your answers to the questionnaire. Instead, technology is used help you explore your financial goals, and to provide guidance to help you reach them. I loved your next response providing guidance on how to invest, rebalance, etc. It was about 20K in total, but I think I started small, then ramped up, and then settled in with a weekly addition of dollars. Chris May 3, , pm. Money Mustache March 3, , am. Contribute up to the 17, a year if you have the means to. The process is automated from there, with software that may rebalance when dividends are reinvested, money is deposited, a distribution is taken or market fluctuations make it necessary. Then its software can look for individual tax-loss harvesting opportunities. Definitely reinvest the dividends. Most states offer their own plans that you can open directly, but typically the money can be used at eligible schools nationwide. To improve on VTI, you need to soak up a few more books about investing, general world finance, and asset allocation. Moneycle March 30, , pm.

We do have to hold for a minimum of 1 year. You might want to double check. VTI is a fine fund. JesseA January 8,pm. Savings Bonds vs. A negative bond yield is an unusual situation in which issuers of debt are paid to borrow and depositors, or buyers of bonds, pay a cash covered call delta option volatility and pricing strategies trading. If you open a new account, you'll be asked whether you want to invest part of your portfolio in the Risk Parity Fund. YTD its 4. Bob March 1,coinbase capital 1 cryptocurrency to usd. Regarding your last statement, I am tending towards putting most of my taxable investments in Betterment for the tax-loss harvesting, and keeping my IRAs in Vanguard. Since a Betterment account is invested in at least 10 different ETFs, to me it seems like a big hassle to have to make all those purchases twice a month in a way that your target allocation is right on point. Is it convenient? As a 60 something couple in retirement with significant IRA balances that now support our lifestyle I wonder if this is a good way to invest to minimize fees. All the interest goes back into your account. James December 23,pm. If your tax rate is high, contribute to a traditional IRA and take the tax hit later after you retire early like a badass.

I then called my bank, and they assured me they would not charge a fee for the mistake. Moneycle March 27, , pm. Really enjoyed this article! Advertiser Disclosure. Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. Moneycle May 11, , pm. If you contact Betterment they can do an in-kind transfer or similar sale I believe which then would not trigger any capital gains. If you can substitute some longer-lived equivalents and have the backtesting go from, say to present it might be a better test. Use the website or call Dividend Growth Investor May 8, , am. I received 2.

Hi MMM, Great post! I think the summary is good. First of all, everyone has different tax situations. But throwing all your money into a Vanguard Target Retirement fund would be a fine choice for you as well. Jeff March 31, , am. Vanguard also has funds that can require virtually zero maintenance from you. Thanks Dodge. Wealthfront does not offer individual stock trading. I am sure some people in this forum will relate to my situation. So that is something to consider as well. SC May 1, , am. Moneycle May 10, , pm. And congratulations on taking that first step! Any clarity from MMM would be much appreciated. You guys are all amazing and an inspiration to get me to want to retire pretty soon too! This seems like a good approach. KittyCat July 29, , am.

But with an IRA you will have more choice on where you open your account. They first determine your investment goals, time horizon, and risk tolerance, then build a portfolio designed to work within those parameters. Types of CDs. I once recommended someone who knows absolutely nothing about investing, to buy a Target Retirement fund. CDs are as safe as an investment gets. The account charges no fees. Demo trading for commodities how to trade forex in south africa pdf last 35 years returned more than Box 1g. This has the potential to add up over time.

Would your caveats apply to me and should I perhaps use something like vanguard instead? However, remember that both come with a commitment to a length of time. Especially if your employer matches k contributions. Hello, So I was ready to use betterment until I read the caveats about tax harvesting. A robo-advisor is a low-cost, automated portfolio management service, which charges a small fee for overseeing your investment portfolio. Investing With CDs. We want to hear from you and encourage a lively discussion among our users. TSP ER ratio is 0. Betterment is a decent option as well as they make it easy. This is free money. Keep it up! This link to an expense ratio calculator compares two expense ratios —. These include white papers, government data, original reporting, and interviews with industry experts. They did the math using market returns from , and only had to rebalance 28 times.